TJX Companies: The Reasons Our View Remains Neutral

Summary

- TJX remains an attractive candidate in terms of profitability and efficiency, despite the challenging macroeconomic conditions.

- The firm has managed to reduce inventory levels without significantly impacting the net profit margin and has also hiked its full-year outlook.

- Although currently overvalued compared to the consumer discretionary sector median, TJX deserves a premium due to its profitability and efficiency.

- We maintain our neutral view.

Chip Somodevilla

The TJX Companies, Inc. (NYSE:TJX), is one of the leading off-price apparel and home fashions retailer in the U.S. and worldwide.

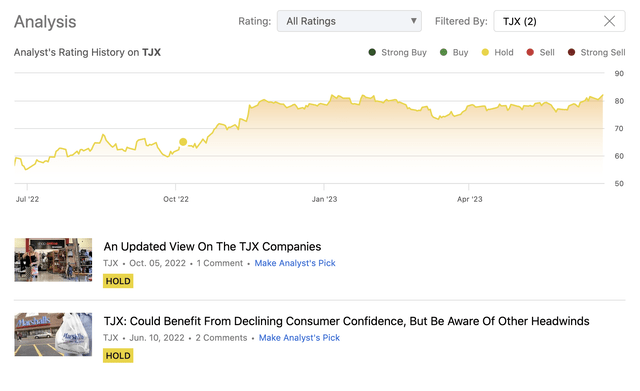

So far, we have published two articles about TJX on Seeking Alpha, rating the company's stock as "hold" both times. Since then, driven by the rally in late 2022, TJX's stock price has increased substantially, outperforming the broader market. Up till now, in 2023, the firm's stock price has remained relatively flat.

Today, we will give an updated view on TJX, focusing primarily on the firm's profitability and efficiency to follow up on our previous writings.

As a recap, here are the main points from our past articles:

- TJX may be well-positioned to be the low-cost retailer of choice, due to its wide range of quality brand offerings.

- Challenging macroeconomic situation, including elevated freight and labour costs, leading to contracting margins.

- Unfavourable FX environment.

- High inventory levels.

All of these points have a direct or indirect impact on both the top- and bottom line results of the company, therefore it is important to pay attention to their developments over time and their potential future impacts.

We will start our discussion today, by looking at the firm's profitability over time.

Profitability

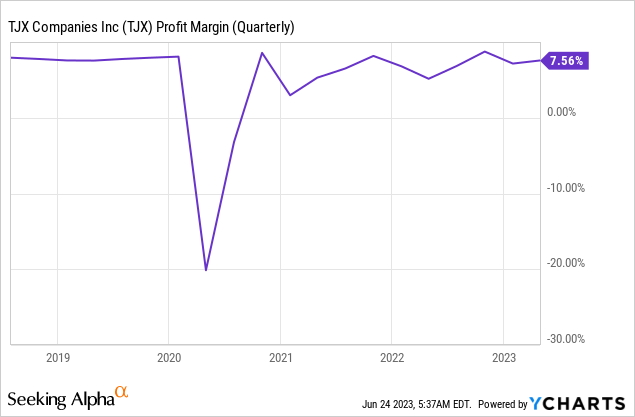

To evaluate TJX's profitability, we will be using the net profit margin as our primary measure. It is the ratio between net income and revenue, and is a widely used indicator of profitability. The following chart shows the company's net profit margin over the past five years. Excluding the sharp drop during the beginning of the pandemic, the firm's profitability stayed relatively stable.

In general, we like to see profitability staying stable or increasing over time. Considering the challenging macroeconomic environment, a stable margin over the past years can definitely be treated as an attractive achievement.

Looking forward, we have to understand which factors could impact this measure and how.

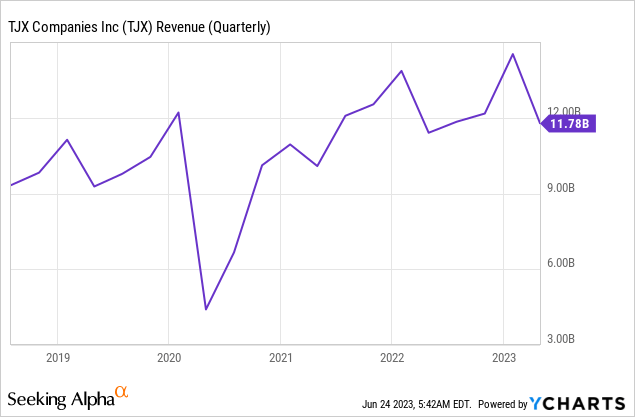

Previously we claimed that during times of low consumer confidence off-price retailers may see an uptick in demand for their products, as consumers are likely to switch to lower cost alternatives to save money. While there have been ups and downs in terms of revenue in the past quarters, sales are still at or above pre-pandemic levels.

Further, consumer sentiment continues to remain poor. While there has been an uptick since the lows in 2022, the readings remain around the levels seen during the 2008-2009 financial crisis, well below the pre-pandemic levels.

U.S. Consumer confidence (Tradingeconomics.com)

Based on these figures, we do not expect a significant decline in demand in the coming quarters.

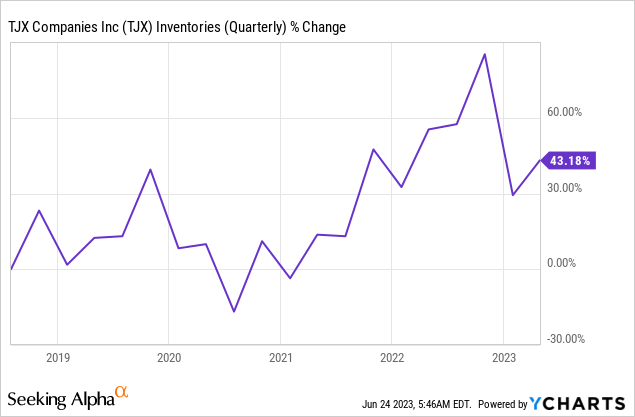

Also, we have been elaborating on the potential negative impacts of the high inventory levels in our previous writings. We highlighted potential problems with excess inventory. To get rid of excessive or obsolete inventory, significant discounts may be necessary, which could eventually lead to a contracting profit margin.

It is definitely positive to see, however, that TJX has managed to reduce its inventory levels significantly, without having a major impact on the net profit margin.

Last, but not least, we need to point out two recent news, which also increase our confidence in the stable profitability of the firm in the near future:

- The company's potential competitive edge over its competitors on the current market environment.

- The hike of the full year forecast after the Q1 results.

All in all, we believe that TJX remains an attractive candidate from a profitability point of view, in the current environment.

Efficiency

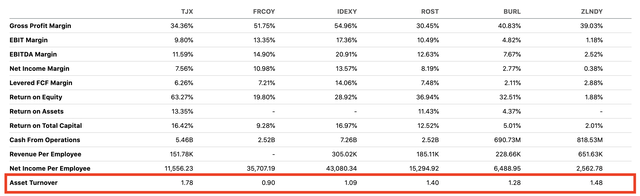

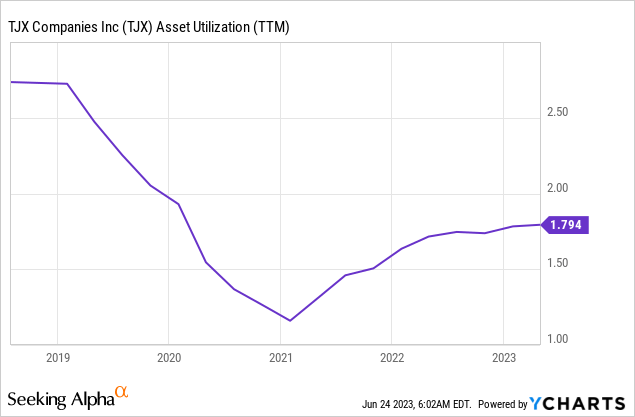

A widely used efficiency measure is the asset turnover, or asset utilization. It is the ratio between revenue and total assets, and measures how efficiently the company uses its assets to generate sales. Just like with the profit margin, we normally prefer to see improving or stable trends.

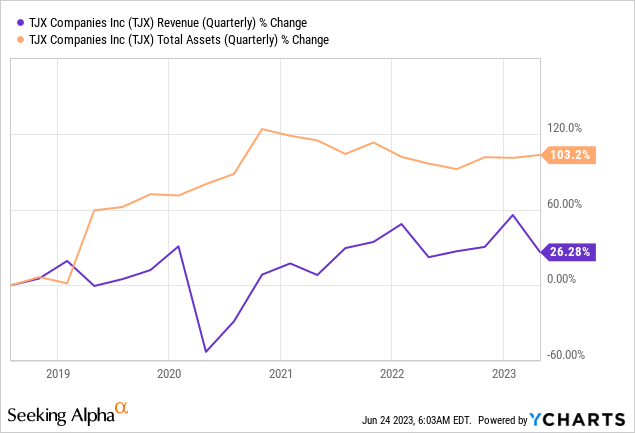

Asset turnover has dropped sharply in 2019 and 2020, but since its bottom in early 2021, it has kept improving gradually. The reason for the decline has been that the growth in total assets has outpaced the revenue growth.

At this point, there are two factors which need to be examined. First, what has caused the growth in total assets, and second, are the revenue figures representative or they may be manipulated/inflated.

Total assets

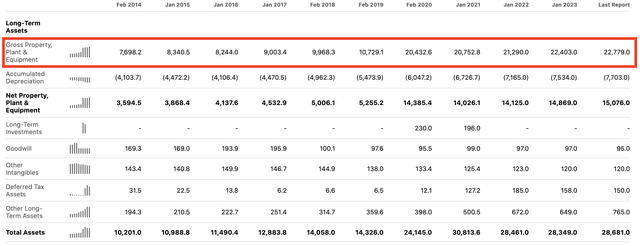

The jump in total assets has been driven by the increase in PPE in 2019/2020.

Long-term assets (Seeking Alpha)

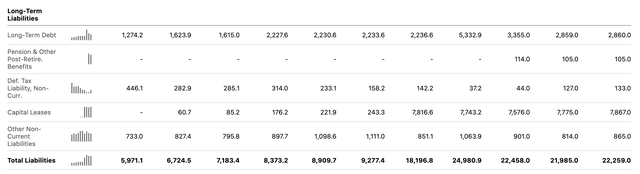

This is also closely related to the increase in the amount of capital leases found in the long-term liabilities section of the balance sheet.

Long term liabilities (Seeking Alpha)

Revenue

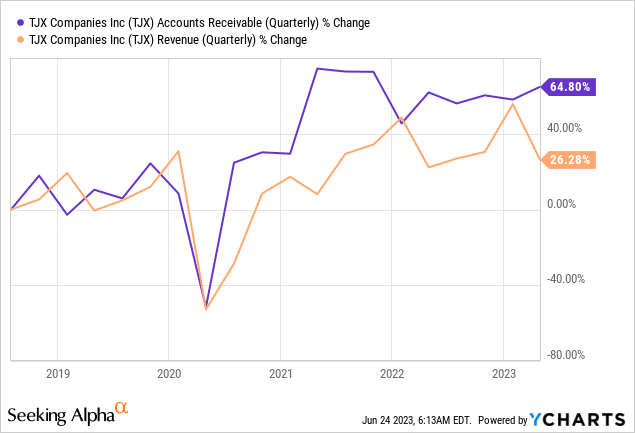

A way to identify potential manipulation of the sales figures is to compare the revenue growth with the growth in accounts receivable. If the accounts receivable grow faster than the revenue, it may mean that the firm is trying to sell more on credit to pull forward demand from future periods, or it might have modified its revenue recognition practices.

The chart above shows that accounts receivable have been growing at a slightly higher pace in the recent quarter. While the divergence is not large at this point, we will have to keep an eye on this development in the near future.

Now, to put TJX's efficiency into perspective, the following table compares the firm's asset turnover with those of its competitors and peers. Among this group, TJX has the most attractive asset turnover ratio.

Conclusions

All in all, we believe that TJX is a well-run company, which has fared quite well in the recent quarters despite the challenging macroeconomic environment. The firm appears to be attractive both from a profitability and an efficiency point of view. Looking forward, the firm's competitive and the upward revised full year outlook also provide some confidence for the near term.

The only question that remains now, does it justify an upgrade from our previous neutral rating?

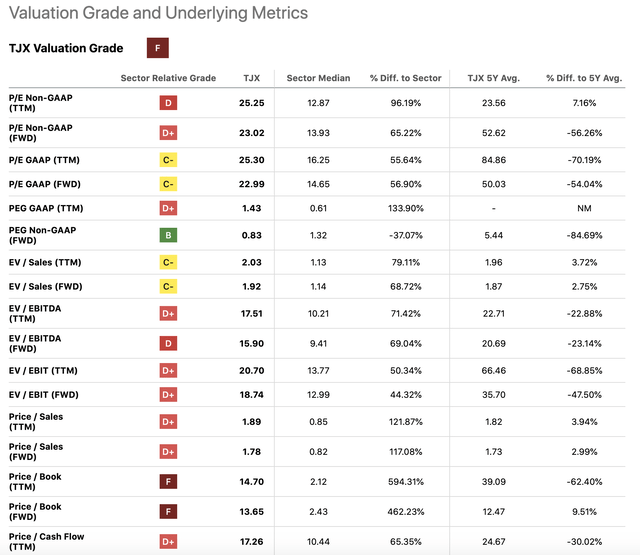

TJX still appears to be overvalued compared to the consumer discretionary sector median. However, this may not be a fair comparison, because other companies in the sector may be much more negatively impacted by the macroeconomic environment than TJX. For this reason, we believe that TJX deserves a premium over the median, especially when we consider its profitability and efficiency too.

Valuation metrics (Seeking Alpha)

On the other hand, we believe that a P/E multiple of 25x for an off-price retailer is too high. We would like to see the stock price pulling back to the $60s, before we would reconsider upgrading the stock to a "buy".

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.