Montrose Environmental: M&A Activities Picking Up, May Drive Growth

Summary

- I reiterate a buy rating for MEG given its raised guidance and M&A activity traction.

- The company has increased its FY23 adjusted EBITDA guidance and closed two significant deals, GreenPath Energy and Matrix Solutions, which are expected to drive further growth.

- MEG's improved EBITDA outlook should lead to a reversion to historical valuation of 22x forward EBITDA.

Wirestock/iStock via Getty Images

Summary

I initially recommend in January to buy Montrose Environmental (NYSE:MEG) based on a few key factors. Firstly, the environmental industry is challenging to enter due to its complex regulations and fragmented market. As a result, customers are seeking environmental solutions providers that can handle issues throughout their entire life cycle and across different jurisdictions. MEG aims to target oversaturated markets with many competitors, many of which specialize in a particular niche or regulation. MEG has the advantage of being able to attract and retain clients and grow relationships due to its global reach and diverse range of offerings. When competing for large accounts that need a national scale provider, MEG stands out with its ability to offer unified, geographically dispersed services and a single point of contact for all of a client's needs. My confidence with this view is now reinforced with the raised guidance, M&A activity traction, and market recognition on MEG results (stock jumped from $30s to $40s). Going back to MEG 1Q23 results, it was spectacular with a beat against consensus estimates. Despite the expected decline in COVID-19-related revenues, CTEH's adjusted EBITDA dollars and margin came in significantly better than expected due to growth in revenues from higher-margin environmental response services. Importantly, the M&A part of MEG equity story has finally started to show strength, which I expect to drive further growth to the business. Consequently, management increased in FY23 adj. EBTIDA guide to reflect the solid EBITDA performance.

Raised guidance

To begin, management has increased guidance for FY23 adjusted EBITDA from $71 million at the midpoint to $73 million, reflecting the strong EBITDA performance thus far this year and the contribution from the recently closed GreenPath Energy acquisition in May. As MEG incorporate the Matrix Solution acquisition and the full contribution from GreenPath in FY24, I anticipate an acceleration in EBITDA growth through FY23 and an even larger step up in FY24. I believe the market is reacting positively to this improved guidance which sets a good stage for further position momentum (more attention now on the stock would mean it takes shorter time to reflect any positive news/results).

M&A activities gaining traction

Things finally picking up on the M&A side of things. The two closed deals are GreenPath Energy and Matrix Solutions. Both of these buyouts excite me, and I consider them to be excellent investments. In my opinion, MEG can use GreenPath to further establish itself in the Canadian market, and the service dovetail nicely with MEG's current greenhouse gas emissions offering. The Matrix Solutions deal, MEG's largest since CTEH, was finalized three weeks ago. I prefer the Matrix deal to the GreenPath one because of the synergies it creates. Matrix, for context, is a Canadian provider of environmental consulting services, employing 570 people across 19 offices. In the LTM April 2023, Matrix brought in $72.5 million in revenue (with EBITDA margins of 6.2%) and generated $4.5 million in EBITDA (20% of MEG LTM EBITDA). For MEG, the long-term effects of Matrix go far beyond a temporary boost in EBITDA; the company now has 570 employees, 70% of whom hold advanced degrees, a strong brand, and blue-chip customers thanks to the acquisition. The merger should also open up new avenues for cross-marketing efforts. The synergies from the Matrix acquisition, in my opinion, will become more apparent in subsequent quarters. Most encouraging is the belief by management that Matrix EBITDA margin can increase from its current 6.2% to the low to mid teens by FY24, effectively doubling margins from current levels. Therefore, Matrix could produce $9 million in EBITDA post-synergies, which is roughly 36% of MEG LTM EBITDA.

Valuation update

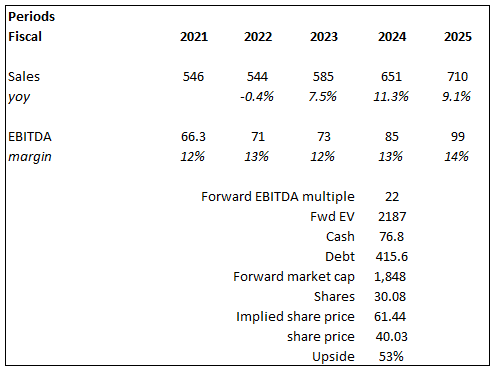

As a result of the revised EBITDA outlook, I have updated my model, as shown below. The key changes here are my expectations for increased revenue and EBITDA margins after accounting for acquisitions and synergies. Note that I use consensus revenue estimates, but I disagree on EBITDA margins because consensus is implying a margin decrease in FY24, which I don't believe is correct given the synergies from the acquisitions. With a better EBITDA outlook, I believe the market will revert MEG valuation to its historical average of 22x forward EBITDA. This would increase the share price to $61.

Owner's work

Risks

I anticipate that MEG will continue its expansion through M&A. If MEG is unable to close as many deals in the future, its growth rate may be lower than its long-term average. If MEG is unable to smoothly incorporate the acquired businesses, the expected revenue and cost synergies may not materialize. It can also be challenging for a company to establish a consistent culture when it undergoes frequent mergers and acquisitions. Finally, Investors may have a harder time gauging MEG's performance in the absence of a direct public competitor.

Conclusion

I maintain my buy recommendation for MEG based on the positive developments in M&A activities and raised guidance. Management's increased guidance for FY23 adjusted EBITDA reflects the strong performance and contribution from recent acquisitions. The GreenPath Energy and Matrix Solutions deals have the potential to drive further growth for MEG, particularly the Matrix acquisition with its synergies and expansion opportunities. The market has responded positively to these developments, and I expect the stock to gain momentum. Considering the improved EBITDA outlook and historical valuation trends, I believe MEG's share price could reach $61. While risks such as slower deal closures, integration challenges, and limited direct competitors exist, I am confident in MEG's growth prospects.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.