Array Technologies: Positive Cash Flow Ignites Momentum

Summary

- Array Technologies, Inc has experienced strong demand in the solar industry, with a positive cash flow of $41.9 million for the quarter and an FCF margin of 11.12%.

- ARRY's DuraTrack solar panel and SmarTrack software maximize energy production by ensuring optimal exposure and panel positioning.

- Despite a slowdown in orders and awaiting IRA guidelines, ARRY's strong growth, margins, and industry position make it a solid investment opportunity in the solar market.

MAXSHOT

Investment Rundown

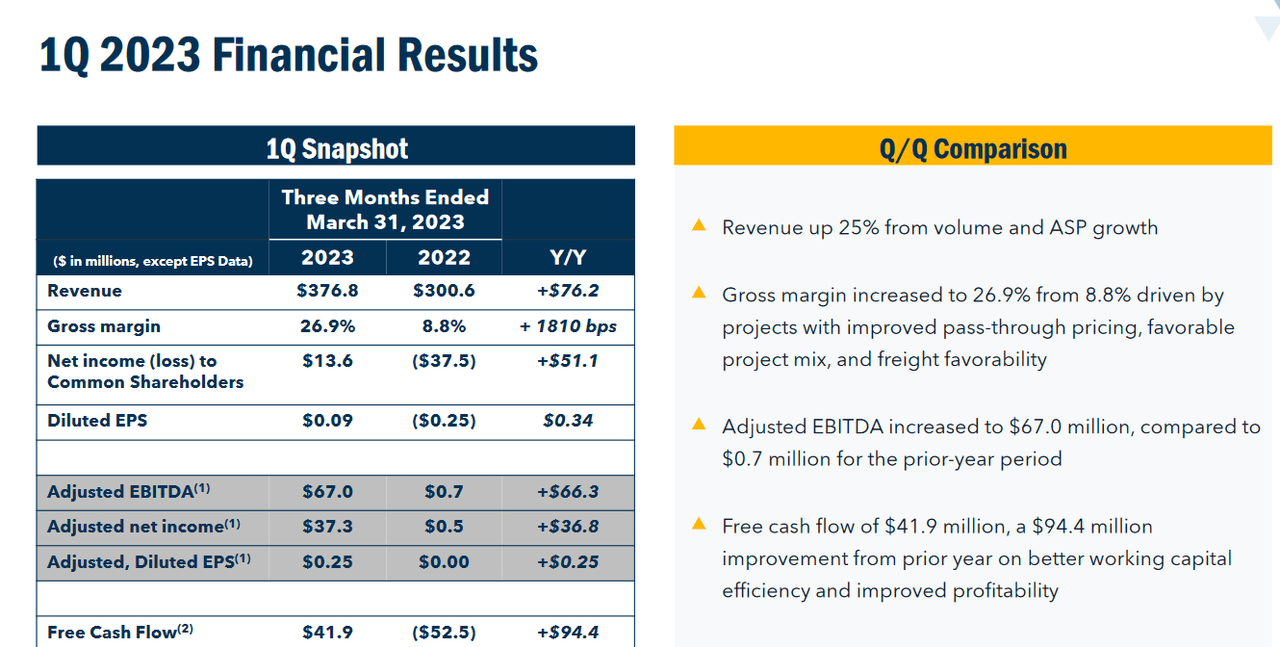

The solar industry has seen nothing but high demand over the last several years as the shift towards renewables is increasing. This growing demand is visible in the last earnings report for Array Technologies, Inc. (NASDAQ:ARRY) as well. They managed to achieve a positive cash flow of $41.9 million for the quarter, leaving them with a strong FCF margin of 11.12%. These impressive results seem to have ignited the share price from the beginning of May when the report was released. Even though the company is trading at an FWD p/e of 25, the demand paired with the expansions of margins in the business makes it a buy and a great way to gain exposure to the solar market.

The Product

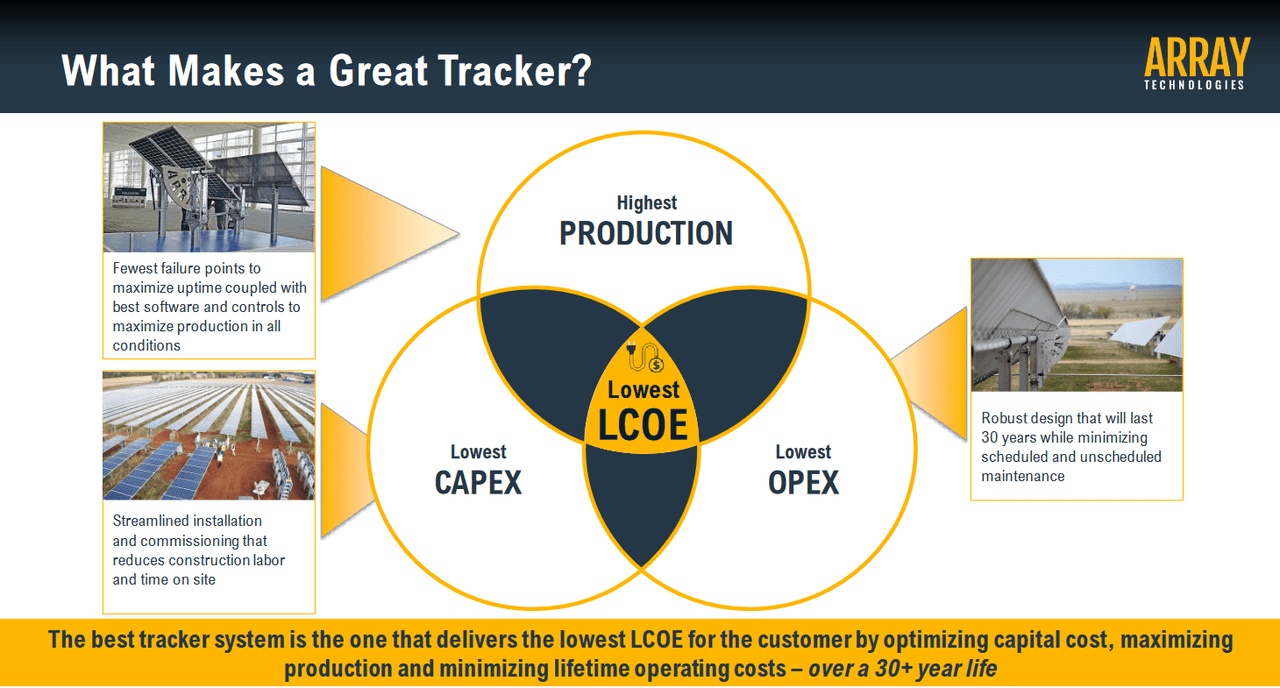

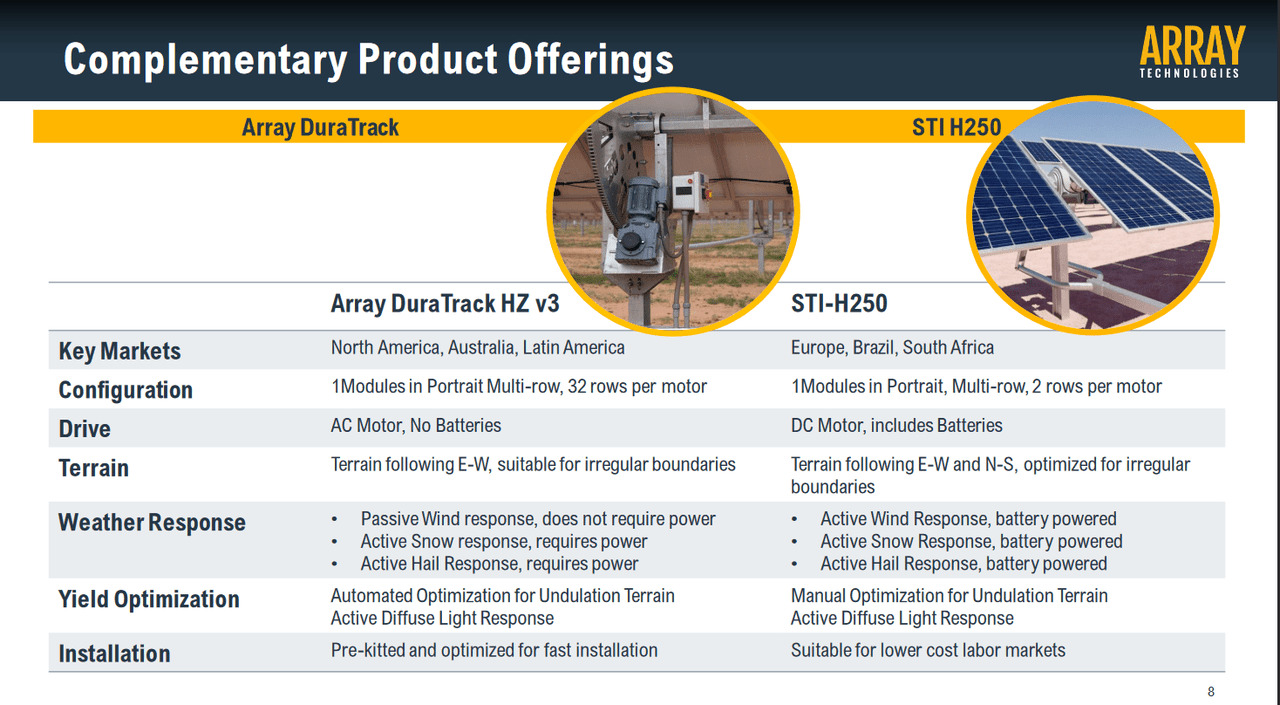

Array Technologies operates both in the United States and internationally. Their core expertise lies in the manufacturing and provision of solar tracking systems, aimed at maximizing the efficiency and output of solar modules. Their flagship products, namely the DuraTrack and SmarTrack, play a pivotal role in this endeavor.

Tracker Market (Investor Presentation)

The DuraTrack system is designed as a single-axis solar panel, offering enhanced mobility. By adopting a dynamic approach, the panel can adjust its position throughout the day to continuously face the sun, ensuring optimal exposure and energy generation. This mobility is instrumental in harnessing the maximum potential of solar radiation.

Complementing the DuraTrack system is the SmarTrack software. Developed to optimize panel positioning, SmarTrack utilizes intelligent algorithms and data analysis to determine the ideal orientation for each solar panel. This optimization process helps to maximize energy production by ensuring the panels are precisely aligned to capture the most sunlight possible.

Products (Investor Presentation)

Together, the DuraTrack solar panel and the SmarTrack software form a comprehensive solution provided by Array Technologies. By leveraging advanced technology and innovative design, Array Technologies empowers its customers to harness the full potential of solar energy, contributing to a sustainable and clean future.

The Solar Market Is Glowing

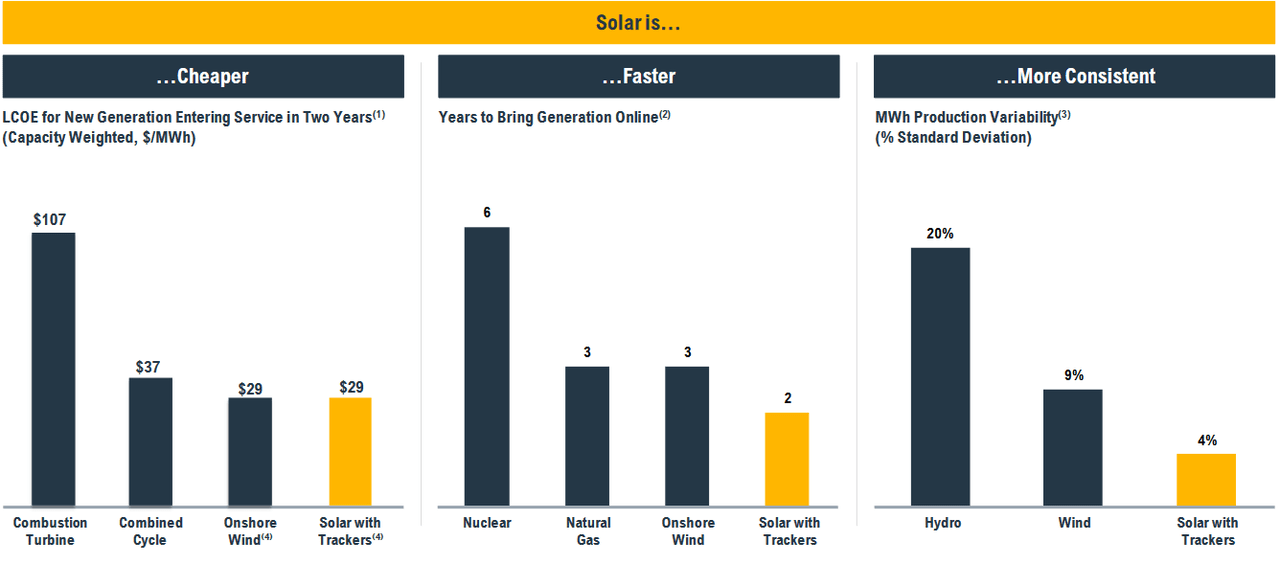

As mentioned previously, Array Technologies operates in the solar sector, which I believe holds significant potential for future growth. With increasing awareness about the source of energy and the growing trend of electrification in modern households, the demand for solar power is expected to rise in the coming decades.

In the United States, the residential sector represents one of the largest markets for solar energy. States like California are at the forefront, actively promoting green energy initiatives. Consequently, solar adoption in California is experiencing rapid growth, making it one of the most promising regions in the country. Projections indicate a CAGR of 16.5% in the TAM for solar companies until 2030. This growth is driven by factors such as new construction projects and the increasing adoption of solar energy systems. The adoption of solar seems to be growing steadily each year and ARRY is taking steps to ensure their part of this market.

Solar Market (Investor Presentation)

ARRY is also seeing its edge over other more traditional sources of energy as its product helps customers ensure they have both a cost-efficient product but also one that is easier to adapt to. Solar is taking the lead in many of these areas, both in the residential market and the commercial.

Earnings Highlights

As was highlighted before, the first quarter to the start of 2023 was a success for ARRY. They managed to achieve a strong gross margin of 26.9% as they are phasing out of their old model and burning off old contracts. This new transition by the company seems to be making them out to be a real winner and a solid opportunity in the solar space.

Looking at the guidance the company provided, it wasn't noticeably higher than what they were expecting. They still see revenues being between $1.8 - $1.9 billion, which puts ARRY at a p/s of just around 1.7 which I don’t find that high to pay for a solar company growing revenues by 25% YoY. Helping this strong growth was the favorable timing the company had with closing out their project timing with their Array Legacy segment.

A noticeable part of the quarter was the slowdown in orders, the CEO Kevin Hostler touched on this briefly too, “I will note that we did have a slowdown in our order activity this quarter, which was not unexpected. Our pipeline remains strong, but many of our customers are still awaiting final IRA guidelines around domestic content before issuing final awards and are delaying project start dates to provide more time to evaluate its provisions”. I think that 2023 will prove to be a slightly challenging year for the industry and for ARRY as they await the earning benefits from the IRA and their domestic content guidelines. Looking ahead to 2024, the IRA benefits are expected to help bring incremental profitability and cash flows. So going into Q2, maintaining margins and a slight growth in orders would be bullish and could set off another upswing for the share price.

Industry Comparison

There are plenty of lackluster companies in this space that both lack a decent balance sheet and positive margins, Array Technologies has all of this it seems. A popular solar company like Sunrun Inc. (RUN) for example has TTM gross margins of 11.9% and negative cash flows of over $2 billion. Despite Array Technologies being smaller, I find them severely more intriguing and the better option.

Where Array Technologies is also coming out ahead is the dilution of shares. Now this isn't something you want to see as a potential investor, but often with growing companies like ARRY, especially in growing industries, one of the necessary steps is to dilute shares to raise capital. Array Technologies is no stranger to this and the shares outstanding have gone from $120 million in 2019 to $150 million in Q1 2023. But looking at RUN theirs went from $123 million to $220 million during the same period. Now their revenues have also massively increased during that time as well. If the estimates for RUN come true regarding their EPS as well, then they would be trading at a p/e of 10 in 2026, which would be around the same as ARRY. Why I still find ARRY to be the better option is simply that they have already managed to establish their margins and are growing them. They are trading based on fundamentals rather than the wishful thinking of future prospects.

Final Words

Array Technologies has seen a strong uptrend over the last few years and with the trends of the solar market, I find it unlikely we will see any sudden halt in the growth in the coming years. The transition towards renewables is happening and plenty of capital is flooding into the sector. I think ARRY offers investors a solid opportunity to gain exposure to this.

Their solar tracker systems seem to be in high demand and ARRY is transitioning out of their old model and improving margins as a result of it. I think we aren't long until they stop diluting shares too and we see even stronger EPS growth. With a p/e of 25, I think the company still is a sound buy even after the run-up the last month or so.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.