If You Believe In Soft Landings, International Paper Is A Cyclical Buy

Summary

- International Paper may be entering buy territory as its valuation and operating setup are the strongest in years.

- The company's financial health has improved due to tight pandemic management, with a significant reduction in debts and liabilities since 2017.

- If the US economy avoids a deep recession, International Paper's leaner operating structure and more conservative balance sheet could support a large ramp for income generation in 2024.

- Future, full economic cycle EPS could be well over $3, producing a long-term P/E under 10x.

PhonlamaiPhoto

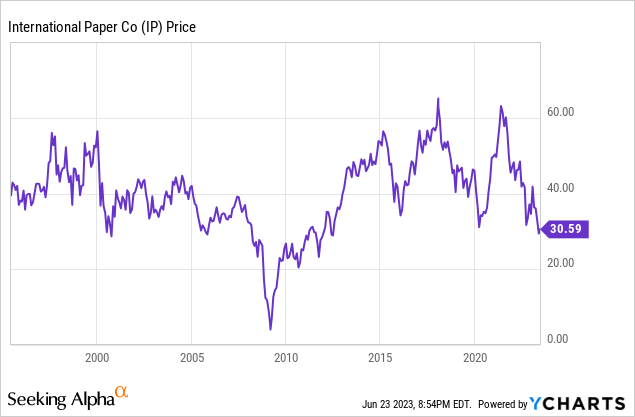

A leading paper, box and pulp producer in America is International Paper (NYSE:IP). It is also one of the more cyclical businesses on Wall Street. The stock boomed in the early rebound after the pandemic during 2020 into the beginning of 2021, but has faded in price since that point. The share quote has declined from $60 to $30 over two years, discounting a Wall Street predicted recession in paper demand.

So, the question for ownership today is which direction will the economy head going into 2024, as the stock market tends to discount the future by a good six months? The good news is International Paper is sitting at its strongest valuation and operating setup, perhaps since 2012, if not the once-in-a-generation Great Recession bottom of 2009. So, if we get a mild recession or even a soft landing without a material drop in processed paper/pulp demand, researching the company for investment right now makes sense.

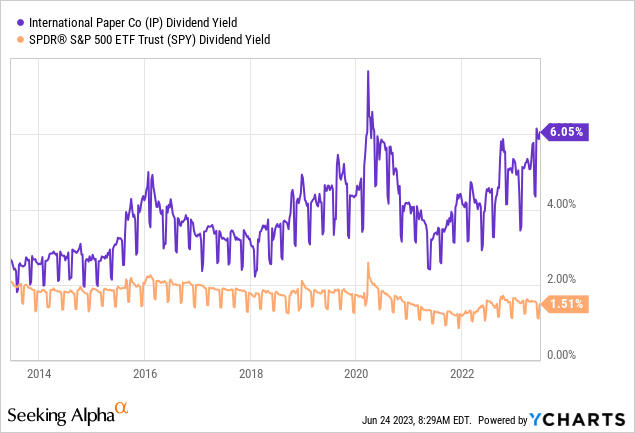

My conclusion is IP may be entering buy territory, as the chart pattern could be bottoming in June. While I personally believe the odds of a deep recession are just as likely as a soft landing, one way to hedge a brighter outcome for U.S. GDP growth is to purchase shares now. The company is projected to remain nicely profitable into 2024, and a trailing 6% dividend yield is worthwhile to hold. In fact, the current dividend spread in favor of IP vs. the S&P 500 index cash distribution is greater today than any other point over the last decade.

YCharts - International Paper vs. SPDR S&P 500 ETF, Dividend Yield, 10 Years

Improving Operational Profile

What I like about International Paper best today is the company's underlying financial health has improved dramatically with tight pandemic management of costs and debts. Usually at a peak in the economic cycle, this business and other deep cyclicals have engaged in unnecessary/unusual acquisition and capital expenditure strategies, with increased debt loads (on overconfidence about the economic outlook). Not this time around for IP.

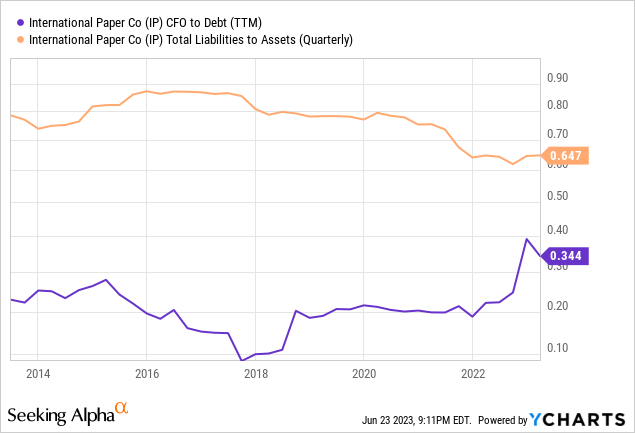

The data points that stand out to me are the reduction in debts and total liabilities since 2017. The balance sheet has improved dramatically with net equity and assets providing an excellent foundation for record profitability in the next economic upcycle. Total liabilities vs. assets, for example, have declined from a ratio of 0.88x to 0.65x over six years. Over roughly the same span, trailing 12-month cash flow coverage of debt rose from a low of 0.10x to as high as 0.39x a few quarters ago.

YCharts - International Paper, Cash Flow to Debt, Total Liabilities to Assets, 10 Years

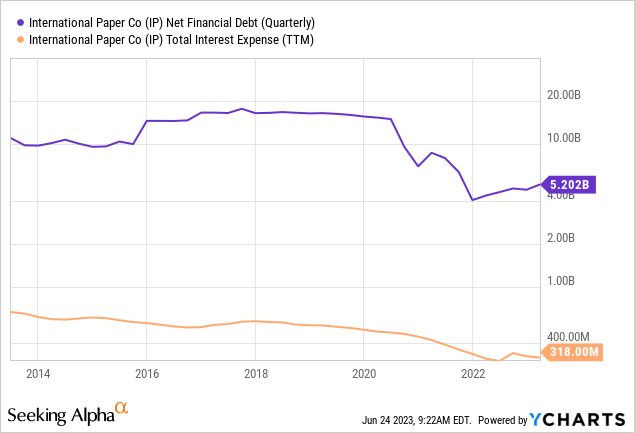

You can see below the 50% reduction in debt over 10 years and 70% drop over six years has slashed interest expense dramatically. Falling from a debt peak of $18 billion in 2017 to just $5 billion in 2023 opens up all kinds of financial flexibility, and may propel profit margins to new heights.

YCharts - International Paper, Net Financial Debt and Trailing Annual Interest Expense, 10 Years

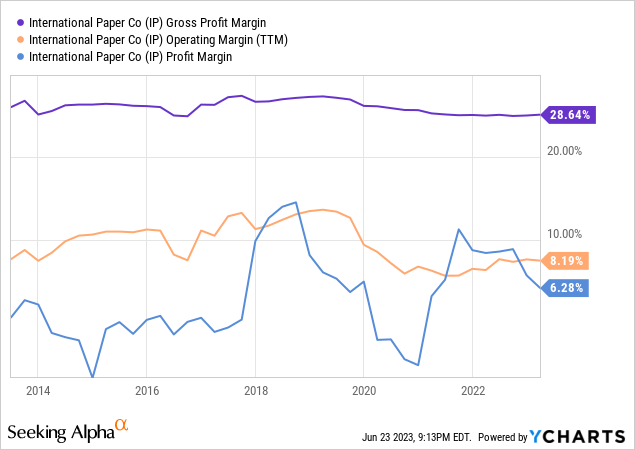

While gross profit margins have been consistently around 30% over the past decade, operating margins do have room to grow from the current 8% reading. If operating margins rise back to 2019's 13% high in the next economic recovery phase, final income margins above 10% could become the new normal for a reduced-debt International Paper operation.

YCharts - International Paper, Various Profit Margins, 10 Years

And, if a sustainable 9% to 12% final margin range on sales is the future (vs. sub-5% margins a decade ago), I can argue a far richer valuation should be put on shares by Wall Street.

Valuation Story

You can review the swings up and down in share pricing since 1995 below. To be honest, the company operates in a paper industry that has not grown much in decades. The result has been investors use this name as cyclical swing trade and dividend income streamer. Outside of the tank in price during the Great Recession, the 2-year price slide of 2021-23 is the next largest drawdown lacking a substantial bounce. Is this weakness justified, especially if a deep recession is avoided?

YCharts - International Paper, Weekly Share Price, Since 1995

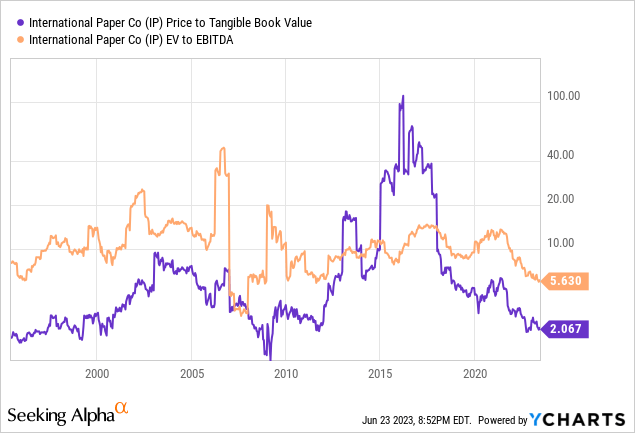

The two data points of fundamental worth drawing me to IP are the price to "tangible" book value setting and enterprise valuation on basic cash EBITDA. The last time both were valued this low at the same time was 2012, before price moved from $25 to $48 over less than 12 months.

YCharts - International Paper, Price to Tangible Book Value, EV to EBITDA, Since 1995

First, for cyclical businesses, price to tangible book value is important as it explains the theoretical accounting-cost value of its plant & equipment, cash, receivables and inventory after all liabilities are subtracted. It's a simple liquidation value, give or take, in many circumstances. In reality, actual net asset selling values are often higher with inflation increasing the market price of assets past the cost to acquire them, assuming operations are generating income. The only time over the last 30 years IP has traded significantly under 2x tangible book value was during the worst of the Great Recession. Otherwise, the current valuation is about as cheap as the company gets historically.

Second, the substantial reduction in debt has slashed the total enterprise value of the company, while cash flows have been steady the last year. The result has been an exceptionally low EV to EBITDA ratio of 5.6x. The only instance witnessing a lower multiple was 2007. I can argue IP at $30 in June 2023 is about as inexpensive as it has traded on this comparison since the early 1980s.

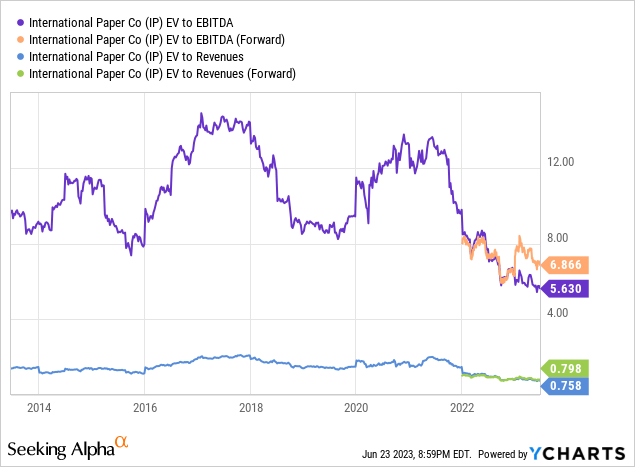

Again, when we look at a 10-year chart of EV vs. EBITDA and include a look at trailing sales, International Paper appears to be incredibly cheap. If the economy does not tumble hard in the second half of 2023, you might even say the valuation setup represents a bargain in June.

YCharts - International Paper, EV to EBITDA & Revenues, 10 Years

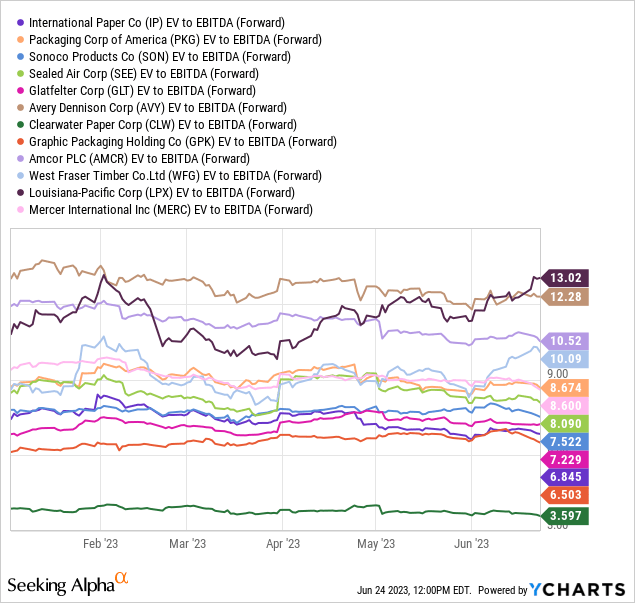

Measured against other paper producers, lumber suppliers, and specialty shipping product makers, IP is on the low end for EV to EBITDA ratios looking at "forward" 2023 expected results by analysts. Only Clearwater Paper (CLW) is materially less expensive. I wrote about the upside potential of Clearwater in February here.

YCharts - IP vs. Paper Product Competitors, EV to Forward Estimated EBITDA, 6 Months

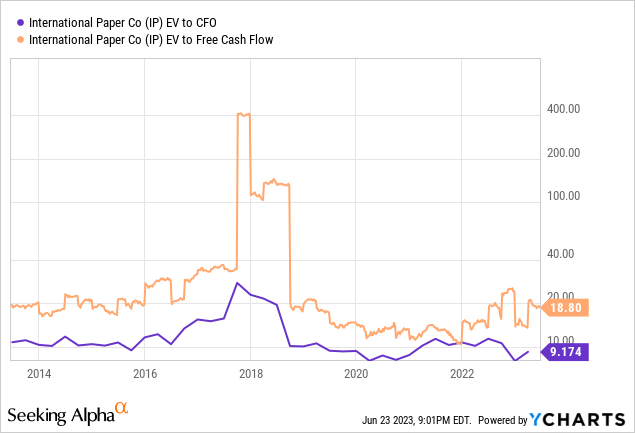

Further, EV to cash flow and free cash flow is similarly unappreciated by investors today. Both are trading on the lower end of the 10-year spectrum, with EV to traditional cash flow at a 30%+ discount right now to long-term averages.

YCharts - International Paper, EV to Cash Flow & Free Cash Flow, 10 Years

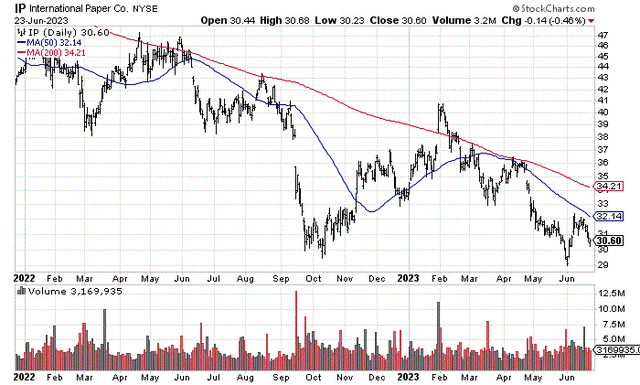

Technical Chart

The technical trading chart pattern and momentum picture offer no clue of a bottom yet. If stronger momentum was clearer, I would consider a truly bullish take on International Paper. The Renko chart is indicating price lows could be taking shape (not pictured), and something of a double-bottom formation in price around $30 with October's level could appear. Both would tell a momentum reversal story and be quite bullish if a price rebound above the 50-day moving average appears this summer. Even better, a jump above the 200-day moving average approaching $34 next week would really get my attention, as it has failed to hold above this overhead trend resistance for almost two years running (ignoring a few days here and there).

StockCharts.com - International Paper, 18 Months of Daily Price & Volume Changes

Final Thoughts

Consequently, my IP position is quite small, as I await confirmation of a trend reversal. With odds still favoring a slowdown in the U.S. economy during the second half of 2023, I do not recommend an aggressive position size in the stock. Adding on weakness and/or on strength with a cost-average trading strategy should reduce the risk of another big equity market swoon generally.

In time, the Federal Reserve will have to pivot to lower interest rates to prevent a prolonged and deep recession. When they do (under a number of possible scenarios), International Paper will almost surely perform strongly, as the "upswing" part of the economic cycle becomes the new Wall Street debate. An economy running on near-record aggregate debt to GDP levels is especially burdened by higher rates. With inflation rates already in decline, any hint of rising unemployment and weaker corporate profits will likely be met by another round of aggressive money printing by the world's main central bank.

Smart investors should be incrementally adding to cyclical ideas in my view. You don't want to be holding limited cyclical exposure later in the year. Names like International Paper usually fly higher right after Fed easing policy is announced. We could be getting close to stock market players discounting a brighter future, the opposite of 2022-23 which has been discounting a slowdown.

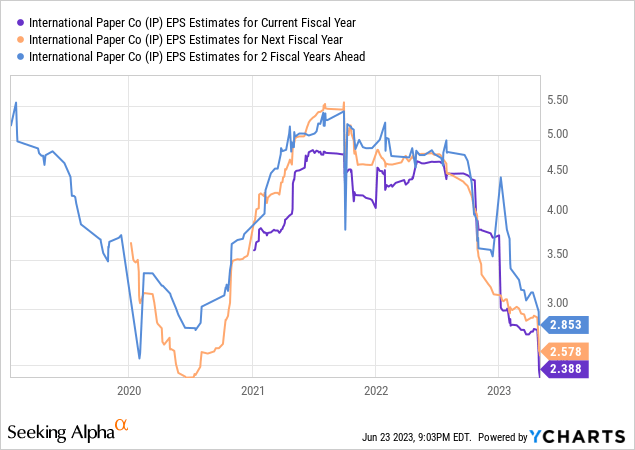

My thinking is EPS may bottom in the $2 to $3 annualized range over the next 6-12 months, and then begin to rise on stronger economic growth in the second half of 2024. You can review the swings in analyst projected profits per share below over the last five years. I am estimating EPS over the next five years will average closer to $4, with peak earnings of $6 to $7 likely by 2025. So, a share price of $30 may be quite desirable for the long-term buy and hold crowd. The current 6% dividend yield will be a bonus for taking on recession risk.

YCharts - International Paper, Forward Multi-Year Analyst EPS Estimates, 5 Years

And, if we get a Fed pivot with a soft landing, a return to the IP highs of 2021 between $50 and $60 a share could become reality. A leaner operating structure, stronger balance sheet, and still profitable operations at the cycle bottom could support a large ramp for income generation in 2024. At least that's the bullish argument today.

I am pegging downside risk is limited to $20 a share, just above tangible book value of $15. To trade any lower, we would need a prolonged and deep recession. My estimated downside risk on investment capital of -25% for a total return, including the 6% dividend, vs. best-case upside potential of +100% seems to heavily tilt in favor of ownership over the next 12-18 months. I rate shares a Buy.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (10)

There's a decent amount of stuff out there that's unloved at the moment, actually.

BXP (hoo boy do I get sht for this one when I mention it), DIS or INTC for the ever hopeful turnaround optimist, MDT...