Gentex: An Attractive Play Even In Light Of Recent Underperformance

Summary

- Gentex Corporation, a producer of digital vision and connected car products, has underperformed recently despite a solid track record and absence of debt.

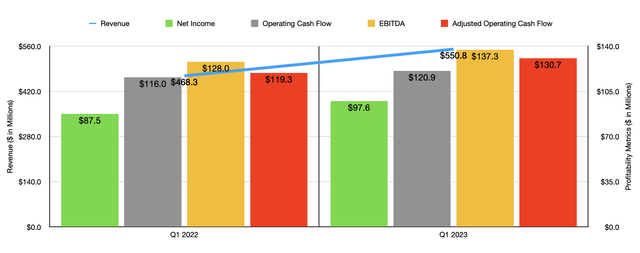

- The company's Q1 2023 revenue was $550.8 million, a 17.6% increase from the previous year, with net income up 11.5% to $97.6 million.

- Despite not being cheap compared to similar firms, GNTX's strong financial condition and continued growth warrant a soft 'buy' rating.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Edwin Tan /E+ via Getty Images

Even though I consider myself a value investor, I do like to keep checking up on my investments and my investment prospects on a fairly regular basis. I need to know if the picture is changing for the better or for the worst for a company, especially if it is achieving financial performance that is deviating materially from what I anticipate. One company that has recently underperformed that I was bullish on is Gentex Corporation (NASDAQ:GNTX), an enterprise that produces and sells digital vision, connected car, and dimmable glass products, as well as fire protection products. Shares of the company were never exactly cheap. However, it's solid track record as of late, combined with the absence of debt and a significant amount of cash on hand, has led me to believe that the company can and should outperform the broader market. However, that outperformance has failed to materialize. Digging into the numbers, I believe that my bullish thesis still remains intact. So instead of changing my stance on the enterprise, I will argue that additional patience and time will likely be required for the company to truly deliver.

Great results recently

A little over three months ago, in March of this year, I decided to look once again at Gentex to see exactly how the company was coming along. From the time I had written about the firm previously in October of last year, through the date that I decided to check up on it in March, shares were up 11.8% compared to the 6.1% seen by the S&P 500. This outperformance what is encouraging. And what I found upon revisiting the company is a business that did indeed have a rather rocky 2022 fiscal year. But the end of the year was particularly promising and the forecast for 2023 struck me as bullish in nature. Add on top of this that shares were just barely cheap enough to warrant some optimism, and I had no problem rating the enterprise a 'buy'. Since then, the stock has continued to appreciate, climbing by 4.3%. Such a return over a short window of time would generally be considered positive. But compared to the 13.4% seen by the S&P 500 over the same period, results have been disappointing.

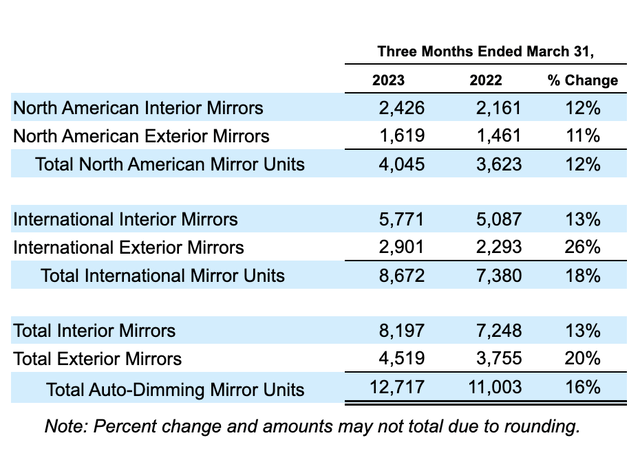

If you focus solely on the most recent financial data covering Gentex, you would probably be surprised to see that shares have underperformed the broader market. Revenue during the first quarter of the company's 2023 fiscal year, for instance, came in at $550.8 million. That's 17.6% above the $468.3 million generated one year earlier. There were a few different drivers behind revenue changes from year to year. But one thing that the company definitely benefited from was a roughly 15.6% surge in the number of auto-dimming mirror units. This number grew from 11 million to 12.7 million. Even more impressive was the 17.5% increase in the number of international mirror units sold, with the number climbing from 7.4 million to 8.7 million. Even in North America, the company experienced a nice bit of growth, with a number of mirror units growing 11.6% from 3.6 million to 4 million. Although a very small part of the pie, it is noteworthy that the revenue that the company generated associated with dimmable aircraft units spiked 118% from $1.9 million to $4 million. And outside of this category entirely, fire protection sales also increased, growing by 10% from $8.4 million to $9.3 million.

This increase in sales brought with it higher profitability as well. Net income, for instance, shot up 11.5% from $87.5 million to $97.6 million. According to management, the firm did suffer some from a decrease in its gross profit margin from 34.3% to 31.7%. This was driven largely by higher raw material costs, prior commitments that the company had made to annual customer price reductions, an unfavorable product mix, and higher labor costs. The picture would have been worse had it not been for a reduction in freight expenses. Other profitability metrics also improved for the business. Operating cash flow, as one example, inched up from $116 million to $120.9 million. If we adjust for changes in working capital, we would have seen this number improve even more from $119.3 million to $130.7 million. And finally, EBITDA for the enterprise expanded from $128 million to $137.3 million.

When it comes to the 2023 fiscal year in its entirety, management does have high hopes for the business. Revenue is expected to come in at around $2.2 billion. If this comes to fruition, it would represent a sizable increase over the $1.9 billion reported for 2022. Estimates regarding the company's cost structure indicates the net income for the year should be around $378 million. Those same estimates imply operating cash flow of $483 million and EBITDA of $555 million.

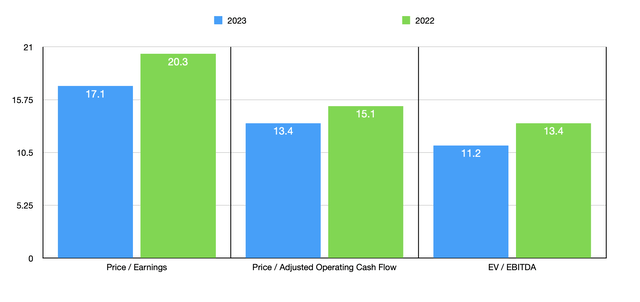

Using this data, it becomes quite easy to value the company. As you can see in the chart above, shares are trading at a forward price to earnings multiple of 17.1. This is down from the 20.3 reading that we get using data from last year. The price to adjusted operating cash flow multiple should decline from 15.1 to 13.4, while the EV to EBITDA multiple of the company should drop from 13.4 to 11.2. Relative to similar firms, shares are not exactly cheap. As you can see in the table below where I compare it to five similar enterprises, four of the five companies are cheaper than Gentex on a price to earnings basis and on an EV to EBITDA basis. Using the price to operating cash flow approach, three of the five companies ended up being cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Gentex | 20.3 | 15.1 | 13.4 |

| Autoliv (ALV) | 17.3 | 12.1 | 8.5 |

| Lear Corp (LEA) | 19.4 | 10.7 | 7.6 |

| Fox Factory Holding Corp (FOXF) | 20.8 | 15.7 | 14.9 |

| Standard Motor Products (SMP) | 16.8 | 14.3 | 8.2 |

| Modine Manufacturing (MOD) | 10.9 | 15.4 | 9.7 |

Outside of the valuation data, there are some other items that I think are noteworthy. As I mentioned earlier in the article, the company has no debt. It also boasts $245.1 million in cash and cash equivalents. This is on top of $229.4 million worth of long-term investments that it has at its disposal. Management is also very innovative. Even though the industry in which the company operates may not seem like one that would involve a lot of potential changes, the firm launched 18 net new interior and exterior auto dimming mirrors and electronic features during the first quarter of 2023 as a whole.

While innovating, the company is also dedicating resources toward growing its physical footprint. For instance, in the first quarter of 2022, the company began construction on a 350,000 square foot manufacturing facility in Michigan that it estimates will cost between $80 million and $90 million in all. That is expected to be operational by the final quarter of this year. They have also started working on two building expansions, with one involving the addition of 300,000 square feet to one of its distribution centers, all at a cost of $40 million to $45 million. The other expansion project is of one of its manufacturing facilities for an extra 60,000 square feet that it estimates will cost between $20 million and $30 million. If management is making these moves, then the firm likely will benefit. However, it is worth noting that its current building capacity should allow it to produce between 34 million and 37 million interior mirror units each year and 15 million to 18 million exterior mirror units each year. That's a significant amount of volume in and of itself.

Takeaway

From what I can see, Gentex is on solid footing. The company's financial condition is fantastic and growth continues to impress. I understand that shares of the business are not exactly cheap, especially relative to similar firms. But some companies do warrant some premium over the competition. And Gentex is, I believe, one such example of that. Because of this, I've decided to keep the company rated a soft 'buy' at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.