Hecla Mining: Alexco Deal Pushes Silver Reserves To Record High

Summary

- Hecla Mining reported a 21% increase in silver reserves to 240.9 million ounces in its FY2022 Reserve & Resource statement.

- The company has seen growth in silver-equivalent reserves over the past ten years, outperforming many other silver producers.

- That said, I still don't see enough margin of safety here, with HL trading at ~32x EV/FY2024 FCF estimates and ~1.50x P/NAV vs. some peers at below 10x EV/FY2024 FCF.

Juan Jose Napuri

It's been a mixed start to the year for the precious metals sector, with margins down on balance in Q1 2023 vs. Q1 2022 and slightly higher capex year-over-year, affecting free cash flow generation for most producers. Unfortunately, the results have been even less impressive from a reserve replacement standpoint, with most mines having to ratchet up cut-off grades because of the impact from inflationary pressures. The result is that less than 30% of larger gold producers successfully replaced reserves in 2022 and we saw similar struggles in the silver space.

However, Hecla (NYSE:HL) was one name to buck this trend, ending the year with record silver reserves and silver-equivalent ounce [SEO] reserves helped by its acquisition of Alexco at an attractive price. Let's dig into the company's FY2022 Reserve/Resource report a little closer below:

Keno Hill Silver District (Company Presentation)

2022 Reserves

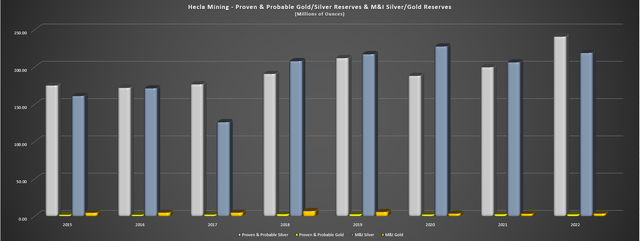

Hecla Mining released its FY2022 Reserve & Resource statement earlier this year, reporting a 21% increase in silver reserves to ~240.9 million ounces, partially offset by a 6% decline in gold reserves to ~2.56 million ounces. Notably, Hecla achieved this growth in silver reserves without pulling its silver price assumption used to calculate reserves higher, like we saw from several other producers. Just as importantly, this growth in silver reserves came with an improvement in grades, with the company adding the ultra-high grade Keno Hill Mine in the Yukon to its reserve inventory, with an average silver grade of ~770 grams per ton, dwarfing its previous average grade of ~420 grams per ton of silver with its ounces at Greens Creek (Alaska) and Lucky Friday (Idaho). Also worth noting and, as the chart below shows, Hecla's measured & indicated [M&I] silver resources also increased materially, with Hecla ending the year with ~219.1 M&I silver ounces to back up its large silver reserve base.

Hecla Mining - Proven & Probable Gold/Silver Reserves & M&I Silver/Gold Reserves (Company Filings, Author's Chart)

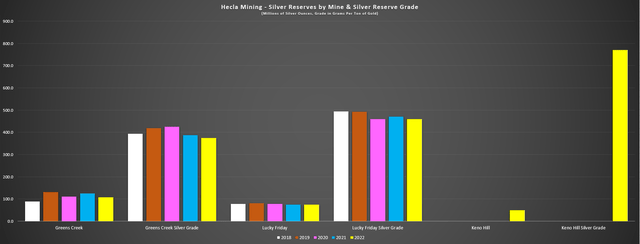

Digging into the report a little closer, Hecla would not have successfully replaced reserves without the benefit of an added ~49.5 million ounces of silver from Keno Hill, with its reserves at Greens Creek declining to ~108 million ounces at a slightly lower average grade of 374 grams per ton silver (FY2021: ~387 grams per ton silver). Hecla noted that the decline in reserves at Greens Creek (7%, 1%, 4%, and 6% declines in silver, gold, zinc, and lead reserves, respectively) was because of lower margin material and material near historical mined areas with unknown backfill conditions being removed. The silver lining is that a study is looking at whether these ounces can ultimately be moved back into reserves. On a positive note, the company continues to hit encouraging intercepts in the Upper Plate Zone, with mineralization expanded to the west with a highlight intercept of 3.8 meters of ~305 grams per ton silver, ~4.8 grams per ton of gold, and ~16.9% lead/zinc or ~1,150 grams per ton silver-equivalent.

Hecla Mining - Silver Reserves by Mine & Silver Reserve Grade (Company Filings, Author's Chart)

Looking at the company's high-cost Casa Berardi Gold Mine in Quebec, this asset could not replace reserves in 2022 either, with a 10% decline in gold reserves to ~1.6 million ounces (5.83 gram per ton gold underground grade, 2.74 gram per ton gold open-pit grade) related to higher costs that led to increased cut-off grades. The company called out higher steel, fuel, and especially labor costs from an inflationary standpoint, which led to an increase in the cut-off grade for underground and open-pit material to 4.11 grams per ton of gold and 1.37 grams per ton of gold, respectively vs. 3.46 grams per ton of gold and 1.27 grams per ton of gold previously. So, while Casa Berardi's grades increased year-over-year, tonnage fell materially to ~19.0 million tons (FY2021: ~20.8 million tons), and with this material increase in cut-off grades it could be more challenging to replace all mined depletion in the future.

Lucky Friday Operations (Company Website)

On a positive note, Lucky Friday replaced mining depletion successfully, ending the year with ~74.6 million ounces of silver reserves at an average grade of ~466 grams per ton silver and ~12.0% lead/zinc. Assuming an average throughput rate of ~400,000 ton per annum, the ~6.0 million ton reserve base supports a 13+ year mine life, making this one of the longer life and higher grade assets in the silver space sector-wide. And while M&I resources declined, this was primarily to M&I ounces moving into the reserve category, with some impact from increased cut-off grades. As highlighted in the report, NSR cut-off values have increased from ~$216.19/ton at the 30 Vein to ~$241.34/ton, while NSR cut-off values for the Intermediate Veins increased over 11% to ~$268.67/ton vs. ~$241.34/ton previously.

That said, and unlike other producers, Hecla continues to use a relatively conservative silver price assumption of $17.00/oz, so it appears to have some room to flex reserves at Greens Creek and Lucky Friday if it were to increase its silver price assumption closer to the industry average near $19.00/oz. And while reserve growth based on M&A isn't the most desirable form of reserve growth, which is what Hecla achieved in FY2022 (we would have seen a ~4% decline in reserves if not for the acquisition of Keno Hill), the company paid the right price for Keno Hill by buying the company after its share price had undergone a violent correction, and it didn't sacrifice on grades, jurisdiction or asset quality like First Majestic (AG) did, which made a leap of faith that didn't pay off as expected with its acquisition of Jerritt Canyon.

Reserves Per Share

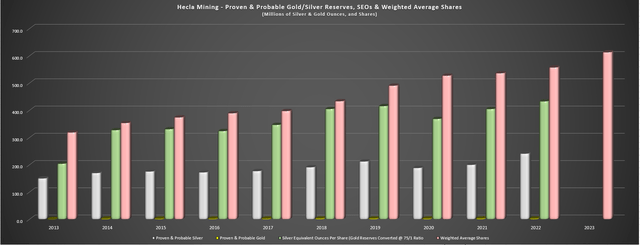

While reserve growth is important for any miner to provide visibility into future production and cash flow, the more important metric to watch is reserve growth per share. This is because the goal when investing in miners is to get increased leverage to precious metals, and if a company is seeing consistent declines in production, cash flow, and reserves per share, one is actually getting negative leverage and is likely better off just owning the metal itself. Fortunately, while there are many companies with abysmal track records of production and reserve growth per share in the silver producer space, Hecla is an exception. In fact, as the chart below highlights, the company has continued to increase its silver and silver-equivalent ounce reserves per share with only modest growth in its share count. And as highlighted previously, this is despite using a silver price assumption to calculate reserves that is below the industry average ($17.00/oz), with SEO reserves increasing from ~204 million to ~433 million from 2013 to 2022.

For comparison, First Majestic is using a silver price of $21.50/oz in their 2022 year-end Reserve/Resource statement.

Hecla Mining - Proven & Probable Gold/Silver Reserves, Silver-Equivalent Ounces & Weighted Average Shares (Company Filings, Author's Chart & FY2023 Estimates)

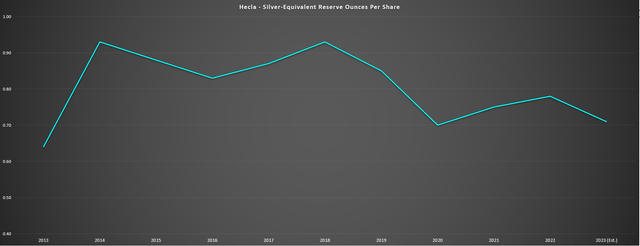

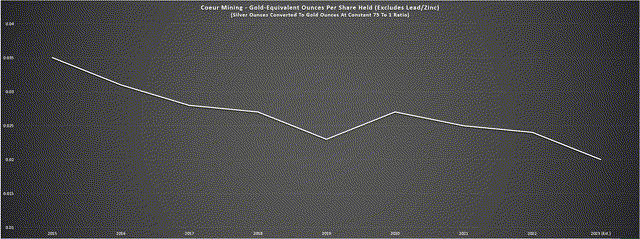

Looking at the chart below which tracks SEO reserves per share compared to its weighted average annual shares outstanding, we can see that Hecla's reserves per share are up vs. 2013 levels despite a tough decade for the price of silver and despite using a lower silver price assumption than at the beginning of the period ($17.00/oz vs. $20.00/oz). That said, the trend has been down following the 2018 peak, so it's not as impressive as other miners like Agnico Eagle (AEM) that have continuously increased reserves per share, with reserves per share likely to hit a new multi-decade high at year-end 2025 if not for any major divestments. Still, Agnico Eagle is the gold standard in the sector and one of the companies with the best track records from a reserve growth per share standpoint, and when compared to what's available in the silver space like Coeur Mining (CDE) with its reserve per share trend shown below, Hecla is head and shoulders above its peers and is one of the top-3 names for maintaining one's leverage to metals vs. requiring more shares to get the same production/reserves like most other silver names.

Hecla - Silver-Equivalent Ounces Per Share (Company Filings, Author's Chart & FY2023 Estimates) Coeur Mining - Gold Equivalent Ounces Per Share Held (Company Filings, Author's Chart)

Recent Developments

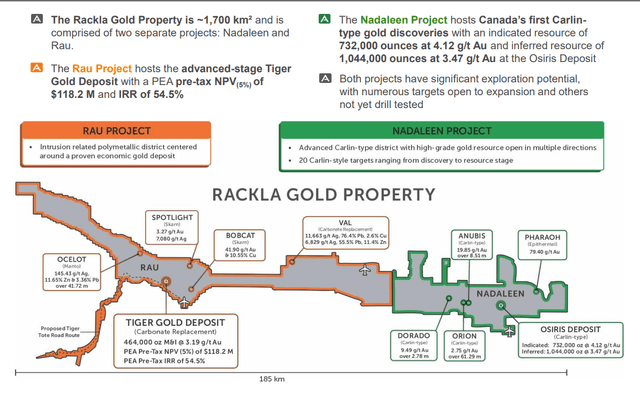

Finally, if we look at recent developments, Hecla may not add additional reserves based on its proposed acquisition of ATAC Resources, but it will add meaningful resources in relatively close proximity to its Keno Hill Project in Yukon Territory. For those unfamiliar, Atac Resources holds a massive land package across its Rackla Gold Property, made up of the Rau Project and Nadaleen Project with 1,700 square-kilometers of tenements and a massive potential gold/polymetallic belt. After only a few years of drilling, ATAC delineated a resource base of ~2.24 million ounces of gold between two deposits (Tiger at Rau and Osiris at Nadaleen), with well above average grades of 3.19 grams per tonne of gold at Tiger [M&I grade] and 4.12 grams per tonne of gold at Rau [M&I grade). However, these are just two targets among several on the land package, with impressive results from several other polymetallic and gold targets such as Ocelot, Anubis, and Orion.

ATAC Resources - Rau & Nadaleen Projects, Yukon (Company Filings, Author's Chart)

For now, Hecla has its hands full with increasing throughput at Lucky Friday and working to ramp up Keno Hill to full production, so I would expect this project to sit on the shelf for the time being. And while there's normally not much value in adding a project that might not head into production for a decade or longer into a pipeline, the price paid here and the fact that Hecla is now operating in the Yukon with its Alexco acquisition made this a pass that was hard to pass up. In fact, the company paid just ~$24 million or less than $11.00/oz on measured, indicated, and inferred resources, resulting in less than 1% dilution for a ~33% increase in M&I gold ounces (~3.67 million ounces ---> ~4.87 million ounces). Hence, I think this was a smart move, especially, especially given the district-scale land package with this being a low-risk (minimal share dilution), but very high reward bet on this asset.

Summary

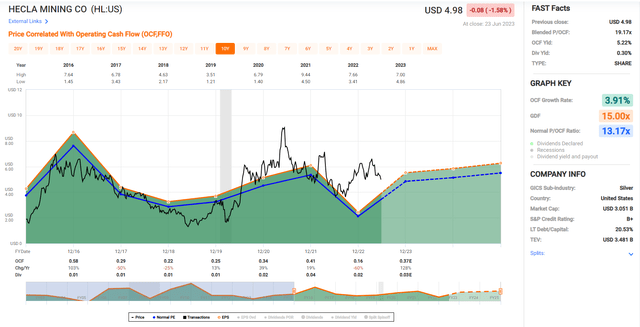

While several silver producers have continued to see steady declines in reserves per share, Hecla is one of the few producers that's seen growth in silver-equivalent reserves over the past ten years, even if the trend has been slightly negative since the 2018 peak. Notably, this outperformance from a reserve growth per share basis complements its production growth per share, and the company hasn't leaned on higher silver prices to ensure successful reserve replacement, with its silver price assumption of $17.00/oz well below the industry average. That said, and as highlighted in my most recent update, I still don't see enough margin of safety in Hecla's stock here, with the stock trading at ~32x FY2024 EV/FCF estimates (~$105 million) and ~1.50x P/NAV when there are some precious metals names trading at less than 10x FY2024 free cash flow estimates and well below 1.0x P/NAV.

Free cash flow is defined as operating cash flow minus growth and sustaining capital.

Hecla - Historical Cash Flow Multiple (FASTGraphs.com)

Some investors might argue that Hecla deserves a significant premium for its Tier-1 jurisdiction profile 50% plus all-in sustaining cost margins, a rarity in the silver space with most producers operating out of Tier-2 jurisdiction. And while I agree with this assessment, I continue to see the current valuation as a little rich, and I prefer to buy miners only when they're hated and on sale, neither of which is the case with Hecla currently. Hence, I continue to see better opportunities elsewhere in the sector. That said, if Hecla were to decline below US$4.15 per share where it would at closer to ~1.25x P/NAV and closer to ~12.0x EV/FY2024 operating cash flow estimates, I would view this as a buying opportunity.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

I expect Silver to test $28 per Ounce in 2023.

https://imgur.com/a/rBZmvuMSubscription Link:

buy.stripe.com/...