Maersk: Don't Count Out Shipping Just Yet

Summary

- I've been reviewing Maersk pretty much on a 2-3 month basis for about a year now, and I've been starting to invest in the company. I want to grow this.

- Maersk is a global-leading shipping company - and with the ongoing political and supply chain situation, this becomes more and more important.

- As the company continues to drop due to very much expected trends, I consider the business a "BUY" - stronger and stronger, and potentially cheap soon.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

shaunl

Dear readers/followers,

It's time to review the potential in shipping and one of the major players in the industry - A.P. Møller - Mærsk A/S (OTCPK:AMKAF). The company has underperformed since my last article. My position isn't yet large in the company, and that's why I'm probably going to buy more after the weekend in this company. Since my last piece, Mærsk is down double-digits, but I view the potential as significantly above where the valuation currently puts it. Since my first article back in December, we're more or less flat, but still underperforming the overall average.

Expanding this position has been a very slow process. The share price on a native basis is over 10,000 DKK per share, which is one of the reasons I'm buying slowly. I also want to once again mention that shipping is not a stable or predictable segment - beyond predicting the fact that shipping and logistics will be needed.

However, the income for the companies, that's another question entirely. In my last article, I made a case for a 20,000 longer-term price target - that's for the native share. The company typically trades at a high premium, and this premium implies a far higher share price.

However, let's review what we have here and why the company is still a "BUY" to me.

A.P. Møller - Mærsk A/S - We're going down in 2023, but the company is still attractive

So, the fundamental upside for a company like this, in this position, is clear to me. Ocean Freight and Logistics aren't going anywhere, and A.P. Møller - Mærsk A/S is one of the market-leading businesses here.

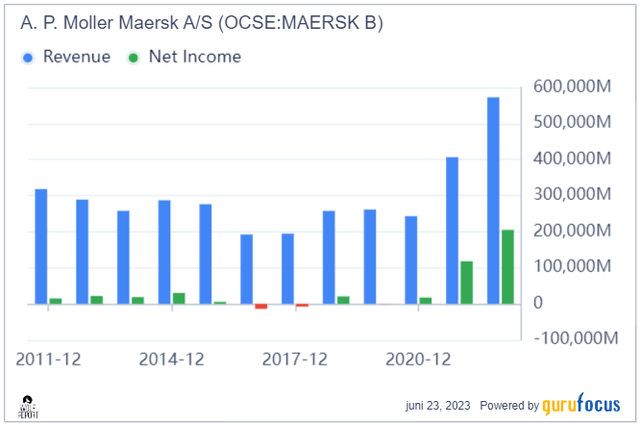

Because the company had a very, very good 2022, the company's current margin and ROIC trends are huge - with a 97.6% gross margin and a 32.49% net margin trend. On a normalized basis, this is far lower. Look at the historical trends when it comes to revenues and net income...

Maersk revenue/net (GuruFocus)

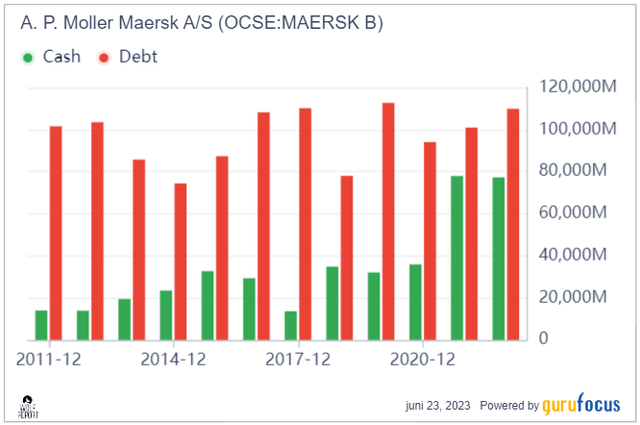

...and also cash/debt.

The picture I want to convey you is that the company while having had 2 great years, is now reversing and is likely only going to see adjusted EPS going down to between 1,000-2,000 DKK for the fiscal of 2023, with GAAP somewhere at the 100-300 DKK range, down from 1,5000 in 2022 and almost 1,000 in 2021.

This, as you might expect, comes with plenty of company price volatility where we can expect the company to move down as some of these trends crystallize.

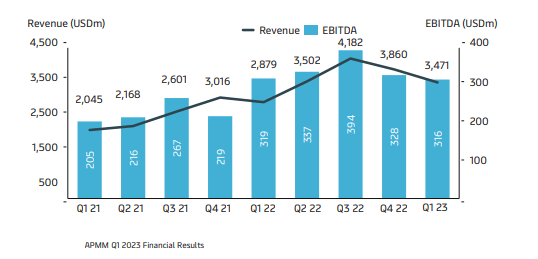

The 1Q23 report is the latest one we have - and we can already see some of those things happening here. It's important to point out that all of the trends we're currently seeing here are fully expected by the company, and nothing comes as a surprise. The group EBIT margin was at 16.4% here, well below 2022, and the company managed to generate over $14B in terms of revenues.

Costs were continued at a high level, and volumes declined across every segment, with inventory corrections in order - they have been expected for over 18 months and are now going with full force. The company does not change its guidance due to this report.

For the ocean segment, normalization is in fact going almost exactly as expected, with the company's cost control doing "its job". Average contract rates for 2023 continue to trend toward the spot rates. However, at the same time, the company has already signed 75% of the expected annual contract volume as of 1Q.

Logistics and services meanwhile, showed stable results.

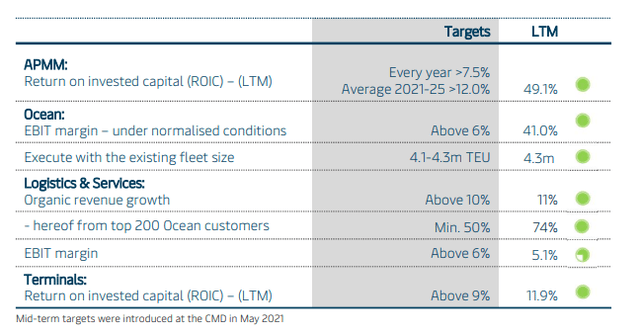

Maersk IR (Maersk IR)

Trends like consolidation of M&As played a big part here, but nothing can offset the massive inventory correction that we're seeing in both NA and EU - and this is driving things down, finally. Maersk was able to report some new commercial wins though, which is able to make up for at least some of the lower volumes here.

Terminals are a bit trickier. The company had incredibly strong cost control, retaining a segment ROIC of almost 12% - but at the same time, the lower volumes are especially pronounced here, and resulted in a sub-$900M revenue compared to over a billion since essentially 3Q21. We're really in Normalization mode, and as much as I'd like to see better results, there's a strange sort of pleasure in seeing things normalize as well - even if it does mean that investments are sometimes dropping more than we might like.

Maersk's road map remains unchanged. The company still targets its transformation in all segments.

The near-term targets can be said to be as follows for Maersk. 2023 is primarily about delivering growth and better profitability for the logistics segment. When we move into 2024, we're going to see the launch of a company tech platform that will drive growth in integrated logistics, with 2025E and forward seeing modular, integrated networks for the company which will provide lower volatility in an industry that by its character is almost the textbook definition of volatility.

The company continues to expect a full inventory normalization by the end of the first half year, which will in turn lead to a more nuanced and clear demand environment unimpacted by some of these historical trends.

For 2023, the company expects GDP growth to be muted, alongside every other forecast. The container market is expected to be negative, around -2.5%, potentially up to 0.5% positive, and the APMM segment expects growth in that range.

Maersk guides for full-year EBITDA of upwards of $11B, but there is a $3B spread to the lower target range there, implying significant uncertainty, and FCF of at least $2B. CapEx guidance at around $10B for the year, slightly growing in the next few years due to increasing investments in integrator strategies, tech, and decarbonization. Impairments and restructuring charges were lower than expected as well, at least for this quarter.

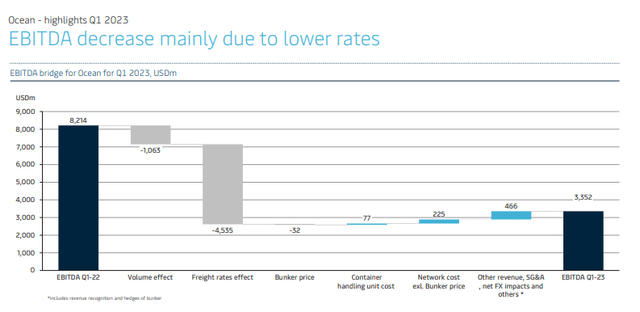

The mean reason for the company's current decline is the significant decrease in freight rates. This should not be a surprise, nor should it be something that worries you as an investor - because this was both communicated and expected on the part of the company for several quarters now. Here is the 1Q23 EBITDA bridge for Ocean that showcases some of these trends.

The things that I would look at for Maersk are as follows.

The inflation and cost pressure specifics are, beyond what the company can't control in freight rates, the most relevant indicators for near-term and 2024-2025 performance and results. Fuel bills and carbon conversions are relevant here. I also want to compare declined freight-rates to pre-COVID-19 and peak freight rates, by which I mean freight rates from 2019 and before. As it stands now, the CFFI is around 20% higher than 2019, which translated into average freight rates would be around $350 higher. This can then be calculated into a net cost of around $100 higher in terms of bunker cost per container as well as the non-bunker costs of around $500 higher than -19, due to other cost increases. What this currently implies is that Maersk is managing a run rate of about 0. However, assuming this also means assuming Maersk is not able to cut costs to offset some of these cost increases compared to 2019 - which I believe, and Maersk believes they'll be able to do. The takeaway from some of the specifics really is a generally lower profit for the year, and Maersk does not give official guidance beyond the considerations that:

1. Profitability is regressing with new contracts coming in, tending towards shipment rates.

2. The company is working on costs.

How exactly this turns out, in the end, remains to be seen, and I'm very curious to see 2Q, but more of all 3Q, when the company expects normalization to be over.

This does not materially impact my positive thesis on Maersk however, for the following valuation-related reasons.

A.P. Møller - Mærsk A/S - The valuation remains compelling - if you consider scale and long-term macro

I made it clear in my last article, that the company is not really "cheap" as such, despite my 20,000 DKK per share native price target. Maersk is at a good price here. If we forecast the company at its typical premium of 20-27x, you can easily find a double-digit upside.

To a full reversal of 27x, that upside is around 19-20% per year. The company remains BBB+ rated, with a low debt/cap of 17%. The yield is still 17.14% at today's price, but this will obviously be normalizing as we go forward in the next year, going from the current annual dividend to around 79-100 DKK/share dividend, implying a forward yield of below 1%. The company has never really been a "yield monster" before these two years, and I expect this to fully normalize before 2024E. What we should expect from Maersk is a payout of no more than a 1-2% yield at the most. Anything higher than an average dividend, and you're buying the business at a superb price.

S&P Global targets for the business remain lofty. Going down from almost 40,000 DKK per share that we saw during its peak, we're ow down to 22,000 DKK from a range of 34,000 on the high side to 13,000 on the low side. Out of 15 analysts, 7 are at a "BUY" or "Outperform" here. It's the typical set of stances you'll find in a company that is in the midst of a decline, no matter how justified or expected it may be. Sometimes it's as though some of these analysts have difficulty doing a simple NTM forecast. Expecting an average of 40,000 DKK in PT, with an actual range high of 52,000 DKK was absolutely ludicrous in an environment where the company stated that they expect profit normalization in 2023.

I do believe the windfall of cash Maersk managed to get in the last two years will eventually translate to a far higher "base" level of profit for the company - but we will be nowhere near those two years for trends and results.

So, I'm sticking to my 20,000 DKK share price target here.

We still know that earnings for the 2023 period are going to be significantly lower than they were in 2022. Some are forecasting a 2023E earnings decline of over 80%, along with a massive, 60%+ cut in the dividend, given that no earnings range that the company itself seems to expect can support a dividend of 4,500 DKK per year - so such a forecast makes complete sense.

Remember, normalizing Maersk in terms of share price sees us going down to around 6,000 DKK per share at the lowest. The more this company falls, the more I will end up buying and building a strong and long-term position in the business. When it comes to my own behavioral heuristics in investing, I know exactly how much I'm buying and at what pace - and so far, this has worked out well for me, because I'm "only" in about -a 12% decline in this position.

I'm happily buying more here. I'm not calling the company "cheap" yet, but if it should fall below 11,000, that's a change I'm making as well.

Here is my current Maersk thesis.

Thesis

- This is one of the world's most important shipping companies. At a good valuation, this company is, to me, a no-nonsense "BUY" with no looking back. The flow of goods dictates the state of our national economies, which makes the company a major player in macro.

- I view the company currently as fairly or even slightly undervalued in the face of what is an unprecedented logistics crisis.

- It's a "BUY" here to me - and I view it with a target of 20,000 DKK/share, updated as of the latest few days.

- I recently bought more in the company, and my stake in Maersk is actually growing quite rapidly, now over 0.6%.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them:

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I won't call it "cheap" here, but aside from that, you can definitely "BUY" Maersk. I'm buying more here.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management/wealth management for a select number of clients. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMKAF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks I write about. Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.