SoFi Technologies: Rally Was Overdone

Summary

- SoFi Technologies has seen its shares rise by more than 80% in 2023, but a recent "Sell" initiation by Compass Point caused a slump.

- The company continues to grow its business, with revenues up 43% YoY, but profitability remains an issue as it generates losses and dilutes shareholder value through stock-based compensation.

- SoFi's high valuation, lack of profits, and ongoing dilution make it a less attractive investment option despite its strong business performance.

- I do much more than just articles at Cash Flow Club: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Three Spots/iStock via Getty Images

Article Thesis

SoFi Technologies, Inc. (NASDAQ:SOFI) is a financial services company that has seen its shares rise substantially so far in 2023. Following a "Sell" initiation by Compass Point, shares slumped on Friday, however. Since SoFi is still not profitable, and since the year-to-date rally has made the company substantially more expensive, SOFI does not look appealing right here, I believe.

What Happened?

SoFi Technologies generated nice gains so far this year, as the stock trades up more than 80% from the beginning of January. This rally was driven by an overall stock market rise, a move of investors back into tech and growth stocks, and some optimism from investors due to student loan payments resuming.

On Friday, however, SoFi Technologies saw its shares decline following some bearish analyst remarks. Compass Point argued that the year-to-date rally was overdone and that tight financial conditions could negatively impact SoFi Technologies' growth in the coming years, as capital isn't as cheap and abundant as it was during the near-zero interest rate years during the pandemic.

Operational Performance: Growing Quickly, But Questions Surrounding SOFI's Profits

SoFi Technologies, Inc. was well-liked by investors not too long ago -- during the times of easy and cheap money, fast-growing tech companies, even without profits, were among the favorites of investors. And SOFI fits that profile very well, as it does indeed generate a lot of business growth.

That remained true during the most recent quarter when SOFI reported that its revenues were up 43% year over year. While that was the lowest growth rate over the last twelve months -- revenue growth was in the 50s during the three previous quarters -- a business growth rate of more than 40% is compelling for sure.

SoFi Technologies' revenue growth rests on several pillars. First, the company adds new customers, which expands the client base to which SOFI can loan money and to which SOFI can sell financial services. During the most recent quarter, SOFI added a little more than 400,000 new customers, which is a pretty compelling customer addition rate. This suggests that SOFI is doing a good job at marketing its services and that its offering is attractive for clients, e.g. due to being easy to use and due to a well-thought-out app design.

SoFi Technologies also does more and more business, on average, with existing customers. This happens due to customers being happy with their experience in one area, and using SOFI for additional services in the future. SoFi Technologies also adds new offerings and financial services over time, which expands its market potential further.

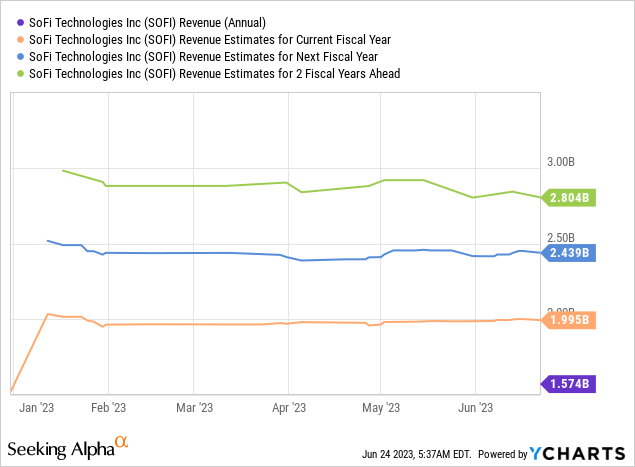

While growth has slowed down during the most recent quarter, which can, at least partially, be explained by customers being somewhat uncertain about the future and a potential recession, growth remained high in relative terms. Of course, no company can grow at 40% or 50% per year forever, as that is mathematically impossible. It seems highly likely, though, that SOFI will continue to see its business expand at an appealing pace. Looking at Wall Street estimates for SoFi Technologies' revenues, we see the following:

The company generated $1.6 billion in sales last year and is forecasted to generate $2.0 billion in sales this year. For the following two years, the forecast stands at $2.4 billion and $2.8 billion. This translates into expected revenue/business growth rates of around 25% this year, 22% next year, and 15% in the following year.

If Wall Street analysts are correct -- which is not guaranteed, of course -- then SOFI will continue to grow its business at a 20%+ rate for the current year and the following one, before seeing its business growth rate slow down to the mid-teens range.

Even a 15% annual growth rate is well above what one can expect from the broad economy or the average stock, but investors should note that this is well below the growth rate seen over the last couple of quarters. While growth will remain attractive in absolute terms, it will likely be considerably lower compared to what some investors might have gotten used to. And this makes sense, as the law of large numbers dictates that maintaining a high relative growth rate becomes ever more complicated as a company grows and eventually matures -- it is thus normal for a company to experience a growth slowdown over time.

While SOFI's business growth performance is looking positive, its profitability does not look appealing. The company continues to generate losses, although those were, at least, slightly smaller than expected during the most recent quarter (see earnings report linked above).

When we look at EBITDA instead of profits, where interest expenses, tax expenses, depreciation, and amortization are backed out, then SOFI is profitable -- at least when we also make some (non-GAAP) adjustments. On this basis, SOFI has earned $76 million last quarter. And the company also guides for around $280 million in adjusted EBITDA for the current year. Since that equates to around $70 million in profit per quarter, SOFI apparently is not expecting any profitability improvement during the remainder of the year -- instead, it looks like the average EBITDA per quarter during Q2 to Q4 could be slightly lower compared to the first quarter. This isn't a positive sign, of course, but it is also possible that management's guidance is on the conservative side and that there will be a guidance upgrade later this year -- SOFI has beaten its own guidance for the first quarter, thus one can definitely make the case that the FY guidance is on the conservative side.

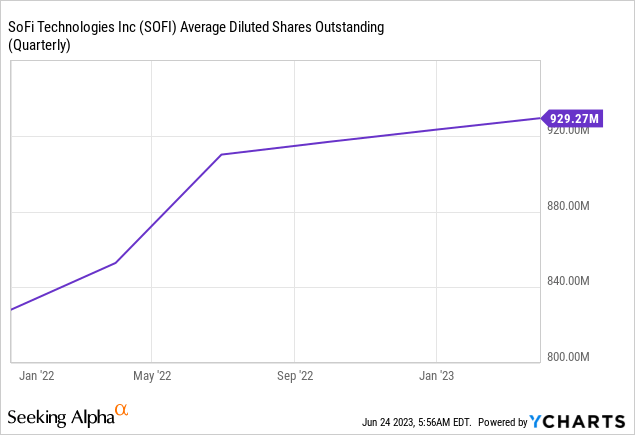

When it comes to SOFI's adjusted EBITDA guidance, it is important to take a closer look at some of these adjustments. SOFI does, for example, back out the cost of share-based compensation. This is a normal practice and many other companies do the same. However, most companies do not issue shares at the same pace as SOFI. Stock-based compensation totaled $64 million during the most recent quarter, which is equal to almost all of the adjusted EBITDA profit that SOFI has generated during the period. Annualized, SOFI's stock-based compensation expense is around $250 million -- again, that's awfully close to the forecasted EBITDA. While stock-based compensation is a non-cash expense, it definitely comes at a real cost for shareholders, as their stake in the company gets diluted meaningfully over time. The following chart is telling:

Since the beginning of 2022, SOFI's share count has risen by more than 10%, meaning each share's portion of the company's future profits, cash flow, and so on has declined substantially. Before 2022 began, the share count rose even more quickly.

Since SOFI continues to issue shares at a hefty pace to employees and management, investors have to accept ongoing meaningful dilution going forward. This will not hamper business growth, but it will mean that investors' participation in said business growth will not be as large as some might think. If revenues rise by 25% but the share count rises by 10% over the same time frame, the company's revenue per share will expand by just 14%, for example [1.25/1.10].

Final Thoughts

SoFi Technologies is currently trading at a market capitalization of around $8 billion. Based on the expected EBITDA for this year, this makes for a price-to-EBITDA multiple of 29, which is quite high. We can also look at SOFI's enterprise value to EBITDA multiple, which accounts for debt usage and cash held on the balance sheet. SOFI's enterprise value to EBITDA multiple is 40 right now, based on estimates for the current year, according to YCharts.

That is elevated in absolute terms, and it is also expensive compared to how other financial tech companies are valued: PayPal (PYPL), for example, trades with a 10x EV to EBITDA multiple. Of course, PayPal is growing at a slower pace relative to SOFI, but on the other hand, PayPal is profitable and returns cash to its owners, which cannot be said about SoFi Technologies. Looking at the broader tech industry, a 40x EV to EBITDA multiple seems pricey as well. Microsoft (MSFT), which is an absolute AI leader with massive margins and a fortress balance sheet, trades with an EV to EBITDA multiple of 24, for example.

SoFi Technologies is thus ambitiously priced for sure, despite not being GAAP profitable for now. With growth likely slowing down in the coming years, one can argue whether this valuation is justified.

While SOFI's underlying business performance remains appealing, the lack of profits, the ongoing dilution, and the high valuation following strong gains in 2023 make me believe that SOFI is not very attractive right here.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

This article was written by

If you want to reach out, you can send a direct message here on Seeking Alpha, or an email to jonathandavidweber@gmail.com.

Disclosure:

I work together with Darren McCammon on his Marketplace Service Cash Flow Club.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (16)

Insane guidance and the stock is trading off a double from its May report. It’s rebuilding a midway support level and with only 10 million outstanding shares it’s going to be a monster. Total anti China and anti sentiment play. Timing couldn’t be better….my biggest position by far. Best of luck!

Direction Ticker Company Name Shares Traded | % of Total ETF

Buy SOFI SOFI TECHNOLOGIES INC 283,996 | 0.2503