Oracle: Well-Positioned To Capture Growth In AI Demand (Rating Downgrade)

Summary

- Oracle Corporation has shown impressive growth in its total cloud revenues, outpacing most of its peers and benefiting from a solid partnership with Nvidia.

- The company is well-positioned in the cloud and AI industry due to its solid technical approach and technological leadership in advanced cloud computing.

- Despite the excellent results and long-term outlook, the current share price is too demanding, leading to a rating downgrade to a hold.

Cristi Croitoru

Investment thesis

I lower my rating on Oracle Corporation (NYSE:ORCL) and update my revenue and EPS estimates following the company’s Q4 2023 results (which beat the Wall Street consensus) and the strong continued growth expectations from management. Oracle seems to be excellently positioned to benefit from the boom in AI and cloud computing demand.

AI has been at the center of everything lately. Or at least it seems to be. Everyone seems to be talking about the AI potential for the likes of Nvidia Corporation (NVDA) and Microsoft Corporation (MSFT), resulting in these tech giants trading at extreme valuations. Meanwhile, I feel like Oracle is still often overlooked by investors as a leading cloud services and cloud infrastructure provider. Of course, this might not look like it right now after the massive run the shares have been on since the start of the year (up 42%), driven by the popularity of AI. Still, Oracle is trading far below the valuation multiples of its cloud competitors offering a much more attractive opportunity at first sight.

Oracle has been slow to transition to a cloud-based revenue model, which has put it at a disadvantage relative to some of its competitors who were early adopters of cloud technology. Yet, the narrative is shifting, and Oracle is rapidly taking market share in cloud computing today, driven by the company’s early focus on AI services and strong partnership with Nvidia. Oracle was already integrating AI capabilities long before any of its competitors, giving the company a solid head start to benefit from the exploding demand for AI witnessed by Oracle management.

One of Oracle's primary cloud offerings is its Oracle Cloud Infrastructure (OCI), which provides a range of cloud computing services, including compute, storage, networking, and databases. OCI is designed to be highly secure, reliable, and scalable, and it is aimed at enterprise customers who are looking to move their mission-critical workloads to the cloud. Oracle has also been expanding its cloud applications portfolio, with offerings such as Oracle Fusion Cloud Applications, which include ERP, human capital management (HCM), SCM, and customer experience (CX) applications. These cloud applications are designed to help customers modernize their IT environments, improve efficiency, and reduce costs. This collection of software stacks and cloud services positions the company favorably for solid growth over the next several years and lets it leverage its already strong relationship with enterprises across the globe to extend its reach in the cloud realm.

In this article, I will take you through the latest developments and financial results and update my estimates and view on the company accordingly following its Q4 results and 1Q24 outlook. Please note that this article is an update on my in-depth coverage of Oracle a couple of months ago in which I dive a lot deeper into the company’s offering, competitive position, and expected growth.

Do not underestimate the cloud and AI potential of Oracle

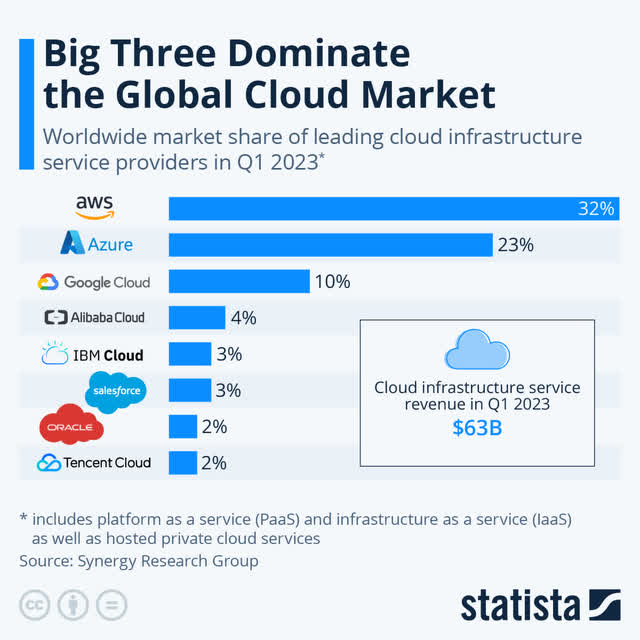

Whereas Oracle was seen as a legacy software company showing no to low single-digit growth over the last several years and management making a ton of bad acquisitions offering very little value, which led to a far from an impressive performance by the company over the last decade, the narrative has now shifted. Today Oracle is a meaningful competitor in the cloud industry and one of the leading providers of a cloud infrastructure capable of supporting AI features and services. And while its cloud computing market share of 2% might not seem very impressive compared to the likes of Microsoft and AWS, Oracle is taking market share at a rapid clip as it has plenty of levers to pull to boost its growth and leverage its technically impressive cloud infrastructure, mostly thanks to its early focus on AI. Highlighting the technical superiority of its platform is the extended partnership with the leader in AI today, namely Nvidia.

Oracle’s cloud infrastructure has been selected by Nvidia to run the first Nvidia DGX cloud at a massive scale. The impact of this should not be underestimated as the AI supercomputing service running Nvidia’s new generative AI cloud services is a massive plus for Oracle in the consideration of companies aiming to run AI services. The partnership makes Oracle the first cloud platform to support AI computing at scale (supported by a total of close to 33,000 Nvidia A100 GPUs) which is massive in today’s AI-focused business environment. The deal also allows Oracle to resell Nvidia-backed services, including high-performance storage to enterprises for their on-premises needs, improving the cloud offering of Oracle. Simply put, this partnership with AI leader Nvidia puts Oracle ahead of its competitors from a technical standpoint in the support of complex AI workloads for thousands of customers and this could be a meaningful reason for companies to pick OCI as their cloud provider.

This is what Larry Ellison said regarding this:

NVIDIA themselves are doing AI development in the Oracle Gen2 Cloud. And we are partnering with NVIDIA to build the world's largest high-performance computer, an AI computer with 16,000 GPUs. The extreme high performance and related cost savings of running generative AI workloads in our Gen2 Cloud has made Oracle the number one choice among cutting-edge AI development companies, including Mosaic ML, Adept AI, Fouhear [Ph], Modal Labs, Character, HyperReal, SliceX, Vector Space Bio, Falconry, Respeacher, Altair, InfoWorld, 12 Labs, Layton Space, plus many, many others.

On that note, let's take a look a look at Oracle’s latest quarterly result.

Oracle delivers a solid Q4 with accelerating growth in its cloud offering

For the latest and final quarter of its fiscal year, Oracle reported growth of 18% YoY as revenue totaled $13.84 billion, including a $1.5 billion contribution from Cerner. Excluding the positive impact of the Cerner acquisition, growth was limited to just slightly over 4% which is far from impressive. Yet, this is primarily due to a 15% decrease in license revenue which partly offsets the strong growth in cloud services of 23%. And as these cloud services are becoming a larger share of the total revenue (68% in 4Q23 vs 64% in 4Q22) this is something long-term investors should be focusing on for long-term growth.

Diving a bit deeper, total cloud revenues for Oracle increased by 55% (33% excluding Cerner) to $4.4 billion in Q4, up from 43% growth in the previous quarter as growth continues to accelerate for Oracle and outperformed the growth rates reported by competitors. Within these total cloud revenues infrastructure as a service (IaaS) revenue which is basically revenues generated by Oracle’s cloud infrastructure, contributed $1.4 billion, up 77% YoY. OCI consumption revenue even increased by a staggering 112% YoY, resulting in overall Infrastructure cloud services annualized revenue of $5.2 billion. As a result of the companies offering and dominant technical capabilities, the Oracle cloud platform is much preferred among customers to run all their requirements, whether this involves new services like AI or Oracle heritage offerings like database, Java, or ERP software. Moreover, according to Oracle, its specific hyperscaler technology allows it to support a much higher performance than any of its peers, including cloud leaders AWS and Azure. As cloud computing is paid by the minute, a higher performance is clearly beneficial to clients in bringing down their cloud costs as they are able to run more in the same time frame compared to competitors.

In addition, cloud database services increased by 41% as Oracle continues to migrate its database customers to the cloud. Management expects a third leg of growth here and a further acceleration over the next couple of quarters, alongside its enterprise software applications (SaaS) and Gen2 OCI cloud services. Oracle already has an extensive customer base through its enterprise software offering. As Oracle migrates these customers to cloud-based versions of these enterprise software stacks, the company is in an excellent position to upsell these existing customers to other cloud-based solutions offered by Oracle. Also, due to its extensive enterprise software offering and the transition of these to the cloud, Oracle has the most comprehensive and innovative set of apps across back office, CX, and industrial applications. This comprehensive offering from Oracle allows it to service customers of any size around the world through its NetSuite and Fusion enterprise software stacks. A deeper explanation of these can be found here.

According to Oracle, another factor setting it apart from the competition is its focus on customer success. Oracle has found that the success of its customers determines its own success as high customer satisfaction drives the use of more of Oracle’s cloud solutions by its clients. In addition, once a customer finds the Oracle suite of cloud solutions useful and is treated as a partner, this one is unlikely to leave for a competitor, even if this one has a better pricing plan. In the end, this approach by Oracle results in higher renewal rates, expansion rates, and referencing

Back to the financial results, in Q4 software as a Service (SaaS) revenue, which includes Fusion ERP (up 28%) and NetSuite cloud ERP (up 24%), totaled $3 billion and was up a very strong 47% YoY. Oracle Fusion Cloud Applications include ERP, human capital management (HCM), SCM, and customer experience (CX) applications. These cloud applications are designed to help customers modernize their IT environments, improve efficiency, and reduce costs. Due to its many decades of experience, Oracle is one of the largest players in these enterprise software packages. This results in over 340,000 customers in 175 countries.

Oracle is still very much focused on moving its legacy customers to the cloud-based applications of these enterprise software stacks, boosting growth considerably and easily outpacing its direct competitors over the last four years. As a result, Oracle’s cloud-based enterprise applications now have an annualized revenue of $6.6 billion, up 24% YoY. This transition to the cloud should remain a growth driver for Oracle over the next several years as well and as the company has a strong competitive position, the transition also allows it to take more market share in these respective industries.

Moving on, total cloud revenues and license support revenues together totaled $9.4 billion and were up 25% YoY, accelerating from 20% in Q3. This was driven by Oracle’s incredible offering of cloud-based enterprise applications, its focus on its autonomous database, and impressive growth in Gen 2 OCI.

Overall, Oracle has seen a much more resilient performance in cloud compared to its large cloud competitors which have seen declining growth over the last year. Meanwhile, Oracle has grown its Gen 2 cloud infrastructure at a rapid clip over the last three years with it today being seven times larger and still showing accelerating growth sequentially. Also, Oracle’s cloud infrastructure growth rate doubled over the last year, indicating that the cloud services offered by Oracle are in high demand among enterprises as Oracle is especially strong in AI support, allowing it to take market share in the overall cloud industry.

Moving to the bottom line, The gross margin for cloud services and license support was 78% which in itself is very impressive, yet this is down from the mid-90s last year as the mix between cloud revenue and licensing has changed quite a bit with cloud massively outgrowing the license support. As cloud services hold lower margins, this has meaningfully brought down margins. Still, the gross profit increased by 19% (10% excluding Cerner).

With margins of both IaaS and SaaS revenues improving, this is expected to largely offset the further impact of this negative revenue mix. In addition, the continuing data center capacity expansion worldwide allows Oracle to drive up margins as it is able to service more regions. Following this, the operating income increased by 12% YoY to $6.2 billion, showing an operating margin of 44%. As a result of the slight decrease in margins, EPS growth came in somewhat below revenue growth as this grew 8% to $1.47, still outperforming the consensus by $0.09. Finally, free cash flow came in at $3.7 billion.

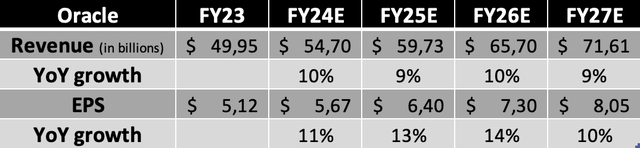

This Q4 result also meant the completion of Oracle’s FY23 fiscal year. Quickly summarizing this, Oracle reported revenue of $50 billion, up 18%, and EPS of $5.12, up 27%. Free cash flow for the full year totaled $8.5 billion. Also, as a result of strong cloud bookings and the Cerner acquisition, RPO increased by 47% in constant currency and totaled $67.9 billion, of which 50% will be realized over the next 12 months.

As for the shareholder returns, these were well covered by free cash flow over the last year as Oracle repurchased $1.3 billion worth of its own shares and paid $3.7 billion in dividends over the last 12 months. As free cash flow is expected to grow solidly over the next several years driven by margin improvements and lower investments (as a percentage of revenue) over time. Therefore, I believe there is enough room for further dividend growth and more buybacks over the next several years as well, although I believe paying down debt should be a priority by management.

Outlook and ORCL stock valuation

Moving to the outlook for Q1, management expects to report revenue growth of 8% to 10% as current exchange rates function as a 1% tailwind. Management indicates that it sees some potential for further upside from this current projection, but this depends on the rate at which Oracle can expand its capacity to customers. This quarterly growth is, of course, driven by strong growth in total cloud revenue as this is expected to grow by 29% to 31% YoY (excluding Cerner). And while this is down slightly from 33% in Q4, with this growth Oracle still beats most of its cloud peers. This strong topline growth should also drive meaningful growth in EPS as Oracle projects EPS to grow between 9% to 13% YoY and to come in at between $1.12 and $1.16.

As highlighted by the Q1 expected growth rate, FY24 should be another strong year for Oracle. As it is seeing unprecedented demand for its cloud services and AI services in particular, management believes it should be able to grow cloud revenues in FY24 at a similar rate to FY23, despite the significantly larger revenue base. Excluding Cerner, total cloud revenues in FY23 were up 29% to $13.6 billion. Including the contribution of Cerner, cloud revenues totaled $15.9 billion. This means that if Oracle were indeed to maintain its total cloud revenue growth rate at 29%, this would result in total cloud revenue of $20.51 billion. This continued impressive growth in cloud revenues for Oracle also results in this accounting for a larger part of total revenue which should be a driver of Oracle’s overall growth rate. As for FY24, Oracle expects Capex to be similar to FY23 which puts this around $8.7 billion. Overall operating margins should expand in FY24 which should positively impact EPS growth.

Following this guidance from management and the excellent financial results delivered by the company for its fiscal Q4, I now project the following results for the years until the company’s fiscal FY27 (ending May 2027).

Long term projections (Daan Rijnberk)

(Q1 estimate includes revenue of $12.66 billion and EPS of $1.17.)

Shortly explaining these estimates, I now expect Oracle to report slightly under 10% revenue growth in its fiscal FY24 combined with EPS growth of 11% as a result of slight margin improvements as guided by management. Oracle will most likely see strong and resilient growth in its cloud business due to the boom in AI demand and other headwinds for cloud computing. Oracle seems excellently positioned to benefit from these massive growth drivers. And it's these same growth drivers that will allow Oracle to keep growing at a solid pace for the foreseeable future as well due to the company's strong competitive positioning in AI and crucial partnerships. Meanwhile, EPS will outgrow revenue as Oracle will continue to improve margins further while also buying back its own shares to reward its shareholders.

Moving to the valuation, Oracle currently trades at a forward P/E of 21x which is meaningfully higher compared to the 18x forward P/E last time I covered the company as the share price has increased by over 38% over this time frame. As a result, Oracle is currently quite a bit more expensive than it was a couple of months ago, driven by the AI hype and excellent financial results of both the company itself and Nvidia. This has also driven the valuation to over 37% above its 5-year average, although it could be argued that the current outlook for the next five years is significantly better compared to the previous five years, explaining and warranting the higher valuation.

And still, Oracle might be one of the cheapest leading cloud and AI service providers as the likes of Nvidia, Microsoft, Amazon (AMZN), and Salesforce (CRM) are all trading meaningfully higher. Still, large downsides to the Oracle investment case are its large debt position and the risks created by the integration of Cerner. Oracle still has over $95 billion in debt on the balance sheet which compared to the strong balance sheets of its peers is a meaningful downside for investors as this brings with it additional risks and financial limitations. Also, most of its peers are expected to outgrow Oracle over the next several years. Therefore, I choose to remain conservative and award Oracle a P/E of 20x as this seems fair considering all circumstances. Based on its fiscal FY25 EPS, this results in a target price of $128, leaving only a limited upside of 7.5%. (Please note, this target price is solely based on its forward P/E and is only for indicative purposes.)

For comparison, 33 Wall Street analysts currently maintain a target price of $122 combined with a buy rating.

Conclusion

Oracle delivered excellent results in Q4 and is clearly showing its strength in cloud and AI services by showing impressive growth in its total cloud revenues that outpace most of its peers. The company is very well positioned through its technical approach and technological leadership in advanced cloud computing, driven by a solid partnership with Nvidia. This positioning is crucial to the investment case here as Oracle is entirely focused on leveraging this to drive growth over the next several years and strengthen its position in the cloud and AI industry.

Yet, despite these excellent quarterly results and the impressive long-term outlook, the recent run-up in the share price following its excellent results and the explosive demand in AI services has caused a somewhat more demanding share price compared to a couple of months ago when I rated shares a buy. As a result, I chose to take a more conservative stance towards the shares and lower my rating to a hold today as the current share price leaves only a very limited upside to my target price. This also considers the company’s high debt burden and slightly lower growth expectations compared to peers.

Oracle remains one of my favorite companies to benefit from cloud computing and AI growth. Yet, the current share price is simply too demanding, and I, therefore, recommend investors to wait for a slight pullback in share price as I am personally targeting a buy price of between $105-$110 to create some more downside protection.

I rate Oracle shares a hold at a share price of around $118.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ORCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)