Western Union: Now Is The Right Time To Buy

Summary

- Western Union's shares have the potential for steady price appreciation in the long run due to improving fundamentals.

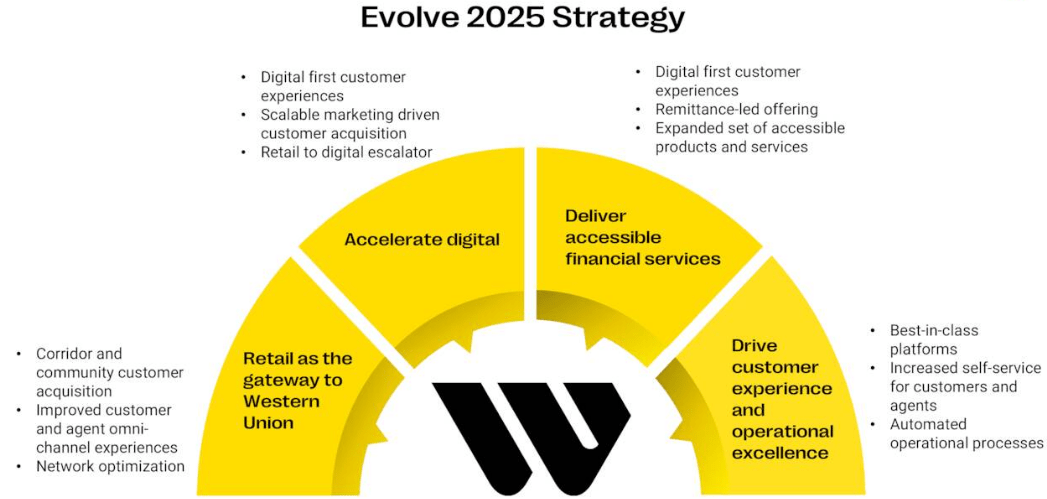

- The company's new business strategy, Evolve 2025, is showing positive results in stabilizing its retail business and accelerating growth in its digital business.

- Despite risks such as increasing competition and a potential recession, Western Union's stock price drop represents an attractive buying opportunity with limited downside risk.

martinrlee

Western Union (NYSE:WU) shares have lost nearly half of their value in the last two years due to concerns about declining financial numbers and increased competition. However, I believe it is time to capitalize on the significant selloff because WU's shares have the potential to generate steady price appreciation in the long run. It also appears that the stock has already bottomed out, with only a limited amount of downside risk remaining. Furthermore, the company's healthy dividend yield of more than 8% will encourage investors to hold the stock for the long term and wait for its price to reverse the losses.

Improving Fundamentals Supports Dip Buying

WU Price Change in Two Years (Seeking Alpha)

Concerns about financial growth and escalating competition have caused shares of Western Union to trend downward over the last two years. The payment transaction & processing services sector has seen a significant influx of new fintechs in recent years, many of which use cutting-edge methods to simplify payment processing for customers. The Western Union Company, on the other hand, is a well-known global leader in money transfer and payment services, offering its products through agent locations and banking channels in more than 200 nations. In addition to the entry of new players, it seems that one of the oldest companies in the sector took a long time to adapt to changing market conditions, such as a shift towards online services rather than physical locations. As a result, over the past five years, the company's revenue has steadily decreased, falling from about $5.5 billion in 2018 to an anticipated $4.13 billion in 2023. Similarly, its earnings per share, cash flows, and other financial metrics have all suffered.

Evolve 2025 Strategy (Q1 Presentation)

Nevertheless, 2023 may be the last year of financial and business deterioration. Western Union's new business strategy, which emphasizes attracting new customers, improving customer retention, and improving core operational performance, has started to pay off. The financial figures for the last two quarters indicate that the company has made progress toward achieving its primary goal of stabilizing its retail business and accelerating growth in its digital business. For instance, the company experienced positive transaction growth in North America for the first time in nearly two years, while its Middle Eastern and European operations (excluding Russia) experienced a 200 basis point increase from the prior quarter. Transactions in Latin America increased 100 basis points sequentially and by 9% year over year.

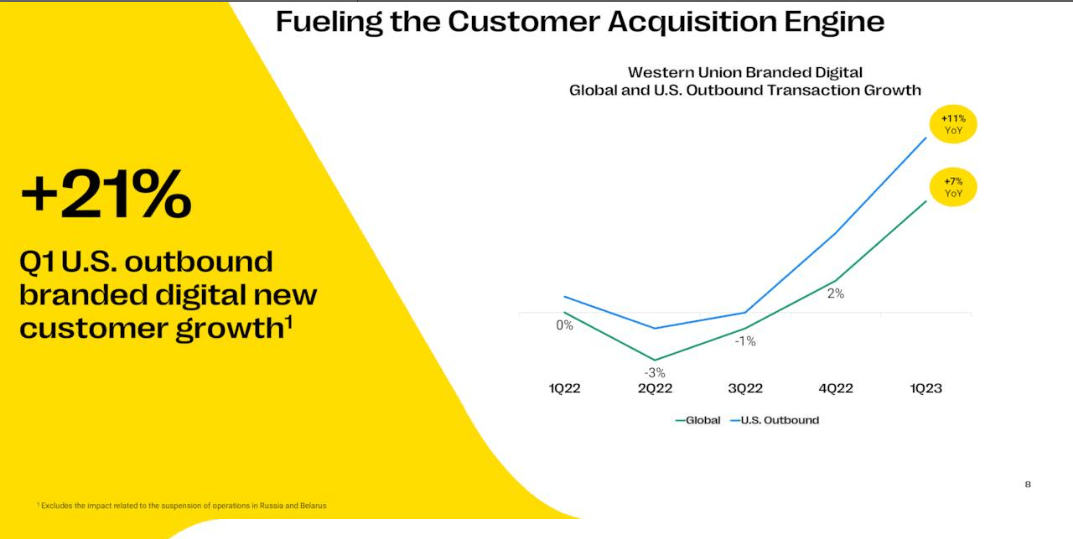

US Outbound Digital Customer growth (Q1 Presentation)

Particularly, the company's branded digital go-to-market program has helped to speed up growth in the digital business and total transactions. Following a 30% year-over-year increase in the fourth quarter of 2022, the company saw a 21% year-over-year increase in US outbound branded digital customers in the first quarter of 2023, with transactions increasing 11%. Overall, except for Russia and Belarus, the company's global branded digital transactions increased by 7% year over year in the quarter. Results are still soft in the retail segment. However, the company is now pursuing a solid plan to stabilize its retail business. Instead of simply adding more active locations, the company is seeking to enhance its existing business by reducing transactional friction by introducing new products and services, integrating loyalty programs, improving stage and payment options, and streamlining refunds.

Along with increased transaction volume, improved core operational performance has benefited revenues and margins. The company reported $1.03 billion in revenue in the first quarter, the slowest decline in the previous three quarters. Revenue decreased by only 1% year over year in the March quarter, despite a three percentage point negative impact from the suspension of operations. Moreover, the company's earnings per share of $0.43 was the highest in the last two quarters and represent a small increase on a year-over-year basis if we exclude a contribution of $0.05 from business solutions and $0.04 from operations in Russia and Belarus. For the full 2023, Wall Street's median forecast of $1.62 per share represents a mid-single-digit decline from 2023. However, Wall Street anticipates steady earnings growth in the upcoming years, consistent with the company's Evolve 2025 strategy. Overall, it appears that the company’s new business strategy is likely to reverse the financial deterioration and return it to a growth trajectory from 2024. Therefore, I believe the impact of negative events has already been priced in WU’s stock in the last two years and there might be a steady recovery in the year ahead.

Dividend is Safe

The high dividend yield of over 8% offered by Western Union does not appear to be a dividend yield trap. This is because the dividend is entirely funded by earnings and cash flows. Currently, the company pays a quarterly dividend of $0.24 per share. With earnings per share projected to be $1.62 in 2023, the company's annual forward payout ratio based on earnings is around 55%. Although its dividend payout ratio is higher than the historical average in the 40% range, it appears manageable because the company does not operate in a capital-intensive industry. Furthermore, as the company's earnings are likely to grow in the future, the payout ratio will most likely return to historical levels.

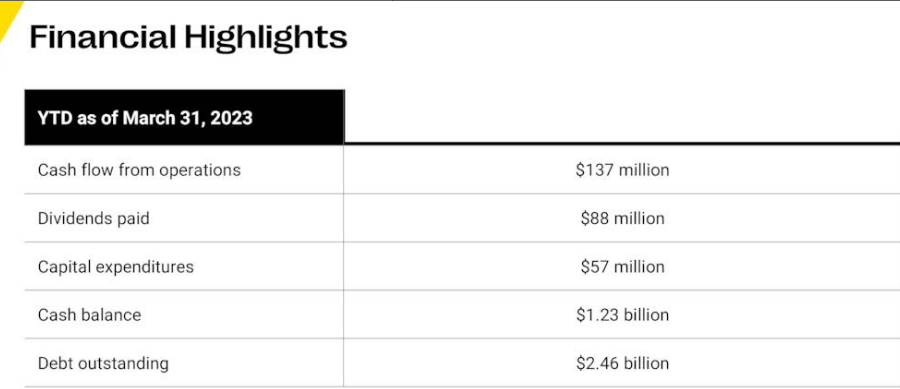

First Quarter Presentation (Seeking Alpha)

Its cash flows fell to $137 million in the March quarter from $200 million the previous year's quarter, owing primarily to one-time payments related to previous period expenses. Despite this, cash flows from operations covered both capital expenditure and dividend payments. There will be more cash flow coverage as the cash flows are likely to improve in the upcoming years as a result of increased earnings. Quantitative analysis also shows that the company's dividends are secure. Its dividend received high quant grades across the board, including growth, consistency, safety, and yield.

Valuation and Quant Rating

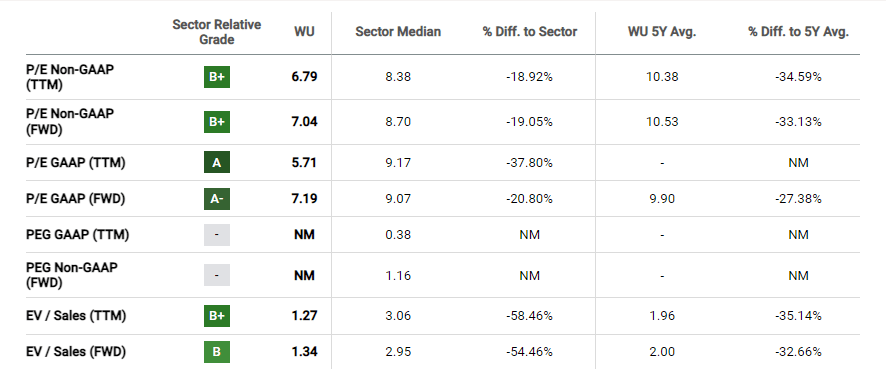

Valuations (Seeking Alpha)

Western Union appears significantly undervalued based on valuations. For example, the stock appears undervalued based on both forward price-to-sales and earnings ratios because shares fell more quickly than analysts' estimates for earnings and revenue. Furthermore, the 2024 forward price-to-earnings ratio is even lower, at 6.90 times, reflecting the likelihood of higher earnings in that year. This suggests that Western Union stock has a much higher value than its current price, making the selloff a buying opportunity.

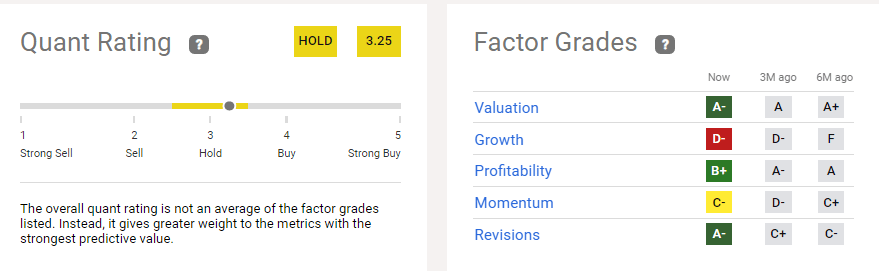

Quant Rating (Seeking Alpha)

Based on quantitative analysis, Western Union stock is on the verge of entering the buying zone. Its stocks received a hold rating with a quant score of 3.25. Three critical factors, including valuations, profitability, and revisions, received high quant ratings. Quant ratings indicate that WU stock is trading at an attractive valuation, which is in line with what I already said above about valuations. The quant grade for earnings revisions also increased to negative A from C plus three months ago, which amply demonstrates that Wall Street has increased its expectations for earnings growth. On the downside, the company received a D on the growth factor because of the decline in revenue and earnings over the previous quarter. Its momentum score has improved in the last three months, and I expect it to improve further because shares now have limited downside and better long-term growth prospects.

Risk Factors to Consider

There are numbers of risk factors to consider when it comes to investing in Western Union. The biggest risk is increasing competition from traditional and digital players. If the company failed to implement its Evolve 2025 Strategy, it would create volatility in its shares price and dividends. Recession is another risk that could hurt remittances and other C-to-C transactions in the quarters ahead.

In Conclusion

Western Union's stock price drop of around 50% from recent highs represents an attractive buying opportunity because its fundamentals have begun to improve as a result of its new business strategy. Its forward valuations have also been flashing buy signals as the likelihood of steady growth and profitability has increased. Western Union's high dividend yield is another important factor that makes it a good stock to hold for the long term and wait for its price to return to its recent highs.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.