GSK: A Biopharma Giant On Sale

Summary

- GSK, or GlaxoSmithKline, has performed badly in the past decade, but its future outlook may not be as bleak.

- The company has spun off its consumer healthcare segment to focus on the vaccine and HIV segments, which present huge growth opportunities.

- The current valuation is significantly discounted compared to both peers and its own historical average.

- The company just announced the settlement of the Zantac trial in July, which should vastly lower its litigation risk.

Wirestock

Investment Thesis

GSK's (NYSE:GSK) performance has been really disappointing in the past decade, with shares down over 30% during the period, vastly underperforming the S&P 500 (SPY) which increased over 170%.

In order to improve shareholder value, the company spun off its consumer healthcare segment last year, which allows it to better focus on core segments such as vaccines and HIV. The company has a strong pipeline and product line in these segments, which should help drive growth moving forward. The company's current valuation is also very cheap and the latest settlement of the Zantac lawsuit should vastly lower its litigation risks.

Massive Vaccine Market

GSK, or GlaxoSmithKline, is one of the largest biopharma companies in the world. The London-based company specializes in the infectious disease and HIV area, which accounts for over half of its total revenue. In order to narrow down its focus, the company spun off its consumer healthcare segment last year, which subsequently went public under the name Haleon (HLN). After the spin-off, GSK is now targeting vaccines and HIV as its major growth driver.

Vaccine is a massive and fast-growing market. According to Vantage Market Research, the global market size for vaccines is forecasted to grow from $43.8 billion in 2022 to $90.5 billion in 2030, representing an excellent CAGR (compounded annual growth rate) of 9.5%.

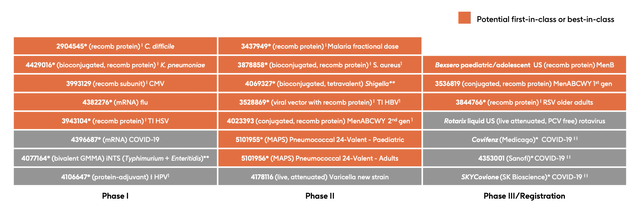

The market expansion is driven by the ongoing improvement in technology and the rising importance of disease prevention. GSK is one of the leaders in the industry with 25 vaccines supplied across 160 countries. The company is well-positioned to benefit from ongoing market expansion as it currently has 23 projects in its pipeline, with 15 of them potentially being first-in-class or best-in-class, as shown in the picture below.

Notable vaccines include Arexvy, a subunit RSV (respiratory syncytial virus) vaccine for adults above 60. It just received approval from the FDA (Food and Drug Administration) last month and a US launch is expected by the end of the year. This is the world's first approved RSV vaccine for older adults and should be a significant growth driver. For instance, RSV is expected to become a $4 billion market by 2027. The company is also developing a new influenza vaccine through mRNA, a newer technology made popular by Covid-19. mRNA could potentially make the new vaccine much safer and more scalable.

The Opportunity In HIV

HIV (human immunodeficiency virus) presents another major opportunity for GSK. According to Fortune Business Insight, the global HIV market is forecasted to grow from $30.5 billion in 2021 to $45.6 billion in 2028, representing a solid CAGR of 5.9%. While annual new HIV infections have been declining, the number is still pretty elevated at 1.5 million, significantly higher than UNAIDS' target of 500,000, as shown below. This should continue to create a large demand for treatment and prevention products.

GSK is also a leading company in the HIV industry, with best-in-class products such as Cabenuva, Apretude, and Dovato. For instance, Cabenuva is the first and only complete long-acting HIV treatment for adults, while Apretude is the first injectable treatment for HIV pre-exposure prevention. The strong momentum of these products led the HIV segment to a 15% growth in the first quarter and should continue to boost growth moving forward.

UNAIDS

Cheap Valuation

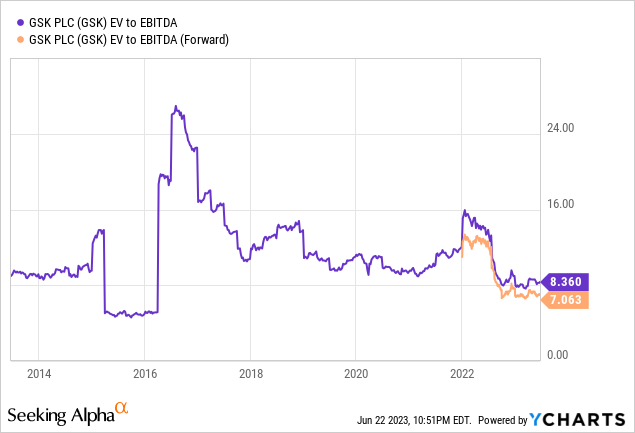

After the ongoing decline in share price, GSK's valuation looks extremely compelling in my opinion. The company is currently trading at an EV/EBITDA ratio of 8.4x, which is discounted compared to both peers and its own historical average. (I am using the EV/EBITDA ratio as it can take the debt into account). As shown in the first chart below, the current multiple is near the bottom of its historical range, representing a meaningful discount of 19.2% compared to its 5-year average EV/EBITDA ratio of 10.4x.

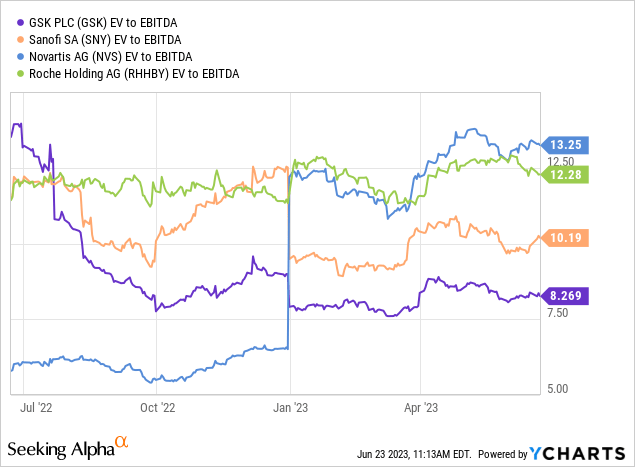

The company is also notably cheaper than other major Europe pharmaceutical companies such as Sanofi (SNY), Novartis (NVS), and Roche (OTCQX:RHHBY), as shown in the second chart below. The peer group has an average EV/EBITDA ratio of 11.9x, which represents a significant premium of 41.7% over GSK. The company is trading at a notable discount due to its weak and inconsistent growth, but I expect it to improve moving forward as the vaccine and HIV segment continues to gain traction. A rebound in growth should trigger an expansion in multiple, which should lead to meaningful upside potential.

Litigation Risk

Litigation around Zantac had been a major concern of GSK in the past year, with the first trial originally scheduled for July. Earlier today, the company said it had reached a confidential settlement with the claimant, preventing the case from going to trial next month. There are still other cases pending, but this deal should encourage other claimants to settle, which is a huge win for GSK. While there are certainly still some risks around litigation, the potential impact should now be substantially lower following this settlement.

Investors Takeaway

GSK has been a letdown in the past decade, but its future outlook seems to be improving. Following the spin-off of Haleon, the company is now putting all its focus on the vaccine and HIV segment. The two segments present huge growth opportunities and the company's strong pipeline and product line are well-positioned to benefit from ongoing market expansion. The latest settlement of the Zantac trial is also very encouraging as the litigation risk should be much lower now. The current risk-to-reward ratio looks compelling with fundamentals improving while the valuation remains highly discounted. I believe GSK stock should have ample upside potential and I rate it as a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.