BHP Group: Industrial Metals Royalty Companies Offer Higher Return At Lower Risk

Summary

- BHP Group's valuation is expensive compared to industrial metals royalty companies Labrador Iron Ore Royalty Corporation and Ecora Resources, which have better business models and higher average earning yields.

- Royalty companies benefit from larger profit margins, less exposure to risks, and inflation protection while still being in the mining industry.

- The commodity mix of a combination of LIORC and Ecora is similar to that of BHP, but BHP is mainly exposed to low grade rather than high grade iron ore.

- While BHP has some metallurgical coal and potash diversification, there are cheaper companies with royalties on these commodities as well.

Photon-Photos/iStock via Getty Images

Thesis

BHP Group (NYSE:BHP) trades at a premium to industrial metals royalty companies such as Ecora Resources (OTCQX:ECRAF) and Labrador Iron Ore Royalty Corporation (OTCPK:LIFZF), despite these royalty companies having a superior business model and a more desirable commodity mix. 53% BHP's EBITDA in 2022 came from low grade iron ore and 24% came from unloved coal. By contrast, Ecora is transitioning its royalty asset base from metallurgical coal to base metals, and Labrador Iron Ore Royalty Corporation (OTCPK:LIFZF)(LIORC) has a royalty on a high grade iron ore mine, whose iron ore can be used for green steelmaking as well as for steelmaking using metallurgical coal. Therefore, I rate BHP as a sell, and recommend buying royalty companies such as Ecora and LIORC instead.

Company Overview

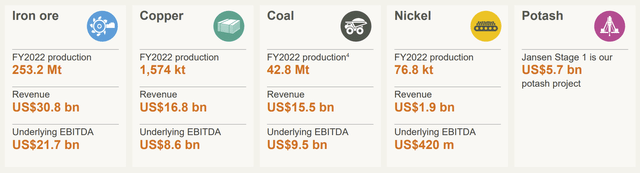

BHP is the world's largest mining company by market capitalization. It primarily focuses on mining iron ore, copper, coal, nickel and potash (see chart below). While BHP has base metals diversification, it remains primarily a bulk commodity mining company with iron ore accounting for 47% of its revenue and around 53% of its EBITDA, and coal accounting for 24% of its revenue and around 24% of its EBITDA. It primarily mines iron ore in Western Australia's Pilbara region and mines coal in northeastern and southeastern Australia. Its base metals mines account for the remainder of its revenues and EBITDA and are located in Australia and South America. Its potash project is based in Canada, and is expected to produce 12 million tons of potash annually, which will generate around $6 billion in annual revenues using a $500 potash price. Therefore, nickel and potash generate the least amount of revenue for BHP.

BHP 2022 Annual Report

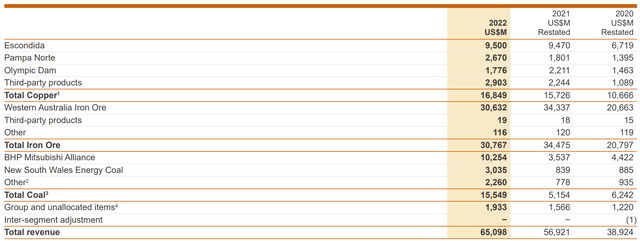

BHP's revenues and resulting profits have increased in the past couple of years due to growth in its bulk commodity segment (see chart below). In 2021, iron ore prices were high, and therefore accounted for most of BHP’s revenue increase for that year. In 2022, coal prices spiked higher causing BHP coal revenues to triple, and was responsible for BHP’s revenue increases for that year. However, coal prices and iron ore prices have since fallen, and this could result in BHP's revenues and profits falling this year.

BHP 2022 Annual Report

Company Financials

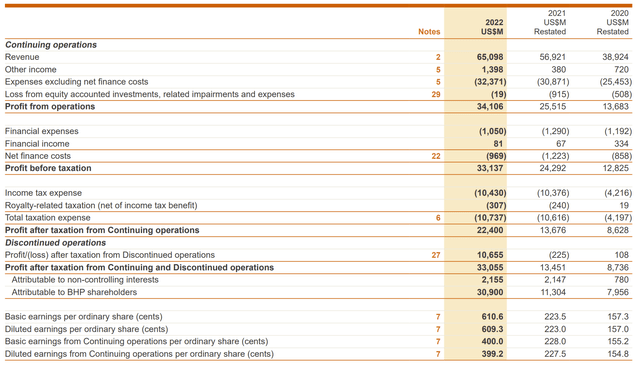

BHP report their results from July to June, so the most recent annual report covers the time period July 2021 to June 2022. This report also contains the most recent financial statements, as the more recent reports are much more high level. Looking at the chart below, BHP’s costs increased from around $25 billion to around $32 billion from 2020 to 2022. However, their revenues increased at a faster rate from around $37 billion to $65 billion due to higher prices for especially iron ore and coal. This resulted in after tax profits from continuing operations expanding from around $9 billion to around $22 billion. In addition, 2022 profits were further swelled by a one time $11 billion gain from discontinued operations, primarily due to BHP Petroleum merging with Woodside. Focusing on earnings from continuing operations, and using a market cap of $153 billion, gives BHP a price to earnings (P/E) ratio of around 6.8, which is not that cheap given the high coal and iron ore prices in 2022. Using 2021 or 2020 earnings instead would give BHP a P/E ratio of around 11.2 or 17.8 respectively.

BHP 2022 Annual Report

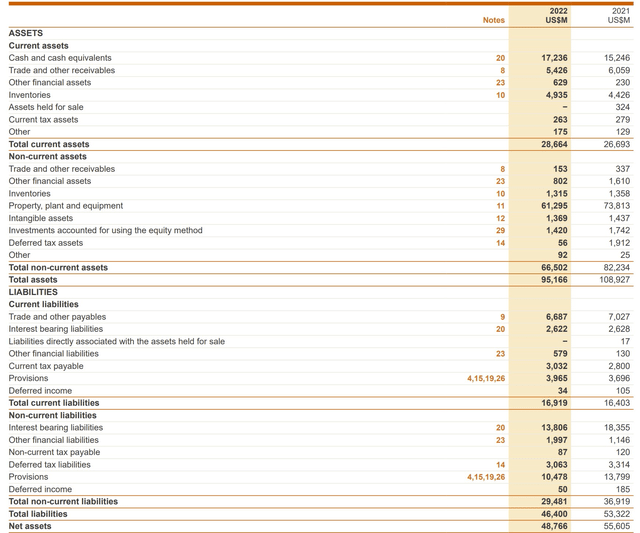

BHP's balance sheet, as of June 30, 2022, looks strong, with its cash and cash equivalents exceeding its interest bearing liabilities. Its primary assets are cash and cash equivalents and property, plant and equipment, while its primary liabilities are interest bearing liabilities and closure and rehabilitation provisions. Assets totaled $95.2 billion and liabilities totaled $46.4 billion, resulting in a net asset value (NAV) of $48.8 billion. Using a market capitalization for BHP of around $153 billion gives BHP a price to NAV (P/NAV) ratio of around 3.14.

BHP 2022 Annual Report

Company Valuations

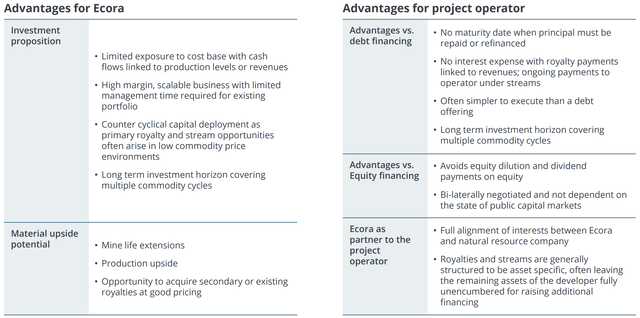

In order to evaluate whether BHP is a buy or a sell, is it useful to compare its valuation with that of its competitors. As I am a big fan of royalty companies due to their superior business model over mining companies (see chart below), I will compare BHP's valuation with that of two royalty companies which combined have a similar commodity mix to BHP. BHP is around 50% exposed to iron ore and 50% exposed to base metals and coal. LIORC, which I previously covered here, is 100% exposed to high grade iron ore, while Ecora Resources, which I previously covered here, is primarily exposed to base metals and coal.

Ecora Resources February 2023 Investor Presentation

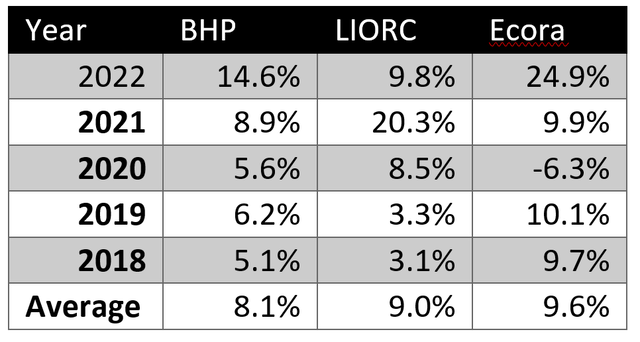

The chart below compares the earnings yield for BHP, LIORC and Ecora over the past 5 years. Note that BHP values are calculated from July of the previous year to June of the current year, and I use dividends for LIORC, as it pays out all its free cash flow in dividends, and thereby this better reflects its earnings than its reported earnings value, which tends to be much too high.

Interestingly, despite having a superior business model, both royalty companies LIORC and Ecora are currently trading at higher 5 year earnings yields than BHP. They also have lower valuations in terms of price to net assets, as I previously calculated P/NAVs for Ecora of 0.45 and LIORC of 0.66, compared to a 3.14 P/NAV for BHP. Therefore, Ecora and LIORC look like better buys at current valuations than BHP.

Authors calculations based on financial data sourced from Seeking Alpha

Risks to Thesis

Factors that can influence the performance of BHP, Ecora and LIORC moving forward include jurisdiction risk, operator risk, growth in commodity production, and commodity price changes. BHP, Ecora and LIORC primarily have mines in Canada and Australia, and therefore are all relatively resilient to jurisdiction risk. In fact they have better jurisdictional risk profiles than most other mining and royalty companies. Interestingly, all bulk commodity mines for these companies are located in either Australia or Canada, with the base metals mines covering more jurisdictions including countries in South America.

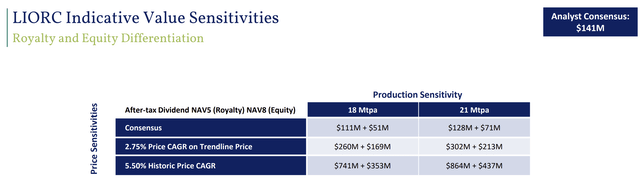

BHP faces many operator risks, including its cost of production exceeding commodity prices, which Ecora and LIORC are less exposed to. Interestingly, though, this results in BHP having smaller margins and thereby higher leverage to commodity prices than either Ecora or LIORC. Therefore, BHP could outperform in the short term if an increase in commodity prices causes BHPs earnings to rise faster than those of Ecora and LIORC. However, as has been seen in recent years, rising commodity prices are eventually followed by higher costs, resulting in the long run underperformance of mining companies compared to royalty companies. While I have referred to LIORC as a royalty company, it is not a pure play royalty company as it also owns an equity stake in Iron Ore Company of Canada which is the operator of the Carol Lake mine, in addition to its royalty of the Carol Lake mine itself. The chart below sourced from Altius Minerals (OTCPK:ATUSF), which owns a substantial stake in LIORC, shows how cost increases over time lowers LIORC's ratio of equity net asset value to royalty net asset value from 0.55 (71/128) to 0.51 (437/864).

Altius Minerals 2023 Investor Day Presentation

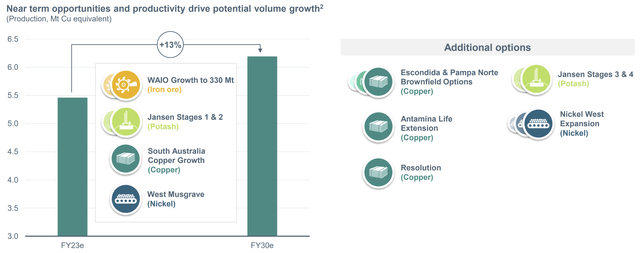

BHP could also outperform Ecora and LIORC, if either the prices of its commodity mix or its future production increases faster than that of Ecora and LIORC. BHP expects its copper equivalent production to increase by 13% between 2023 to 2030 (see figure below). It is unclear whether this figure includes BHP's coal production, and whether its coal production will increase or decrease. However, given that coal is not displayed anywhere in the figure, it is unlikely to increase, and BHP could eventually follow the example of other peer mining companies in disposing of its coal assets. Since coal accounted for 23% of BHP's revenues in 2022, this means that production of all BHP's commodities may actually decrease between 2023 and 2030. By comparison as outlined in my previous articles on Ecora and LIORC available here and here, I expect production growth for Ecora and LIORC to be much higher than BHP's production growth.

BHP's Bank of America Global Metals, Mining & Steel Conference 2023 Presentation

Regarding potential commodity price outperformance, BHP's commodity exposure closely mirrors that of a combined portfolio of Ecora and LIORC. However, there are a few differences, in that BHP is mainly exposed to low grade iron ore compared to LIORC's high grade iron ore exposure, BHP has exposure to potash, which neither LIORC or LIORC do, and BHP will potentially continue to produce coal for many years while Ecora will soon transition to generating most of its revenues from base metals. I will examine each of these in turn.

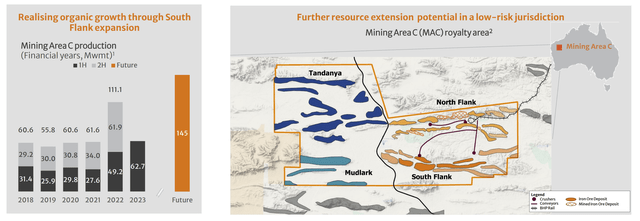

The fact that BHP is exposed to lower grade iron ore than LIORC, is more a risk to BHP than LIORC, as low grade iron ore emits more carbon dioxide per ton of steel produced, and only high grade iron ore is suitable for green steelmaking. However, if investors prefer the lower grade iron ore, this exposure can be almost precisely replicated through buying shares of Deterra Royalties (OTCPK:DETRF), which owns a 1.232% revenue royalty on BHP's Mining Area C (MAV) iron ore mine in Australia (see chart below). This mine is expected to eventually produce 145 million tons of iron ore annually, which using BHP's 2022 annualized iron ore sales price of $113 per ton, would give estimated annual revenues of $202 million. Using a valuation for Deterra Royalties' MAC royalty of 10 times annual revenues, gives a fair value of this asset of $2,020 million. By comparison, Deterra's current market cap is currently around $1,670 million, which means its P/NAV is lower than 1 and thereby it is likely more undervalued than BHP.

Deterra Royalties 1H23 Results Presentation

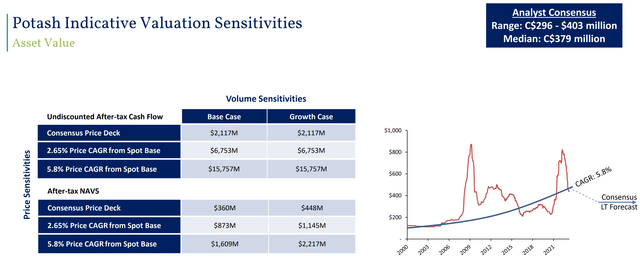

While BHP's potash assets are currently a small part of their portfolio, its share of the portfolio could potentially increase, due to the large resource base of its Jansen mine which could support high production rates. Jansen has a mine life of 94 years based on reserves alone, with reserves of 1,070 million tons containing 24.9% potassium oxide and resources of 6,510 million tons containing 25.6% potassium oxide. Therefore, in a potash bull market, Jansen could be a significant revenue contributor for BHP, and in fact BHP is trying to move up the opening date for Jansen. However, even for this fairly niche commodity, there is a royalty company, Altius Minerals, which would be a better buy than BHP. Potash accounted for 40% Altius Minerals' C$103 million in revenues in 2022, with most of the remaining revenues coming from copper, iron ore and coal. This compares to a market cap of C$993 million, which makes Altius Minerals fairly valued based on current revenues, and undervalued based on a large expected increase in especially iron ore revenues once Champion Iron's (OTCQX:CIAFF) Kami project goes into production. Also, according to Altius Minerals, the NAV of their potash royalties may be worth more than their market cap (see figure below).

Altius Minerals 2023 Investor Day Presentation

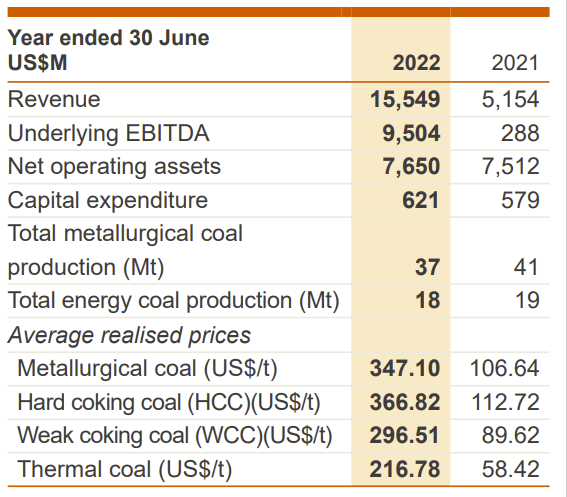

Unlike Ecora, BHP has exposure to both metallurgical and thermal coal. However, metallurgical coal accounts for the majority of its coal revenues. In 2022, BHP sold 37 million tons of metallurgical coal at an average price of $347 per ton, and 18 million tons of thermal coal at an average price of $217 per ton (see figure below). Due to its diversified commodity mix, BHP is able to make large profits from its coal assets without suffering the same valuation penalty as pure play coal producers. For example, the largest hard coking coal producer in the U.S., Warrior Met Coal (HCC), currently trades at a trailing P/E ratio of 2.7. Therefore, an investor could include Warrior Met Coal along with Ecora and LIORC, in a portfolio that more precisely replicates BHP's portfolio at a much cheaper valuations.

BHP 2022 Annual Report

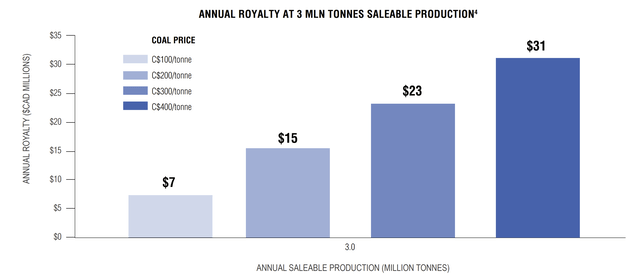

However, I think small cap royalty company Morien Resources (OTCPK:APMCF) would be a better addition to the portfolio. Morien Resources owns a royalty on the Donkin coal mine in Nova Scotia, which is in the process of scaling up and is expected to eventually produce 3 million tons of high-volatile, semi-soft B metallurgical coal. Coal from this mine is usually marketed as metallurgical coal, but could also be sold as thermal coal in atypical situations where the price of thermal coal exceed that of metallurgical coal. The Donkin mine semi soft metallurgical coal is a type of weak coking coal, which BHP sold for an average price of $296 per ton in 2022 (see figure above) or around C$390 per ton. If metallurgical coal prices revert back to their 2022 levels in the future, this company will be a true cash cow, generating around C$30 million annual in revenues, which is equivalent to its current market cap of C$31 million (see figure below).

Morien Resources March 2023 Corporate Update

Final Thoughts

There is something deeply broken about the ESG narrative on steel, as low grade iron ore producers are considered investable, even though the low grade iron ore they produce can only be turned into steel using steelmaking coal. Meanwhile the producers who mine the steelmaking coal are considered to be uninvestable. High grade iron ore is required to produce green steel without steelmaking coal, and therefore high grade iron ore poses a threat towards both low grade iron ore producers and steelmaking coal producers. However, steelmaking coal producers trade at a significant discount to low grade iron ore producers.

The three largest low grade iron ore producers are BHP, where low grade iron ore and coal account for 77% of EBITDA (see values above), Rio Tinto (RIO), where low grade iron ore accounts for 69% of EBITDA, and Fortescue Metals (OTCQX:FSUMF), a pure play iron ore producer with over 88% of production being low grade iron ore. These three companies trade at an average P/E ratio of 8. By comparison metallurgical coal producers like Alpha Metallurgical Resources (AMR), Warrior Met Coal and Ramaco Resources (METC) trade at an average P/E ratio of 3. Therefore one potential strategy to play the steel market would be to go short the low grade iron ore producers and go long the metallurgical coal producers.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LIFZF, ECRAF, ATUSF, APMCF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)