Frontier Communications Parent: Rating Upgrade Supported By Attractive Valuation And ARPU Uptrend

Summary

- FYBR's valuation has become attractive after the stock declined due to the new CAPEX guidance.

- Ongoing demand for fiber and network expansion, increased data usage, and potential early completion of capital expenditure program could drive ARPU growth and positive surprise in free cash flow.

- Risks include weaker headline results due to timing issues with broadband net adds, which could impact stock sentiment.

piranka/E+ via Getty Images

Overview

Stepping on the side-line for Frontier Communications Parent (NASDAQ:FYBR) was the right recommendation, in hindsight. Now that the valuation has taken a hit and the stock is trading below its standard deviation range, I believe the valuation has turned attractive. I also have positive takeaway from the recent results and now see FYBR well positioned to see accelerated growth in fiber broadband subs and an inflection to positive and rapidly accelerating EBITDA growth in 2023. I believe this opportunity arises because of management guide for higher CAPEX in 2023 driven by higher inventory and higher fiber deployment costs owing to inflationary pressures. However, I think this simply an issue with timing, and the secular uptrend for fiber demand and network expansion is only going to continue increasing as businesses and consumers use more data. These should also continue to drive ARPU increase. Another attractive factor here is the if FYBR manages to complete its CAPEX program earlier than expected, we could see a surprise in FCF upside, which would be positive for the stock. I upgrade my rating from hold to buy.

Net adds to increase

The fact that FYBR fiber and broadband net adds have consecutively increased for the past few quarter is a strong evidence that underlying demand remains healthy. Given the strong secular demand, I do not see any hurdles to FYBR continuing this growth momentum, although we might see some seasonality in between quarters which is not surprising, in my opinion. Quite the opposite, I anticipate a surge in adds for FYBR as a result of its fiber expansion plans and the rollout of a 2 Gbps speed tier across its fiber footprint. Looking ahead, growth should continue to be supported by FYBER fiber build-out, which is likely to be completed by FY25/26. Management has stated repeatedly that they are confident in reaching 10 million fiber homes within the next few years, and if the current penetration rate holds, the current number of fiber broadband connections could double from here within 4 years.

ARPU should increase from here

Over the past few quarters, consumer fiber broadband has been rather flattish, bouncing in the low $60s range, which I believe have led to disappointment on FYBR's ability to increase prices. However, I now expect ARPU to see an inflection as FYBR scales back on the use of gift card promotions – which management has used to penetrate into new markets. I think now is the time for FYBR to scale back and let the original ARPU flow into the P&L as fiber-based services are now available to more than 50% of the 10 million customer locations it intends to reach in the next few years. In addition, FYBR has also instituted a quarterly price increase to reflect the yearly inflation rate. Putting all these factors together, I expect ARPU to see an acceleration in 2H23 and also in FY24 (vs easy comps in FY23).

Capex plan

I believe the reason for the stock decline – which has provided a buying opportunity – is due to its CAPEX guidance plan of $3 to $3.2 billion vs. $2.8 billion prior. From a headline perspective, this is clearly not healthy, as this means that FYBR will go deeper into the negative FCF territory. In normal times, this would not have spooked anyone, but given FYBR balance sheet and a sudden deep in FCF, I am not surprised that some investors are jumping out of the name just to stay safe. Objectively, I think the raised CAPEX plan is not that bad, as it is just a matter of timing. To speed up FYBR's fiber deployment this year and take advantage of volume-driven pricing discounts, roughly half of the increase in this CAPEX plan was attributable to building inventory. Inflation is still pushing up labor costs, so it's only natural that build-out costs would rise as well, accounting for the other half of the increase. Most importantly, though, despite the fact that this year cost per pass through might increase, the unit economics expectations should not have changed as the first 2 years were completed with less than $1,000 per passing.

Valuation

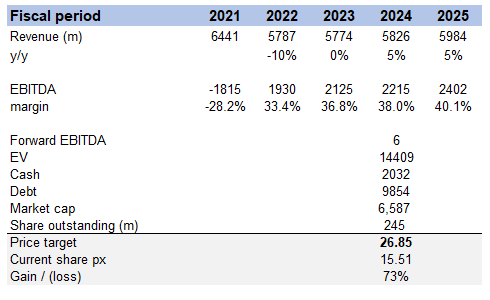

Given the continuous increase in fiber pass through and my expectation for ARPU acceleration in the coming quarters (which will settle at 5% in the long run), I see no reason why FYBR cannot continue to grow top line in the mid-single digits. This should be accompanied by an increase in margin as home pass penetration increases (i.e. higher utilization rate), which should drive unit cost lower. I expect the market to rerate the stock back to its mean EV/EBITDA valuation of 6x as a result of the recovery in growth and increase in margins.

Own model

Risks

I believe the risk would come in the form of weak headline results due to timing of broadband net adds. While management indicate their target of 10 million targets by FY27, the underlying pickup is something management cannot be 100% sure of. If this falls short of consensus estimate intra quarters, this might drive weak stock sentiment.

Conclusion

FYBR stock is now much more attractive given its valuation and the potential acceleration in ARPU. Despite the recent decline in stock value, the valuation has become appealing, and positive results indicate potential for accelerated growth in fiber broadband subscriptions and EBITDA. The ongoing demand for fiber and network expansion, along with increased data usage, should drive ARPU growth. If FYBR completes its capital expenditure program ahead of schedule, there could also be a positive surprise in free cash flow. However, potential risks lie in weaker headline results due to timing issues with broadband net adds, which could impact stock sentiment.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.