Opera Limited: Buy The Pullback

Summary

- Opera Limited's stock has risen by 453% since October 2022, and the recent dip in price makes an attractive entry point for investors.

- The company's strategic shift to Ads, Gaming, and higher ARPU users has resulted in strong growth and profitability.

- Despite the stock's rapid rise, its valuation remains fair, and there is potential for further multiple expansion as the market becomes more aware of Opera's growth story.

suteishi/E+ via Getty Images

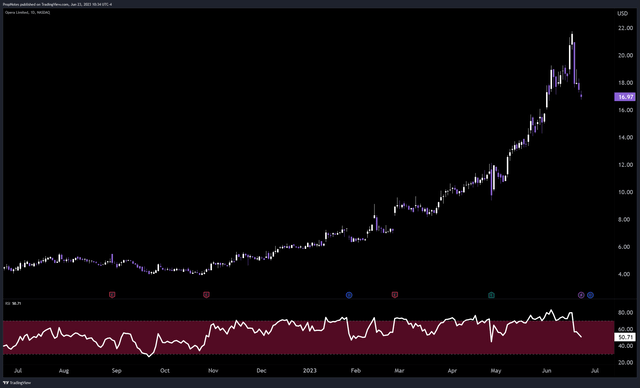

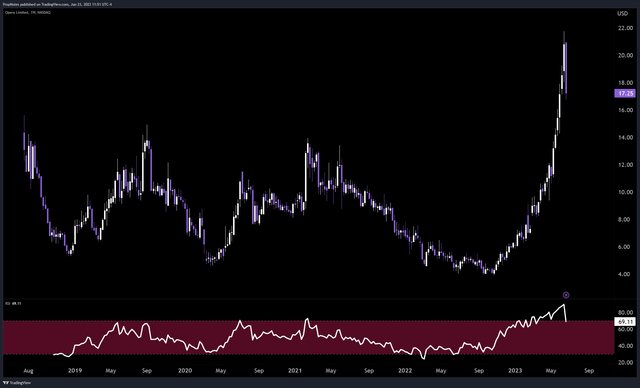

In case you're living under a rock, Opera Limited (NASDAQ:OPRA) is one of the hottest stocks on the market right now, up an astounding 453% since late October 2022 through the recent high made a few days ago. In that 9 month span, shares went from a low around $4, to nearly $22 as of last Friday, June 16th:

In the days since then, the stock has come off more than 20% to its current trading price (as of writing) around $17 per share.

Given the pullback in price, we thought it would be a perfect opportunity to initiate coverage on the stock and give readers our opinion on whether or not this recent dip is buyable. Has the stock come too far too quickly? Let's dive in.

Profile

In case you're unfamiliar with the company, here's a little breakdown.

Opera Limited is a Norwegian technology company founded in 1995 and headquartered in Oslo, Norway. The company's total user base, including users of its desktop browsers, mobile browsers and other services averages around 320 million monthly active users.

The first version of the Opera browser was released the same year as the company's founding and it has quickly become one of the most popular browsers in the world, although it still significantly trails Google's Chrome, Microsoft's Edge, and Apple's Safari browsers in terms of market share.

In order to differentiate itself, the company has continued to develop and release new versions of the Opera browser, and it has also expanded into other areas of complimentary technology, such as mobile gaming and blockchain.

Financial Results

But how does the company make money?

The company's philosophy is entirely based around the following statement:

The browser is an increasingly strategic application-often serving as an access point for content, e-commerce, gaming and fintech activities on the internet, and Opera is utilizing this strategic position to launch and scale new offerings.

We agree. Ultimately, this is a really smart strategy. The main way people interact with the world nowadays is through the internet. By owning the window through which people access the web, you have a large captive audience that you can monetize through value-add offerings.

Right now, the company has a few main verticals. These include Opera Gaming, Opera News, Opera Ads, and Opera Add Ons.

The last one, Opera Add Ons, isn't an official reporting segment, but just what we're calling the company's collection of monetizable features in its main browser. This includes built in VPN service, a fully featured crypto wallet, Generative AI tools, and a shopping cashback rewards program similar to PayPal's (PYPL) Honey.

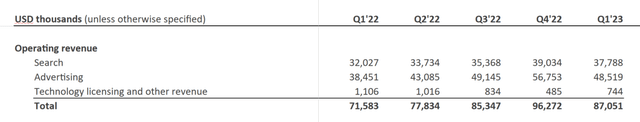

Together, in the most recent quarter, these services produced $87 million in revenue:

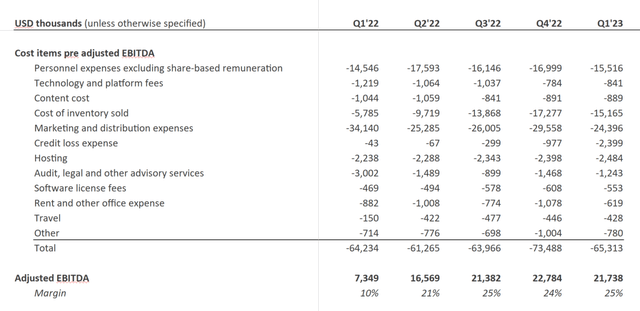

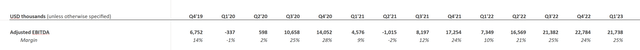

This was primarily driven from search partners like Google paying Opera to direct search traffic their way, along with a growing native ad business. Of this revenue, Opera was able to keep 25% of it in EBITDA margin, which works out to $21 million:

The most recent quarter remains similar to other quarters in terms of expenses, so the increased revenue YoY revenue was a boon to the bottom line. In case you're wondering, Opera's free cash flow margins and nominal figures are highly similar to the Adjusted EBITDA number; there's not much "funny business" going on here with the adjustments.

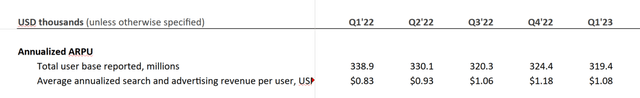

Opera's two most important KPI's tell an interesting story, though:

At first glance, it seems to be a story of user deterioration, as the user base has shrunk from 338 MAU to 319 MAU over the last 12 months. However, revenue per user had its second-best quarter ever.

This confusing mix of user losses and higher ARPU is reflective of re-arrangements in Operas priorities. Before, the company had historically focused on developing countries where it has had a better chance of gaining a foothold - the browser remains quite popular in these regions, like Africa.

The recent shift has re-prioritized the higher-margin users in developed countries, though, and thus ARPU is climbing considerably, from 0.83c per user to $1.04 per user over the last year; growth of 25%.

Zooming out, this is this most recent quarter, along with the previous few, where operating flows have been solid:

Sure, some quarters have seen profitability, but it's never stuck. It seems now from recent results that the company's strategy is working, and earnings have been robust and substantial.

This is what has caused the recent dramatic re-rating in the stock:

Overall, we're happy with the direction of financial results and the surrounding company strategy.

Valuation

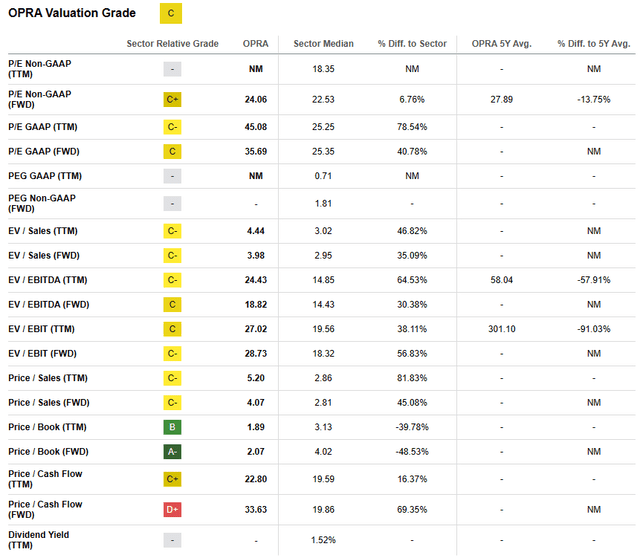

The valuation is where this story gets tricky.

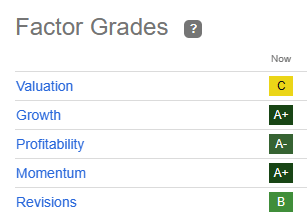

As we've discussed, Growth and Profitability have been strong:

SeekingAlpha

Thus, as a result, the stock has gone on quite the run, up 181% year-to-date, and quite a bit more if you measure from the last 9 months.

However, has the stock come too far too fast?

Judging from the multiple, we don't think so:

Seeking Alpha's Quant Rating system puts the valuation at a solid C, aka, right in the middle of the range. It could be cheaper, but it could be far more expensive. Combined with the great profitability and growth, paying an average price seems attractive.

As Warren Buffett is fond of saying:

It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

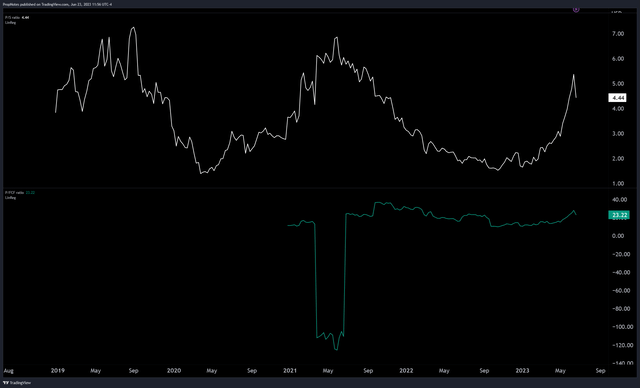

Looking at multiples charted through the company's public history, we see something similar:

Judging from the last 5 years, the stock remains well within historical ranges.

Given how the results have been best-in-class since going public, we expect that the sales multiple may rise towards the range of 8-9x, and out of the range it's been trading in historically. It's difficult to find a peer group to compare Opera to, but suffice it to say there's upside, even vs. more pedestrian tech companies that are growing more slowly, with worse margins, like AGYS. Our comparable at 8x leaves plenty of upside room in the stock to get to what we believe would be "Fair Value", around $30 per share.

Risks

The main risk here is in the realm of business execution. Opera is in a highly competitive industry and a good chunk of the company's revenue comes from bigger companies like Google. If Google or other search partners suffer materially or change marketing strategy, then Opera could be in a very difficult position.

This is one of the reasons that we are so happy with the growth in Opera's Advertising business; it diversifies the revenue significantly.

Other than that, macro concerns can be of note. Advertising is a cyclical business and affected by changes in the broader economy. If advertising slows down, either natively or downstream at search partners like Google, then that could dent cash flow.

Summary

In sum, we're big fans of Opera. The company's recent strategic shift to Ads, Gaming and higher ARPU users seems to be paying off, and we expect solid results for foreseeable future. As far as valuation goes, we think the company is still fairly priced, and could see further multiple expansion as the market becomes more aware of this high-quality growth story.

Overall, using the recent dip should as an entry point looks highly attractive to us.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in OPRA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.