Preferreds Weekly Review: Pricing Inefficiencies Continue To Persist

Summary

- We take a look at the action in preferreds and baby bonds through the third week of June and highlight some of the key themes we are watching.

- Preferreds were roughly flat as higher Treasury yields were offset by tighter credit spreads.

- We take a look at a couple of pricing discrepancies in the B. Riley Financial senior security suite, which are indicative of broader market inefficiencies.

- And highlight our stance on the AAIC and EFC preferreds.

- I do much more than just articles at Systematic Income: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Darren415

This article was first released to Systematic Income subscribers and free trials on June 18.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the third week of June.

Be sure to check out our other weekly updates covering the business development company ("BDC") as well as the closed-end fund ("CEF") markets for perspectives across the broader income space.

Market Action

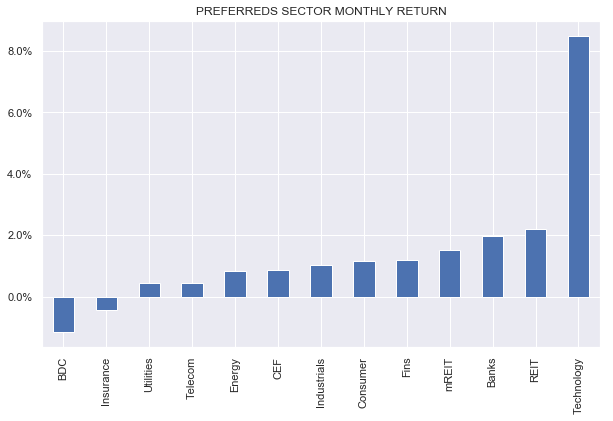

Preferreds were relatively flat this week as higher Treasury yields were offset by tighter credit spreads. Month-to-date, most sectors are up, led by Tech shares - in line with what's happening with the common share market.

Systematic Income

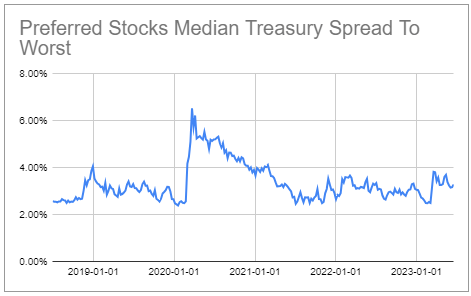

While overall yields are attractive, credit spreads remain tighter than we would like given the Fed is not done raising rates and most macro indicators outside of the labor market are in recession territory.

Systematic Income Preferreds Tool

Market Themes

As many income investors are aware, the exchange-traded senior securities market is not totally efficient. In this section, we highlight a couple of cases where the pricing in the senior security suite of the same issuer (B. Riley Financial in this exercise) is not totally rational. This pattern suggests that investors have to be careful gauging value across the entire suite of senior securities, as the value on offer in the same suite of securities can vary widely.

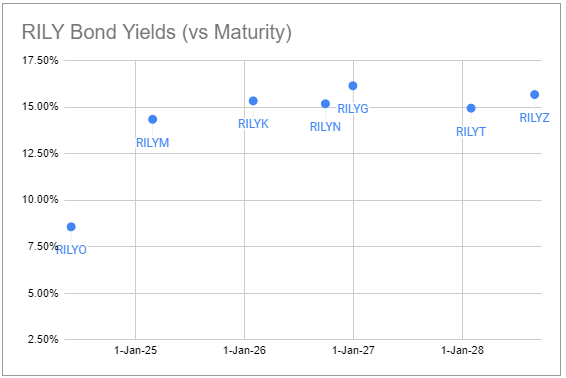

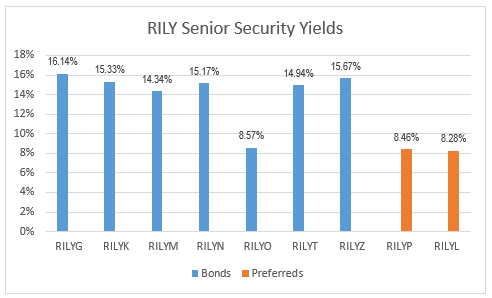

Let's kick off with the Riley baby bond yields, which are shown in the chart below. Here we see that the shortest bond maturing in May-2024 (RILYO) has a 8.6% yield while the Feb-2025 bond (RILYM) has a yield of close to 14.3% which is roughly in line with the rest of the bonds.

Systematic Income

This yield gap of 5.7% for 9 additional months seems very large, particularly in the context of an inverted yield curve. Translating yields into credit spreads, we get a credit spread of 3.4% for RILYO and a credit spread of 9.6% for RILYM. In other words, RILYO is trading as a BB- rated bond, while RILYM trades as a CCC-rated bond. In other words, based on historical default rates, RILYO has an implied default probability of around 1% while RILYM has an implied default probability of 10-15%. It seems odd for the company's default probability to jump by an order of magnitude over the second half of 2024 from a very low level.

What's likely happening here is that investors who like the high Riley bond yields are flocking to RILYO as they view the short-term maturity as money good. However, they are clearly not being appropriately rewarded for taking exposure to the company for close to a full year.

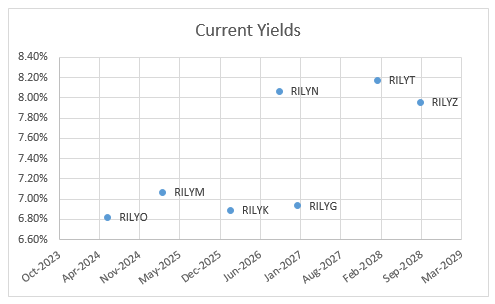

Another possible explanation for this yield divergence is that investors are looking at current yields rather than yields-to-maturity. Current yields will be much more compressed relative to each other, as the following chart shows, however they obviously disregard the pull-to-par.

Systematic Income

The second pattern we noticed recently is that the Riley preferreds are trading at unusually low yields relative to the Riley bonds.

Systematic Income

If preferreds yields were only slightly above their bond counterparts, that might have been justified with the view that financial companies tend to have ultra-low recoveries. This is because they don't have many hard assets and carry very high leverage.

According to this view, it doesn't matter a whole lot whether you are holding preferred shares or senior unsecured bonds. For example, the initial recovery on Lehman Brothers bonds was only around 9 cents on the dollar (revised higher after the actual windup of the business a decade later), not much more from where preferreds would have recovered (i.e. a goose egg).

We are somewhat sympathetic to this view, however in the case of Riley securities preferreds yields are below bond yields which is clearly the wrong way around.

The possible explanation here is that, once again, investors are looking at current yields. Alternatively, the preferreds and baby bond markets are somewhat bifurcated and many preferreds investors don't pay much attention to baby bonds, despite the fact that they trade on the exchange exactly like the preferreds.

This correspondence between preferred and bonds in RILY is not an unusual one-off. We have seen similar discrepancies between bond and preferred yields in mREIT Arlington Asset and CEF Equity senior securities such as OXLC, among others.

Overall, this suggests that investors should look across the entire suite of senior securities to make sure they are earning good value on their capital.

Market Commentary

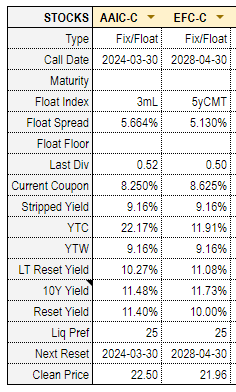

A subscriber asked about the proposed AAIC and EFC merger that we wrote about recently and whether we liked the AAIC or EFC preferreds here.

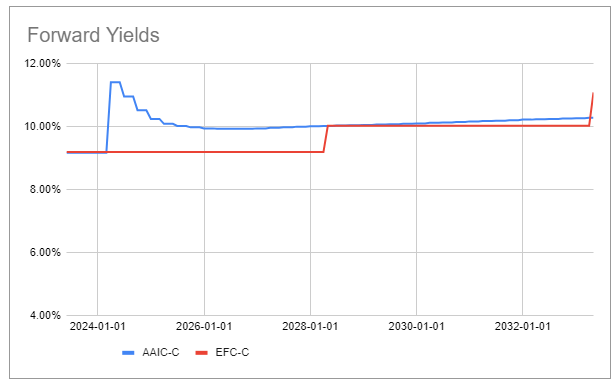

Earlier, we would have said to favor (AAIC.PC) given its attractive yield and high spread over the short-term rate, however we are now beginning to lean towards (EFC.PC).

Systematic Income Preferreds Tool

AAIC.PC will convert to a floating-rate in March of next year, unless redeemed. If not redeemed, its yield is expected to be quite a bit above that of EFC.PC based on forward rates for a few years until EFC itself resets. Over the longer-term, EFC.PC will likely deliver a higher yield as the yield curve disinverts. Its link to the 5Y CMT (constant maturity Treasury) yield is also attractive as a diversifier to the majority of Fix/Float preferreds that are linked to short-term rates. AAIC.PC could deliver a price pop if it survives past its first call date, however, in that case we would switch over to EFC.PC

Systematic Income Preferreds Tool

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EFC.PC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)