Capri Holdings: It's A Value Trap, But A Likely Takeover Candidate

Summary

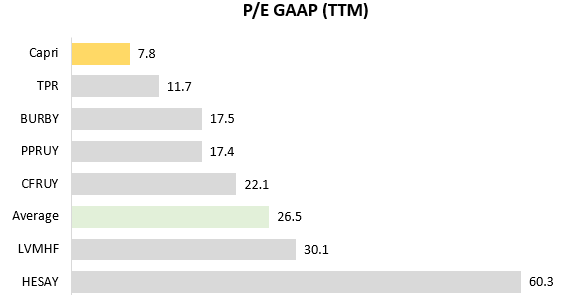

- Capri Holdings trades at a significant discount compared to luxury peers, with an 8x P/E compared to the peers' average of 26x.

- The company's fundamentals have significantly lagged the industry, with zero growth and poor contracting margins.

- Capri's CEO, which has been leading it for the past 20 years, is clearly not the one who could turn things around.

- The company has value trap written all over it, but it could be a takeover candidate for a larger luxury company.

StudioBarcelona/iStock Editorial via Getty Images

Capri Holdings (NYSE:CPRI), the owner of the Versace, Jimmy Choo, and Michael Kors brands, trades at a significant discount compared to its luxury peers.

The discount is so obvious at an 8x P/E compared to the peers' average at 26.5x, it begs the question of whether we have a huge opportunity upon us, or is it a dreadful value trap.

Let's try to answer that question.

Note: With July approaching, almost every luxury house in the world is set to report its financial results for the first half of 2023. I already covered LVMH, my favorite play in the sector, in a previous article, and I plan to write a pre and post-earnings article on every one of the remaining houses. Stay tuned.

Company Overview

Capri Holdings is a global fashion luxury group, consisting of Versace, Jimmy Choo, and Michael Kors. The brands cover the entire spectrum of the fashion luxury categories, including accessories, footwear, ready-to-wear, watches, jewelry, eyewear, fragrance, and home furnishing.

Versace

One of the world's most recognized brands, it was founded by Gianni Versace in 1978 in Milan. Artistically led by Donatella Versace, the founder's sister, for 20 years, Versace accounted for 19% of the group's revenue in 2022. The brand operates through 209 retail stores (owned and franchised), 803 wholesalers, an e-commerce site, and specific product and geographic arrangements.

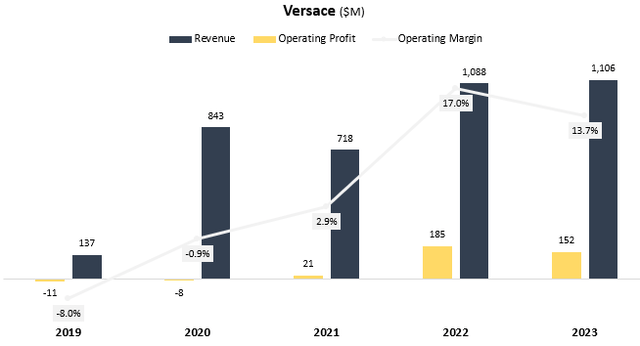

Created and calculated by the author using data from Capri Holdings financial reports (10-K)

After years of little to no operating profits, Versace managed to achieve an all-time high in FY22. It remained in the mid-teens range in FY23, but investors are worried that the Q4-23 margin, which came at 5.1% is representative of the near future. Not good.

Jimmy Choo

A rare sight in the luxury landscape, Jimmy Choo is a British brand and a relatively new one, founded in 1996. The brand accounted for 11% of total revenue in 2022, distributing through 237 retail stores (owned and franchised), 446 wholesales, an e-commerce site, and specific product and geographic arrangements.

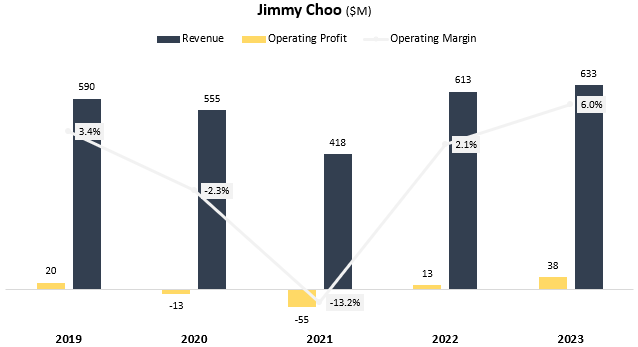

Created and calculated by the author using data from Capri Holdings financial reports (10-K)

Jimmy Choo is performing badly, and that's an understatement. In years of record profits for luxury brands, it barely notched a mid-single-digit margin, and Q4-23 ended in the negative with a -4.6% operating margin. Not good.

Michael Kors

One of the few American luxury brands, Michael Kors was founded over 40 years ago. Its luxury status is questionable, as Michael Kors appeals to a lower price level, or as the company calls it "accessible luxury". This segment accounted for 70% of total revenue, operating through 825 retail stores (owned and franchised), 2,742 wholesales, an e-commerce site, and specific product and geographic arrangements.

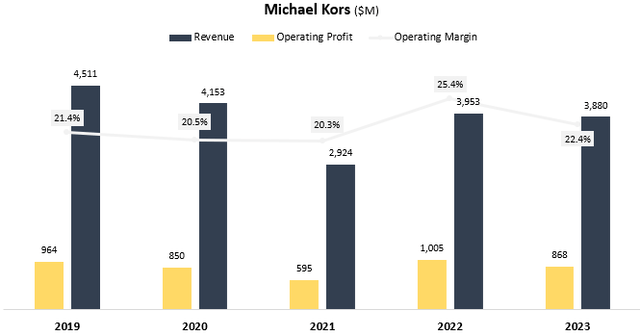

Created and calculated by the author using data from Capri Holdings financial reports (10-K)

Clearly, Michael Kors is the best-performing segment in the group in terms of margins, but revenues are decreasing, with the company unable to reach pre-pandemic levels. Also not good.

The Cheapest Luxury House

The last few years were the years of luxury, as powerhouses like Hermès (OTCPK:HESAY) and Richemont (OTCPK:CFRHF) outperformed the market by a significant margin, and Bernard Arnault, founder of LVMH (OTCPK:LVMHF), became the richest man in the world. But there's one luxury company that didn't participate in the action, and saying it wasn't the best time for Capri would be an understatement.

Seeing its stock plummet by 22.2%, Capri Holdings has underperformed the market by 30.7% in the past year and was the worst-performing company in the industry.

Created by the author using data from Seeking Alpha; Data as of June 25th, 2023

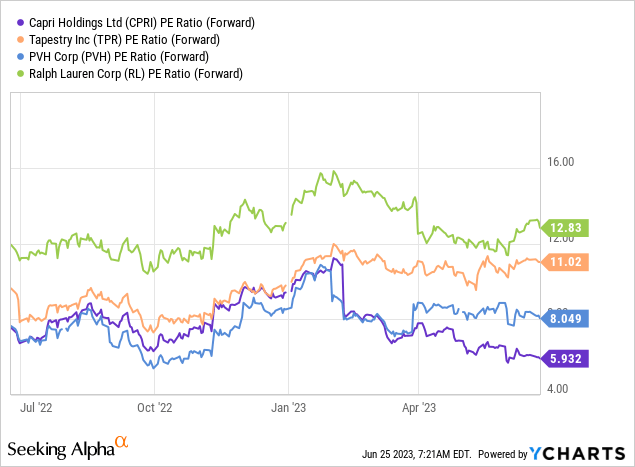

This has led Capri, which was already the cheapest among its peers on a P/E basis, into an even wider discount, with its closest peer trading at a multiple that's almost 50% higher.

Making this comparison could take any investor less than a few minutes. So it's not like we found a hidden treasure. Therefore, we need to understand the reasons for the low valuation and assess whether or not they have merits.

Understanding The Reasons For The 8x P/E

According to the company's 10-K, Capri Holdings is: "a global fashion luxury group, consisting of iconic brands that are industry leaders in design, style, and craftsmanship, led by a world-class management team". Respectfully, the company's results do not reflect industry-leading brands, nor do they reflect world-class management.

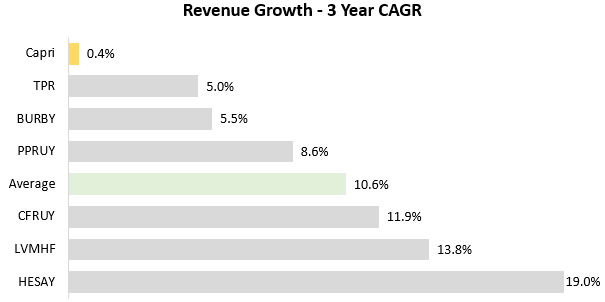

Created by the author using data from Seeking Alpha; Data as of June 25th, 2023

In the past 3 years, Capri managed to not grow at all, while its peers grew at an average of 10.6% annually. Quite the achievement. And management is guiding for no growth in FY24 too, expecting revenues of $5.7B compared to $5.6B in FY23.

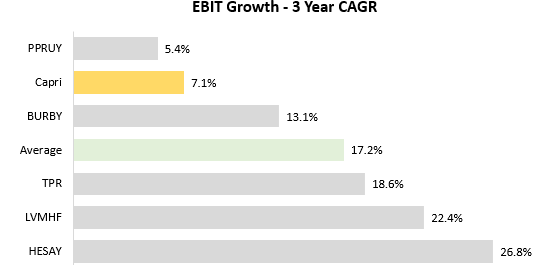

Created by the author using data from Seeking Alpha; Data as of June 25th, 2023

Looking at EBIT margins, Capri is dead last. Even more worrisome, management is guiding for 20% margins as their target long-term goal. In simple words, the long-term goal for the company is still 6.5 percentage points below the peers' average.

Created by the author using data from Seeking Alpha; Data as of June 25th, 2023

Finally, a comparison where Capri doesn't come in last. However, that's driven from a lower baseline for Capri and a higher baseline for Kering. Nevertheless, Capri is still very far off its peers in terms of EBIT growth in the last 3 years.

Management is guiding for underwhelming growth in FY24 too, expecting an adjusted operating profit of $940M compared to $908M in FY23. And remember, we're talking about adjusted operating profit, whereas most of its peers are not relying on those non-GAAP tricks to boost profits. In FY23, adjustments relating to improving efficiencies, ERP implementation, and restructuring, which in my view are all ongoing operational expenses, amounted to $99M. So, that's around a 10% boost by accounting plays right there.

Value Trap Or Huge Upside?

Clearly, Capri's fundamentals have lagged behind the industry. The problem is it's not an issue that can be quickly and easily fixed. There are two foundational keys to the success of behemoths like LVMH and Hermès, which Capri does not have.

Control Over The Entire Value Chain

The first foundational key which Capri lacks is control over its value chain. LVMH and Hermès control the entire chain, and more specifically, they own, manage, and operate almost 100% of the physical locations in which their products are sold, which means they don't rely on a third party to push and market their products. This allows them to control the customer's experience, and capture most of the economics.

The average luxury company turns 1$ of sales into approximately 0.265$ of operating profit, reflecting a 26.5% operating margin. As we saw, this is not the case when it comes to Capri, which derives the majority of its sales through third-party locations.

Contemporary, Hungry Management

The second foundational key is harder to describe, but it's management capabilities or lack thereof. I discussed LVMH's leadership strategy in LVMH in a previous article, and I encourage you to read it. In short, the group, led by Mr. Arnault, makes sure that its leaders never become complacent, with constant in-group role changes. On the other side, we have Capri, which has been led by the same CEO for the last 20 years, and I can't say he's done too good of a job to justify such a long tenure.

Successful companies know how to brand themselves, know how to find relevant partners and know how to innovate. For example, in the last few years, Louis Vuitton appointed Pharrell Williams as a creative director, partnered with Jay-Z and Beyoncé in Tiffany, with Rihanna in Fenty, and produced collections collaborating with Yayoi Kusama. After all, luxury is first and foremost about status-signaling, and who's better than the world's most admired celebrities to showcase the luxuriousness of the brand.

As odd as it sounds saying it on the owner of Versace, it appears that Capri doesn't manage to make its brands as shiny and admirable. Looking at their Instagram following as a point of reference, all the brands owned by Capri combined, have fewer followers than Louis Vuitton. That pretty much sums it up.

Maybe It's Not A Luxury House At All

Perhaps, the company's use of the word luxury is misleading, tricking investors into thinking we have a luxury house on sale, whereas it's just another high-end apparel company. Maybe, if it looks like an elephant and makes the sound of an elephant, it's just an elephant.

Or in Capri's case, if it doesn't have the margins of a luxury company, doesn't grow in the pace of the luxury industry, and doesn't trade near the industry's valuations, maybe it's just not a luxury company.

And if that's the case, when we compare Capri to other high-end retailers, we see it's not that far off. True, it's trading at a forward P/E multiple which is 25% below its closest peer, but it's not a screaming undervaluation. Actually, the fact that the company combines both Luxury and non-luxury brands could hurt its ability to focus on the right strategy which is different for each segment.

It's A Value Trap, But A Strong Takeover Candidate

As you can already assume, I find Capri Holdings to be a value trap. But, there's an asterisk. At the time of writing, Capri is trading right around a $4.2B market cap. Adding its net debt position including lease liabilities, we arrive at a $7.6B enterprise value. Even if we assume a 100% premium, LVMH can acquire Capri with two-quarters worth of cash generation. We already saw the French powerhouse acquire a company for around that price with Tiffany, which it acquired for approximately $16B.

By itself, I think it will be extremely hard for Capri to turn things around. But, a brand like Versace in the hands of the Arnault family could probably become one of the most successful luxury brands in the world.

Looking at the current ownership structure, 90% of Capri is held by institutions, which I'm sure would be more than willing to sell their shares for the right price. In one way or another, I think a Capri takeover rumor will surface in the near future, and that is the only thing, in my opinion, that could bring life to the stock.

Conclusion

The problem with value traps is that it's easy to convince yourself to buy just because the stock is cheap, leaning on the fact that such low expectations could easily be beaten. Hence, it's a trap.

Capri Holdings is an excellent example of such a trap. Ignoring its valuation, no investor in their right mind would have preferred Capri over any of its peers. As we saw, the company stagnated at zero growth while the sector advanced in the mid-teens, and its margins are the worst in the industry. Moreover, even if management is able to achieve its long-term targets, Capri will still be one of the worst-performing companies in the industry in terms of margins and growth.

Despite all of the above, investors are drawn to Capri's mid-single digit P/E like a moth to a flame. In my view, the company needs to go through a major turnaround for investors to see reasonable upside, and its current management, led by a CEO that's been there for the last 20 years, doesn't have the capabilities or the resources necessary to turn the company around.

Thus, I find no reason to own Capri unless it's a hold-and-wait-for-an-acquisition play, and therefore I rate the stock a Sell.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)