Spotify: Grooving To A Growing User Base

Summary

- Spotify Technology S.A.'s user base is rapidly growing, marking its strongest user growth in Q1 since going public.

- The profitability profile is expected to improve with a steady ramp throughout 2023.

- Despite challenges in the advertising market, Spotify aims to smooth out and increase its profitability profile.

- The company's ability to increase profitability and generate higher free cash flow will be crucial for sustaining investor confidence and supporting its valuation.

- I do much more than just articles at Deep Value Returns: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

hocus-focus/iStock Unreleased via Getty Images

Investment Thesis

Spotify Technology S.A. (NYSE:SPOT) is a business that has found a way to turn around its business and has been rewarded by investors for doing so.

For my part, I am bullish on the name and proactively point to the business' underlying health and growing user base.

However, I find its unimpressive free cash flows a concern. Unless Spotify finds a way to dramatically improve its free cash flows, I will struggle to remain bullish on the name.

That being said, Spotify assures investors that it will be improving its profitability throughout 2023, which for now goes a long way to support its rapidly increasing share price.

Rapid Recap

In my previous article, titled "Peter Lynch Turnaround," I stated,

Spotify is a Peter Lynch turnaround. That means a stock where the narrative that everyone knows is one thing. But actual the underlying business is dramatically improving.

I highlighted at the time that I had successfully called Spotify on the way down. Then, I proceeded to argue why it was the right time to turn bullish on this name.

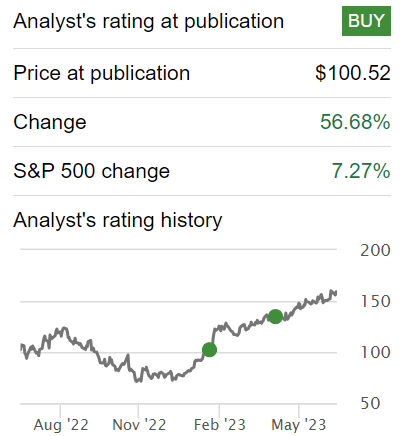

Author's work on SPOT

Since I turned bullish on SPOT, the stock has outperformed the S&P 500 (SP500). Forcing the obvious question, what's next?

Spotify's Near-Term Prospect

Investing is an odd affair. It's so easy for one to look for ''distractor'' information. For one to get caught up in narratives that truly mean nothing at all.

For my part, I argue that the single most insightful aspect to consider for any business is how demanded its services are. If you see that the customer adoption curve that is flat (or worse), that tells you everything you need to know.

There are plenty of businesses that are worthwhile investing in. What's more, you don't need to invest in more than a couple dozen names. You'll find that about 20 names provide more than enough diversification in your portfolio.

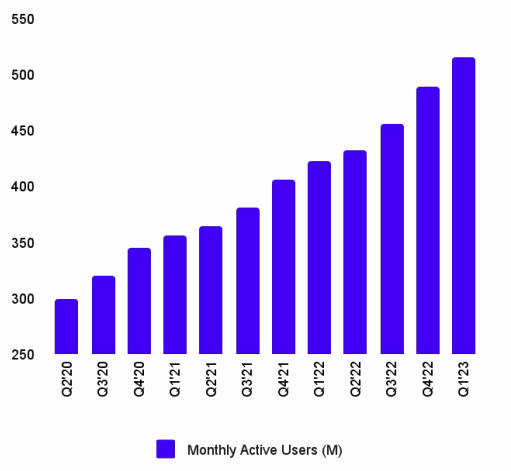

Accordingly, with this insight in mind, consider the following chart.

SPOT Q1 2023

What you see above is that with time, the number of monthly active users is going up. One doesn't need to overcomplicate what is simple.

Indeed, I contend, that in investing it's nearly too easy to get up in insights that one believes are value-added, but are actually taking one further way for the core investment thesis.

In fact, I consider this juxtaposition insightful. Spotify just crossed its strongest user growth since going public. And yet, compared with its IPO price more than 6 years ago, Spotify's share price has largely gone nowhere.

All that being said, there's been reasons for Spotify's lackluster performance.

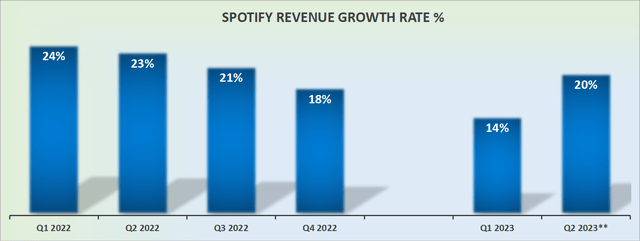

Revenue Growth Rates Are Enticing

SPOT revenues are reported, EUR

Moreover, one reason why Spotify's share price is down from its all-time highs has to do with the fact that a substantial portion of its revenues are tied to advertising revenues.

SPOT Q1 2023

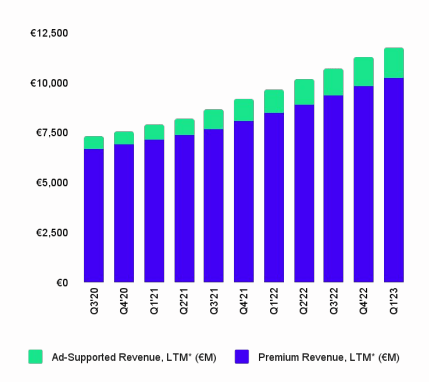

Furthermore, over the last two years, the ad market has faced significant challenges.

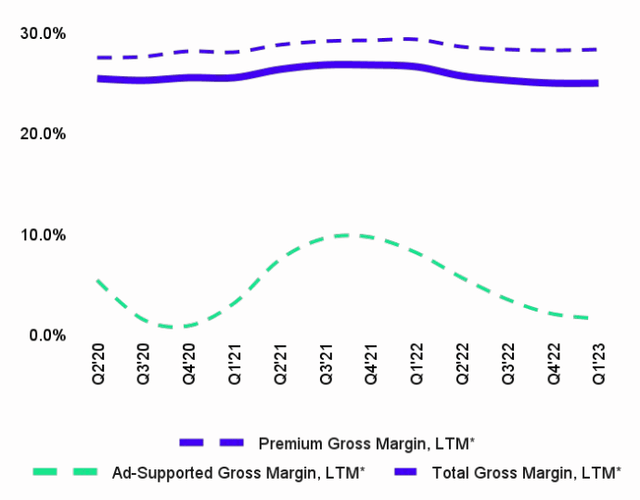

As a consequence, the turbulent advertising market's prospects can best be reflected in the graphic that follows.

What you see above, in Spotify's smoothed-out trailing twelve months ad-supported gross margin profile is that Spotify's ad-supported profitability has been erratic.

From an investors' perspective, any time a business delivers uncertain profitability, investors typically shun those businesses and the stock gets priced with a lower multiple. The key for Spotify has to do with its ability to smooth out and ultimately increase its profitability profile, the topic of our next section.

Profitability Profile is Likely to Improve

Before we progress, note this quote from Spotify's earnings call,

From a profitability standpoint, we continue to expect a steady ramp in gross margins throughout 2023 as well as sequential improvements in our operating loss.

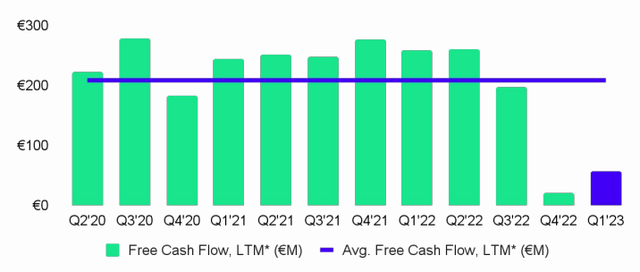

Now we get to the crux of the bearish argument. Yes, Spotify is clearly delivering attractive revenue growth rates. But as alluded to already, those increases in revenues haven't been percolated through the business in terms of increased free cash flows.

Even if we can attest that Q1 2023 saw a meaningful improvement in free cash flow from negative EUR73 million in last year's Q1 to positive EUR22 million in this year's Q1, I'm not confident that this free cash flow is enough to support its valuation.

More specifically, in the absolute best-case scenario, putting aside Spotify's management's stock-based compensation ("SBC") packages, the business is likely to report around EUR200 million of free cash flow. And I'm not sure that paying somewhere close to 150x forward (hypothetical) free cash flows is such a terrific bargain, unless those free cash flows rapidly grow.

The Bottom Line

In my analysis of Spotify Technology, I have a bullish outlook due to the company's turnaround and growing user base.

However, I expressed some concerns about its unimpressive free cash flows, which could impact my bullish stance unless improved significantly.

Despite this, Spotify has reassured investors of improving profitability throughout 2023.

The key aspect to evaluate for any business is the demand for its services, and in Spotify's case, the number of monthly active users continues to increase steadily. Revenue growth rates are enticing, but a significant portion of Spotify's revenues relies on advertising, which has faced challenges in recent years.

The company's ad-supported profitability has been inconsistent, leading investors to be cautious and assign a lower valuation.

However, Spotify expects a steady ramp in profitability throughout 2023. On the downside, while revenue growth is impressive, free cash flows have not seen a significant increase, making the valuation of the stock a concern.

The short takeaway here is that I am bullish on Spotify. But I'm keeping a close eye on its progress.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.