Metropolitan Bank: Well Capitalized And Undervalued

Summary

- Metropolitan Bank's share price has bounced 180% since March 2023 lows, but there is potential for further upside.

- The bank has managed to adjust well during the aggressive Fed Funds Rate hike and maintains satisfactory key capital ratios, making it well-capitalized and keeping risks under control.

- Metropolitan Bank stock is currently trading at $31.96 per share, less than half of its potential fair value of $76 per share, indicating strong undervaluation and making it a buy opportunity, albeit with caution due to its volatility.

serts

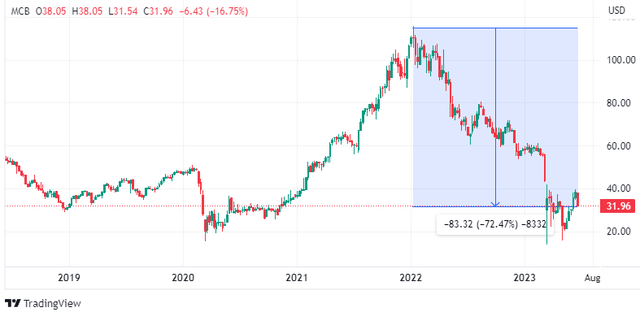

Metropolitan Bank (NYSE:MCB) is one of the banks that suffered most from the banking crisis triggered by the SVB bankruptcy but was already in a strong downtrend that began in early 2022.

TradingView

Since the March 2023 lows, the price per share has bounced a lot, about 180%, yet in my opinion I believe there is still potential for further upside. Metropolitan Bank is well capitalized, has a good interest margin, and its book value continues to rise.

Certainly, buying this bank 2-3 months ago would have been a bargain, but it is easy to talk in retrospect. As of today, I still believe it is still very much at a discount but very little is said about it. The reason is that overall we are talking about a small bank, only $360 million capitalization, and on top of that it does not issue dividends. This is a peculiar choice, but in my opinion not entirely wrong. In fact, as we shall see, thanks to the capital retained by avoiding the issuance of dividends, this bank has grown a lot and is well capitalized.

Analysis of deposits and net interest margin

Deposits are the essential element for the existence of any bank, as they are the raw material to be used in profitable investments.

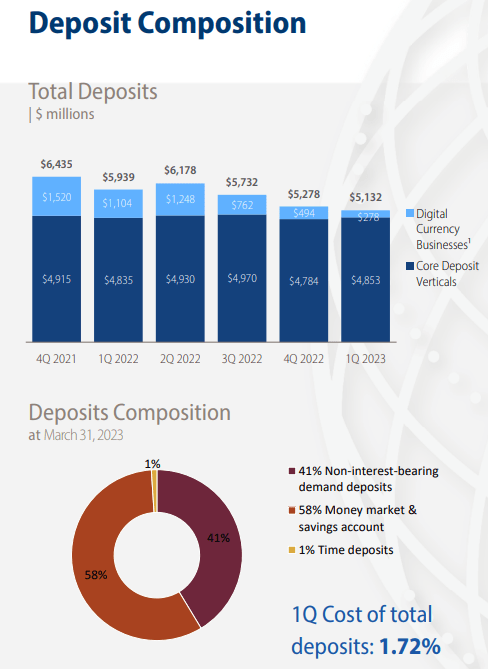

Metropolitan Bank Q1 2023

In the case of Metropolitan Bank, we can see that since Q4 2021 there has been a gradual decline, which is not good at all. However, there are two factors that make this result less bitter:

- The first is that core deposits have remained almost unchanged; compared to Q4 2022 they have even increased.

- The second is that 41 percent are non-interest-bearing demand deposits; which is a much better figure than competitors where on average this figure is on the 20.70 percent.

So on the one hand it is true that deposits are lower, but on the other hand this reduction has not affected the quality of deposits. In total, the cost of deposits is 1.72%, not low but also not worrying.

Metropolitan Bank Q1 2023

Adding the cost of deposits to the cost of borrowing, the total cost of funds is 1.83%. All in all, an affordable cost that did not adversely affect the net interest margin. In fact, the latter improved by 37 basis points over Q4 2022.

Metropolitan Bank Q1 2023

Metropolitan Bank managed to adjust well during the aggressive Fed Funds Rate hike, and that is definitely a positive factor. Personally, I tend to avoid all banks with a declining net interest margin for multiple quarters regardless, but this is not the case here.

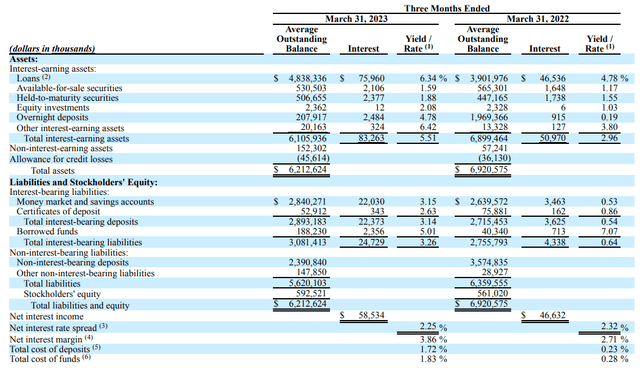

Well capitalized and risks under control

From a bank whose price per share collapses like this we should expect the worst financially, yet this does not seem to be so for Metropolitan Bank.

Metropolitan Bank Q1 2023

The key capital ratios are all broadly satisfactory to the point where the bank can be considered well capitalized. They are lower than in the past, but that is not necessarily a bad thing; after all, liquidity still has an opportunity cost to bear. Being over-capitalized is not good, as it implies the bank's lack of investment ideas and affects the net interest margin/income adversely.

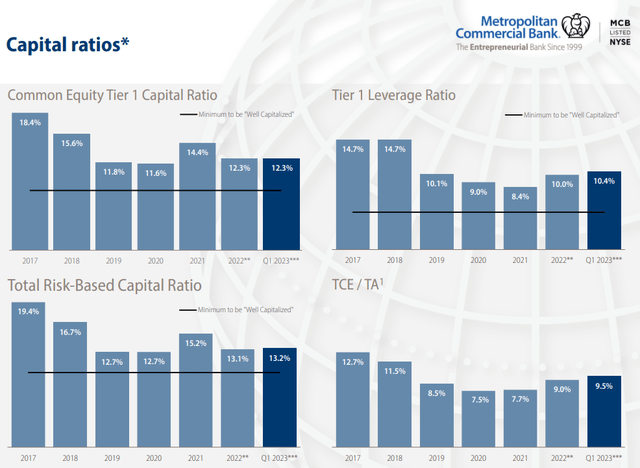

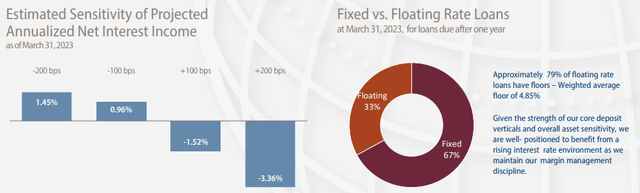

Another aspect that can negatively affect a bank's profitability is interest rate risk. Let us see how this can affect Metropolitan Bank.

Metropolitan Bank Q1 2023

If the Fed Funds Rate is increased by 100 and 200 basis points, net interest income is expected to fall, vice versa if it is reduced. So, the bank believes that the Fed has almost reached the long-awaited pivot, and it is unlikely that it will be able to continue raising rates to 6-7 percent.

The loan portfolio actually reflects these expectations; in fact, 67 percent of loans are fixed-rate, while 79 percent of variable-rate loans have a floor of 4.85 percent. In short, management is trying to attract as much investment as possible at current rates because they expect that in the future there will be no such opportunity. Personally, I agree with this view and believe that such yields will not be easy in the future, which is why it is better to lock them in. After all, the Fed may surprisingly raise the Fed Funds Rate again, but how far? Two more 25 basis point increases are expected for 2023, but still we would be below 6 percent. In other words, exceeding this threshold by much seems unlikely, so I think it is right to take a position on a rate cut.

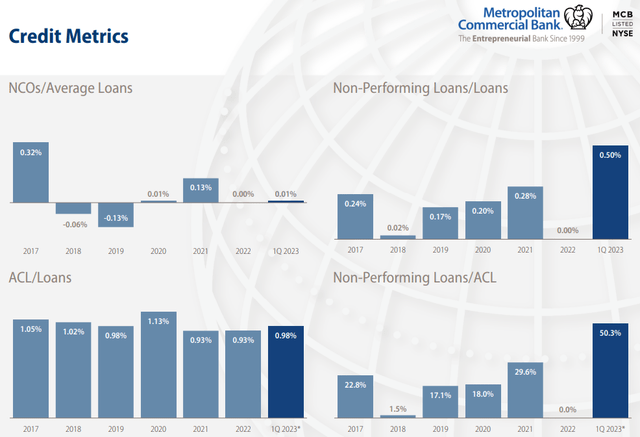

Metropolitan Bank Q1 2023

Finally, regarding credit risk, although there is a huge exposure to commercial real estate (67 percent loan portfolio), there are no signs of obvious deterioration at the moment. The weighted average LTV is 60%. Definitely this is a situation to be monitored in the future.

Valuation and final thoughts

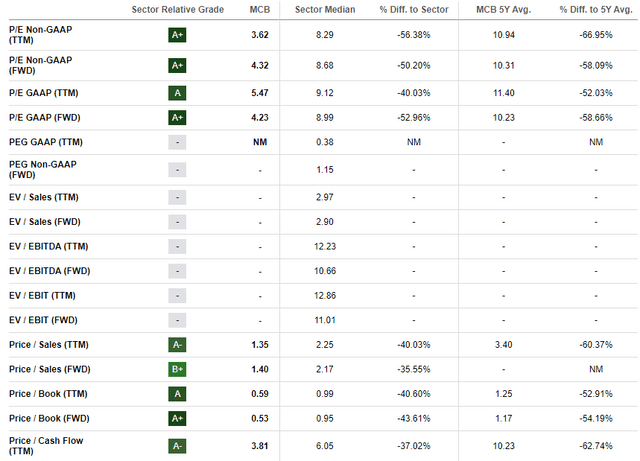

To calculate the fair value of Metropolitan Bank I will use two models, one based on Book Value per share and another on P/E. All data will be taken from Seeking Alpha.

- The average Price/Book Value for the last 5 years has been 1.25x; multiplying this figure by the current Book Value per share of $54.22, the fair value results in $67.77 per share.

- The average P/E over the past 5 years has been 11.40x; multiplying this figure by the 2023 EPS (Street estimates) of $7.40, the fair value amounts to $84.26 per share.

Averaging the two methods, the fair value is $76 per share.

In the recent period it is very common to find undervalued banks following these methodologies; however, it is not so common to find an undervaluation of such magnitude. Metropolitan Bank is currently trading at $31.96 per share, less than half of its potential fair value.

Seeking Alpha

Also supporting a strong undervaluation hypothesis is the comparison of multiples with peers. In particular, the forward multiples all show a rating of A+, which is quite surprising. The GAAP P/E (fwd) is only 4.23x, which is quite absurd in my opinion, as it discounts a scenario where this bank will have serious difficulties in the future to grow. That may be the case for a while, but I doubt that will be the case in the long run: history tells us otherwise.

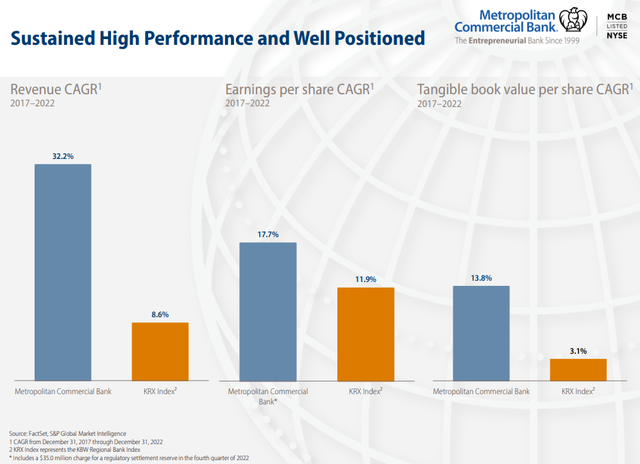

Metropolitan Bank Q1 2023

Comparing Metropolitan Bank with the KRX index, since 2017 its results have been much better. Revenue CAGR of 32.20 percent and EPS CAGR of 17.70 percent cannot belong to a bank that does not know how to grow, which is why I think the market may have overreached with Metropolitan Bank.

The risk that it may perform worse in the future certainly is there, partly because the macroeconomic environment is different, but I doubt it deserves such a low P/E. Thinking that in recent months this bank was trading at about $15 per share with a P/E (fwd) of about 2.80x makes me realize that I missed a great opportunity. At that price, the fact that it did not issue dividends was definitely secondary as the opportunity for high capital gains was more attractive than any dividend. Certainly, Metropolitan Bank represents a very risky investment and one that should not be overweighted in the portfolio, but at that price it was really difficult for it to continue to fall. In any case, even now I consider it a buy since on paper it looks too undervalued, but I would not be surprised if it collapses again: such small banks are very volatile and in a few weeks they can have completely different prices. Better to be careful even if the bank is well capitalized at the moment.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MCB over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not a financial advice, just my opinion.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.