Is Warren Buffett Crazy? Or Crazy Like A Fox?

Summary

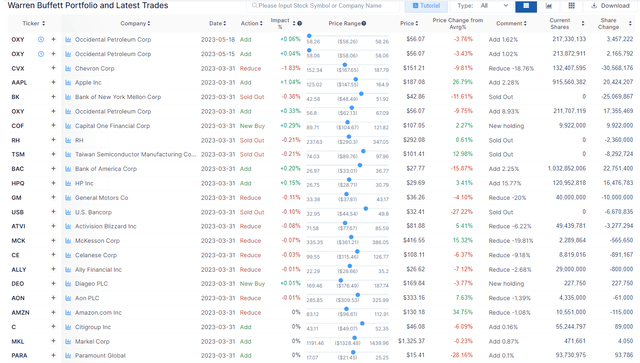

- Warren Buffett's Berkshire Hathaway recently sold most of its bank stocks and bought $1 billion worth of Capital One, despite its exposure to consumer lending and potential short-term pain in a recession.

- The Capital One purchase was likely made by either Todd Combs or Ted Weschler, portfolio managers, who together manage 10% of Berkshire's portfolio.

- Berkshire also bought more Occidental Petroleum, an oil company with a focus on enhanced oil recovery and carbon capture, which Buffett sees as a growth opportunity.

- Buffett hasn't lost his mind, he's just playing a very long game.

- I do much more than just articles at The Dividend Kings: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Paul Morigi

This article was published on Dividend Kings on Friday, June 23rd.

---------------------------------------------------------------------------------------

Warren Buffett is the greatest living long-term investor generating 20% annual returns for 58 years.

- The greatest investor in history was Cornelius Vanderbilt, who turned $2500 (inflation-adjusted) into $200 billion (also inflation-adjusted) over 67 years

- 31% annual returns

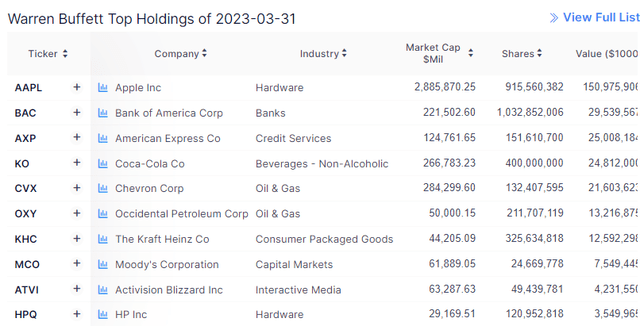

So naturally, many people are interested in what Buffett and Berkshire (BRK.B) are doing with their $300 billion portfolio.

Berkshire's most recent 13-F was shocking to many people. In fact, some think what Buffett has been doing recently is downright crazy.

Is Buffett crazy? Or crazy like a fox? Let's find out.

Buffett Doesn't Like Banks Anymore... Except For Capital One?

"The majority of our businesses will report lower earnings this year than last year," Buffett, 92, said before crowds of thousands at the event on Saturday. During the last six months or so, the "incredible period" for the US economy has been coming to an end, he said." - Fortune

Buffett sold out of all but two banks Berkshire owned, BAC and AXP. Berkshire says it's because it's "cautious." about the banking sector going into a recession and with increased regulations coming due to the failure of four US regional banks.

But if that's the case, then why did Berkshire buy $1 billion worth of Capital One (COF), a bank that is heavily exposed to consumer lending?

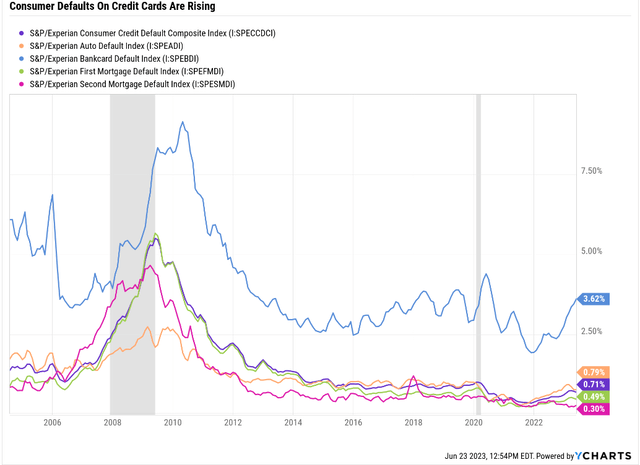

Consumer credit card defaults are soaring, though that's off the lowest levels in history.

So what's going on? Has Buffett lost his mind? Is it time for him to retire?

Buffett Didn't Really Buy Capital One

When you see Berkshire do something that seems to disagree with Buffett's views, it's likely because it's not him doing it.

There are actually four people managing Berkshire's portfolio.

- Buffett

- Charlie Munger

- Ted Weschler

- Todd Combs

It wasn't Buffett that bought $1.2 billion worth of Amazon in 2019; it was either Todd or Ted.

It wasn't Buffett who came up with the idea of buying Apple in Q1 2016; it was either Todd or Ted.

Together Todd and Ted run 10% of Berkshire's portfolio, about $30 billion.

If you ever wonder about Berkshire's small buys or sells, it's these two that are running portfolios within Berkshire's portfolio.

Capital One: Not So Crazy A Buy Even Before A Recession

44% of Capital One's loans are consumer credit cards. That is likely why it's a BBB-rated bank while many of its peers are A-rated (like USB, TFC, and JPM).

FactSet Research Terminal

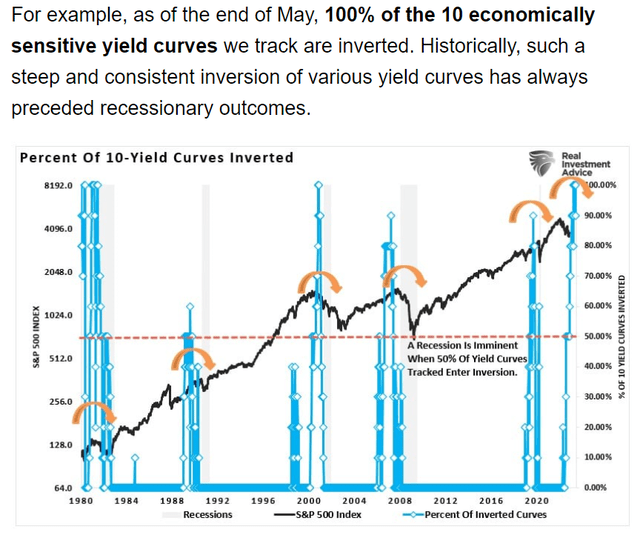

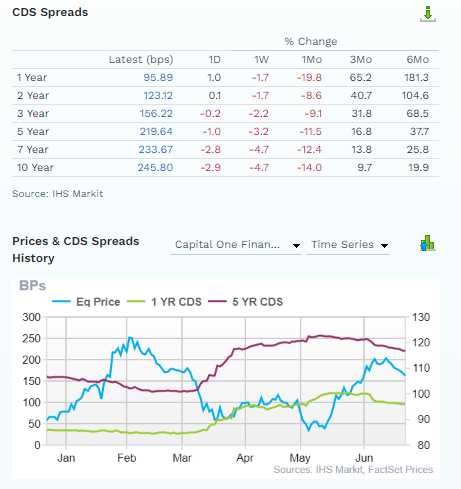

The bond market is certainly more worried about loan losses in the possible coming recession. In the last six months, the 12-month default risk almost tripled to 0.96%.

Note that this entire increase came after SVB collapsed.

The risk has been declining since it became apparent that COF wasn't facing a bank run that might kill it like SVB.

But that doesn't mean Capital One isn't still facing a potentially tough time when the recession finally arrives.

"Capital One is more exposed to the credit cycle than most of its peers because of the large amount of subprime consumer lending it does. Around 31% of the bank's credit card receivables and 47% of its auto loans are from borrowers with a FICO score lower than 660." - Morningstar

Banks are naturally leveraged, and when recessions cause loan losses, that can really hurt earnings. Just take a look at the EPS declines of COF in previous recessions.

- 2007: -49%

- 2008: -43%

- 2009: -68% (90% total decline)

- 2020: -53%

- 2023: -32%

Even a mild recession is going to cause Capital One a lot of short-term pain.

So does that mean Capital One is a mistake by Todd or Ted? Not necessarily.

Capital One: Why Todd Or Ted Probably Bought It

First, let's consider how safe Capital One's 2.3% dividend is.

Consider the payout ratio:

- 2020: 18% (37% DIVIDEND CUT)

- 2023: 20%

- 2024: 18%

- 2025: 17%

Analysts think Capital One will not repeat the dividend cut it did during the Pandemic when the economy was collapsing.

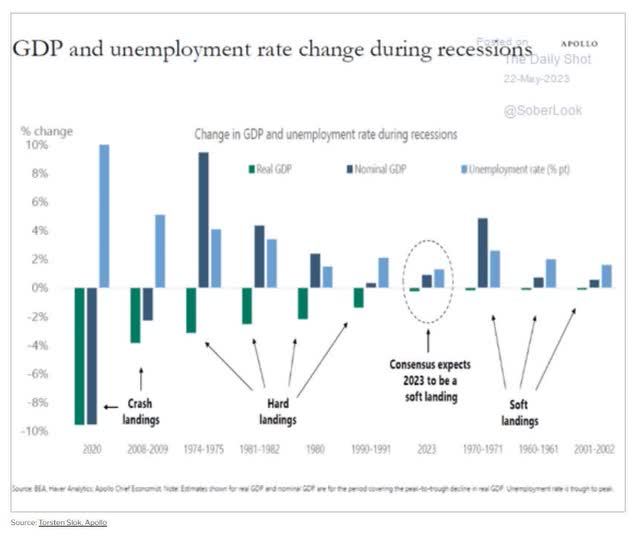

The Pandemic crash was a 9% GDP contraction over two months. The St. Louis Fed warned that unemployment could have risen as high as 50% had the government not stepped in with the largest stimulus in history.

Capital One was using an abundance of caution, cutting its dividend. It wasn't forced to by the Fed; it could have easily maintained it.

Would I personally buy Capital One? No, the yield is paltry, and management has not prioritized income investors. I wouldn't trust Capital One, and its dividend safety score under the Dividend King's 3,000-point safety and quality model is between 47% and 53%.

| Rating | Dividend Kings Safety Score (250 Point Safety Model) | Approximate Dividend Cut Risk (Average Recession) | Approximate Dividend Cut Risk In Pandemic Level Recession |

| 1 - unsafe | 0% to 20% | over 4% | 16+% |

| 2- below average | 21% to 40% | over 2% | 8% to 16% |

| 3 - average | 41% to 60% | 2% | 4% to 8% |

| 4 - safe | 61% to 80% | 1% | 2% to 4% |

| 5- very safe | 81% to 100% | 0.5% | 1% to 2% |

| COF | 47% to 53% | 2% | 5.4% to 6.6% |

| Risk Rating | 68th Percentile Risk Management, Low Risk | BBB stable outlook credit rating =7.5% 30-year bankruptcy risk | Max Risk Cap: 2.5% |

COF's risk of another cut isn't high; it's just a lot higher than higher-quality alternatives.

Better Alternatives

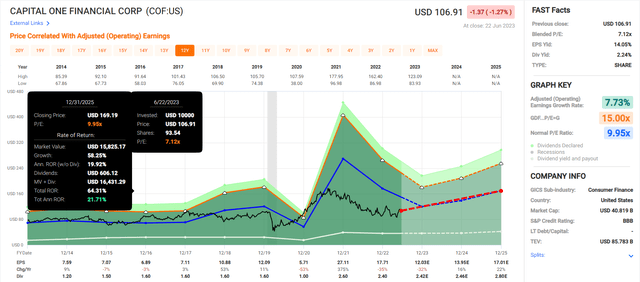

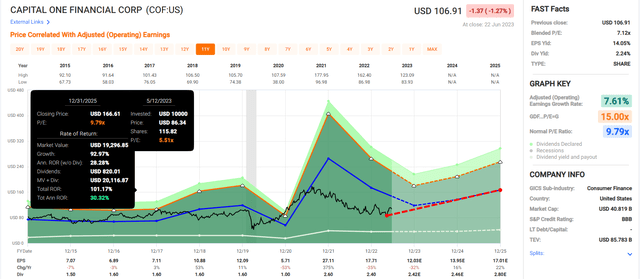

Why did Todd or Ted buy a lot of Capital One? Well, it's return potential was attractive when they bought it.

Why Todd Or Ted Bought COF

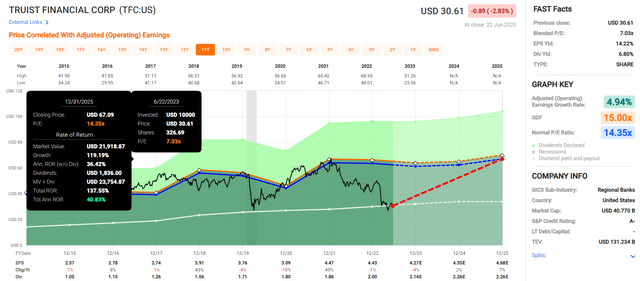

COF offered a chance to double Berkshire's money within three years. 30% annual returns are certainly Buffett-like, but even today, you can get superior return potential from higher-yielding and safer banks.

FAST Graphs, FactSet FAST Graphs, FactSet

Higher, safer yield, A-credit ratings, and return potential that's far superior to Capital One.

I won't speculate why Todd or Ted bought $1 billion worth of Capital One other than to say that it's a faster-growing bank.

So perhaps that is the COF thesis, GARP.

Occidental Petroleum (OXY): Buffett's Second Favorite Oil Company

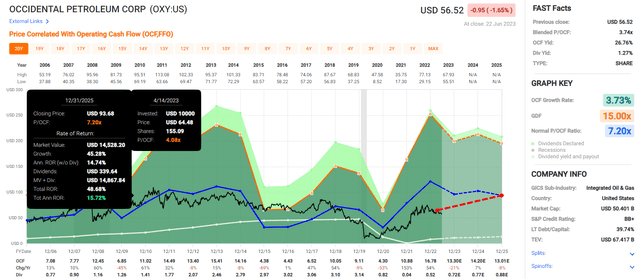

Berkshire bought $265 million worth of OXY in May, and you might think that might have been Todd or Ted too. But it's likely not because OXY is one of Buffett's highest conviction ideas.

Berkshire owns 25% of OXY and 30% if it exercises its warrants.

Berkshire owns $13 billion worth of OXY, its sixth-largest holding.

Buffett's positions are so large that he usually sells or buys small amounts.

What Buffett Saw When He Bought More OXY

Did Buffett buy OXY expecting to make a killing? Nope.

Good, though not great returns from the price he paid.

So why is Buffett such a fan of this company?

Why Buffett Loves OXY And You Shouldn't

You are not Warren Buffett. You can't get deals like these.

"Buffett first invested in Occidental in 2019 when the oil company was in a bidding war with Chevron Corp. to buy its crosstown Houston rival, Anadarko. Occidental CEO Vicki Hollub flew to Omaha, Nebraska, on the company's Gulfstream V and convinced Buffett to add $10 billion to her war chest. It was enough to swing the deal, and Chevron pulled out soon after. In exchange, Buffett got preferred shares yielding 8% annually plus warrants to buy more common stock at $59.62 apiece." - Bloomberg

Buffett was able to finance OXY's victory over Chevron in the bidding war over Anadarko in 2019. He got a sweetheart deal with 8% yielding preferred shares and warrants that let him buy enough stock to own 30% of the company.

Buffett has a personal relationship with Vicki Hollub, CEO of OXY, and is a fan of her discipline in not increasing oil production for its own sake during periods of high oil prices.

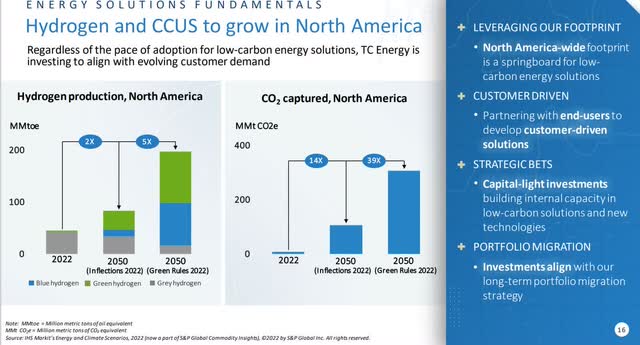

Another thing Buffett likely finds attractive is that Occidental is the industry leader in enhanced oil recovery. This is where CO2 is injected into oil wells to increase pressure, enhanced oil recovery, and reduce the breakeven cost of the well.

Carbon capture and sequestration is a very large growth opportunity for the oil & gas industry. Between 2022 and 2050, it's expected to grow by 1300% to 3800%.

Buffett Isn't Crazy: He's Just Patient

Some investors were shocked that Buffett sold $10.4 billion in stocks in the most recent quarter and warned of a likely recession.

And then Berkshire sold all of its banks, Buffett said he doesn't like banks anymore, and Berkshire bought $1 billion in Capital One.

Buffett also bought more Occidental, an oil company whose cash flows are incredibly sensitive to the economy.

Does this mean that Buffett is lying about recession?

No, he and most people in finance and business know that a recession is likely starting this year or early next year.

To understand Buffett's investments, remember he's the king of patient blue-chip investing.

And there is another very important principle to remember.

Buffett has very rarely made massive bets on any single company. His focus is not on swinging for the fences but consistently hitting singles and doubles.

Why did Todd or Ted buy Capital One? Why did Buffett buy more of an oil stock ahead of the recession?

Because over the next three years, these investments are expected to generate 15% to 21% annual returns.

Those are solid returns in companies that these financial experts understand and are comfortable in.

Is OXY the best oil company Buffett could have bought? No, it's not even his favorite oil company; that would be Chevron (CVX), of which Berkshire owns $21 billion.

Is Capital One the best bank to buy? Of course not; look at the FAST Graphs of TFC and USB, and you can see that.

But for Berkshire, who plays the ultimate long game, the question isn't, "are these the very best companies we can buy to make the most money in three years?" It's simply, "are these reasonable and prudent investments that we understand and are likely to make good to great returns over decades"?

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my $2.5 million family hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.