Tsakos Energy Navigation: Grab A 9.7% Yield With The Preferred Shares

Summary

- Tsakos Energy Navigation is experiencing a period of very strong cash flows thanks to its exposure to Suezmax and Aframax vessels.

- The company sold a bunch of vessels and generated a gain in excess of $80M.

- Tsakos is using its profits to fund the construction of newbuilds while it also will retire one series of preferred shares.

- The remaining two series of preferred shares remain interesting from an income perspective.

- Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Learn More »

rgaydos

Introduction

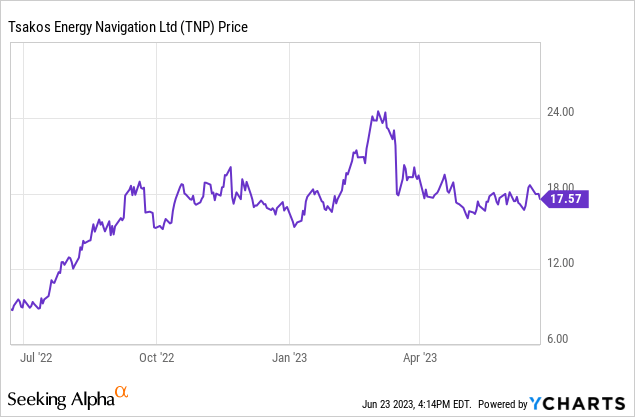

In the income-focused segment of my portfolio I bought a substantial long position in two series of preferred shares issued by Tsakos Energy Navigation (NYSE:TNP). I was increasingly getting interested in the company's ability to lock in strong charter rates for its Suezmax and Aframax segments, which have put in a stronger performance than the larger VLCC vessels. The common shares of Tsakos have performed well, the balance sheet has gotten stronger, and despite seeing higher interest rates on the financial markets, the price of the preferred shares hasn't gone down as the lower risk profile (thanks to the stronger financial performance) is mitigating the impact of higher interest rates as the market requires a lower risk premium.

Strong charter rates in the oil shipping market are boosting the company's profits

Thanks to very strong charter rates, Tsakos Energy Navigation has never been in a position as strong as right now. That was clearly visible in the first quarter of this year as the company posted record results. While that made for a great headline, it's important for investors to realize a substantial portion of that net profit was generated through the non-recurring sale of vessels.

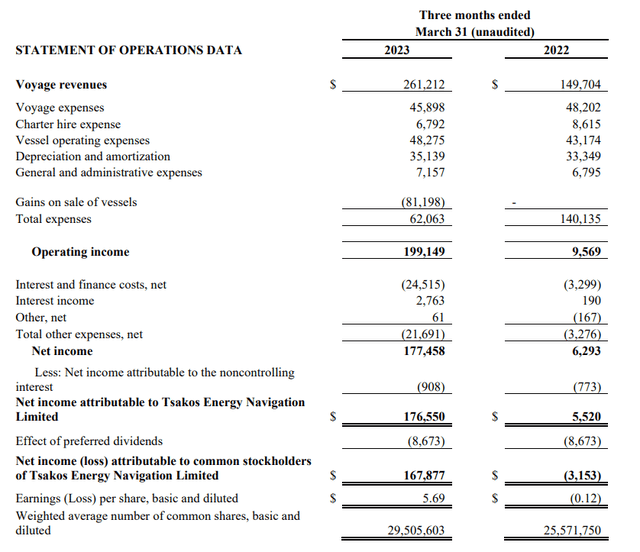

As you can see below, the income statement shows an operating income of $199M which is more than 20 times higher than in the first quarter of last year. And credit where credit is due: Tsakos Energy is definitely taking advantage of the strong charter rates as the voyage revenues increased by in excess of 70% to $261M while the operating expenses and voyage expenses barely increased.

And even if you would deduct the $81M gain on the sale of vessels from the operating income, the recurring operating income would still have been a very respectable $118M. Going back to the results on a reported basis, the net income of $177.5M is a great performance, but one should still deduct the $0.9M in net income attributable to non-controlling interests as well as the $8.7M preferred dividend payments. This resulted in a net income of $167.9M attributable to the shareholders of Tsakos, for an EPS of $5.69 based on the weighted average share count of 29.5M shares.

Even if we would completely ignore the gain on the sale of vessels, the net income would still have exceeded $85M and this would represent an EPS of just under $3. So while the non-recurring gain definitely boosted the EPS, the underlying and normalized net profit would still have been very impressive.

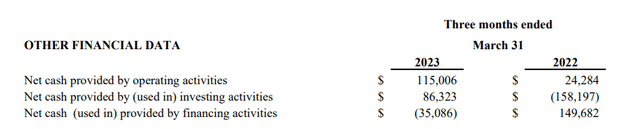

Unfortunately the company only provides a summarized cash flow statement (see below) and that's actually pretty useless as one needs more details to reach an informed opinion.

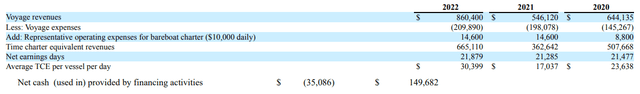

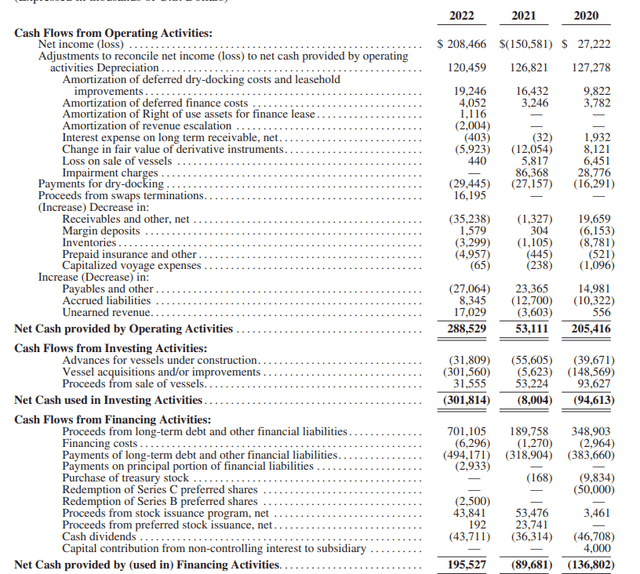

That's why I think it does make sense to have a look back at the detailed cash flow statements as published by Tsakos in its FY 2022 annual report. And just to put things in perspective, the average time charter equivalent per vessel per day was approximately $30,400 in FY 2022.

That's approximately 25% lower than the average TCE in Q1 2023 but of course it is important to realize Tsakos owns several different asset classes and the average TCE is exactly that - an "average."

I'll be pretty brief as my sole purpose is to "set the scene." The total reported operating cash flow in FY 2022 was $288.5M, but this included a net investment in the working capital position of in excess of $40M while I also will deduct the $6.3M in financing costs. This means that on an adjusted basis, the operating cash flow was approximately $320M (this includes the preferred dividend payments). A strong result which is more than sufficient to cover the needs to rejuvenate the fleet. And keep in mind that with an operational fleet of in excess of 50 vessels, an increase of the average charter rate by $10,000/day adds almost $200M to the full-year cash flow result.

The preferred shares are still a valid income idea

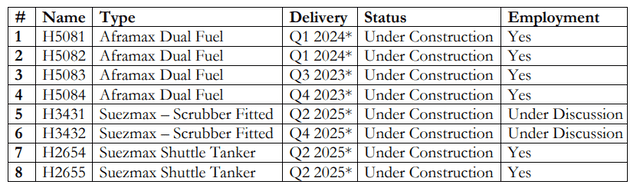

So what does a company do with all that cash? First of all, Tsakos continues to expand its fleet. As you can see below, the company will take delivery of eight new vessels within the next 2.5 years. Thanks to the very strong cash flow results, Tsakos should have no difficulties to fund these acquisitions (and bank debt will be available as most of the ships have already signed contracts for employment).

A second decision made by the board of directors is to call the Series D preferred shares. This didn't come as a complete surprise as this is what I wrote in my 2021 article:

These preferreds are callable right now but are trading at a discount of 5-6% to par. I think it's unlikely these preferred shares will be called right now, but I would not rule it out if the charter rates indeed start to go up.

The charter rates have indeed moved up, and Tsakos is now indeed calling that specific series of the preferred shares. Personally, I own both the D Series and F series of the preferred shares. The D Series will now be called in a few weeks and I need to rethink my redeployment of cash.

I still own a very sizeable position in the F-Series which are trading as (NYSE:TNP.PF), which currently have a 9.5% preferred dividend which will become a floating dividend after July 2028 based on the three-month LIBOR +6.54% (this will undoubtedly be updated to the SOFR benchmark rate as it is the most likely reference rate but I can't recall seeing official confirmation on this from Tsakos. In any case, we are still five years away from the reset date).

The question now is whether or not I should roll (some of) the proceeds from the Series D call into the Series E preferred shares. The E-series are trading as (NYSE:TNP.PE) and have a 9.25% preferred dividend which will get switched to a floating dividend based on the three-month LIBOR + 6.881% from May 2027 on (again, Tsakos will likely use a SOFR based benchmark once the reset happens).

As Tsakos is calling one series of the preferred shares, the remaining (series of) preferred shares are actually getting safer as the asset coverage ratio (total equity versus total preferred equity) will increase while the preferred dividend coverage ratio will also improve.

Investment thesis

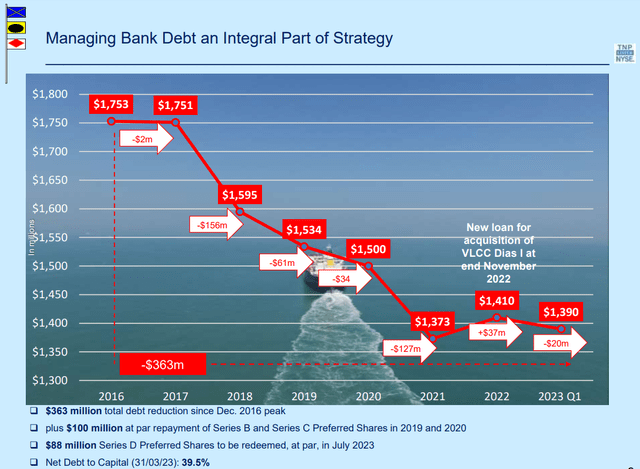

This means there's zero doubt in my mind to at least hold onto my Series F preferred shares as the preferred dividend is very well covered, and even if charter rates would suddenly fall off a cliff, the preferred dividends are cumulative in nature and will likely continue to be paid. Let's also not forget Tsakos has rapidly reduced its net debt although the effective debt level has stabilized since the end of 2020 as Tsakos is now deploying cash to acquire new vessels.

The strong performance of Tsakos Energy Navigation also makes the Series E preferred shares a "buy" but investors who already own the Series F don't really have any upside if they would either switch from F to E or buy the Series E. But investors that don't own any of the preferred shares yet should consider having a look at both issues of the preferred shares.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TNP.PF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I also have a long position in TNP.PD but those shares will be called in a few weeks.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (36)