BP Looks Undervalued Compared To The Other Supermajors With A 4.57% Yield

Summary

- BP shares are undervalued compared to its peers, with a 2023 forward P/E of 5.96 and trading at 3.67x its TTM FCF.

- BP is committed to returning capital to shareholders through buybacks and dividend increases, as long as oil stays above $60 per barrel.

- Projections from the IEA, EIA, and BP suggest oil demand and prices will remain stable or increase through 2030, supporting BP's profitability.

Sergei Dubrovskii

Oil and gas isn't an exciting industry, but these fuels are necessary to our way of life. This isn't an exciting industry as the biggest news typically revolves around oil prices. Oil and gas aren't going to create the level of enthusiasm that technology has, but that doesn't mean the sector is uninvestable. Normally I write about energy infrastructure companies, as I like being an equity owner in the energy tollbooths across America, but I see an opportunity in BP p.l.c. (NYSE:BP) shares. When I look at the supermajors, which include Exxon Mobil (XOM), Chevron (CVX), BP, and TotalEnergies (TTE), BP and TTE look significantly undervalued compared to their U.S. counterparts.

BP has been dead money for more than a decade, as shares trade at less than 50% of their 2007 levels. BP is back to dividend growth since the reduction in 2020, and its printing tens of billions in profits annually. The market didn't seem to like that BP was slowing its buybacks, as shares fell from $40.01 to $36.78 on May 2nd after earnings were released. BP is a complicated investment because it is heavily dependent on commodity prices, and it operates in a non-ORG-friendly sector that isn't necessarily ESG-friendly. BP could continue to be dead money, but I think the recent pullback could be an opportunity. At the end of the day, BP is a printing press for profits, is growing its dividend again, allocating billions toward buybacks, and is attractively valued compared to its peers.

BP is currently trading at an attractive valuation

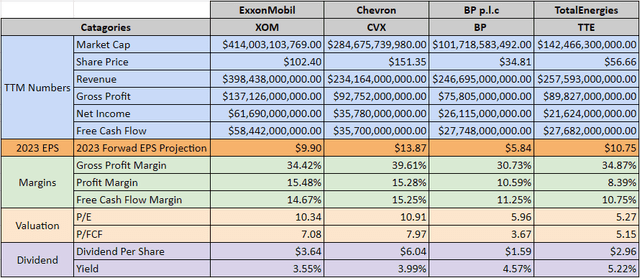

Below is a table I constructed using information from XOM, CVX, BP, and TTE. I used the TTM numbers for revenue, gross profit, net income, and free cash flow (FCF). Based on the TTM numbers, I looked at the margins, then their valuations in the form of the 2023 forward P/E and current P/FCF.

Steven Fiorillo, Seeking Alpha

Currently, WTI is $69.16 per barrel, and Brent is trading for $73.85. If we see a massive drop in commodity pricing, this analysis would certainly change.

BP is the smallest supermajor by market cap as it is currently a $101.72 billion company. While it's smaller than its peers, it's still a cash-generating machine. In the TTM, BP generated $246.7 billion in revenue and delivered $26.12 billion in net income and $27.75 billion in FCF. BP has a 30.73% gross profit margin which is the lowest of the group, but it squeezes out a 10.59% profit margin and an 11.25% FCF margin. When your generating $246.7 billion in revenue, this amounts to over $25 billion in FCF and pure profit. XOM and CVX have larger margins and generate larger amounts of profits, but they're trading at much larger valuations with a lower dividend yield.

Put the industry aside, $1 of revenue and $1 of profit is $1 of revenue and $1 of profit, regardless of if you are selling semiconductors or barrels of oil. When you purchase company shares, you're paying the present valuation for all the future profits produced and exchanging personal capital for an equity position in a business. Everybody who owns just 1 single share of a company's stock is an equity owner, as each share represents a percentage of the company, the revenue generated, and the profits.

Looking at BP through the lens of an actual business rather than comparing the oil and gas industry to tech makes shares look very cheap. BP is projected to generate $5.84 in 2023 EPS, which places its 2023 forward P/E at 5.96. Paying 6 times earnings for a company generating $26.12 billion in pure profit seems like an attractive valuation. BP is also trading at 3.67x its TTM FCF which is also incredibly low. Even International Business Machines (IBM) trades at a 2023 forward P/E of 13.71 ($129.43 / $9.44) and a P/FCF of 12.25x ($117.53B / $9.6B).

Looking at BP from a business, not a headline perspective, it's an incredible deal, assuming commodity markets aren't disrupted. Based on the current TTM numbers, buying every share on the open market for $101.72 billion would take you 3.9 years to repay that outlay from the current profits and 3.67 years to generate that $101.72 billion back from FCF. Those are not normal metrics, and while oil pricing provides a level of risk, the numbers look too cheap to ignore.

BP posted a strong Q1 but shares sold off because the market didn't like that buybacks were slowing

BP reported a $0.24 EPS beat in Q1 after delivering $4.96 billion in its underlying replacement cost profit when the street was looking for $4.28 billion. Shares slid -8.8% after the earnings were released on May 2nd because BP announced it was going to repurchase $1.75 billion in shares over the next quarter, which was $1 billion lower than the $2.75 billion spent on buybacks in the prior three months. An analyst from Jefferies said that this would more than offset good operational performance as BP was the first international oil company to reduce its buybacks in the upcoming quarter. Russ Mould, an investment director at AJ Bell, cited that the buybacks were disappointing and hints at longer-term challenges BP is facing.

I think this was a complete overreaction, and shares traded down off headlines without digesting the commentary. After reading the Q1 earnings call transcript, it's clear that BP isn't reducing its buybacks for no reason, as they are sticking to its previous projections. Murray Auchincloss, who is BP's CFO discussed the five priorities BP has regarding its surplus of profits. BP had communicated that 60% of the profit surplus would be allocated toward buybacks. BP provided guidance on February 7th that as long as oil stayed above $60 they could allocate $4 billion to buybacks throughout the year. In Q1, BP ended up allocating $2.75 billion toward buybacks because they had a working capital release that added to the profit allocation. BP isn't focusing the buyback allocation on a run rate, but rather a percentage of the profit surplus and is holding true to this methodology.

What's crazy to me is that BP is getting dinged for only allocating $1.75 billion toward buybacks this quarter. When you do the math, BP would be repurchasing 1.72% of the company at the current valuation ($1.75B / $101.72B) over a three-month period. How many companies are repurchasing 1.72% of the company's shares in a 3-month period? The board has outlined that as long as oil stays above $60, BP will target $4 billion per year in buybacks with a 4% dividend increase. I think the sell-off was overdone, as BP is delivering on what it said it would do, not a 3rd party interpretation of what it should do.

Can BP continue to deliver these levels of profits and allocate billions toward buybacks and dividends?

If the oil and gas markets cooperate, BP should continue to deliver excess profits, allocate $4 billion toward buybacks, and increase the dividend by 4% annually. This is a big if as nobody can actually predict what will occur with the price per barrel. There are too many variables from expanding and contracting global demand to production levels and increases or cuts from OPEC.

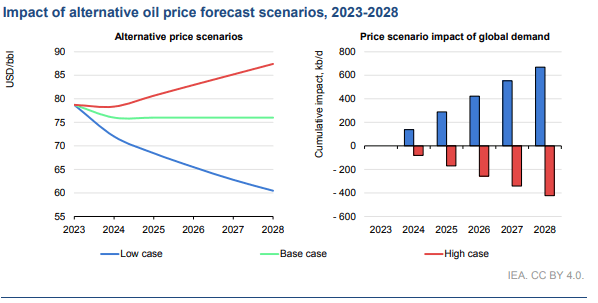

I look at the data from different sources, including the International Energy Agency (IEA), Energy Information Agency (EIA), and different forecasts, such as global energy outlooks from BP. In the latest oil 2023 analysis and forecast to 2028 from the IEA their reference case for oil remains above $75 thru 2028. In their low case, they see oil declining through 2028 but staying above $60, and on the high side, oil is around $87.

IEA

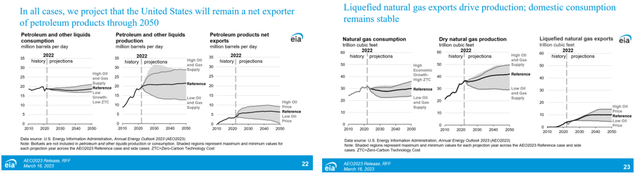

The EIA publishes two critical reports: the International Energy Outlook (published every two years) and the Annual Energy Outlook. The Short-Term Energy Outlook from the EIA is clearly indicating that U.S crude oil and liquid fuel production, in addition to natural gas production, will increase over the next two years. The reference case in the Annual Energy Outlook from the EIA projects that petroleum and other liquid production will slightly increase from now through 2050, and dry natural gas production will increase by roughly 20% through 2050.

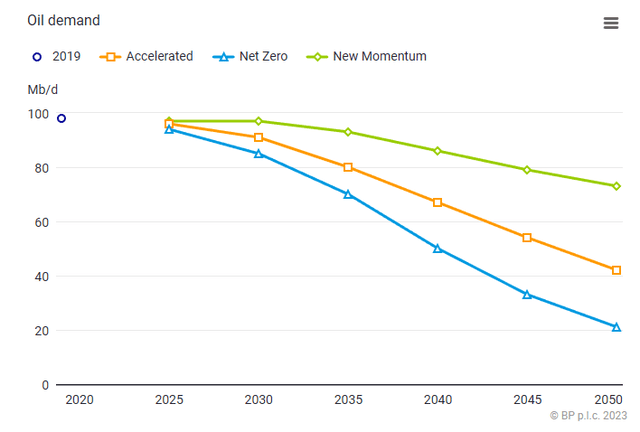

BP is projecting that the new momentum in the energy markets is significantly different than the net zero 2050 projections. In the new momentum, oil demand will stay at the current 97 Mb/d levels thru 2030, then decline to 86Mb/d in 2040 and 73Mb/d in 2050.

The combination of the IEA forecasting that oil will stay above $60 per barrel in their worst-case scenario, the EIA forecasting oil and gas production increasing thru 2050 in the U.S., and BP revising their oil demand forecast to be well above net zero levels and staying the same thru 2030 makes me believe that BP will continue to deliver for shareholders. There are another 6 years in this decade (2024-2029), which means that if oil stays above $60, BP will allocate another $24 billion to buybacks and raise the dividend from $1.59 to $2.09.

Conclusion

Shares of BP have declined since Q1 earnings and have been dead money for more than a decade. Investing in the oil patch isn't for the faint of heart, as there are many variables that impact sentiment and oil prices. In my opinion, BP is trading at too low of a valuation for its level of profitability, and trading at 5.96x 2023 earnings and a 3.67x P/FCF is a bargain, especially when profits and FCF exceed $25 billion. BP is a printing press for profits, and as long as oil stays above $60, they are committed to returning capital to shareholders in the form of buybacks and dividend increases. From 2024 thru 2029, BP could return at least $24 billion in buybacks and increase the dividend to $2.09. Based on the IEA, oil isn't projected to decline further than $60 through 2030, making me even more bullish on the valuation. As BP trades under $35, I think shares are a bargain with a dividend yielding 4.57%.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BP, XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.