Intel IDM 2.0 At Risk

Summary

- Intel continues to press forward with its IDM 2.0 strategy at full throttle, with a slew of new foundry investments amounting to more than $50 billion this month.

- The chipmaker also confirmed the separation of P&L attributable to its foundry model at its inaugural Internal Foundry Model webinar earlier this week.

- Yet, the stock continues to move in tandem with broader market volatility despite being significantly undervalued, underscoring limited company-specific value accretive factors to sustain durable upside potential ahead.

- Increasing investment outlays in the name of IDM 2.0 with little fundamental progress on its comeback plan is putting investor confidence in the stock further on edge, especially as market conditions continue to deteriorate.

- Looking for more investing ideas like this one? Get them exclusively at Livy Investment Research. Learn More »

JHVEPhoto

Despite lingering cyclical weakness, chipmakers have continued to spend big in an attempt to "sever dependency on overseas suppliers" and safeguard capacity at home. In an attempt to "friend-shore" manufacturing, and diversify critical supply chains beyond China amid mounting geosocial tension, the U.S. and its allies - counting the EU, Japan and India - have collectively announced more than $100 billion in financial incentives for the semiconductor sector alone.

And Intel (NASDAQ:INTC) has been one of the biggest beneficiaries of the development, as it rides on the coat-tails of "friend-shoring" to bolster funding sources required for the significant capital outlays ahead of its IDM 2.0 turnaround strategy. But considering ongoing shakiness in Intel's fundamental performance, as well as persistent challenges to its demand environment given both transient cyclical headwinds as well as increasingly fierce competition, investors' confidence in the stock's prospects remain weak. This is consistent with the stock's significant discount relative to peers exhibiting a similar growth and profitability profile, and a market-driven rally over the past month that appears to be rapidly losing steam, which reflects elevated execution risks being priced into the shares' current valuation with limited catalysts ahead to restore durability to its longer-term upside prospects.

The Latest IDM 2.0 Developments

The chipmaker has announced a slew of new investments across Poland, Germany and Israel just this month, underpinning total investments that will cost north of $60 billion.

- Germany: Intel announced plans to invest €30 billion in a semiconductor manufacturing facility in Magdeburg, Germany last year, which is expected to begin volume production in 2027 "using Intel's most advanced, Angstrom-era transistor technologies" - namely, 18A and 20A. The chipmaker has recently confirmed receipt of an expanded subsidy package from the German government to facilitate the build-out of its new plant in the region. Due to persistent inflationary pressures that have upped the related investment costs, Intel has successfully negotiated an increase to the project's government subsidy package from €6.8 billion to €10 billion. The upcoming Germany plant will be part of Intel's "Silicon Junction" chip fabrication hub to supply Europe's technology needs. The Silicon Junction will consist also of a previously announced expansion of Intel's footprint in Leixlip, Ireland, costing €12 billion, to facilitate Intel 4 process manufacturing in Europe.

- Poland: Intel announced last week it has set aside "up to $4.6 billion" for a chip "assembly and test facility" in Wroclaw, Poland, adding to its Silicon Junction aspirations. The planned facility is expected to come online in 2027, aligning with the start of production roadmap in Germany.

Assembly and test facilities, such as the one planned in Poland, receive completed wafers from fabs, cut them into individual chips, assemble them into final products and test them for performance and quality.

Source: Bloomberg News

- Israel: Aside from Europe, Intel will also be expanding its footprint in Israel where it already has "R&D centers [and an] advanced manufacturing facility". The chipmaker has proposed to build a new fabrication plant in Israel, bringing the total value of investments earmarked for the region since 2021 to $25 billion.

The recently announced investments come on the heels of $60 billion to $100 billion already earmarked for "a new fabrication hub within the U.S., contingent on funding for the [U.S.] CHIPS Act" over the next 10 years. This includes investments totalling more than $50 billion into new fabs that have already broke ground in Arizona, Ohio and New Mexico.

Beyond expansion of its global PPE footprint, Intel has also been actively contemplating and engaging in strategic investment activities as of late that indicate ambitions that would further complement its IDM 2.0 roadmap. This includes the decision to cash in some of its investment in Austrian chip manufacturing equipment supplier IMS Nanofabrication by offloading a 20% stake to Bain Capital, in line with management's aims to preserve capital for expansions underpinned by IDM 2.0. It has also been reported that Intel is in talks with leading chip IP firm Arm Ltd. to participate in the latter's upcoming IPO. The materialization of such an arrangement could drive significant synergies by complementing Intel's foundry ambitions, given Arm's designs are currently adopted by reputable chipmakers and tech giants spanning Intel itself, as well as Nvidia (NVDA), AMD (AMD), Broadcom (AVGO), Qualcomm (QCOM), and Apple (AAPL).

As part of its IDM 2.0 roadmap, Intel has already inked a collaboration with Arm earlier this year that would "enable chip designers to build low-power computer system-on-chips on the Intel 18A process" - the most advanced process technology that will start volume manufacturing by mid-decade, servicing "server products, client products, networking products and many foundry products". And the potential linking-arms of the two with Intel becoming an "anchor investor" ahead of Arm's IPO would likely further market opportunities for the Foundry Services ("IFS") segment by driving "new options and approaches for any fabless company that wants to access best-in-class CPU IP and the power of an open system foundry with leading-edge process technology", bolstering its foundry share gain prospects over the longer-term.

In addition to the capex spending and investment activity spree, Intel has also moved forward on breaking out the P&L for its IFS segment to enable better accountability over realizing planed cost efficiencies going forward. The restructuring decision was confirmed during Intel's inaugural "Internal Foundry Model Investor Webinar Conference" earlier this week, in line with intensions management had outlined during the company's first quarter earnings call:

…while everyone understands that we are establishing an internal foundry model, I'm not sure we've fully explained the importance and impact of this change. Giving the manufacturing group their own P&L and the BUs' standard wafer price will drive a more efficient factory network and a better decision on design to cost at the BU level. It will also serve to create parity between internal and external foundry customers and drive a more efficient manufacturing cost structure needed to compete and win external foundry customers. With a separate P&L for the manufacturing group, we will also provide you with a cleaner comparison of the BUs to their external fabless peers.

Will It Work?

Yet the return to its foundry roots has started off on the weaker foot amid persistent cyclical headwinds. This is corroborated by steady declines observed in IFS segment sales in recent quarters, compounded by negative production cost implications stemming from industry-wide inventory corrections that have hampered Intel's ability in ramping up output volumes (i.e. underutilization). And while it remains critical for Intel to achieve its target for delivering five nodes (Intel 7, Intel 4, Intel 3, Intel 20A, and Intel 18A) by 2025 - two of which (Intel 4 and Intel 7) are already in volume production - uncertainties continue to loom large when it comes to whether the process technologies will be sufficiently competitive at the time of materialization, given the rapidly evolving expertise in the chip manufacturing landscape.

Specifically, improvements to IFS revenue growth will likely stay muted through the remainder of the year, despite signs of stabilizing PC market trends based on management's remarks during the first quarter earnings call:

As the industry continues to navigate through multiple global challenges and headwinds, we remain cautious on the macro outlook, even as we expect some modest recovery in the second half. We are seeing increasing stability in the PC market with inventory corrections largely proceeding as we had expected.

Despite management's optimism for the global foundry TAM to reach $200 billion by the end of the decade, IFS' share will likely stay nominal over the next five years as it remains in the building phase of its global footprint and advanced process nodes to address increasing compute requirements, while also trying to find new customers - who are also Intel's greatest competitors - and managing internal manufacturing efficiencies. As such, material acceleration is unlikely until the latter half of the decade, underscoring significant execution risks and uncertainties over the IDM 2.0 strategy's payout prospects. Specifically, despite Intel's ambitions to "regain transistor performance and power performance leadership" through its current process roadmap by 2025, and differentiate its offering from rival foundries with superior total cost of ownership benefits for customers, uncertainties remain over whether its advanced 18A and 20A nodes will be sufficiently competitive at the time of materialization given rapidly evolving technology needs.

Admittedly, even with the anticipated start of shipment on Emerald Rapids later in the year, followed by Sierra Forest and Granite Rapids in 2024 - which Intel regards as a critical inflection that will "make a meaningful difference in terms of [its] competitive position" - we remain cautious given the related technologies will likely remain inferior to existing and upcoming rival offerings. And Intel's recent unveiling of Clearwater Forest, which will be based on the Intel 18a process node technology with competitive performance against TSMC's [TSM] 3nm process, is unlikely to start shipping until mid-decade, leaving room for execution risks still when it comes to stemming its "falloff in market share".

Source: "Intel Q1 2023 Earnings: Brace For More Turbulence Ahead"

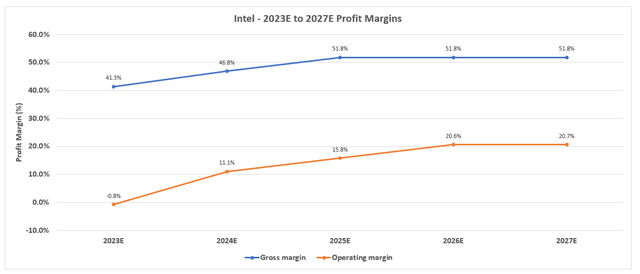

And even with expectations that elevated factory start-up costs will start to moderate over the course of next year, given anticipated improvements in utilization as end market inventory corrections come to an end and permit manufacturing volumes to ramp up towards full capacity, Intel's ambitions to return its profit margins towards the 60% range and stay competitive amongst peers remain further out in the future. Taken together, Intel remains long ways from realizing returns on its capital-intensive turnaround strategy, with great uncertainties ahead, especially as its investment outlays balloon despite generous government policy and financial support.

Valuation Analysis Update

Given the increasingly uncertain market climate, blighted by persistent inflationary pressures, rising borrowing costs, and recession fears that risk fizzling the recent rally observed across both the semiconductor and broader tech sectors, fundamental upsides remain the only factor capable of sustaining valuation gains. This is consistent Intel's comparatively modest stock gains observed this year (+22 YTD) when punted against its semiconductor peers (SOX: +43% YTD) on the back of burgeoning AI interest, given lacking proof of fundamental strength, which is likely dragged also by weak momentum observed for the chipmaker's Gaudi processors designed for AI applications.

Pierre Ferragu

Pat, you mentioned Gaudi like a very, very positive benchmark on large language models. When I look around me, I don't see, like, good tangible signs of Gaudi, like really gaining traction and getting big, despite the fact that the work today is really starting for more processing power and more capacity to run these models.

So my question was, am I just not seeing something that will become apparent very, very soon? Or are there still building blocks and parts and things that Gaudi is missing before really taking this very fast-growing opportunity?

Pat Gelsinger

Yes. I think it's a fair commentary that we're only starting to see good positive proof points in the industry. So I think that's a fair critique, Pierre…we have many opportunities that we're now engaging in globally. You'll also see us taking more aggressive steps with our dev cloud presenting this as a developer environment for the market. So I think we have a lot of work to do here to show up in a meaningful way. But we think the Gaudi 2 strategy has now started to gain quite a lot of interest in the market. So overall, we feel like we're now starting to show up in this space, but we have a lot of work to do to land meaningful revenue customers in this area.

And considering lumpiness expected for Intel's margin expansion and market share gain roadmap pertaining to the Internal Foundry Model, which will primarily rely on cost efficiencies and performance optimization advantages not realizable until mid-decade when the 18A process begins volume manufacturing, fundamental uncertainties are likely to persist within the foreseeable future, and remain a multiple compression risk ahead for the stock. And the greater the capex spend, the greater the execution risks ahead, considering challenging market conditions right now alongside increasingly fierce competition in both chip design and manufacturing technologies that are clouding visibility into the investments' payout prospects.

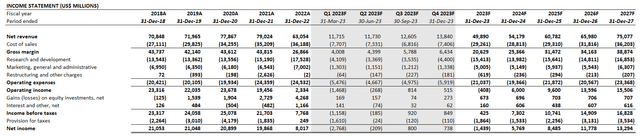

Adjusting our fundamental forecast for Intel for actual first quarter results, as well as recent developments to its capex roadmap and demand prospects, the company's bottom-line will likely take at least another three to five years to recapture the 20 points from its historic margins in the 60% range.

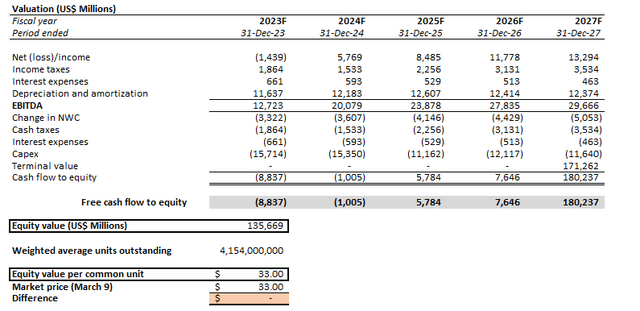

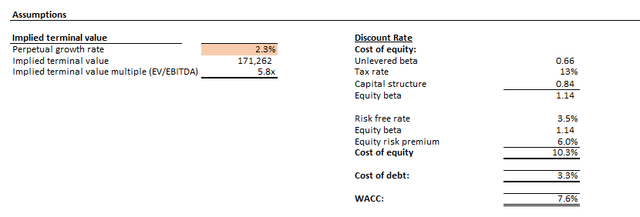

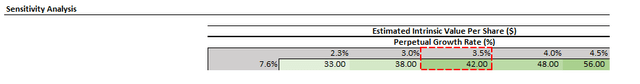

Based on the discounted cash flow ("DCF") analysis on projected cash flows taken in conjunction with our fundamental forecast for Intel, with the application of an 8% WACC in line with the company's capital structure and risk profile, the stock's current price at about $33 apiece implies a perpetual growth rate of about 2%. The figure reflects a significant discount to the premium observed at its semiconductor peers as market continues to price in optimism over impending secular tailwinds for advanced computing chipmakers despite transient macroeconomic challenges, and underperforms the anticipated pace of long-term economic growth across Intel's core operating regions.

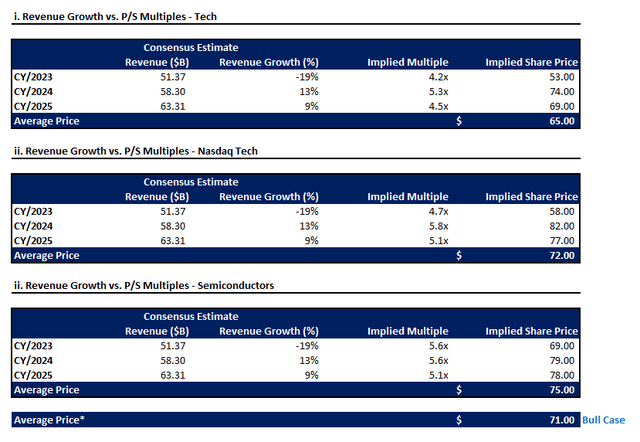

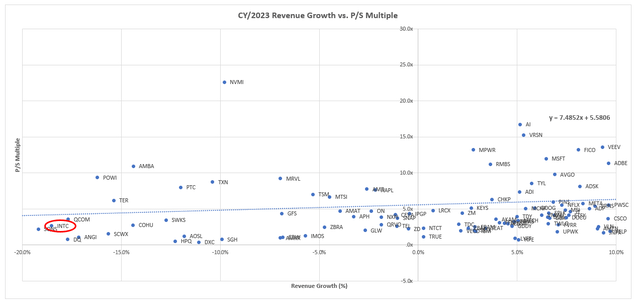

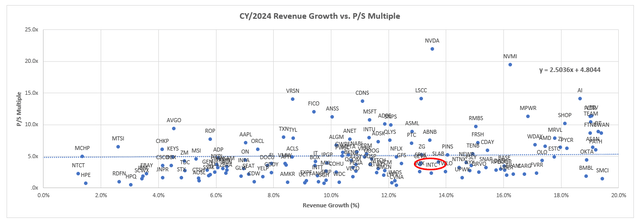

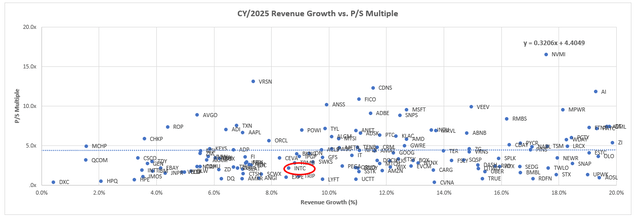

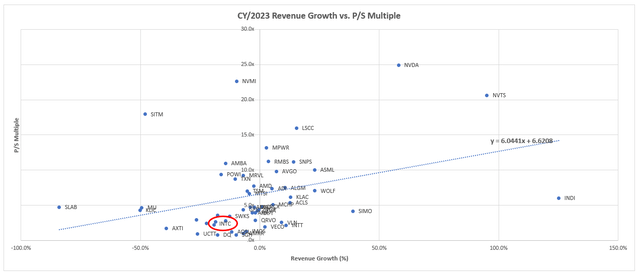

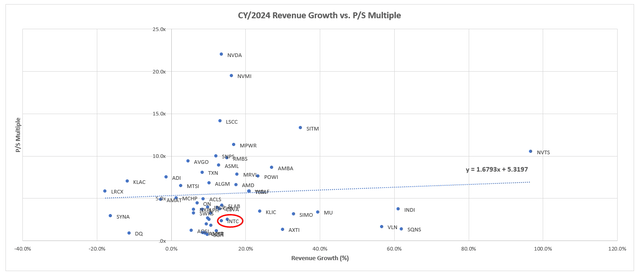

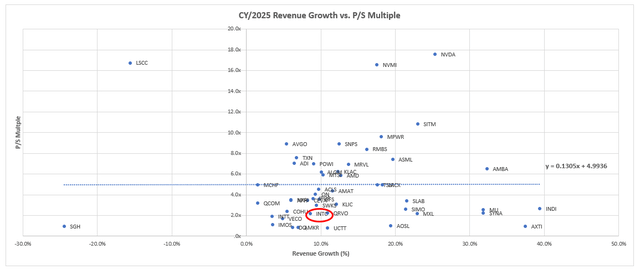

The stock also appears underpriced when considering the multiple-based valuation approach. The Intel stock is currently priced at under 3x estimated sales, while the broader semiconductor peer group trades at an average of almost 7x.

i. Sales Growth vs. P/S Multiple - Tech Sector

Author, with data from Seeking Alpha Author, with data from Seeking Alpha Author, with data from Seeking Alpha

ii. Sales Growth vs. P/S Multiple - Semiconductor Sector

Author, with data from Seeking Alpha Author, with data from Seeking Alpha Author, with data from Seeking Alpha

Even when applied a conservative implied perpetual growth rate of 3.5% in line with the blended pace of anticipated economic expansion across Intel's core operating regions to the DCF analysis, while holding all other key valuation assumptions (e.g. 8% WACC and cash flow projections) constant, the stock has potential to trade in the $40-range, which would represent upside potential of almost 30% from current levels.

And in the best-case scenario where Intel closes its valuation multiple gap from peers exhibiting a similar growth profile, the stock could potentially exceed $70 apiece, nearing its peak from 2020 and 2021 during the pandemic boom.

However, despite appearing fundamentally valued, there remains limited near-term catalysts to unlock pent-up upside potential in the stock, subjecting it to further market-driven volatility ahead. This is in line with Intel's laggard performance relative to both the semiconductor and tech benchmark gauges this year - while the tech-heavy Nasdaq 100 and Philadelphia Semiconductor Index are both headed towards their "best opening six months to a year ever", Intel stock gains have been much more modest.

Despite the underlying business' attempts in drawing awareness to its prowess in the supporting the development and deployment of next-generation AI technologies via full-stack hardware (e.g. Sapphire Rapids; Gaudi), software (e.g. OneAPI) and fabrication (e.g. Intel 7/4/3/20A/18A) offerings, Intel's prospects in capitalizing on both the return of cyclical tailwinds and impending secular demand continues to be overshadowed by lingering investors' concerns regarding near-term challenges such as the lumpy recovery to its core PC market - especially amid prospects for further tightening of financial conditions - as well as broader uncertainties to the realization of its ambitious turnaround strategy. Until there is consistent positive progress supportive of IDM 2.0's capability in strengthening Intel's fundamental durability (e.g. market share gains, margin expansion, etc.), which is likely still at least several quarters out, sentiment will remain in moderation, subjecting the stock to further macro-driven market fluctuations ahead.

The Bottom Line

Admittedly, the stock continues to trade at significantly discounted levels relative to both Intel's peers as well as the underlying business' fundamental prospects. And the ability to rely on government help to fund longer-term growth remains a tailwind for Intel's capital-intensive IDM 2.0 comeback plan. Yet, Intel's ambitious roadmap to "regain its former chip glory" is looking more like a catch-up game than an innovative plan, as its technological appeal continues to trail industry peers, with prospects of reaching parity in their competitive momentum still a big uncertainty. Intel's relatively modest fundamental progress is also doing little to improve visibility into the payout prospects of its capital-intensive IDM 2.0 strategy, which continues to bode unfavourably with the volatile market climate. Given the stock's continued exposure to macro-driven multiple compression risks ahead, with limited idiosyncratic value accretive factors present in the near-term to support a durable rally, we expect further downsides in tandem with broader market weakness.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service's key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!

This article was written by

Boutique investment research shop providing professional coverage on disruptive thematic equities. Our analysis provides a deep dive on growth drivers present in the secular market to identify outperforming investments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)