Opera Limited: The Momentum Can Continue

Summary

- Opera, known for its PC and mobile web browsers, has seen significant growth in its GX gaming browsers, with a higher ARPU than the company average.

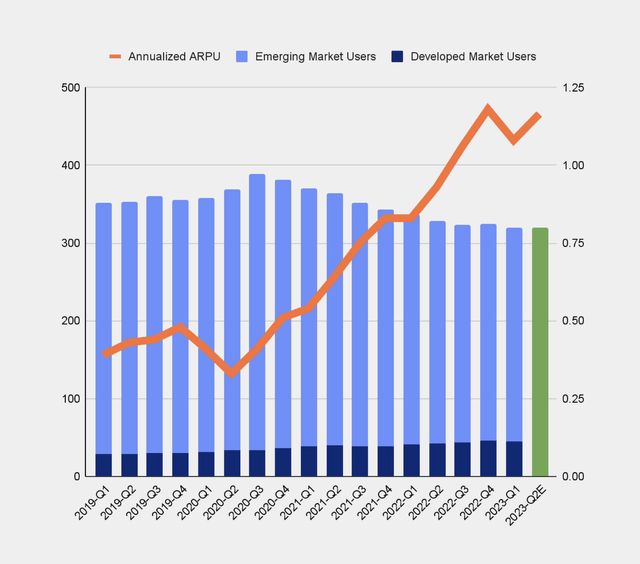

- The company has shifted focus to higher-valued users and developed markets, increasing its developed market users by 53% and ARPU by 174% since 2019.

- With user gains from pre-installations not contemplated in guidance, the company looks poised to continue to beat and raise.

Henrik5000/E+ via Getty Images

One of the hottest stocks of 2023, Opera (NASDAQ:OPRA) has some more room to run.

Company Profile

OPRA is best known for offering a variety of PC and mobile web browsers. The company also offers gaming portals and development tools, an ad platform, news content recommendation products, and Web3 and e-commerce products and services.

The firm operates several browsers, including Opera Mini, Opera for Android, Opera for iOS, GX Mobile, and Opera, which is its PC browser. The company says its Opera browser is optimized for speed and battery life and offers features such as a free, built-in VPN service. Its Opera GX browser, meanwhile, allows gamers to customize their browser to optimize their gaming performance.

Opera Mini, its original mobile browser, is a cloud-based browser that runs the data through its servers, compressing it in order to reduce data consumption. It Android browser, meanwhile, has features such as a crypto wallet and VPN, while its iOS browser has a native ad-blocker, a Crypto Wallet and the Flow syncing feature.

The company generates revenue primarily through search and advertising. It has revenue share relationships with Google (GOOGL) and Russia’s Yandex when users use one of OPRA’s built-in search bars. It also generates revenue from delivering ads on its browsers and other properties, as well as through technology licensing.

Opportunities and Risks

OPRA started out with focus on emerging markets, and its Opera Mini browser became particularly popular due to its ability to reduce data consumption in these markets. While many people in the U.S. may not have heard of OPRA, it has approximately 319 million monthly active users, including 243 million for mobile, with much of them in emerging markets.

The problem with emerging markets, however, is that the ARPU in these markets tends to be very low. So the company smartly began making a shift before the pandemic to start to focus on higher valued users and developed markets. Since 2019, the company has been able to increase its developed market users by 53% and its ARPU by a whopping 174%.

Company Presentation

Annualized ARPU rose 40% in Q1 to $1.08. Search revenue, meanwhile, increased 18%, which the company credited to its PC footprint growth in North America. Ad revenue grew an even faster 26%.

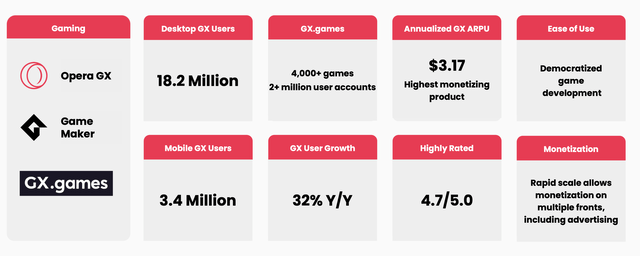

One area of particular strength for OPRA has been its GX gaming browsers. The PC version was launched in Q2 of 2019 and has been a huge success. It now has approximately 18.2 million users for its desktop version and 3.4 million users on its GX mobile browser, which was launched in May 2021. Overall, GX users grew 32% year over year in Q1, showing the continued momentum of the gaming browser.

Company Presentation

Just as importantly, the ARPU for the GX browsers is much higher than the company average. In fact, GX ARPU is nearly 3x the company average ARPU, coming in at $3.17 annualized in Q1. That was up from $2.70 annualized a year ago, although down from $3.30 in Q4

Opera GX’s success can be found in its ability to become ingrained in the gaming echo system, and fixing problems like lag. The majority of Opera GX users are Gen Z, tapping into an attractive demographic for advertisers. Users also spend nearly 8 hours a day with the browser turned on, which seemingly should give the company the ability to increasingly monetize this user base.

The company has also done a great job growing its GX user base through partnerships with gaming streamers and influencers. The company estimates that there are 400 million games outside of China, so with only 20 million GX users, there are still a lot it can reach.

Outside of GX, the company has other opportunities to grow as well. It has made deals with some OEMs to preload its browsers on devices and be part of their system updates, which could help drive user growth in the second half. Any revenue from this is not currently in guidance, representing upside.

And not surprisingly, OPRA is also looking towards AI as well. Discussing the AI opportunity on its Q1 earnings call, Co-CEO Lin Song said:

“It's a definite beneficial to us in terms of user awareness and in terms of getting new users, right? So that's very helpful. It's actually a bit of marketing spend because you just seek out browser, right, because of it. So for now, it's definitely positive. And we do also see that user engagement on others will increase. However, on the other hand, what's the best business model around it? I would say it's still to be explored. And more like it definitely improves the whole browser time spend and user are more active and we start to have more revenue for sure. However, I think I understand your question that it is in general have a cost and then people are trying to take out what's the best way to get revenue out it. I mean the way I said is that, in general, by our calculation, you will probably have to spend -- more likely it depends on choice, right? I know we can ask users to pay for it. For now, actually, the integration on the side bar actually user paid for it. There's no extra cost for us, which is good. But we may in the future choose to actually have that directly and natively integrated, while we will bill our cost, but then we will predict to get that back by advertisements and by working with partners. Exactly how we plan with that, it's still the work in the process. But I think we are relatively optimistic about it's going to be positive to the whole -- to us in this.”

When it comes to risks, advertising is OPRA’s biggest source of revenue, at about 56% of its total in Q1. While OPRA hasn’t really seen much of an impact at this point, the ad market overall has been soft across mediums. There is no reason to think it is totally immune from these pressures.

Competition is another potential risk. OPRA’s success in gaming could open the door for other challengers. Gaming is a market that big tech giants like to play in, and they could be able to replicate what OPRA is doing with their own gaming-focused browsers. Any change or loss of its revenue share deals with GOOGL or Yandex could also hurt results.

Valuation

OPRA currently trades around 17.7x the 2023 consensus EBITDA of $81.7 million and 15.4x the FY25 consensus of $94.2 million.

It trades at a forward PE of 24.5x the 2024 consensus of 73 cents.

The company is projected to grow revenue nearly 17% in 2023 to $386 million, and 14.5% to $442.2 million in 2024.

There are no great public comparables to OPRA, and its historical valuation isn’t much help either.

Conclusion

OPRA has been one of the hottest stocks in 2023, up over 225% year to date and over 300% over the past year. The company has been doing a tremendous job of increasing its higher-ARPU user count and pushing up its overall ARPU. Its GX Browser is becoming ingrained in the gaming echo system, and it still has plenty of growth ahead of it.

All in all, I think the gains in the stock have pushed it to around fairly valued. It has solid, but not hyper growth, and a between mid-teen to 20x multiple looks appropriate in my view. That said, with pre-installations in the second half not contemplated within guidance, I think the company should continue to beat and raise for the rest of the year, and push its multiple towards the higher end of that mid-teen to 20x multiple. While it doesn’t have the same upside as at the start of the year, the stock should still have some more momentum left.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.