Charles Schwab: Buy While The Market Is Pessimistic

Summary

- Charles Schwab investors were spooked in mid-June as management announced it still faces higher funding costs.

- However, dip buyers continue to support SCHW's bottoming process, holding its March lows robustly. Hence, the fears could have been overstated.

- However, a near-term recovery is unlikely, as the headwinds over its earnings power could persist through 2024. As such, investors need to be patient if they add now.

- SCHW remains in a long-term uptrend, with buyers defending the current levels. Sellers have been unable to force a steeper pullback against dip buyers returning.

- Ultimate Growth Investing members get exclusive access to our real-world portfolio. See all our investments here »

TrongNguyen/iStock Editorial via Getty Images

The Charles Schwab Corporation (NYSE:SCHW) investors got a scare in mid-June, as the leading financial services company provided its monthly update. CFO Peter Crawford informed investors to expect a 10.5% decline in second-quarter revenue at the midpoint as the company continues to face higher funding costs headwinds. Read our previous coverage on SCHW here.

While the update assured investors that its cash sorting challenges could have peaked, there are concerns that the impact on Schwab's earnings visibility could persist through 2024. Therefore, I assessed that the market could remain tentative over a quick upward re-rating in SCHW stock in the near term as investors assess the impact on its earnings power.

I think the market's anxiety over the company's ability to navigate these challenges makes sense. According to Seeking Alpha Quant, SCHW's "D-" valuation grade suggests it trades at a premium against its financial sector peers. However, its "A" growth and profitability grade could provide helpful clues to the market's optimism about Schwab's robust business model.

Morningstar reminded investors that the company's "massive scale and industry-leading cost efficiency" underpin its wide economic moat. As such, I think it's essential for investors to assess whether they are confident in the company's ability to recover from its cash-sorting malaise, even as the Fed remains hawkish.

Bank of America or BofA (BAC) highlighted in early June that investors should not understate the headwinds, as Schwab's "cash sorting issues may persist longer than expected, potentially extending into 2024."

Given the significant contribution of net interest revenue to Schwab's topline (more than 54% in Q1), investors will closely monitor the developments. Furthermore, SCHW's sum-of-the-parts or SOTP valuation framework indicates that its net interest revenue segment accounts for more than 55% of its valuation.

The revised consensus estimates suggest that Schwab's overall revenue growth could recover in FY24, following a 6% decline in FY23. Therefore, the trend in analysts' estimates corroborates with management's commentary that "realignment of client cash will likely subside in the second half of 2023." However, I assessed that the developments remain highly fluid, as seen in Crawford's caution over the company's second-quarter revenue outlook.

Moreover, Treasury Secretary Janet Yellen's recent commentary suggests that investors should brace for more pain as regulators are "preparing for a potential resurgence of the industry's earlier turbulence." While Yellen doesn't expect the banking crisis to be worse than what we experienced in March moving ahead, her comments indicate that earnings recovery would be highly uncertain in the near term.

With that in mind, SCHW holders must assess whether dip buyers have been confident in bolstering the support for its bottoming process since it fell to lows last seen in late 2020.

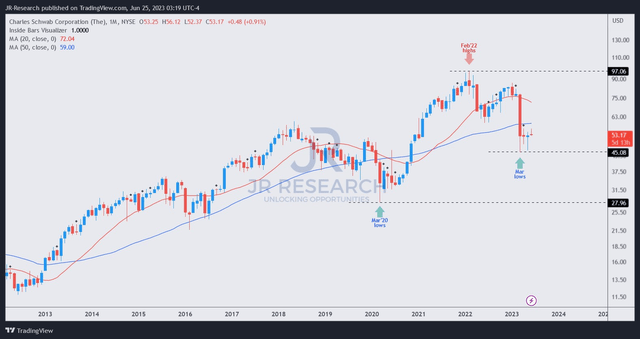

SCHW price chart (monthly) (TradingView)

I assessed that dip buyers had returned confidently, supporting SCHW's bottoming process since its March 2023 lows.

As seen in SCHW's long-term chart above, the stock remains in a long-term uptrend, even though its momentum has weakened. However, as long as dip buyers continue to support its March 2023 lows from being decisively breached, it should attract long-term investors to return confidently as SCHW consolidates along the current levels.

Regaining support above its 50-month moving average or MA (blue line) will need to be carefully watched, as it would portend a continuation of its bullish bias. Hence, it should be clear that SCHW is not out of the woods, even as it consolidates. Despite that, high-conviction investors should find the current levels attractive, as SCHW's adjusted forward P/E of 16.9x is still well below its 10Y average of 21.8x.

Therefore, unless SCHW fails to retake its bullish bias over the next four to six months, investors should find the current levels attractive. However, if SCHW's momentum remains tepid, it could suggest that buyers aren't confident about buying management's optimism in its ability to recover in earnings power. Therefore, investors are urged to continue monitoring SCHW's recovery closely.

Rating: Maintain Buy.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore and currently holds the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SCHW, BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)