New York Community Bancorp's Floating Preferreds Pay Out A 7.4% Yield

Summary

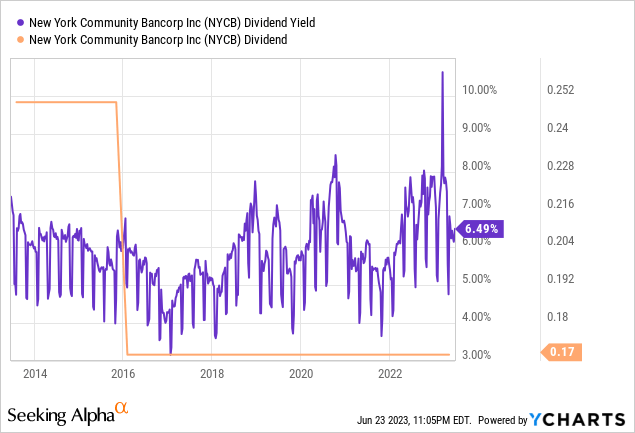

- New York Community Bancorp is currently paying out a 6.5% annualized forward dividend yield to common shareholders.

- The bank saw fiscal 2023 first quarter net income grow by 14% sequentially to $159 million.

- Its Series A preferreds are currently trading at a 13% discount to par value with a yield on cost of 7.4%.

cmart7327/E+ via Getty Images

New York Community Bancorp (NYSE:NYCB) has come out as an expected winner of the March 2023 banking panic. The common shares of the Long Island-based regional bank are up 21% year-to-date, outperforming its peers and also ahead of the S&P 500 by just over 500 basis points. The dividend income is the prize here and NYCB last declared a quarterly cash dividend of $0.17 per share, in line with its prior payment and a 6.5% annualized forward yield. Crucially, the acquisition of assets of FDIC-seized Signature Bank in March stands to entirely change the growth profile of TBV and dividends that have stagnated for most of the last decade.

What's the play here? That the deal has materially derisked the investment case for NYCB and opened up an opportunity to accumulate a position in either the common shares or the preferred shares. The fixed-income structure of the preferreds, their current large yield on cost, and their discount to par value despite being backed by a highly profitable business have heightened their investment case.

The Series A Preferreds And The 7.4% Yield On Cost

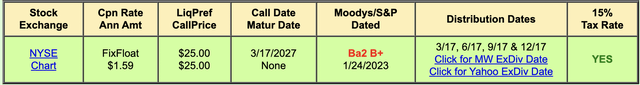

New York Community Bancorp 6.375% Series A Preferreds (NYSE:NYCB.PA) started trading in 2017 when the bank sold 20 million depositary shares each representing a 1/40th interest in a share of fixed-to-floating rate Series A preferred stock. The fixed annual coupon at $1.59 means a 7.4% yield on cost against preferreds currently swapping hands for $21.67 per share. They're noncumulative like all bank preferreds, inherently reducing a layer of security for its holders and making them less attractive to comparative preferred securities in industries not subject to the same stringent capital requirements. However, this risk of a coupon suspension is essentially near-zero as it would only ever happen in a scenario where the bank was on the path to FDIC receivership.

There are several reasons to be long here. Firstly, there are currently trading at a $3.33 difference to their $25 par value, a 13% discount to par value that can be aggregated with the coupon for total possible future returns. To be clear, these can be bought for just under 87 cents on the dollar with their call date coming up on the 17th of March 2027. Whilst they're perpetual so NYCB has no obligation to redeem at par at this date, their current yield to call stands at 10.7%. Do you think the broader stock market indices like the S&P 500 or the Dow Jones will be able to provide a near 11% return per year over the next four years? If not, these preferreds form a low-risk and more stable alternative.

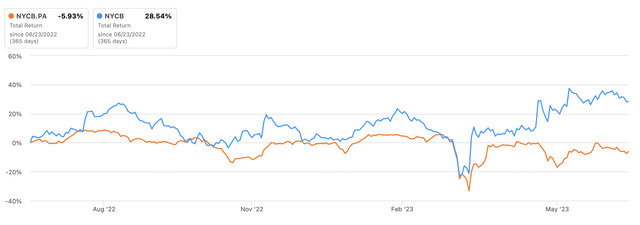

However, the preferreds have drastically underperformed the commons over the last 1-year by losing 5.93% versus a gain of 28.54% for the commons. Zoom out over the last 3 years and the Series A sport a 1.46% gain versus a 21.85% gain on the commons. That the preferreds have underperformed the commons over a period marked by the type of macroeconomic disruption that sparks a flight to their type of safety highlights the resilience of the underlying business and market optimism around the benefits of the Signature Bank acquisition. Critically, with some forecasts placing inflation as set to remain above the Fed's 2% target for much of the next year, every basis point of potential return should be chased and these preferreds have an attractive base coupon rate.

Strong Operational Gearing As Deposits Rise And Net Income Ramps Up

The March banking panic was the direct outcome of the Fed hiking interest rates ten consecutive times to their highest level since 2008 at 5% to 5.25%. It has likely fundamentally catalyzed a change in the zeitgeist of banking. NYCB's core risk is that there will be a pertinent flight of insured and uninsured banking deposits to the four systematically important banks Citi, Bank of America, Wells Fargo, and JPMorgan Chase. NYCB last reported revenue for its fiscal 2023 first quarter of $2.65 billion, a huge 665.9% increase over its year-ago comp as a result of the acquisition.

NYCB brought in net income to common stockholders of $159 million, a sequential growth of 14% over the fourth quarter as its net interest margin expanded by 32 basis points to 2.6%. Total deposits were $84.8 billion as of the end of the first quarter, up $26.1 billion from $58.7 billion as of the end of the fourth quarter. Crucially, the $7.65 billion market cap NYCB now has non-interest bearing deposits that form 27% of its total deposits. Tangible book value ("TBV") per share of $9.86 was a growth of $1.63 sequentially over the fourth quarter. Hence, NYCB's commons are currently trading at a small 6.2% premium to TBV. The bank has meandered through periods of trading at a premium and discount to TBV over the last 5 years but its TBV jump in the first quarter is unparalleled and set against TBV that's essentially flatlined for years. I'm neutral on the commons on the back of this premium but would consider a position later in the summer was this to invert.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.