Southwest Airlines: Remains A Top Pick On Resilience And Adaptability

Summary

- Southwest Airlines has shown resilience and adaptability in the post-pandemic era, with revenues nearing pre-pandemic levels and a focus on operational efficiency.

- Despite strong performance, Southwest's stock has depreciated almost 50% since early 2021 due to rising interest rates and debt accrued during the pandemic.

- The company remains a top pick for long-term investors due to its robust balance sheet, extensive network coverage, and ability to weather potential economic headwinds.

Michael Ciaglo/Getty Images News

Southwest Airlines (NYSE:LUV) has shown its strength and adaptability in the post-pandemic era. The company's benefiting from robust travel demand, particularly with the resurgence in leisure travel, and its revenues are now flirting with pre-pandemic levels. While travel demand has helped the recovery, much of this achievement is due to the leadership team's emphasis on operational efficiency on the allocation and staffing front. With potential economic headwinds on the horizon, Southwest Is still a top pick for long-term investors with a robust balance sheet and an extensive network with coverage. The company is also making strides in managing costs and optimizing network and personnel deployment efficiencies, which could prove vital in weathering future economic uncertainties.

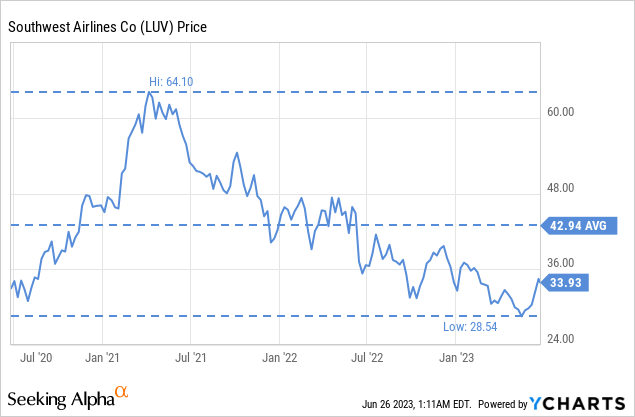

Evaluating Southwest Airlines' Stock Performance Amid Rising Interest Rates

Despite what appears to be stronger than anticipated travel demand, Southwest Airlines' stock trajectory tells a distinctly less optimistic story. Amid the Federal Reserve's aggressive campaign of interest rate hikes designed to curb inflation, the airline's shares have experienced a significant downturn. From its peak in early 2021, the stock has depreciated almost 50%, a distressing trend that could lead some observers to question the financial stability of the company.

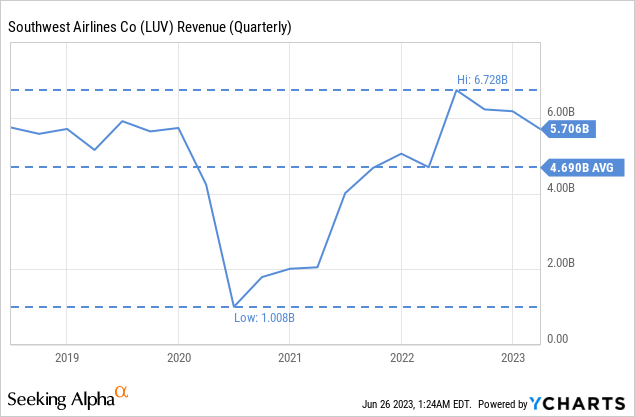

If we take a look at the current business situation, southwest is firing on all cylinders. Is posting decent revenue growth and approaching key milestones, with revenue figures reaching The emblematic pre-pandemic level in late 2022.

For followers of the travel sector and its key players, the attainment of pre-pandemic performance levels has been a major target, prominently touted in numerous earnings calls. This goal, in large part, arises from the extensive damage the COVID-19 pandemic inflicted on these corporations. The sector was in chaos during the peak of the pandemic, with losses so severe that it seemed an inevitability for big airline companies to face bankruptcy, at least according to social media chatter. However, thanks to decisive leadership and potentially some aid from governmental fiscal measures, major players managed to mitigate the harm and weather the storm. Yet, despite the high expectations, shareholders who remained faithful to the management and company prospects during the toughest times are not reaping the anticipated rewards. Quite ironically, the primary issue appears to be the substantial debt the company accrued during the pandemic in an effort to strengthen liquidity.

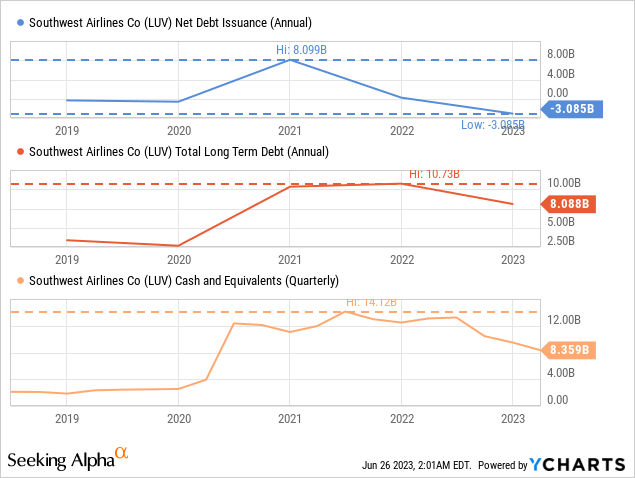

The bolstered liquidity has certainly strengthened Southwest's balance sheet at a critical time, but like any substantial loan, it is now exerting pressure on the company's cash balance. A close examination reveals that the remaining long-term debt closely aligns with the remaining cash balance, a circumstance that is far from ideal. However, the silver lining remains Southwest's ability to maintain profitability and generate solid cash flows, enabling it to meet interest obligations effectively. Although the debt will become more manageable over time, we are likely still a few years away from that point. This debt burden is presumably influencing investors' perception of the stock, as interest payments could pose a significant load, particularly if the company experiences a period of unprofitability due to a recession-induced slowdown in demand or other unexpected developments. Although it's hard to envision a scenario worse than the travel industry's crash during the COVID-19 pandemic, this remains a considerable risk. A parallel situation can be drawn with American Airlines pre-COVID-19, which had allocated a substantial sum towards stock buybacks and was caught unprepared when the pandemic struck.

Investors will likely consider the cash flow issues the industry faced in 2020 as the economic outlook for late 2023 becomes more unclear. However, a key difference with Southwest is its healthy cash balance in relation to its operational scenario. Additionally, Southwest has the capacity to rapidly adjust its staffing levels, enabling it to streamline its model in response to any potential decline in travel demand. As long as the company is responsive to a falloff, it should be able to weather a recession just fine, which is what investors should be focused on.

Another recurring concern pertains to the potential strike action by pilots. From my perspective, this is a negligible factor. In the event of a pilot strike, the entire business model of the airline comes under threat. However, this issue has arisen on numerous occasions in the past, and invariably, the airlines have successfully negotiated solutions that are acceptable to all involved parties. Even if the resolution incurs additional costs to appease the pilots, it's unlikely to pose a significant threat to the business. With share prices at their current low levels, investors should maintain a long-term perspective.

Valuation and Company Outlook

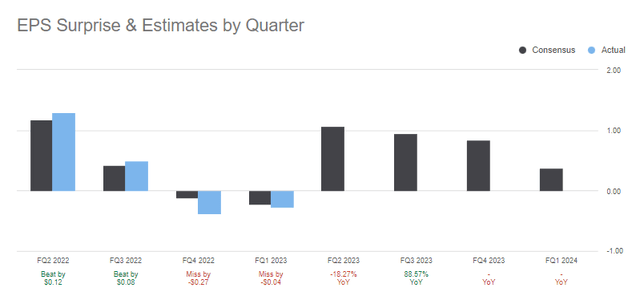

Delving into Southwest Airlines' outlook as we approach the latter half of 2023 - a period typically bustling for the airline industry owing to heightened domestic U.S. leisure travel during Thanksgiving and the winter holidays. As you can see in the chart below, analysts are forecasting a robust performance for the remaining quarters of 2023.

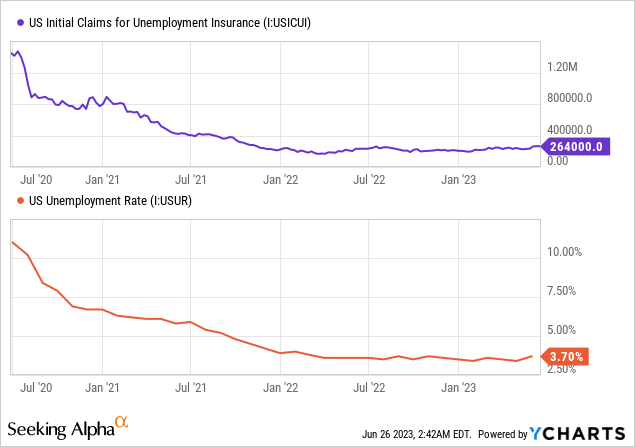

Despite the tightening measures of the Federal Reserve, a deceleration in the travel industry, especially in leisure segments, seems unlikely during the back half of 2023. Even with aggressive rate hikes, significant spikes in the unemployment rate remain unseen. For cyclical industries like travel, the unemployment rate is a key indicator; even if a substantial proportion of the population continues to hold disposable income, a high unemployment rate can severely dampen consumer confidence, and discretionary expenses like travel often bear the brunt of such shifts.

As of now, it remains uncertain whether the unemployment rate will surge significantly as job layoffs have thus far been counterbalanced by substantial job availability. As we debate whether the US will face a recession in the coming months, it's crucial to note the unique dynamics in play within the American economy. Any imminent recession would follow one of the most aggressive expansions of the money supply in U.S. history, and it's uncertain how this abundant liquidity will respond to the Federal Reserve's efforts to rein in inflation. There is also the unfortunate loss of over 1.1 million lives to the Covid-19 pandemic (reported by the CDC), which has resulted in a tighter labor market due to the removal of these individuals from the workforce.

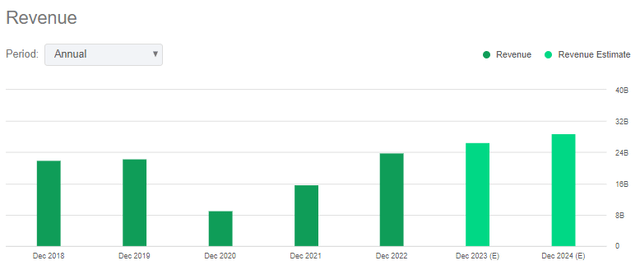

Taking a step back and looking at the bigger picture, we can see that revenues are expected to continue to increase over the next few years, which is, of course, very welcome.

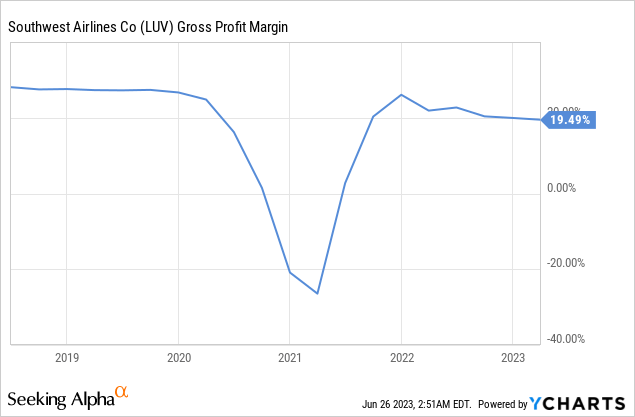

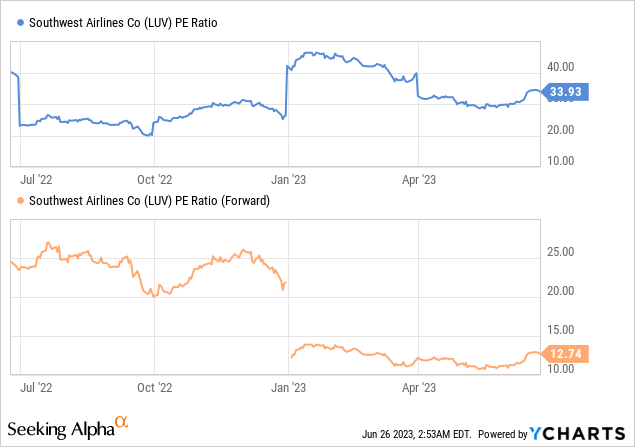

From an EPS perspective, analysts are expecting the company to earn $2.66 per share EPS for 2023, with EPS figures rising to $4.68 by 2025. With the recent selloffs and this strong outlook, we are presented with a compelling valuation for a purchase despite the clear microeconomic headwinds on the horizon. I'm expecting a strong end to the fiscal year 2023, and the company is already maintaining a strong 20% gross margin which is comparable to pre-pandemic levels.

I expect margins to strengthen slightly during the back half of the calendar year 2023 due to strong leisure travel demand and steady business travel. The recession story simply has not played out so far, and these valuations are beginning to look very attractive. We are talking about one of the largest players in the travel industry, trading at a forward PE of less than 13. This is normally a no-brainer.

The Takeaway

It's impossible to overlook the ironclad resilience and agility Southwest Airlines flaunts, even when economic storm clouds loom. The pandemic-era debt, while substantial, hasn't clipped the company's wings. The recovery has been resolute, but the risks are notable. The risk of pilot strikes might unnerve some; historical evidence suggests it's a hurdle the company knows how to surmount. The bigger issue is a potential unemployment surge, but it's essential to keep an eye on the horizon and appreciate the long-term potential for investors, especially given the current valuation. I am building out a position with the company and believe this may be a great dollar-cost-averaging candidate. There may be some pain ahead, but I rate this stock a long-term buy.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.