Lovesac: Good Growth Prospects And An Attractive Valuation

Summary

- Lovesac's growth prospects look promising due to market share gains, improved brand awareness, and new product innovations.

- The company is expected to achieve revenue growth through various initiatives, including new product launches, market share gains, brand loyalty, and the opening of new showrooms.

- Lovesac's margin recovery is anticipated in the medium term, supported by moderating freight costs, improving productivity, and operating leverage.

Scott Olson

Investment Thesis

Despite of tough macroeconomic environment, The Lovesac Company’s (NASDAQ:LOVE) growth prospects look encouraging. The company’s revenue growth is expected to benefit from market share gains, improved brand awareness through an increase in advertising, and new product innovations, which should also help in increasing attach rate and cross-selling. Moreover, increasing the distribution network and new showroom openings should also support sales growth. These tailwinds should help the company in delivering sales growth despite tough comps and uncertain macros.

On the margin front, the company should see a recovery in the medium term with the help of moderating freight costs, improving productivity, and operating leverage. The stock is attractively valued and is also trading at a discount to its historical averages, which combined with revenue and margin growth prospects makes the company a good buy.

Revenue Analysis and Outlook

During the pandemic, Lovesac experienced accelerated revenue growth, primarily driven by a significant increase in e-commerce sales. This surge in online sales was a direct outcome of the company's successful efforts to enhance brand awareness through online platforms. Additionally, Lovesac capitalized on the favorable demand for discretionary items, supported by government stimulus measures, as well as its ability to fulfill customer orders.

Of late there has been some normalization in demand. Compared to 55.3% Y/Y growth in FY22 and 30.8% Y/Y growth in FY23, the company’s sales slowed to 9.1% year over year in Q1 FY24 to reach $141 million.

Looking ahead, I expect that the growth rates of The Lovesac Company will continue to normalize in the upcoming quarters. This normalization can be attributed to challenging comparisons from the strong growth in the prior years and a general slowdown in demand for discretionary items, particularly in an inflationary environment. However, the company should still be able to achieve revenue growth through various initiatives, including new product launches, market share gains, brand loyalty, increased customer satisfaction, and the opening of new showrooms.

The broader economic conditions pose challenges for the discretionary product industry due to consumers' tightened budgets amid inflationary pressures. This raises concerns about the demand for Lovesac's products. However, the company has not observed a slowdown in demand within its product category. This is partly due to its customer base primarily comprising higher-income consumers with household incomes of $75,000 or more. Despite facing inflationary pressures, these consumers can rely on credit and third-party financing, as evidenced by the company's increased credit sales through third-party financing. Further, the company’s main product category - sactionals, which accounts for more than 80% of its sales, is somewhat more resilient compared to the broader home improvement space as one has to replace a sofa when it wears or tears. Its demand is not necessarily linked with major home renovation projects which get postponed during a slowdown. Further, the company’s sactionals are designed to be adaptable, upgradeable, changeable, and durable. This value proposition enables consumers to be willing to pay a premium price even during inflationary times.

Additionally, the company's sales growth has been boosted by product innovations. Notably, the introduction of stealth tech, a home audio system that can be integrated into sactionals or purchased separately, has gained significant traction since its launch and has contributed to market share gains. The company estimates that the product has the potential to become a standalone $100 million brand in the future. Below is an excerpt from management's commentary regarding this product's potential from a prior earnings call,

...starting with products innovation, StealthTech continues to be the highlight for us. Notably the product continues to gain share, and we believe we have merely scratched the surface with respect to its potential, which we believe will grow past the $100 million and more in annual sales in the future."

Mary Fox - President and Chief Operating Officer, The Lovesac Company

The company has a pipeline of new product launches planned for the current year which coupled with increased research and development investments should drive demand and boost market share growth.

Furthermore, as these product launches increase attach rates, they also foster repeat sales. Approximately 38% of the company's total transactions come from existing customers, who are influenced to upgrade their sactionals with these new products even years after their initial purchase. Moreover, the company offers a wide variety of customizable accessories for sactionals, such as covers or pillows, allowing customers to repurchase based on their changing home decor preferences. This approach enhances brand loyalty through repeat sales and further supports sales growth.

Finally, the company's product demand is expected to remain strong due to its efforts to increase customer satisfaction. Unlike traditional customized furniture orders, Lovesac's customizable sactionals guarantee delivery within a day or two. This quick and efficient delivery, facilitated by the company's effective supply chain network and direct-to-consumer operating model, enhances customer satisfaction. The company has further improved its supply chain by opening a third-party-operated distribution center in the Fort Worth area during fiscal year 2023, which became operational in Q4 FY23. This is anticipated to enhance delivery speed and customer satisfaction even more.

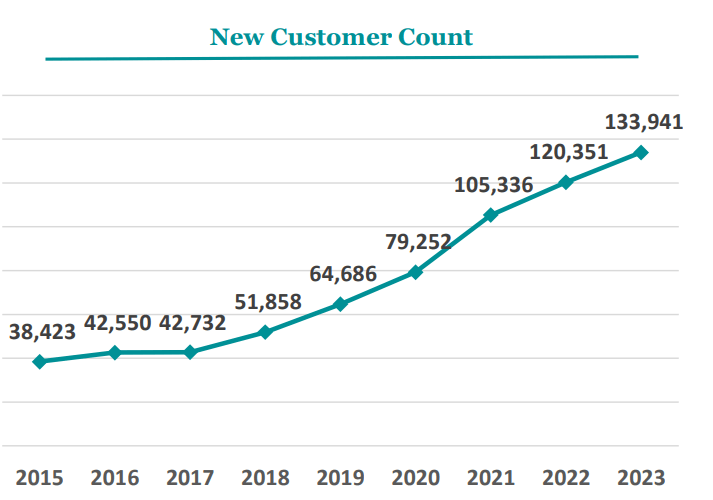

The combination of new product innovations, an efficient supply chain, customizable accessories, and enhanced customer satisfaction has not only contributed to increased brand awareness through word-of-mouth but has also complemented the company's traditional advertising efforts through TV and digital platforms. As a result, the company continues to acquire new customers, with a growth of 11.29% in new customer count during FY23, even after the normalization of stimulus-driven demand.

LOVE’s New Customer Count (Investor Presentation)

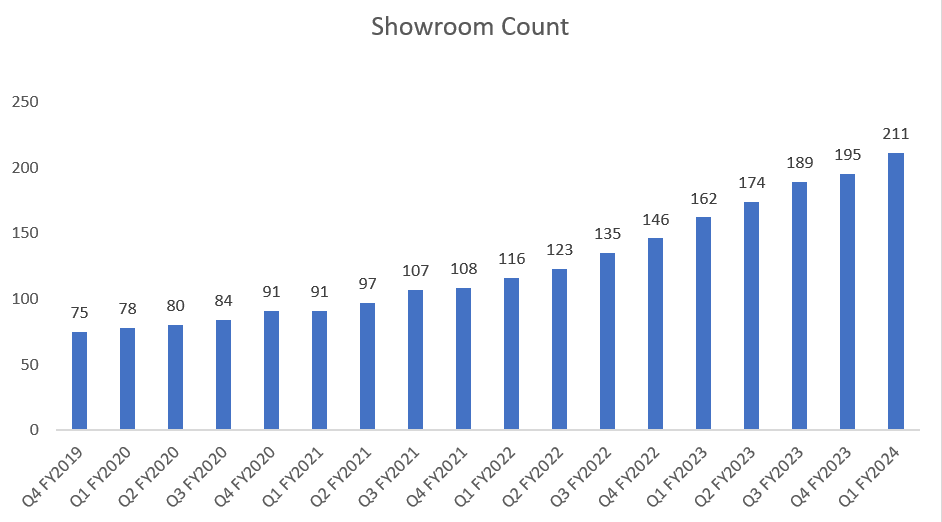

In addition to improving brand awareness, the opening of new showrooms is also aiding the company in acquiring new customers. Lovesac has expanded its total showroom count by approximately 181% since Q4 FY 2019, reaching a total of 211 showrooms. During Q1 FY 24, the company opened 16 new showrooms, and it has plans to open a total of 30 new showrooms in FY24. Looking ahead, the company aims to achieve a showroom count of 400 over the next 5 years. This expanding footprint of showrooms is expected to provide further support for acquiring new customers and contribute to long-term sales growth.

LOVE’s Historical Showroom Count (Company Data, GS Analytics Research)

So, while the macro factors are not that helpful, the company-specific initiatives to drive growth make me optimistic about the sales growth prospects of the company moving forward.

Margin Analysis and Outlook

Over the past two fiscal years, The Lovesac Company has faced challenges in its margins, primarily due to higher tariff charges and increased inbound freight costs driven by inflation. Additionally, the company's margin growth has been impacted by higher investments in marketing and advertising.

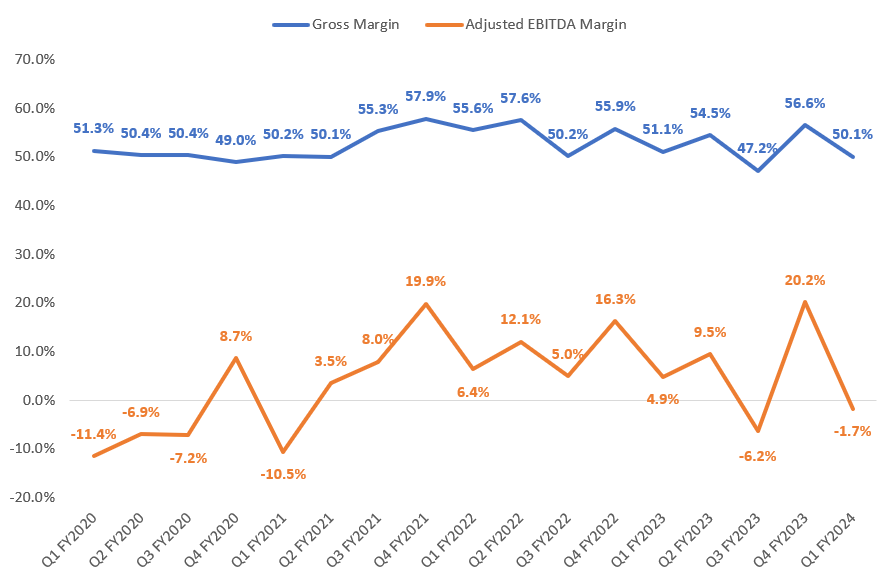

In the first quarter of fiscal 2024, these factors continued to have a negative impact on margin growth. Moreover, the company's promotional efforts to support demand in an inflationary environment also affected the product margin. As a result, there was a year-over-year decline of 100-basis points in gross margin, which stood at 50.1%. Moving down the profit and loss statement, the higher selling, general, and administrative expenses as a percentage of sales, compared to the same quarter of the previous fiscal year, led to a year-over-year decline of 660 basis points in adjusted EBITDA margin, which reached -1.7%.

LOVE’s Historical Gross Margin and Adjusted EBITDA Margin (Company Data, GS Analytics Research)

Looking ahead, I expect that The Lovesac Company should be able to show a recovery in its gross margins. The company's major concern has been the costs associated with inbound container freight, but there are signs of moderation compared to the previous fiscal year, which should support margin recovery. The company has provided guidance for a 340 basis points gross margin tailwind from leverage and lower inbound freight from Q2 FY24 onwards, partially offset by a 100 basis points headwind from outbound warehousing costs. The benefits from moderating freight costs are also expected to accelerate in the second half of fiscal 2024, further supporting the recovery trajectory of gross margin.

While the gross margin is expected to resume its recovery, adjusted EBITDA margin may continue to be impacted in the next few quarters due to higher investments in advertising and technology. However, these investments are intended to contribute to margin recovery beyond fiscal 2024. They are expected to enhance productivity and improve operating leverage. The company is doing technological investments focused on facilitating efficient inventory management based on demand to improve inventory productivity. The company also aims to enhance productivity among showroom employees by automating various tasks using AI, thereby reducing their workload. Additionally, investments in advertising should aid in increasing brand awareness and acquiring new customers, thereby improving top-line leverage and contributing to margin recovery beyond FY24. With these factors in mind, the company holds promising prospects for margin growth in the years to come.

Valuation and Conclusion

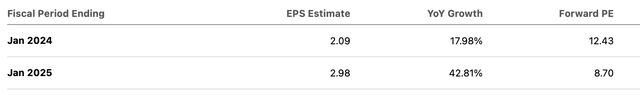

Lovesac's current trading multiple is 12.42x based on the FY24 consensus EPS estimate of $2.09, and 8.70x based on the FY25 consensus EPS estimate of $2.98. These valuations are significantly lower than the historical 5-year average forward P/E of 68.4x. Furthermore, when assessed using the forward EV/EBITDA metric, the company's trading multiple is 8.79x, which is also substantially lower than the historical 5-year average.

Now, I understand that the company’s growth rate has slowed versus what it was post-pandemic, and, in the near term, its valuation multiple is unlikely to reach near what we have seen during the last couple of years. However, the company is still expected to post double-digit solid EPS growth and its valuation looks cheap if we consider its earnings growth prospects.

The Lovesac Company Consensus EPS estimates and P/E Valuation (Seeking Alpha)

With positive growth prospects, despite challenging comparisons, and the prospects of margin recovery beyond FY24, I believe the stock offers a good buying opportunity at its current valuation.

Risks

The company is just a two-product company - sactionals and sacs. So, there is not much product line diversification and a risk from competition is always there. The company is also exposed to risks from global supply chain disruptions and tariffs as its vendors' production facilities are located globally. In addition, there are current macroeconomic factors including lower consumer confidence and a high-interest rate which if continue to worsen may impact the company's business. While I believe at the current low valuations, these risks are already getting priced in, if any of these factors worsens materially it may have a negative impact on the stock price.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.