Navigator Holdings: Solid Expansion And Fleet Utilization Makes It A Buy

Summary

- Navigator Holdings Ltd has experienced a steady growth trajectory with a 10% revenue CAGR in the last five years, making it a good investment opportunity.

- The company has entered into joint ventures to ensure future revenue streams and has grown its cash flows and EBITDA significantly.

- Despite concerns about debt growth and potential risks, NVGS's strong partnerships and growth potential in the North American LNG market make it a solid buy.

nikkytok

Investment Summary

With a global presence Navigator Holdings Ltd (NYSE:NVGS) is an operator of liquefied gas carriers. The company has been on a steady growth trajectory, reaching a revenue CAGR of around 10% in the last 5 years, despite swings in the commodity prices of gas. The last quarter meant a strong recovery for the company in terms of fleet utilization which helped result in a YoY growth of revenues.

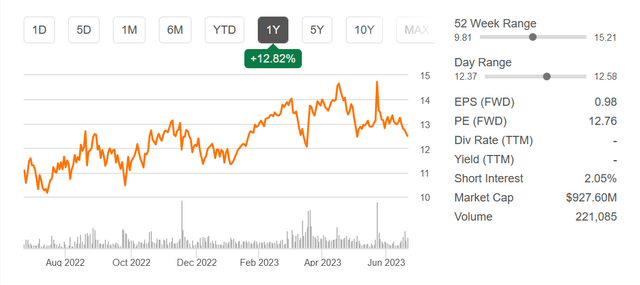

The company recently finished its previous $50 million share repurchase program and also announced a new one amounting to $25 million. At the current market cap of a little under $1 billion that would mean 2.5% of shares are to be repurchased. With stronger utilization and growing revenues, I think the current price of NVGS offers a good entry point and will be rating it a buy.

Solid Positioning For Future Growth

Some of the measures that NVGS is taking to ensure its future revenue streams was the announcement of two joint ventures back in Q3 of 2022. The venture is set to increase the vessels but also supply volumes in the Greater Bay Area. Some of the concerns regarding the announcement were the funding of the venture. As NVGS had struggled with managing margins the question arose regarding whereabouts the capital would come from. But NVGS entered into a revolving credit facility agreement then the venture funding seemed secured.

Most recently, however, the news broke that NVGS and Bumi Armada had entered into a joint non-binding memorandum that to establish a joint venture company that would supply CO2 shipping injection solutions in the United Kingdom. The collaboration came after the discovery that the United Kingdom market holds a potential 30 million CO2 per annum for emitters who aren't involved in any previously awarded carbon capture projects. The beginning of the project isn't expected to be anytime soon, in fact, estimates are that the first shipment would be around 3 years after the final decision regarding investments.

What I want to highlight with this is that NVGS is taking strong measures to engage in the market and ensure they have strong partnerships. Historically this seems to have helped NVGS grow its cash flows. Going from $84 million in 2018 to $121 million in 2022. But the EBITDA of the company has also grown exponentially and in Q1 2023 NVGS achieved their highest quarterly EBITDA on record, $69 million. Driven much by the fact the company had a higher fleet utilization, a result of ensuring partnerships like the ones previously mentioned.

Operational Performance (Q1 Report)

Where NVGS is noting strong growth potential is the fact that for every $1000/day of TCE (Time charter equivalent) is adding $18 million of EBITDA annually for the company. So far NVGS has grown the TCE by 11.7% YoY which helped fuel the last quarter's result. With NGL production in North America continuing to climb I remain optimistic that we will see NVGS continue the growth of its EBITDA as a consequence.

Risks

It think investors need to take into account the fleet size of vessels under different time charters, including ammonia, LPG, and other petrochemical products. Furthermore, if NVGS's expectations of ammonia growth, particularly in Europe, are not met, it may impact the company's revenue streams and overall utilization rates negatively. The difference in the time charts could cause some inconsistent quarterly reports which would be an argument that NVGS aren't to trade at a p/e that would match the growth it has.

Besides that, as stated before, NVGS entering into ventures introduced the need to raise capital for it. NVGS did state it won't use debt to finance its expansion strategies. That opens up the possibility of NVGS having to dilute shares or stop its buyback programs in order to raise capital. If NVGS is seeing strong demand, however, I think that diverting capital that way is a sound decision as it will in the long-run benefit the company as they secure both partnerships and cash flows.

Financials

Taking a look at the balance sheet for NVGS they have so far seen a quite steep decline in the cash that they hold. Going from $190 million to just around $153 million instead. That together with the devaluation of its vessels resulted in a QoQ decrease of total assets of about 7%. Looking historically, however, NVGS has grown its assets at a yearly rate of 9.44% in the last 10 years. With NVGS still seeing potential in the market and funding expansions I think these slight QoQ differences aren't cause for concern.

Debt Growth History (Macrotrends)

Where there might be some cause for concern is that the debts have been steadily climbing in the last few years. It's common as a company is expanding, but the cash flows don't seem to be sufficient right now to finance its ventures, not when they are diverting some of it to buy back shares. As a result, the long-term debts have now reached $876 million in total.

Debt Maturity (Investor Presentation)

The climbing debts, it has also caused the net debt/EBITDA to reach 4.5. A number I am a little concerned with as paying down future debts might be a challenge. But the debt maturity profile that the company has seems fine and in the meantime, I am not worried about the elevated ratio I stated. Instead, I would be looking for NVGS to steadily grow its cash position in order to place itself in a better position when the debt matures.

Valuation & Wrap Up

NVGS has been able to grow revenues steadily and is diverting a solid amount of cash toward buying back shares. The management has made it a priority to enter into several joint ventures to help ensure high fleet utilization.

With growth also noticed in the North American LNG production market then I think NVGS has further expansion possibilities. I don't find the current price to be that high and would be comfortable buying at these levels, as a result, I am rating NVGS a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.