TC Energy's Diverse Assets Yield Low-Risk Operations And Stable Cash Flow

Summary

- TC Energy is a leading energy infrastructure company with extensive pipeline networks in the United States, Canada, and Mexico, ensuring stable cash flow and earnings.

- The company has strong financials and promising market outlook, with increasing natural gas prices and exports expected in the coming years.

- Despite potential risks, such as fluctuating commodity prices and global economic conditions, TC Energy is an excellent low-risk investment opportunity with solid long-term growth potential.

onurdongel

Introduction

TC Energy (NYSE:TRP) is a leading energy infrastructure company that operates in the United States, Canada, and Mexico. The company's operations encompass natural gas and liquid pipelines, power generation, and natural gas storage facilities. TC Energy's core business comprises five operating segments: Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexican Natural Gas Pipelines, Liquids Pipelines, and Power and Energy Solutions.

TRP business and financials

The primary driver of TC Energy's financial success is their extensive infrastructure assets and commercial agreements in the transportation, storage, and delivery of natural gas and crude oil, as well as power generation facilities that produce electricity. The company generates significant EBITDA from their natural gas pipelines in both the United States and Canada. With the continued high demand for natural gas in North America's energy landscape, TC Energy's long-term contracts ensure a stable cash flow and earnings stream while minimizing operational risks.

In the first quarter of 2023, TC Energy maintained strong financial statements, thanks to sustainable cash flow growth and progress in their funding program. One of the company's major assets is TRP's Keystone crude oil pipeline, which transports crude oil to the Gulf Coast and Midwest of the United States. Other critical assets include NGTL and Mainline natural gas pipelines, responsible for transporting approximately 75% of Western Canada's natural gas capacity. Notably, TC Energy increased its NGTL System total deliveries in 1Q 2023 compared to 1Q 2022, reaching an average of 14.5 Bcf/d. These impressive operations during the first months of 2023 resulted in a net income of $1.3 billion compared to only $0.4 billion year over year in 1Q 2022

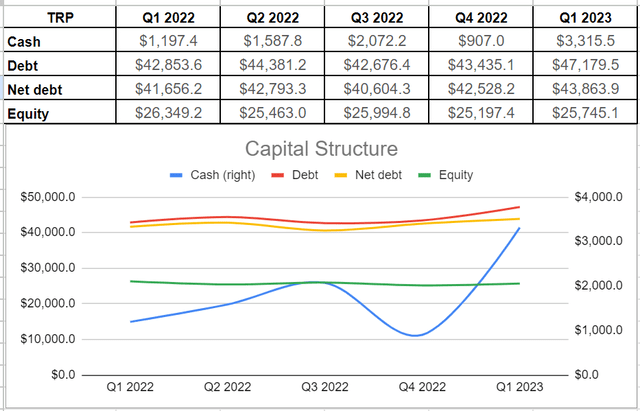

During the recent quarter, TRP's cash balance saw an astonishing surge, reaching $3.3 billion. This is a significant increase from the $907 million at the end of 2022 and $1.2 billion in 1Q 2022. Although TRP's net debt level increased slightly to $43.8 billion at the end of the first quarter compared to $42.5 billion at the end of 2022, their equity level remained almost constant at $25.7 billion over the last year. However, this increase in debt levels is not a concern as TRP has continued its industry-leading secured capital program by placing $1.4 billion worth of projects in service during the first quarter and planning to put another $6 billion in service by the end of 2023 (see Figure 1).

Figure 1 – TRP’s capital structure (in millions)

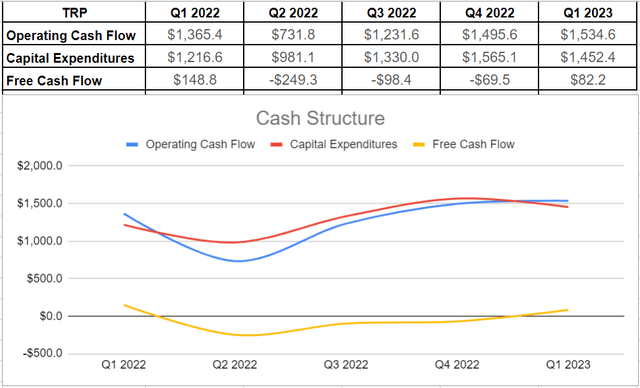

The U.S. Natural Gas Pipelines have achieved a new record for delivering to LNG export facilities, resulting in TRP management revising their predicted comparable EBITDA to be 5% to 7% higher than the $2.4 billion in 2022. Despite experiencing three consecutive quarters of negative free cash flows, TRP generated $82.2 million of free cash flow due to an increase in operating cash flow to $1.5 billion in the recent quarter compared to $1.3 billion at the end of 1Q 2022. Additionally, the management team has committed to keeping capital expenditures between $6 to $7 billion by year-end, using cash savings from in-service projects for deleveraging. Once they hit their leverage ratio target of 5x, they plan to increase shareholder returns through dividends and share buybacks (see Figure 2). Furthermore, TC Energy invested $363 million in dividend reinvestment and share repurchase plan (DRP) at the beginning of 2023 and plans to pay a dividend of $0.93 per common share by the end of 2Q 2023.

Figure 2 – TRP’s cash structure (in millions)

What make TC Energy a highly valuable investment is its unique combination of long-term and qualified contracts, as well as short-term and long-term pipeline projects. Their extensive pipeline network throughout the U.S., Canada, and Mexico provides promising opportunities for return on investment. TC Energy's well-qualified assets, such as the NGTL and Mainline natural gas pipelines, are crucial to Canada's energy export infrastructure and prevent serious capacity deficiencies. Overall, TC Energy is an excellent investment opportunity for those seeking low-risk options with solid long-term growth potential.

Market outlook

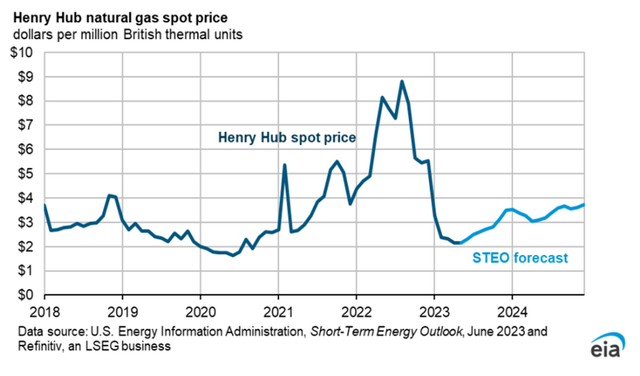

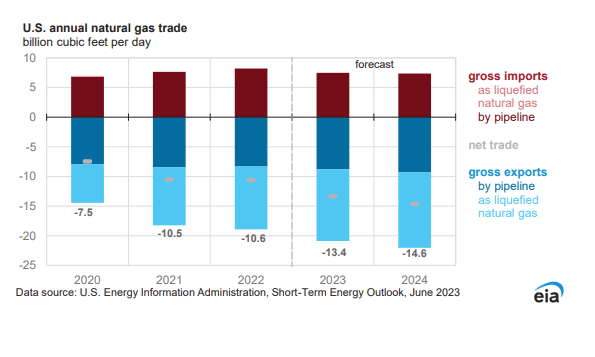

As a prominent midstream company with significant operations in North America, TC Energy is heavily reliant on the volatility of commodity prices. It is expected that during the summer, the Henry Hub natural gas benchmark in the U.S will rise and reach an average of $2.6/MMBtu by the end of the third quarter of 2023. This increase in natural gas prices is predicted to continue through 2024, with a 30% increase compared to 2023 and reaching $3.40/MMBtu by the end of that year. Furthermore, it is anticipated that the share of natural gas in U.S. electricity generation will rise to 41% in 2023 from 39% in 2022 before decreasing back to 39% by the end of 2024. Figure 3 illustrates the predicted Henry Hub natural gas spot price over the next year, while Figure 4 shows that U.S. natural gas exports are expected to increase during both 2023 and 2024 compared to 2022. It is also noteworthy that U.S. natural gas exports via pipelines are expected to increase, with gross exports projected to climb from 8.31 Bcf/d in 2022 to 8.81 Bcf/d in 2023 and further to 9.31 Bcf/d in 2024.

Figure 3

Figure 4 – U.S. annual gas trade

EIA

Why I might be wrong

Despite TC Energy's strong performance and positive market outlook, the company is not immune to potential risks that could impact its operations. One such risk is the potential impact of temperature and climate changes on its assets. Government policies related to decarbonization could significantly affect long-term energy supply and demand, which may have an adverse effect on TC Energy's operations. As a capital-intensive industry, TC Energy requires substantial amounts of debt and equity financing for its projects. If the company cannot access capital at a competitive cost due to current economic uncertainties, it may negatively impact its ability to generate revenue. Additionally, TC Energy's business strategy relies heavily on the continued production of natural gas and crude oil by its customers. If production declines or costs rise, customers may struggle to explore new reserves affordably.

Conclusion

Looking ahead, TC Energy's position as a leading midstream infrastructure company is a direct result of its operations in the United States, Canada, and Mexico. With ownership of North America's largest natural gas networks, the company is well-positioned to connect cost-effective basins to high-demand markets. Furthermore, TC Energy boasts a stable cash flow profile thanks to a combination of long-term and qualified contracts, short-term and long-term pipeline projects, and an extensive pipeline network. When all was said and done, after analyzing TC Energy's financials and market outlooks, I believe that a buy rating is appropriate for TRP stock.

As always, I welcome your opinions.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)