PENN Entertainment: Positioned For Growth In The Digital Gambling Landscape

Summary

- PENN Entertainment has experienced a decline in its stock price to a 52-week low of $23.16 following the dismissal of a Barstool Host due to a racially offensive remark.

- Despite the recent challenges, PENN has shown a strong COVID rebound, with revenues surpassing pre-pandemic levels and expansion into the digital markets.

- The company maintains a substantial cash reserve of over $1.5 billion, supporting its consistent positive cash flow and providing a foundation for future growth opportunities.

- PENN's deployment of its tech stack, including its proprietary risk and trading platform, enhances its mobile product offering and increases customer engagement and retention.

- The acquisition of Barstool Sports has strengthened PENN's presence in the sports betting industry, providing a means for advertisement with high brand loyalty and showing strong growth in cross-platform views and social media followers.

Lacheev

Introduction

After dismissing Barstool Host Ben Mintz due to a racially offensive remark made during a live stream, PENN Entertainment (NASDAQ:PENN) has hit a 52-week low of $23.16, a far cry from its COVID rally to prices over $130 a share. This decline has prompted me to analyze the investment aspects behind the company (its instability). The company has had a well-rounded rebound with revenues above pre-COVID levels, expansion into the digital markets, and over 1.5 Billion in cash, cash equivalents & securities on hand, accompanying its consistent cash flow positive business model.

Company Overview

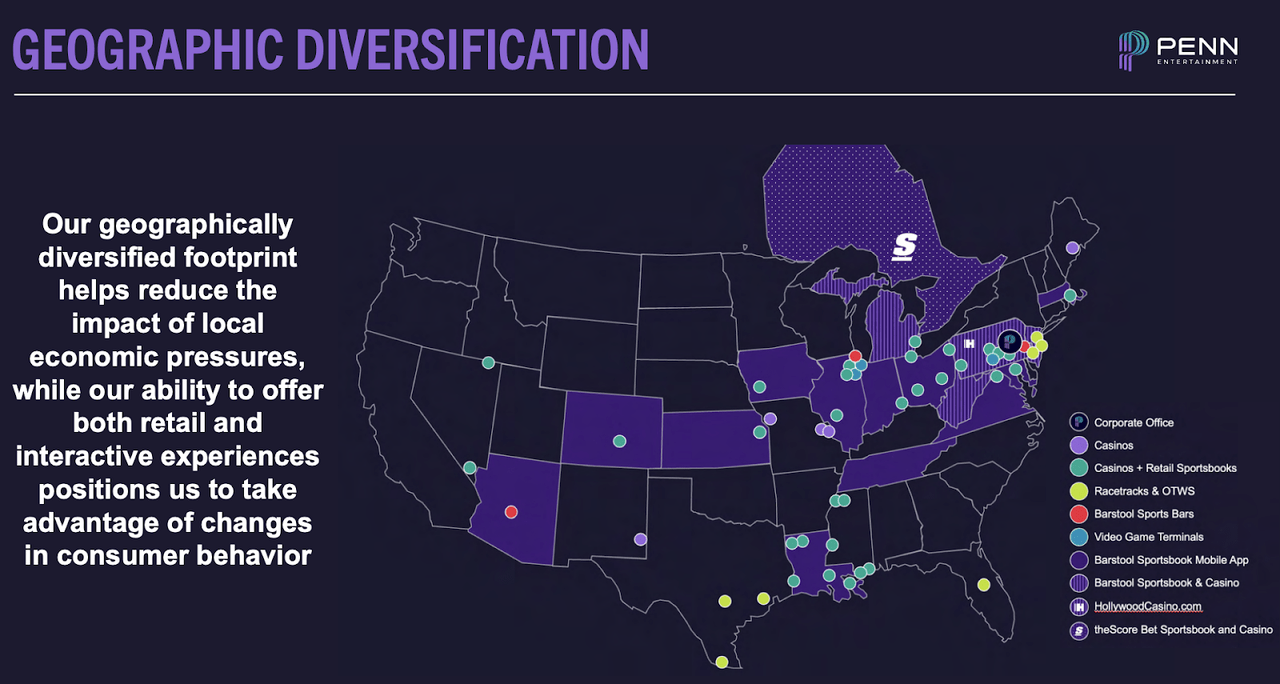

PENN Entertainment, Inc. operates in the consumer cyclical sector, specifically in the resorts and casino industry, providing integrated entertainment, sports content, and casino gaming experiences in North America. It operates through five segments: Northeast, South, West, Midwest, and Interactive. PENN Entertainment runs online sports betting in various jurisdictions and iCasino under a portfolio of brands, including Hollywood Casino, L'Auberge, Barstool Sportsbook, and theScore Bet Sportsbook and Casino. The company's portfolio also includes MyChoice, a customer loyalty program offering a set of rewards and experiences for business channels. In addition, PENN Entertainment owns various trademarks and service marks, including Ameristar, Argosy, Boomtown, Greektown, Hollywood Casino, Hollywood Gaming, L'Auberge, and M Resort. PENN Entertainment operates 43 properties in 20 states, a combination of resorts, casinos, and other entertainment venues.

Investment Thesis

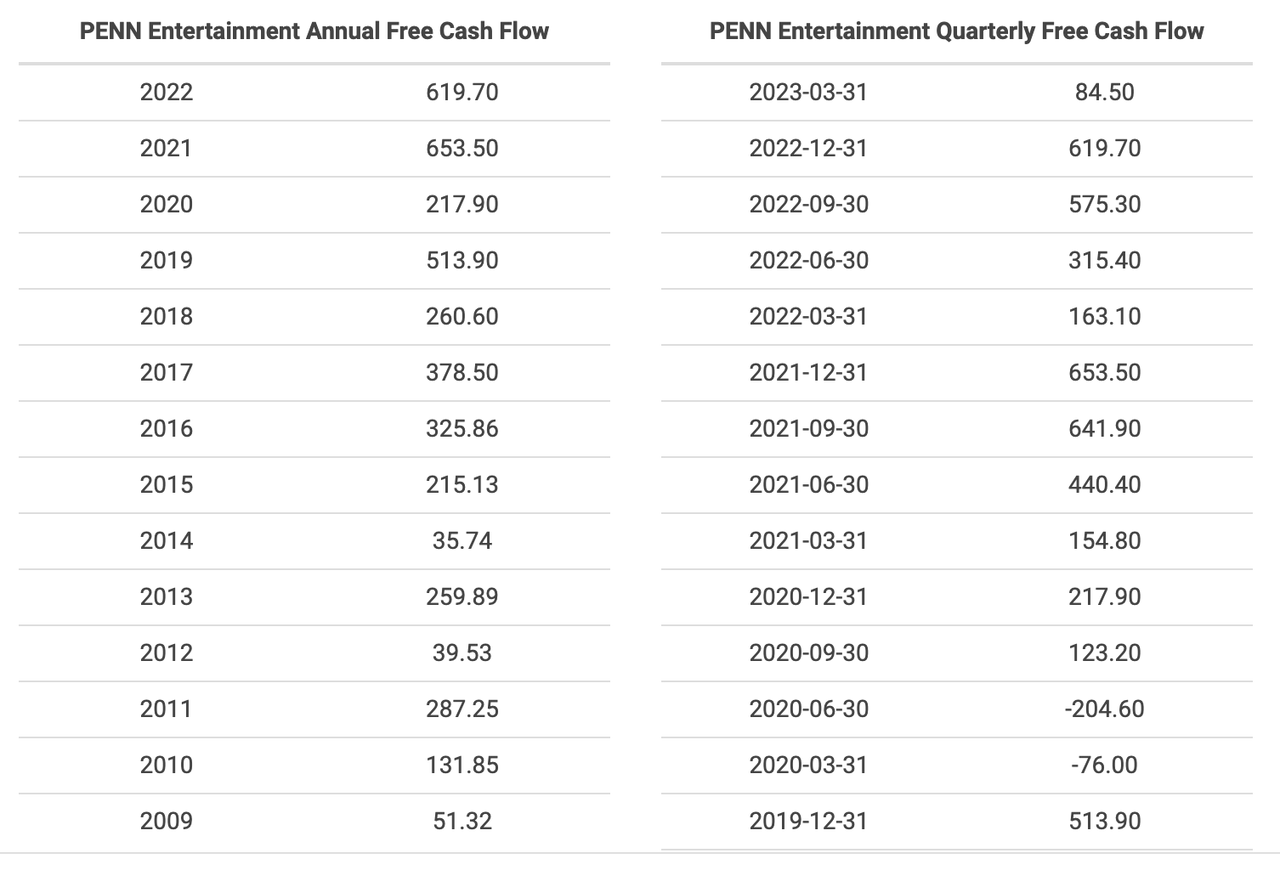

Consistent Track of Positive Cash Flow: PENN has demonstrated a remarkable track record of consistent positive cash flow over the past 13 years, even amidst the challenges posed by the COVID-19 pandemic. The company has effectively utilized its cash from operations to fuel its expansion into the digital gambling sector through iCasino and PENN Game Studios, experiencing impressive growth rates of 33.1% and 42.1% respectively. Additionally, PENN has strategically pursued acquisitions such as Barstool Sportsbook and has continued to expand its presence in traditional casino markets. This prudent approach has enabled PENN to strengthen its position in the industry and seize new opportunities for growth.

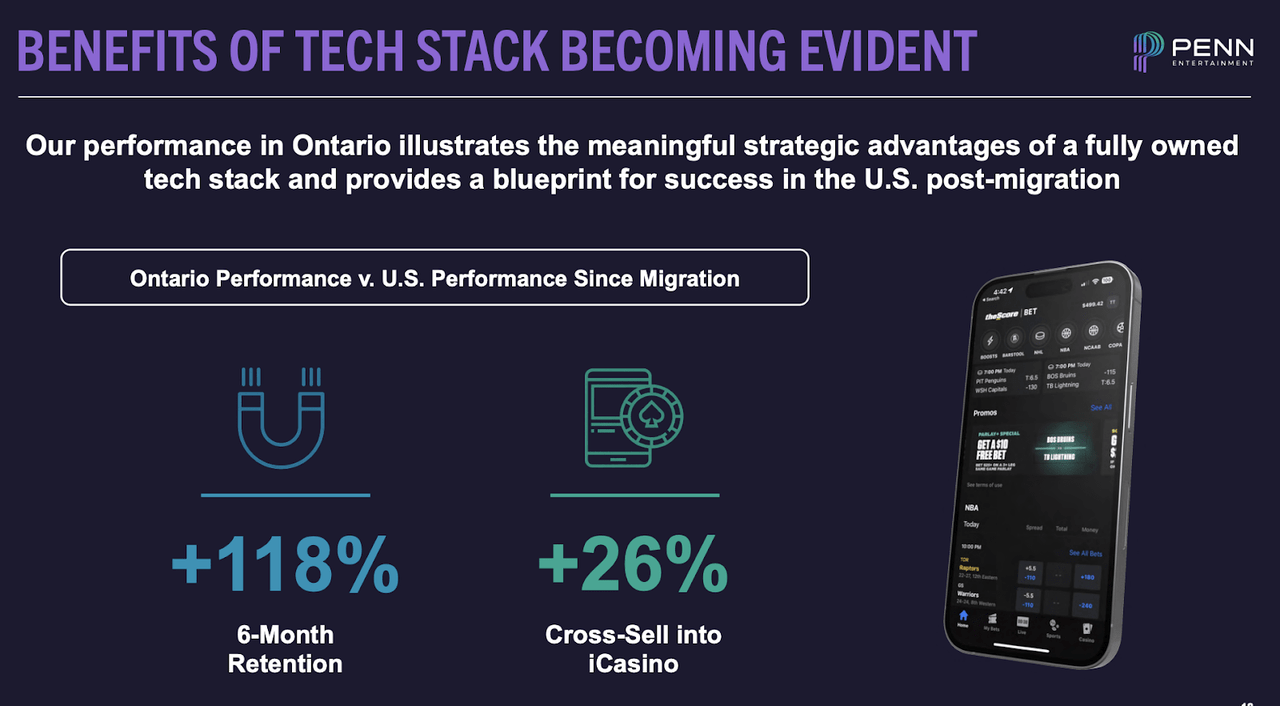

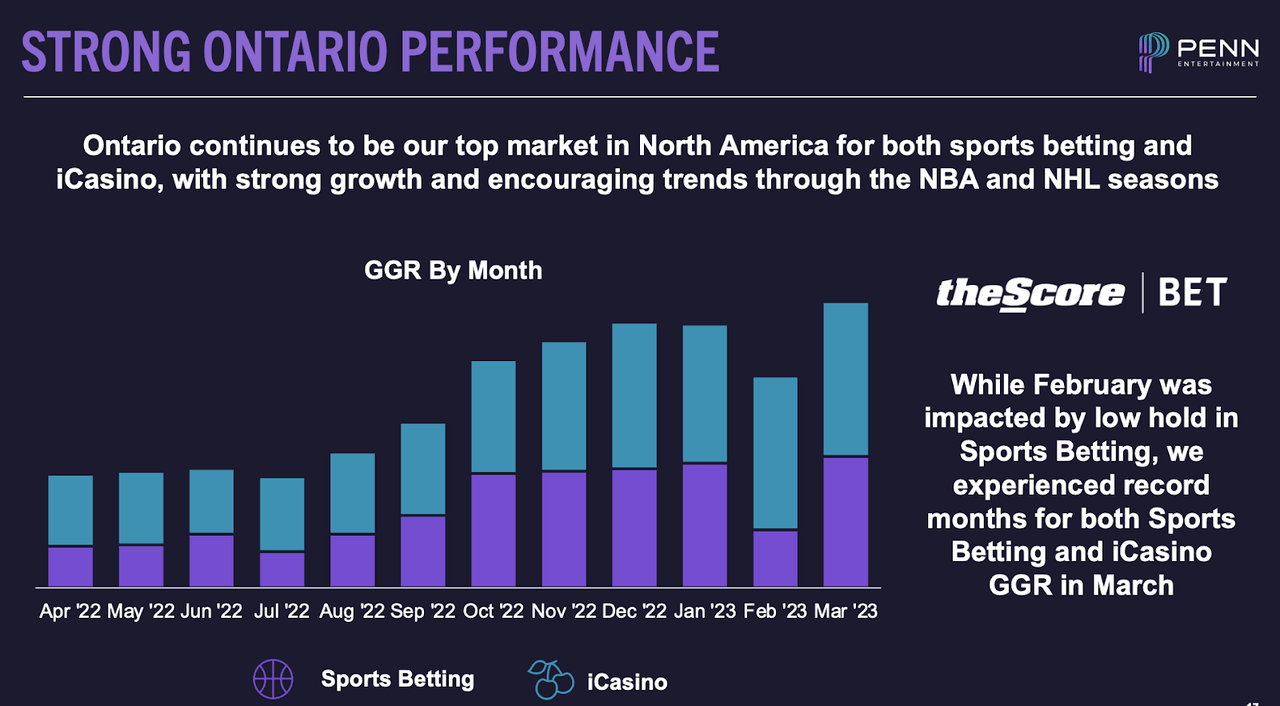

Deployment of Tech Stack: Penn National Gaming announced that its subsidiary, Score Digital Sports Ventures, has launched its proprietary risk and trading platform, marking the completion of theScore Bet's strategy to bring its sportsbook technology in-house. The platform, which includes the Risk and Trading platform, Player Account Management system, and Promotion Engine, has been custom-built by its in-house product and engineering teams. This move enhances theScore Bet's mobile product offering, allows for increased personalization, and enables more efficient service to users. Additionally, the Score Bet plans to introduce a new Parlay+ feature for all major league sports. The company also plans to migrate the Barstool Sportsbook in the U.S. to this new platform in Q3 2023. This technological milestone is expected to increase customer engagement and retention, provide cost savings, and deliver a more personalized product experience in the market. The results of its deployment in Ontario are evidenced below:

PENN Entertainment PENN Entertainment

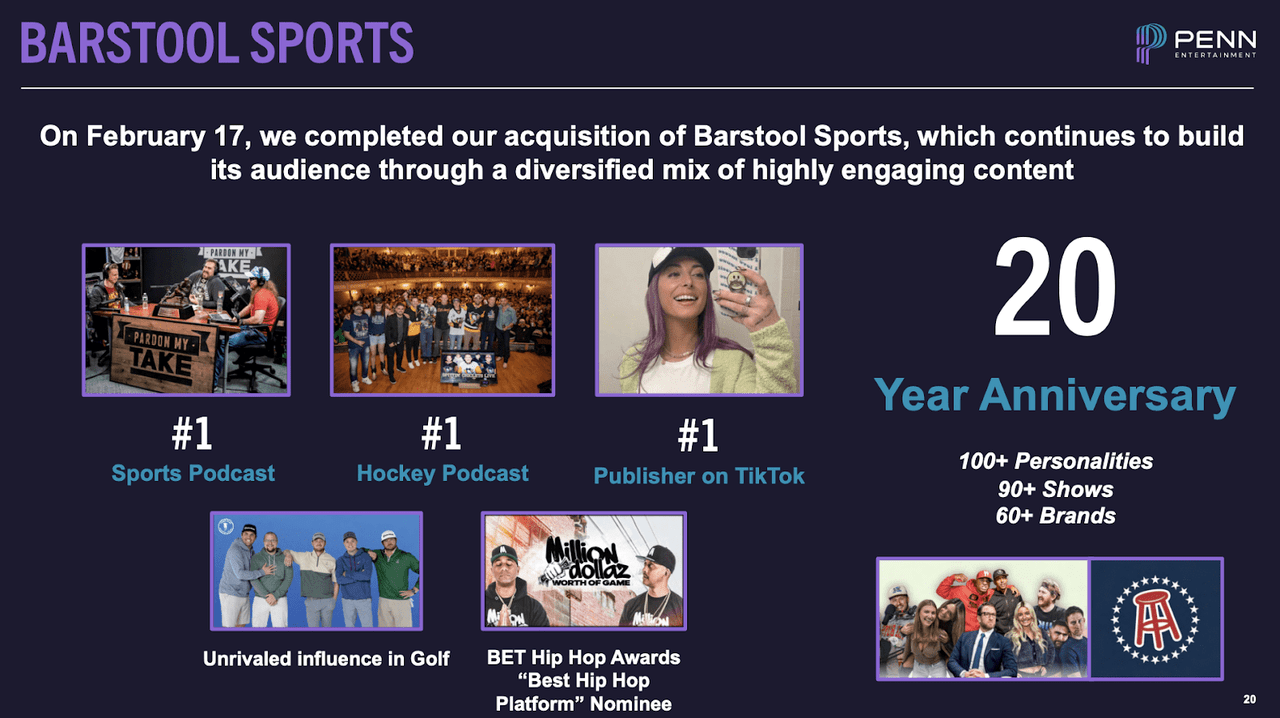

Accession of Barstool Gaming: Barstool Sports has become a central avenue in PENN's leap toward sports betting, completing their acquisition this past February "to build its audience through a diversified mix of highly engaging content." Barstool provisions PENN as a means for advertisement with high brand loyalty. We're seeing strong y/y retail and online sports betting launches in Kansas (+7.9%), Ohio (+8.1%), and Massachusetts (+14.1%). And, this accompanies Barstool Sports Q1 Highlights of over 40% y/y growth in cross platforms views and a 60% increase in both YouTube subscribers & TikTok followers.

Upcoming Projects

Aurora Project:

PENN plans to develop a new $360 million land-based casino and hotel near the Chicago Premium Outlets mall in Aurora, replacing the existing Hollywood Casino Aurora riverboat property. The project will feature a modern casino and hotel, including 900 slots, 50 live table games, a Barstool Sportsbook, and approximately 200 hotel rooms. Construction is set to begin in late 2023.

Joliet Project:

As part of the Rock Run Crossings development project in Joliet, PENN intends to build a new land-based casino, replacing the current Hollywood Casino Joliet riverboat property. With an estimated budget of $185 million, the project will comprise a modern casino with 800 slots, 45 live table games, a Barstool Sportsbook, and 10,000 square feet of meeting areas and an event center. Construction is expected to commence in late 2023.

Hollywood Columbus Hotel Project:

PENN plans to construct a new hotel at Hollywood Columbus, featuring 180 rooms and new food and beverage offerings. The estimated budget for the project is approximately $100 million. The hotel will be connected to the existing property, creating around 100 permanent new jobs and numerous temporary construction jobs. Construction is scheduled to start in late 2023.

M Resort Hotel Tower Project:

PENN is preparing to add a second hotel tower to the M Resort in Henderson, Nevada. The estimated budget for this project is $206 million. The expansion will provide approximately 384 rooms, bringing the total to 774 rooms and suites. Along with the additional rooms, the project will include expanded meeting space, updated amenities, and partnerships with local entities, to be announced at a later date.

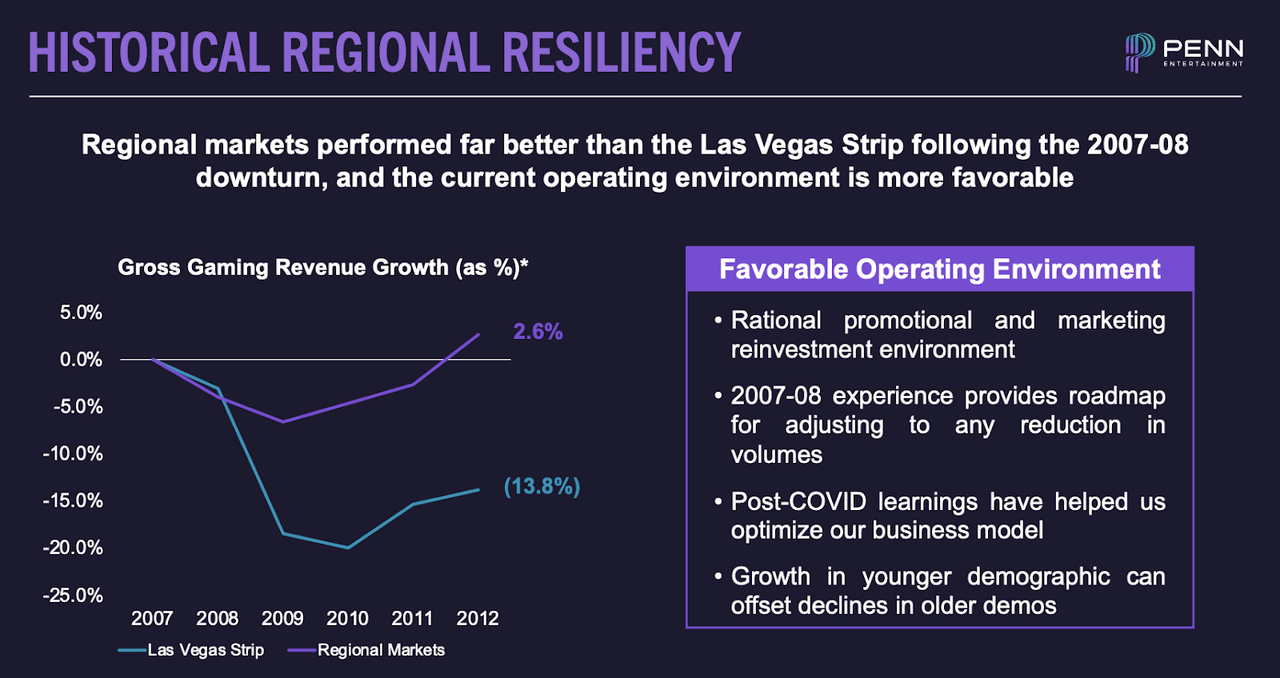

Strength of Regional Markets: Regional markets have shown resilience to past economic downturns serving as risk mitigation. PENN continues to reinvest in these markets optimizing their business model.

Leasing Model: Gaming and Leisure Properties (GLPI) is a real estate investment trust (REIT) that was spun off from Penn National Gaming (PENN) in 2013 (good, reliable, & longstanding relationship). GLPI owns a significant portion of PENN's brick-and-mortar casino properties and leases them back to PENN. This arrangement allows PENN to have more flexibility with its cash flow by freeing up capital that would otherwise be tied up in owning the properties (~$450 million in 2022 share repurchase). By leasing the properties from GLPI, PENN can allocate its financial resources to other areas such as expanding its operations, investing in new projects, or reducing debt. This arrangement also helps PENN avoid some of the risks associated with property ownership, such as property maintenance and fluctuations in real estate values.

Industry Analysis

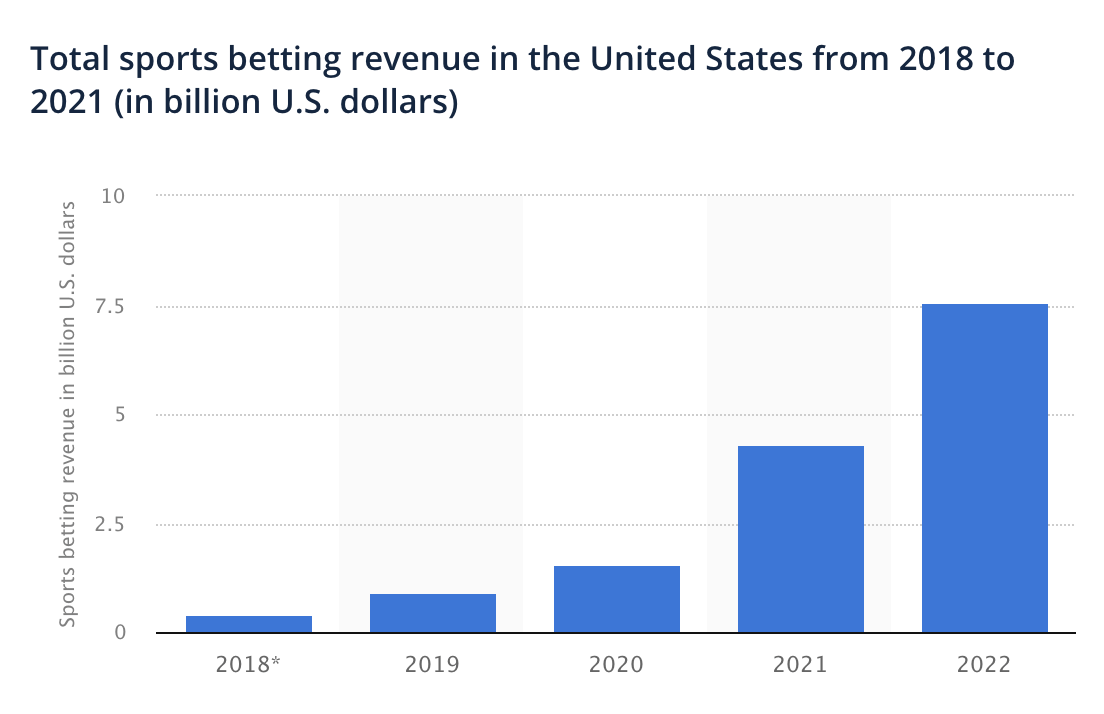

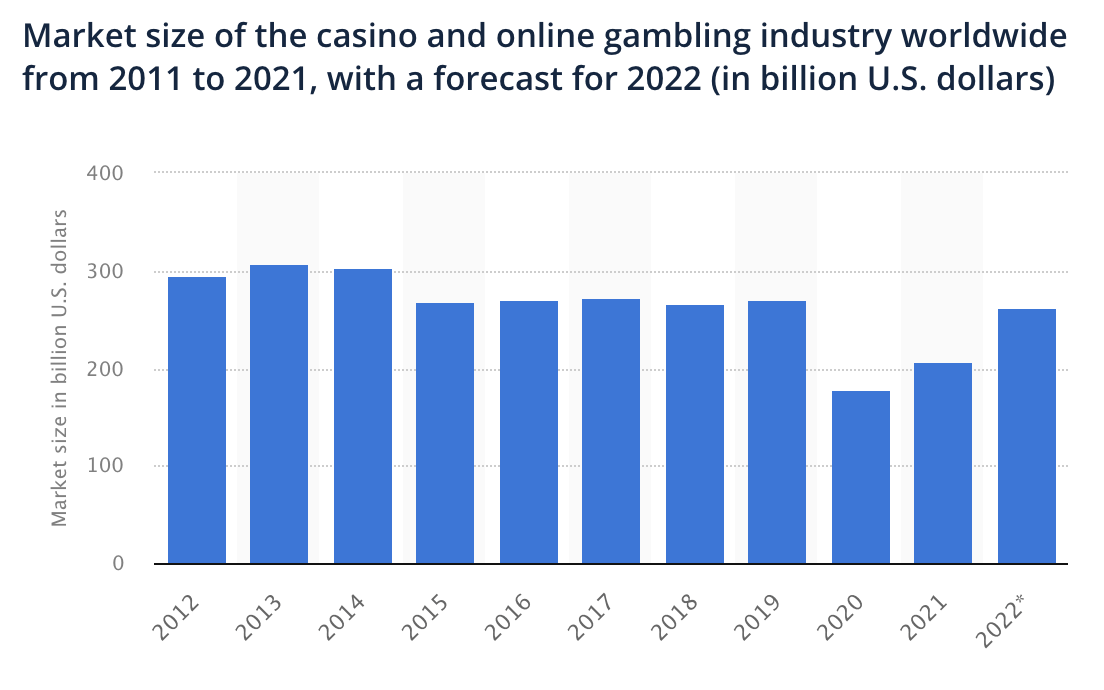

The global gambling industry continues to thrive, bouncing back to pre-pandemic levels, while also undergoing a significant shift towards digitalization. Furthermore, the realm of sports betting has experienced consistent growth, particularly in the United States. From 2018 to 2022, the total revenue generated from sports betting in the country surged from a mere 430 million to an impressive 7.5 billion and showcasing a remarkable growth rate of 74% in the past year alone.

Statistica Statistica

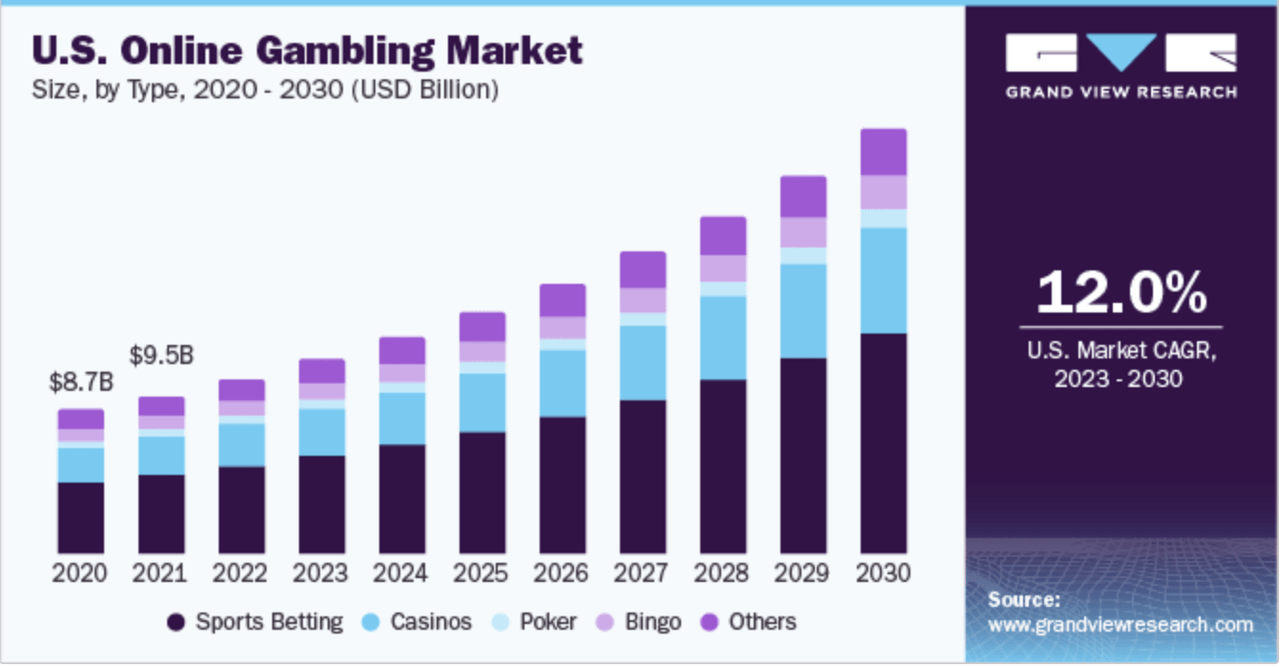

PENN Entertainment is well-positioned to capitalize on the opportunities presented by the digital gambling landscape through its iCasino and PENN Game Studios. The online gaming industry has a projected CAGR between 2023-2030 of 11.7%. The company is also set to leverage the growing popularity of sports betting following its acquisition of Barstool Sportsbook, poising itself for further growth on this new frontier.

Risks

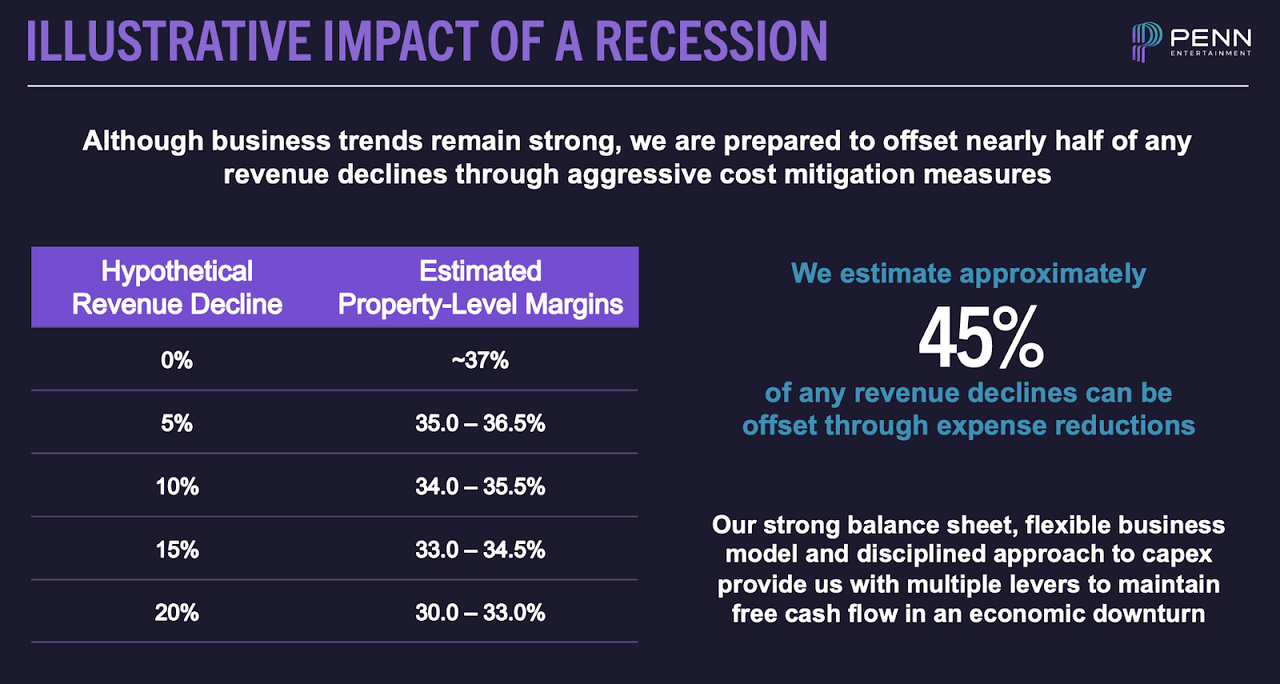

There are certain risks that should be noted, including the potential impact of an upcoming recession, which could particularly pose challenges to the business model of gambling enterprises like PENN (Recent bank failures have the potential to spark such a recession). Furthermore, it is important to consider the significant influence of Dave Portnoy on the company's brand image. If his actions were to deviate from expectations, it could potentially have a negative effect on PENN's brand perception.

Valuation

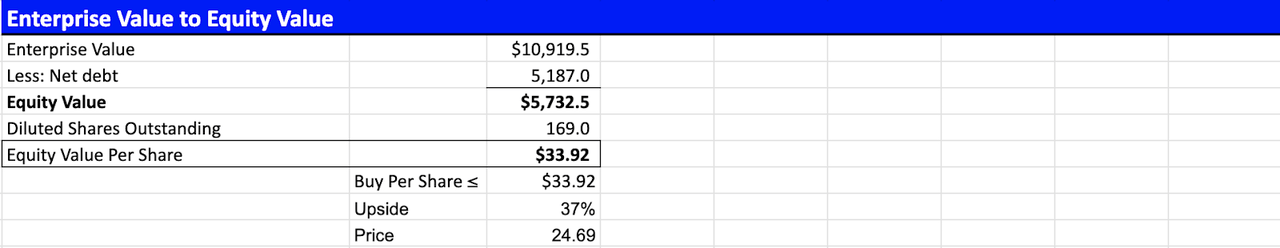

Utilizing a DCF valuation method, I calculated an Equity Value Per Share of $33.92 for PENN Entertainment, entitled through a conservative y/y growth rate of 3% from 2023 to 2027 and a terminal growth rate of 2% from there onward.

Author's own materials (excel)

Even with this large gap of conservatism, I was still led to an undervaluation of 37%. This along with the thesis presented earlier led me to a rating of Strong Buy. Please let me know your thoughts!

Author Recommendation by: Mehul Singh

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.