With An Average Dividend Of 9%, These 2 Stocks Beat The Market For Over A Decade

Summary

- Business Development Companies offer high yields and market-beating returns, making them a valuable addition to an investor's portfolio.

- Top BDCs, such as Main Street Capital and Ares Capital, provide a steady, robust stream of income and long-term market-beating returns.

- Despite their high yields, elite BDCs have proven their resilience during economic downturns, making them a strong investment option.

- Looking for a helping hand in the market? Members of The Dividend Kings get exclusive ideas and guidance to navigate any climate. Learn More »

imagedepotpro

I probably followed a fairly common path when I first began investing. At times I invested in companies with business models I did not understand, I traded too often, and I tended to fall for sucker yields.

However, I contend that losing money in the stock market is akin to touching a hot stove. Simply put, I grew tired of being repeatedly burned, and I learned from my mistakes. Unfortunately, even well learned lessons can sometimes lead one astray.

My early experiences left me with an aversion to high-yield stocks. I tended to believe that hefty dividends equated to very big risk. Furthermore, I found that many stocks with big yields had rather convoluted business models. I migrated to dividend growth investments, and I am happy to say that I've done very well with a portfolio focused on DGI stocks.

Nonetheless, I am always striving to grow as an investor. At times, that means I get an occasional blister from another hot stove encounter, but it also results in my finding new ways to beat the market. After spending a great deal of time dissecting Business Development Companies (BDCs), I'm convinced that they belong in every investor's portfolio.

BDCs not only provide high yields, the best BDCs also provide a strong degree of safety and market-beating returns. My goal is to help others understand how BDCs operate and to prove that the high yields offered by the top notch BDCs are a sign of healthy investments, not the sucker yield that many view as symptomatic of a poor investment.

Understanding BDCs

In 1980, Congress created Business Development Companies to give public investors an additional means to invest in private U.S. businesses and to provide small and growing companies access to capital.

BDCs are required by law to invest a minimum of 70% of assets in the debt and or equity of non-public U.S. businesses with market values of $250 million or less. BDCs must also maintain an asset coverage ratio of at least 150% (the asset coverage ratio is a financial metric measuring how well a company can repay its debts by selling or liquidating its assets) and distribute at least 90% of investment company taxable income to shareholders to avoid corporate income tax on distributed taxable income.

Most BDCs have distribution payout ratios of 80-95%. This is important to note, as high payout ratios are oftentimes the hallmark of sucker yields. Obviously, this is not the case with BDCs due to the distribution requirements.

Furthermore, BDCs must meet specific asset diversification requirements that limit the concentration of an investment in any single company.

A hallmark of top notch BDCs is that the bulk of their investments are in floating rate loans while the majority of their funding is at a fixed rate. Oftentimes, this leads to an increase in net investment income and cash flow per share during rising rate environments.

The so-called proof in the pudding regarding the loan costs for BDCs versus the rate they charge clients lies in the fact that there is a 500-900 point yield spread between most BDCs' borrowing costs and the income they receive on their investments.

The elite BDCs also exhibit a high industry and borrower diversification, well laddered debt maturities, a very low percentage of non-accruals, and a high percentage of first-lien debt investments.

For those unfamiliar with the term, first-lien debt holders have the right to sell the borrower's assets in the event the borrower fails to repay the creditor.

It is important to understand that first lien debt holders are paid back before all other debt holders, including other senior debt holders.

Second lien loans, which oftentimes comprise 20% to 30% of many BDCs' portfolios, are also a form of senior debt. Second lien loans have equal standing with first lien loans in terms of principal and interest payments; however, second lien loans are subordinate to first lien holders in the event that a company's assets are liquidated due to a failure to meet loan obligations.

This is where the required minimum asset coverage ratio of 150% comes into play.

Since BDCs' income is not taxed at the corporate level, distributions are taxed based on the type of income earned by the BDC. Therefore, ordinary income generated by a BDC is taxable for investors at ordinary income rates. At the same time, capital gains generated by a BDC are generally taxable for investors at capital gains rates.

Main Street Capital (MAIN)

I've chosen to highlight Main Street straight out of the gate to illustrate the strength of the elite BDCs. MAIN serves as an example of how hefty dividends, at least those paid by top notch BDCs, are anything but sucker yields.

MAIN IPO'd in 2007, just in time to be tested by the Great Recession. It was common for financial stocks to cut their dividends during the resulting downturn: not Main Street Capital. Nor did MAIN cut the dividend during the COVID crisis.

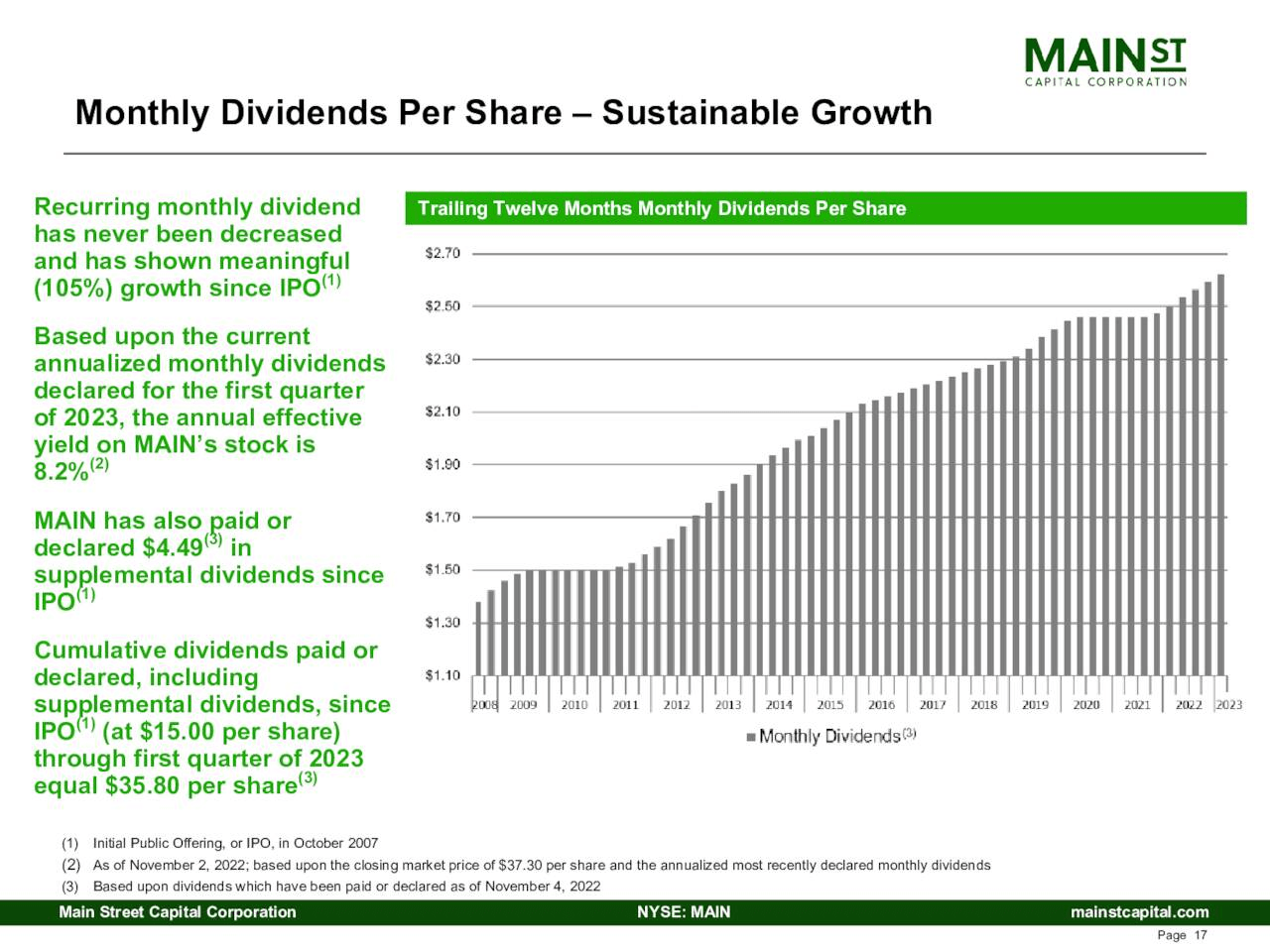

From Q4 of 2007 through Q1 of 2023, MAIN increased the monthly dividend by more than 105%. Those that bought shares of MAIN when it IPO'd have been richly rewarded. The firm has paid $36.30 in dividends to date, well over the $15.00 share price when MAIN IPO'd and very near the current share valuation.

Main Street Capital 2022 Q3 Earnings Call Presentation

From the end of 2007 through September of 2022, MAIN's Net Asset Value (NAV) grew 102%.

MAIN targets companies with revenue in a range of $10 million to $150 million.

MAIN has investment grade credit ratings of BBB-/stable from S&P and Fitch.

MAIN has a weighted average effective yield 10.6%.

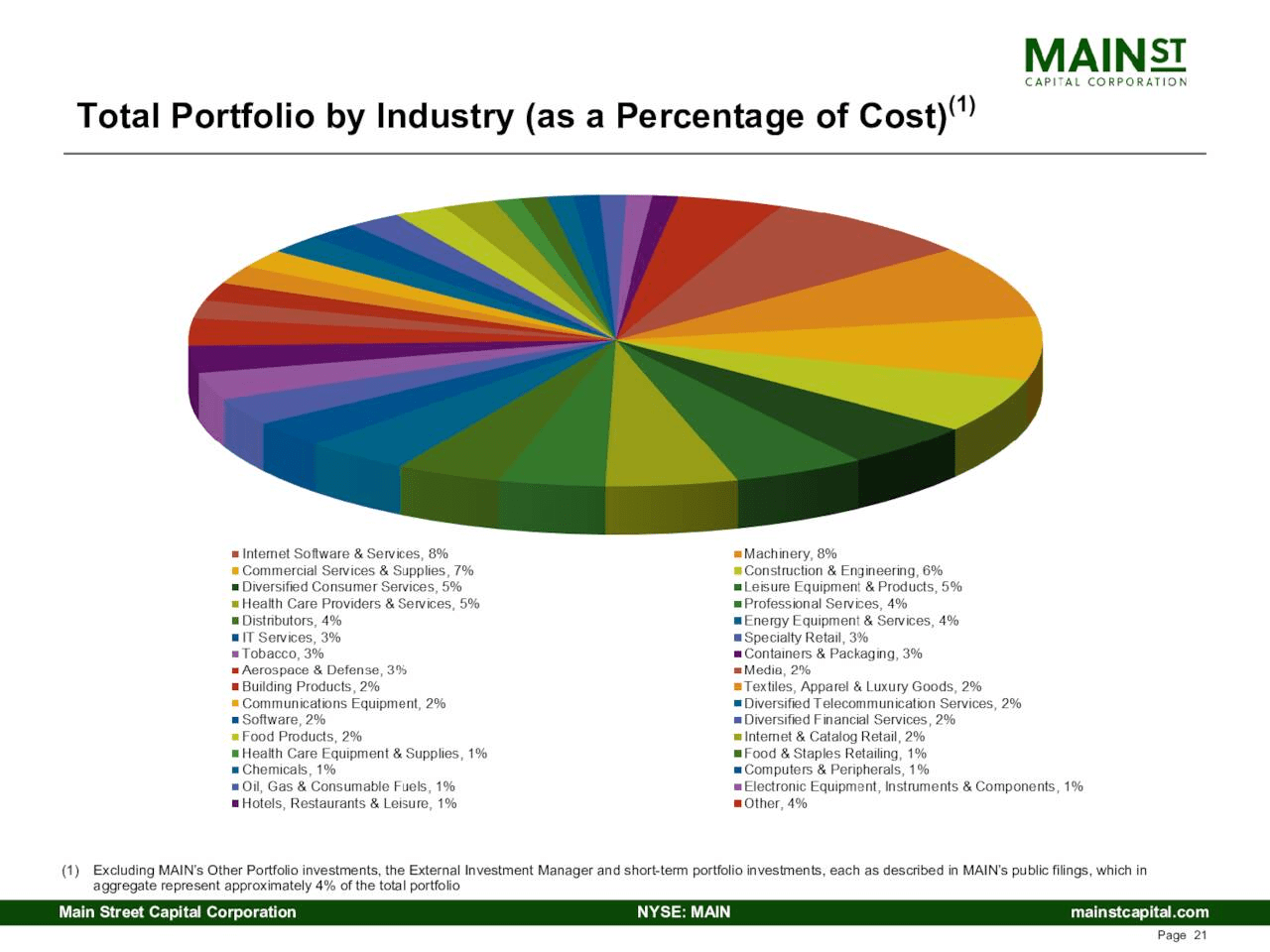

The company has a highly diversified portfolio with investments in 195 companies with the largest single investment representing 3.2% of the total loan portfolio. Of the 79 lower middle market companies in MAIN's portfolio, over half have been clients for greater than five years and a quarter for over a decade.

MAIN also has a high degree of diversification across industries, as is noted in the following chart.

Main Street Capital Investor Presentation

The company ended the latest quarter with 13 investments on non-accrual status, comprising approximately 0.6% of the total investment portfolio.

Of MAIN's portfolio of lower middle market portfolio companies, which comprise nearly half of the firm's assets, 99% are first lien loans.

MAIN holds as much as 27% of assets in equity positions of its portfolio companies. While this is generally considered as higher risk than investments in the form of first and second lien loans, management touts that it aligns MAIN with the portfolio company owners and management teams.

As of March 31st of this year, NAV per share is $27.23, and the stock yields 7.23%. I should add that MAIN pays a monthly dividend.

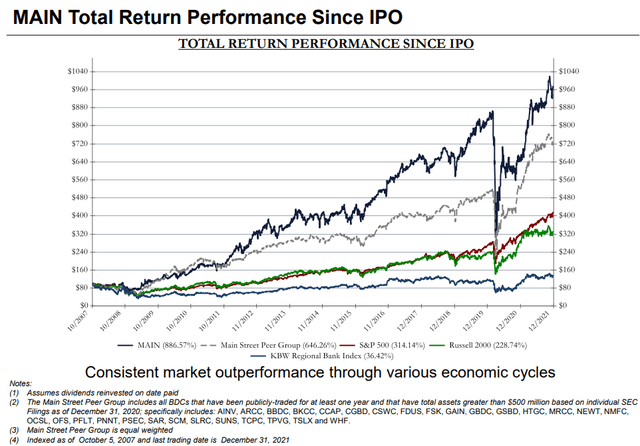

And last but far from least, for those that believe high-yield investments lag the overall market, take a look at the following chart.

Main Street Capital Q4 2021 Investor Presentation

MAIN doesn't just beat the market. Over the long haul, the total return for MAIN trounces the market. MAIN notched an 886% return versus a 314% return for the S&P 500, all while providing a steady source of income.

Furthermore, MAIN's peer group provided a 646% return in the same time frame, additional proof that BDCs generate market-beating returns along with a steady strong stream of passive income.

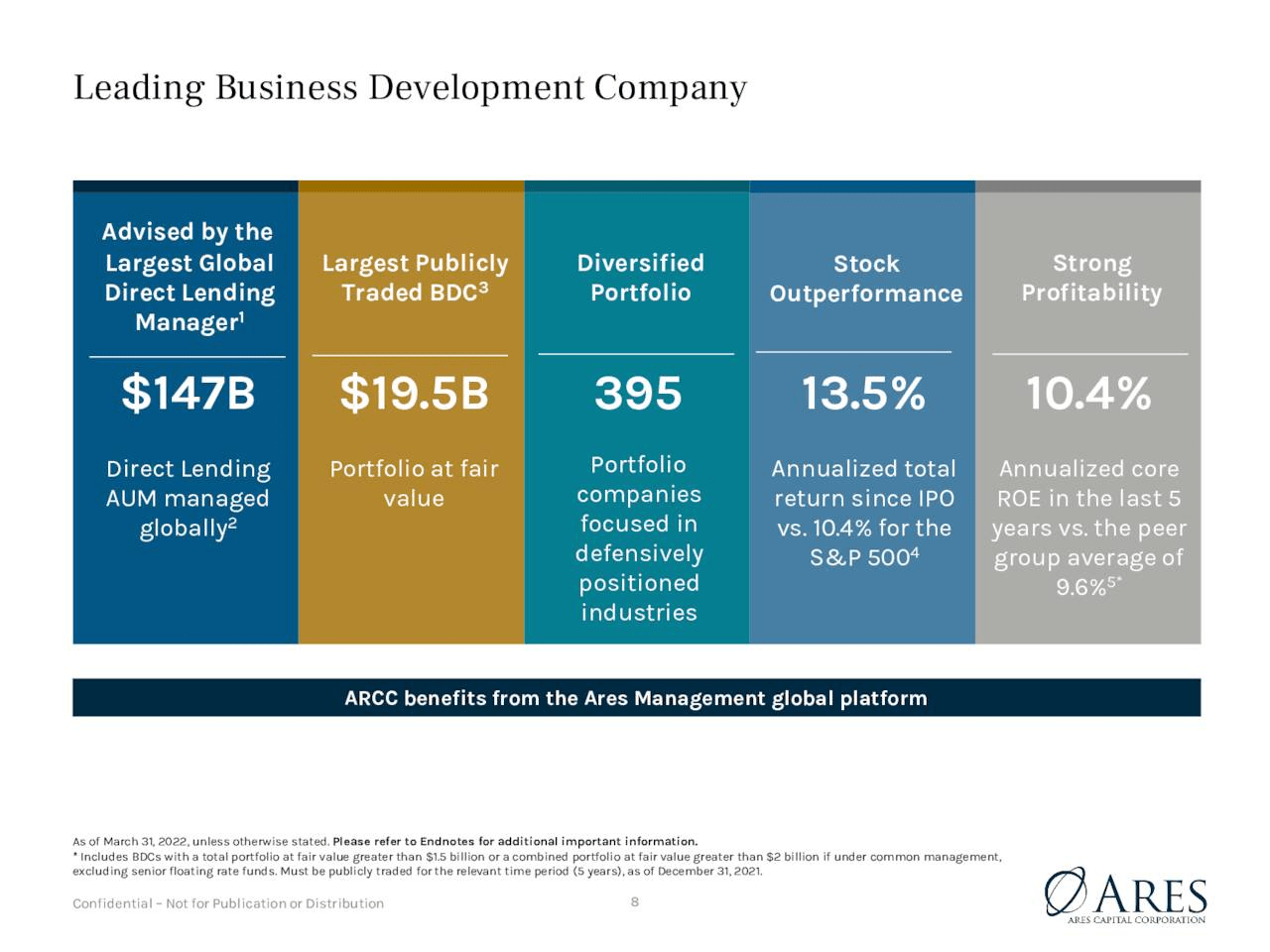

Ares Capital (ARCC)

As of the end of last quarter, ARCC had a weighted average yield on debt and other income-producing securities of 12%. First lien loans originated in Q1 had a weighted average yield in excess of 11%.

The firm's non-accrual rate increased from 1.7% to 2.3% last quarter. However, that is well below the 15-year average of 3%. It also compares well with the BDC industry average of 3.8% through year-end 2022.

ARCC's annual realized loss ratios as of Q4 21 (the last time the firm reported that metric) is 0.0%.

Management is preparing for a more difficult economic environment by deleveraging. ARCC ended Q1 with a net debt-to-equity ratio below 1.1x. This compares well to the mean average of 126.1% for publicly traded BDCs.

Fitch provides an investment grade BBB rating to ARCC.

As of 06/15/23, ARCC's price to NAV was 1.01. That represents an approximate 20% increase in NAV since inception. The mean for publicly traded BDCs is 0.90.

I would opine that ARCC trades at a less attractive NAV due to it being one of the elite BDCs.

The stock currently yields 10.65%, and ARCC has over 13 years of stable or increasing common dividends.

The following chart is a bit dated, it comes from the last June's Analyst Day Presentation, but once again, it shows how quality BDCs have outperformed the broader market.

ARCC Investor Presentation

So since 2004, ARCC has a total return that has beaten the market by 3.1% annually with an average dividend yield over the last four years of roughly 9.5%.

Sounds too good to be true?

Like Joe Friday, "All we want are the facts." And facts don't lie.

Additional Observations Regarding BDCs

Unlike MAIN, ARCC cut the dividend during the Great Recession (neither company cut during the COVID crisis). ARCC cut the base dividend from $0.42 a quarter to $0.35 a 17% reduction.

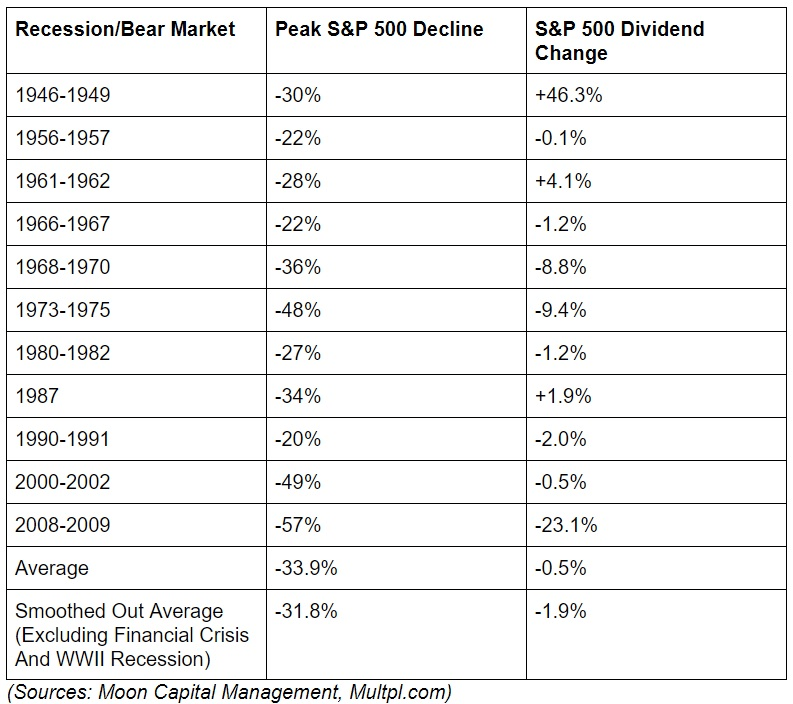

So how does that compare to the broader market? The chart below outlines how the S&P 500 fared. Note that the 2008-2009 market crash resulted in the largest dividend cuts since WWII, and by a wide margin. Furthermore, about a third of dividend paying companies cut their payouts during the Great Recession.

WORLD of DIVIDENDS

My point is that even though ARCC cut the dividend, the company's actions should be placed in context. Furthermore, had you invested in ARCC during the stock's trough in 2009, you would now have an approximate yield on cost of 58%.

Now consider how banks fared during the Great Recession. I point this out, because most investors would consider banks as reasonably safe investments.

Even so, only one bank listed in the S&P 500 did not cut the dividend during the Great Recession, and only two banks listed in the S&P did not cut their dividends during the COVID downturn.

Neither MAIN nor ARCC cut the dividend during the COVID bear market.

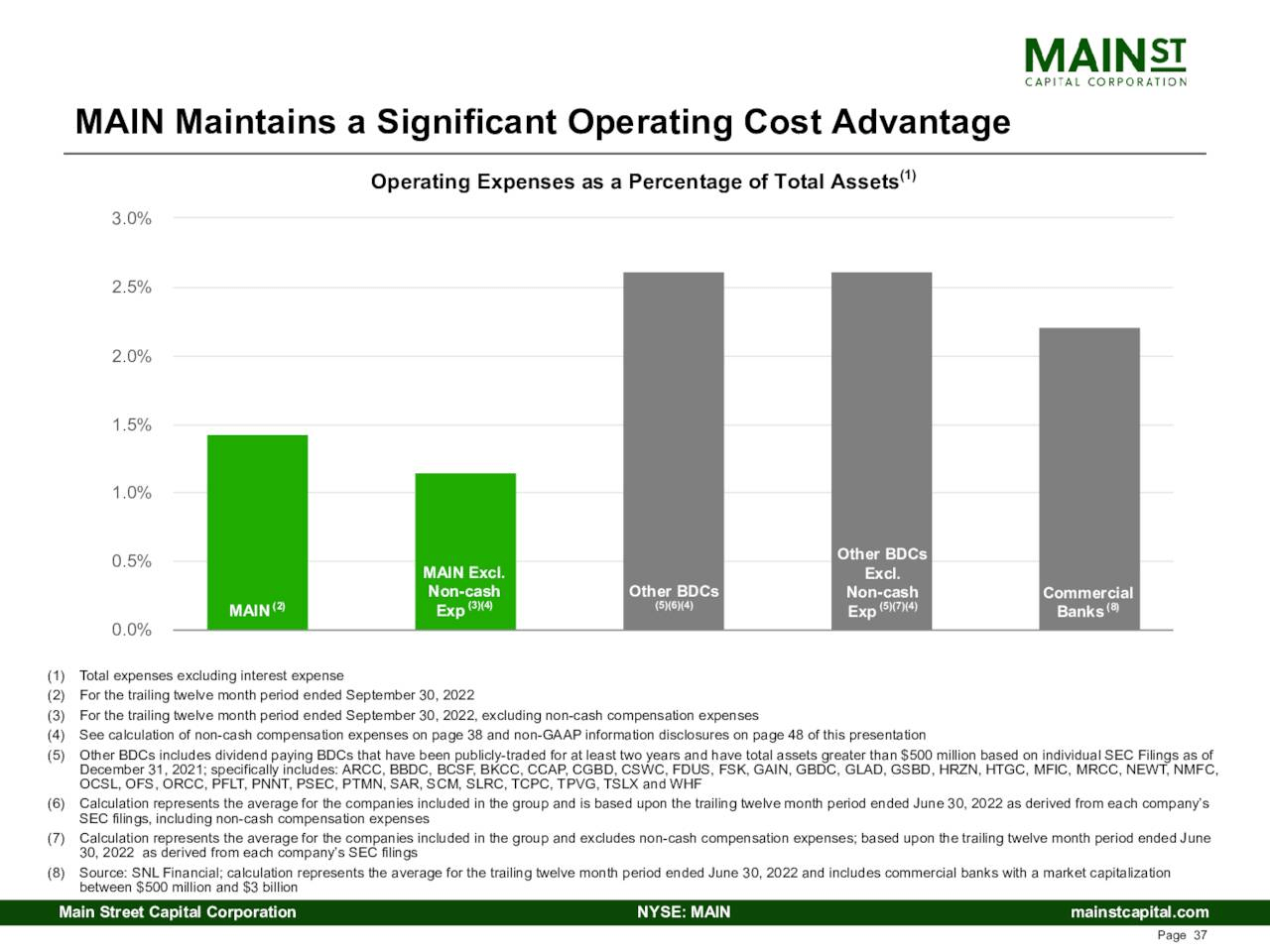

Now peruse the last chart which compares the operating cost advantage MAIN holds over commercial banks.

MAIN Earnings Presentation

MAIN And ARCC: Buy, Sell, Or Hold?

Many investors consider stocks with a yield of 7% or greater as destined for anemic growth that leads to poor total returns over the long haul, or worse yet, as sucker yields that are the hallmark of soon-to-be investment failures.

I've labored to dispel the notion that the high yields associated with top quality BDCs falls under that sort of rubric. In fact, at least for the top flight BDCs, the opposite is true.

MAIN, ARCC, and a handful of other BDCs not only generate a steady, robust stream of income, they also provide long term market-beating returns.

ARCC historically trades at a premium to NAV in a range of 1.15x to 1.25x. As it currently trades at a NAV of 1.01x, I rate ARCC as a BUY.

I have been adding shares of ARCC for over a month, and I will continue to do so at this valuation.

Main Street Capital's historic valuation range is at a 35% to 90% premium to NAV. As of June 15th, MAIN trades at 1.45x NAV.

That places MAIN in a Reasonable Buy range. (I define Reasonable Buy as a level at which I might add to a position in small increments.)

I have a very small position in MAIN, and I intend to add to that investment when the market opens on Monday.

It is important to note that no BDCs went bankrupt during the Great Recession or during the COVID inspired bear market. However, investors dumped shares of the elite BDCs, driving yields up.

With a possible recession on the horizon, investors may be able to pick up names like ARCC and MAIN at a bargain basement price in the not-too-distant-future.

Although I rate MAIN and ARCC as buys, I consider Owl Rock Capital Corporation (ORCC) to be the best BDC investment at this juncture. I authored a piece on that stock earlier this month.

This article was written by

As of 12/08/2022 I am rated among the top 2.8% of authors in terms of overall results. This is according to TipRanks, which provides a 63% success rate and an average 17.3% annual return for my articles. (I update this score on at least a quarterly basis for readers.)

I could be characterized as a safety first investor. My primary focus is on dividend bearing stocks. I seek a degree of safety in my investments by concentrating on companies with competitive advantages and strong balance sheets.

I am a also value / buy and hold investor. Since I require a discount in the share valuations of my investments, my ratings are generally very conservative. My valuation requirements, combined with the high quality companies that I often highlight mean many stocks I rate as a hold perform well over the long term. Readers should consider this when weighing my buy/hold/sell recommendations.

I am a retail investor, with no formal training in investing.

I am a graduate of the U.S Army Ranger school and a former member of the 1st Ranger Battalion and The Old Guard (U.S Army Honor Guard.) I am a retired law enforcement officer. I have approximately 20 years experience as a retail investor.

Best of luck in your investments, Chuck

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MAIN, ORCC, ARCC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have no formal training in investing. All articles are my personal perspective on a given prospective investment and should not be considered as investment advice. Due diligence should be exercised and readers should engage in additional research and analysis before making their own investment decision. All relevant risks are not covered in this article. Although I endeavor to provide accurate data, there is a possibility that I inadvertently relay inaccurate or outdated information. Readers should consider their own unique investment profile and consider seeking advice from an investment professional before making an investment decision.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

AD