Safe Bulkers: A Decent Value In The Dry Bulk Space - Buy

Summary

- Initiating coverage of Safe Bulkers, a leading dry bulk shipper focused on the larger vessel classes.

- The company is effectively controlled by CEO and Chairman Polys Haji-Ioannou, a Cypriot billionaire and shipping magnate.

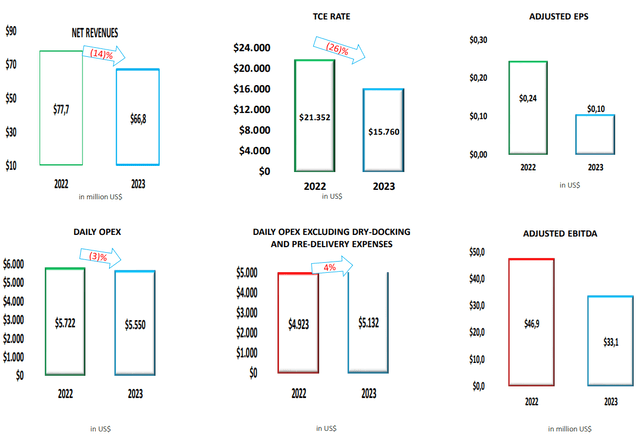

- Last month, Safe Bulkers reported seasonally weaker first quarter results but still managed to generate a decent amount of cash from operations.

- Despite paying a fixed quarterly cash dividend of $0.05 per share and ongoing common share repurchases, the company continues to trade at a steep discount to estimated net asset value ("NAV").

- Given ample liquidity, relatively low leverage, a well-covered quarterly cash dividend and ongoing share buybacks in combination with a 50% discount to estimated net asset value, investors should consider initiating or adding to existing positions in Safe Bulkers.

sandsun

Safe Bulkers Inc. (NYSE:SB) or "Safe Bulkers" is a leading dry bulk shipper focused on the larger, gearless vessel classes. While the company is incorporated under the laws of the Marshall Islands, its principal executive office is located in Monaco.

Safe Bulkers is effectively controlled by CEO and Chairman Polys Haji-Ioannou, a Cypriot billionaire and shipping magnate.

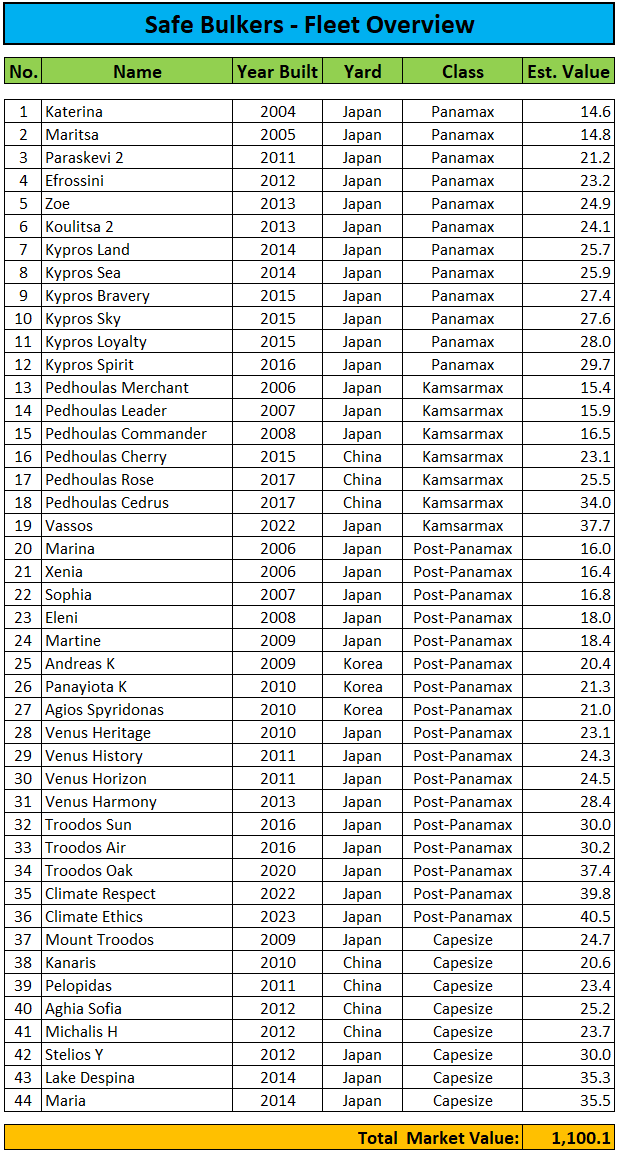

As of May 5, the company commanded a fleet of 44 vessels, consisting of 12 Panamax, 7 Kamsarmax, 17 Post-Panamax and 8 Capesize dry bulk carriers with an average age of 10.8 years and an estimated market value of $1.1 billion:

Regulatory Filings / MarineTraffic.com

Please note that my market value estimate above might be too conservative as scrubber fittings not always seem to be adequately reflected in the numbers provided by MarineTraffic.com.

In addition, Safe Bulkers has committed to an extensive newbuild program of 12 vessels designed to meet the International Maritime Organization's ("IMO") regulations related to the reduction of GHG and NOx emissions of which three have already been delivered. Remaining capital expenditures under the newbuild program amount to $243.1 million.

As of May 5, 2023, the company had an orderbook of nine newbuilds (8x Kamsarmax, 1x Post-Panamax), with four scheduled deliveries in 2023, three in 2024 and two in the first half of 2025.

In addition, Safe Bulkers has been investing more than $80 million to retrofit approximately 50% of its fleet with exhaust gas cleaning systems, commonly referred to as "scrubbers".

Safe Bulkers employs its fleet on a mix of spot and period timer charters with an average remaining charter duration of 0.9 years.

Like many Greece- and Cyprus based shipping companies, Safe Bulkers' fleet is managed by private entities affiliated with the controlling shareholder thus resulting in potential conflicts of interest as also stated in Safe Bulkers' annual report on form 20-F:

Our chief executive officer, Polys Haji-Ioannou, controls both of our Managers. Polys Haji-Ioannou, directly and through entities controlled by him, owns approximately 40.70% of our outstanding Common Stock as of February 24, 2023. These relationships could create conflicts of interest between us, on the one hand, and our Managers, on the other hand. These conflicts may arise in connection with the chartering, purchase, sale and operation of the vessels in our fleet versus vessels owned or chartered-in by other companies affiliated with our Managers or our chief executive officer.

That said, in contrast to a number of Greece- or Cyprus-based shipping companies, Safe Bulkers has not been engaging in dilutive equity sales well below net asset value ("NAV"). In fact, the company has been active repurchasing its own shares in recent quarters updated investors on its progress in last month's Q1/2023 report:

In June 2022, the Company authorized a program under which it may from time to time in the future purchase up to 5,000,000 shares of its common stock. In March 2023, the Company authorized the increase of the share repurchase to a total of up to 10,000,000 shares of its common stock. As of May 5, 2023, approximately 83% of the program, or 8,312,259 shares of common stock, had been repurchased and cancelled.

In addition, Safe Bulkers remains committed to paying a fixed quarterly cash dividend of $0.05 per common share which is well-covered by cash flows from operating activities.

Last month, the company reported seasonally weak first quarter results but still managed to generate $32.7 million in cash from operating activities.

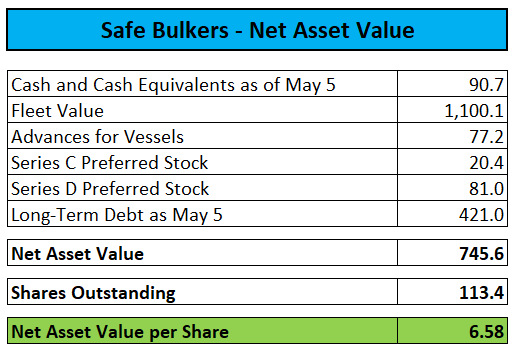

As of May 5, the company had cash and cash equivalents of $90.7 million and total long-term debt of $421.0 million.

After giving consideration to an aggregate $267.2 million in undrawn borrowing capacity under the company's credit facilities, total liquidity amounted to $357.9 million.

In addition, Safe Bulkers has issued two series of preferred stock (NYSE:SB.PC and NYSE:SB.PD) with an aggregate liquidation preference of $101.4 million. Both the Series C and D Preferred Shares currently offer a very safe 8% annual yield.

Valuation-wise, the company is trading at a steep discount to net asset value likely due to perceived subpar corporate governance and abusive capital raises to the detriment of common shareholders employed by a number of smaller peers:

Regulatory Filings, MarineTraffic.com

But at least when judging by Safe Bulkers' course of action in recent years, there appears to be little reason to worry for common shareholders as the company is not only paying a fixed quarterly cash dividend of $0.05 per share but also remains committed to repurchasing common shares at prevailing prices.

With liquidity more than sufficient to deal with the remaining capital expenditures under the company's newbuild program and decent cash generated from operations even in a rather weak charter rate environment, I don't think a 50%+ discount to estimated NAV should be warranted.

Bottom Line

Apart from some general corporate governance concerns related to the fact that the company remains effectively controlled by its Chairman and CEO, there's a lot to like about Safe Bulkers.

Given ample liquidity, relatively low leverage, a well-covered quarterly cash dividend and ongoing share buybacks in combination with a 50% discount to estimated net asset value, investors should consider initiating or adding to existing positions in Safe Bulkers.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in SB over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

I agree with your conclusions.

I have held a long term investment in SB for many years. I also lightlytrade it around my growing core position. The impression I have gained over the years of the founder and controlling shareholder is that he and his team are honest and tries to make money for the shareholders and not from the minority shareholders.

I don’t know whether the stock will ever be discovered by the market. If not I will continue to add on the dips and sell the rips, while keeping eye on the Baltic Dry Index (.BDIY) and the Breakwave Dry Bulk etf (BDRY). Over time I try to buy more than I sell. As far as I can remember it has always traded at a discount to NAV. I appreciate the dividend yield while there is always the chance that the discount may narrow.

I think SB is managed relatively conservatively yet remains opportunistic. It is a fine balance that is hard to come by in the shipping business. Thanks again.