Darden Restaurants: Post-Earnings Correction Presents A Buying Opportunity

Summary

- Darden Restaurants is expected to sustain strong growth through market share gains, price increases, and traffic stabilization.

- The company also has good margin improvement prospects.

- Darden's stock is trading below historical averages and offers an attractive dividend yield, making it an appealing investment option.

Justin Sullivan

Investment Thesis

Darden Restaurants Inc (NYSE:DRI) is expected to sustain its strong growth trajectory helped by market share gains, price increases, and eventual stabilization in traffic. The company's pricing policy, which keeps prices lower than its competitors, coupled with Darden's ability to provide good quality and ample portion sizes of food, attracts consumers and enhances their satisfaction. This should help the company gain market share during this slowdown as consumers are looking for value for money. Over the long term, revenue synergies from the Ruth Chris acquisition and the expansion of new restaurants are expected to contribute to the company's top-line growth. Margin growth is also expected to benefit from price increases. Furthermore, moderating inflation, improved productivity, and cost synergies resulting from acquisitions should facilitate margin expansion. Currently, the company's stock is trading below its historical averages and offers an attractive dividend yield.

While the stock saw some correction post-earnings as the company’s same-restaurant sales Y/Y growth guidance of between 2.5% and 3.5% for FY24 disappointed some investors, this guidance looks conservative given the strong trends in Olive Gardens and Long Horn Steakhouse. I believe the company’s results over the upcoming quarters should allay some of the investor concerns around guidance. When combined with the prospects of revenue and margin growth, and attractive valuation, this makes Darden Restaurants an appealing investment option.

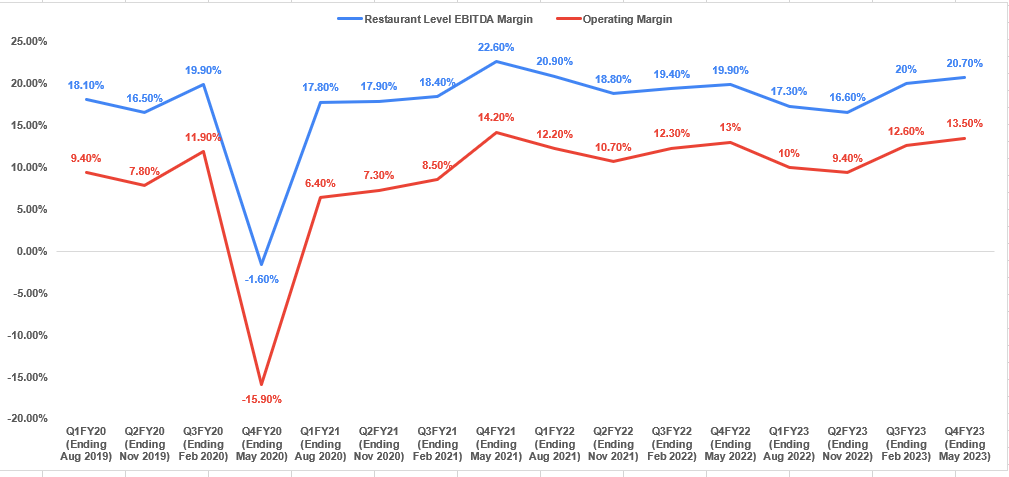

Q4 FY23 Earnings

Recently, Darden released its fourth-quarter fiscal 2023 earnings report. The company witnessed a year-over-year revenue increase of ~6.4% to $2.8 billion, beating the consensus estimates by $30 mn. Additionally, the earnings per share grew by ~15.2% to $2.58, exceeding the consensus estimate of $2.54. Notably, the restaurant-level EBITDA margin experienced an 80 basis points (bps) increase, reaching 20.7%, while the operating margin rose by 50 bps to 13.5%. The revenue growth was primarily attributed to a 4% growth in same-restaurant sales and the opening of new restaurants. The growth in EPS and margins can be attributed to the moderation of inflationary pressures and improved productivity.

Revenue Analysis and Outlook

In my previous article, I presented a bullish thesis on revenue growth, emphasizing the company's strategy of pricing below inflation and the industry, which was expected to attract consumers. Since then, Darden Restaurants Inc. has reported its fourth-quarter fiscal 2023 earnings and the results have shown similar positive dynamics.

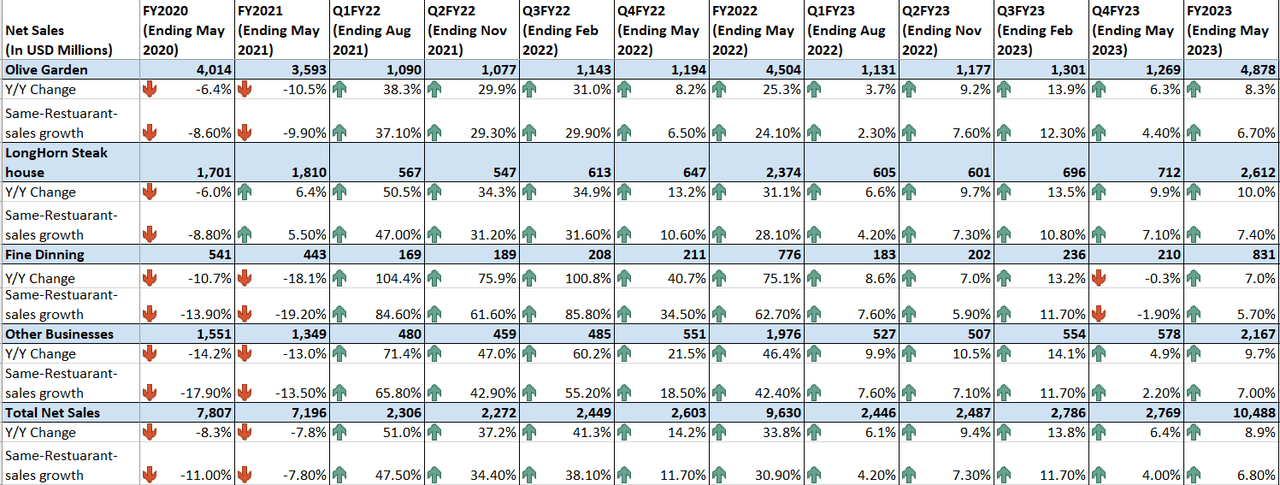

During the fourth quarter of fiscal 2023, the company's growth momentum remained strong. The increase in sales was driven by both price increases and the opening of new restaurants. As a result, average weekly sales experienced a year-over-year growth of 4.1% (and a 15.6% increase compared to pre-COVID levels, i.e., the fourth quarter of fiscal 2019.) The total sales for the quarter reached $2.76 billion, reflecting a 6.4% year-over-year growth. This growth was primarily driven by a 4% increase in same-restaurant sales, with the remaining contribution coming from the opening of 47 new locations. While Olive Garden and LongHorn Steakhouse continued to outperform the broader restaurant industry, the fine dining segment faced challenges due to tough year-over-year traffic count comparisons.

DRI’s Historical sales (Company Data, GS Analytics Research)

Looking ahead, I anticipate that the company will continue to achieve revenue growth, benefiting from various factors such as price increases, value offerings, the resilience of its operating model, and restaurant expansion.

To address inflationary pressures, Darden Restaurants Inc. has implemented price increases over the past few quarters, and they plan to continue this strategy in the coming years. While inflation is showing signs of moderation, management plans to continue implementing incremental price increases albeit at a lower rate. The carryover impact of price increases from the second half of the previous fiscal year, along with additional price adjustments, is expected to support sales growth in the coming quarters. Furthermore, the lower rate of incremental price increases should alleviate some pressure on customers, thereby helping stabilize guest traffic growth throughout the fiscal year.

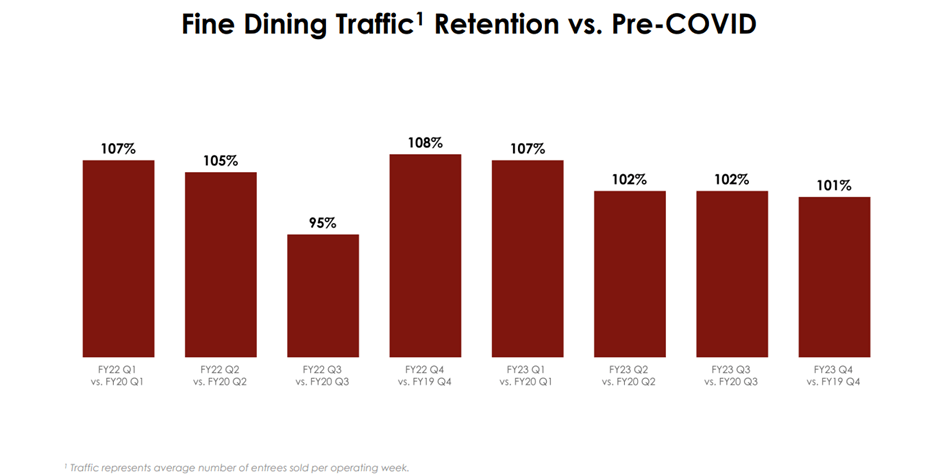

One segment which didn’t do well last quarter was fine dining. Management attributed it to tough comparisons in the fine-dining segment. In Q4 FY22, while the resurgence of demand due to eased mobility restrictions resulted in favorable guest traffic retention compared to pre-COVID levels, it also led to tougher year-over-year comparisons in the fourth quarter of fiscal 2023, resulting in a decline in traffic for the segment. Similar dynamics are anticipated in the first quarter of fiscal year 2024, as the first quarter of the previous fiscal year also experienced good traffic retention (see chart below) compared to pre-pandemic levels. However, after the first quarter of fiscal year 2024, the company expects traffic growth to stabilize in this segment as comparisons ease, removing this headwind as well.

DRI Fine Dining Traffic (Q4 FY23 Earnings' Presentation )

I also anticipate that the strength of Darden's Olive Garden and LongHorn Steakhouse restaurants (which contributed ~71% of DRI’s sales last quarter) should more than offset any near-term weakness in fine dining. The company's ability to offer value meals and its resilient operating model is contributing to strong performance in Olive Garden ad Longhorn Steakhouse. During inflationary periods, customers tend to seek value when spending on discretionary items. Despite tight budgets, customers allocate a portion of their income for enjoying affordable luxuries that provide value and satisfaction. Dining out is considered one such affordable luxury that attracts people and we have seen a good pent-up demand for it post-reopening. If consumers can find good value in it, it becomes a win-win situation. Darden Restaurants has established a reputation for serving high-quality food with generous portion sizes at prices below the industry average. This value proposition attracts customers to its brands, as they receive good satisfaction for their spending.

Furthermore, the company's operating model is highly resilient, characterized by simplicity in execution, menu items, back-office operations, and customer engagement processes. Darden has undertaken business restructuring in recent years to remove complexities and streamline its operations. This simplicity leads to fast table turnover and quality service, resulting in customer satisfaction. This satisfaction is expected to continue supporting traffic, even in a challenging macroeconomic environment. Darden has consistently outperformed industry benchmarks in recent quarters. In the fourth-quarter fiscal 2023, its same-restaurant sales growth surpassed the industry by 470 basis points, and same-restaurant guest counts exceeded the industry by 540 basis points. Management anticipates continued outperformance versus the industry benchmark in the coming quarters, leveraging the strength of Olive Garden and LongHorn Steakhouse, driven by their simplified operations and value offerings. This should enable the company to sustain sales growth despite an uncertain macro environment.

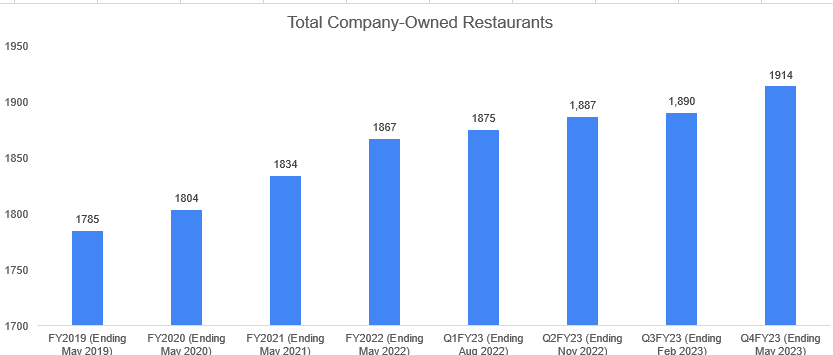

In terms of long-term growth, Darden has good restaurant development plans. The company opened 47 new restaurants in fiscal 2023, representing a year-over-year growth of 2.5%. These new locations contributed approximately 2.1 percentage points to the top line. Darden aims to open an additional 50 gross new restaurants in fiscal 2024 and targets an annual growth rate of 2-3% moving forward. This should continue to support long-term revenue growth. Additionally, Darden recently acquired Ruth's Chris Steak House, which will be reported in the fine-dining segment. While the current macroeconomic environment may not be ideal for the fine-dining sector, given its higher prices and premium services, limiting its immediate impact on the top line, I believe this acquisition will enhance the company's long-term growth prospects through revenue synergies. Ruth's Chris provides Darden with international exposure through its restaurants in Asia and Canada, presenting an opportunity for Darden to expand its other restaurant brands internationally through Ruth's Chris's franchise partners.

DRI’s Historical Company-Owned Restaurants ( Company Data, GS Analytics Research)

Therefore, I believe that Darden Restaurants' business is well-positioned to maintain its revenue growth even in a challenging macroeconomic environment. Management has provided guidance for a 2.5% to 3.5% year-over-year growth in same-restaurant sales in FY24, which I believe is conservative given the strong performance of Olive Garden and LongHorn Steakhouse and expectations of easing comps benefiting fine dining from Q2 FY24 onwards.

Margin Analysis and Outlook

During the fourth quarter of fiscal 2023, Darden Restaurants, like the rest of the industry, continued to encounter inflationary pressure stemming from increased commodity costs and labor wages. However, the pace of inflation is moderating sequentially, which along with price increases and productivity enhancements, achieved through labor efficiencies, contributed to margin expansion in the quarter. As a result, the restaurant-level EBITDA margin saw a year-over-year increase of 80 basis points, reaching 20.7%, while the operating margin rose by 50 basis points to 13.5%.

DRI’s Historical Margins (Company Data, GS Analytics Research)

In the fourth quarter of fiscal 2023, the overall inflation increased by 4.4% year-over-year, showing a significant improvement of 270 basis points compared to the previous quarter. Looking forward, the company anticipates a total inflation rate of 3-4% year-over-year in FY24, with the majority of inflation occurring in the first half of the year. This suggests that inflationary pressures should gradually ease as we progress through the year, thereby alleviating pressure on restaurant margins. The company is also well-equipped to counter these inflationary pressures through price increases.

Furthermore, I expect productivity to continue improving, as evidenced by the continuous reduction in 90-day labor turnover. This trend should result in lower hiring and training costs while enhancing the efficiency of existing employees as they become more familiar with day-to-day operations. Moreover, as part of the business restructuring, Darden has invested in AI tools to drive operational efficiency. These AI tools assist in better guest count forecasting, leading to improved cost management in areas such as staffing and raw materials. These operational efficiencies should further contribute to margin growth.

Additionally, the Ruth's Chris acquisition is expected to generate cost synergies. By the end of fiscal 2025, management anticipates achieving approximately $20 million in cost synergies, primarily through the supply chain and general and administrative savings. This integration should also support margin growth in the future. Overall, I remain optimistic about the prospects for margin expansion in the coming quarters.

Valuation and Conclusion

Darden Restaurants is currently trading at a price-to-earnings (P/E) ratio of 18.46x based on the FY24 consensus EPS estimate of $8.74, and a P/E ratio of 16.73x based on the FY25 consensus EPS estimate of $9.64. These valuations are below the company's historical 5-year average P/E of 21.84x.

The company has a good potential to gain market share and grow its revenue despite the tough macroeconomic environment. Furthermore, the company has a positive outlook for margin expansion due to the moderating inflationary environment. Additionally, Darden offers a solid forward dividend yield of 3.35%, and its management has done a good job in terms of returning cash to the shareholders through buybacks. Based on these factors, I recommend a buy rating for the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

www.cnbc.com/...