SPUS Vs. SPY: Sharia Screens Benefit Investors

Summary

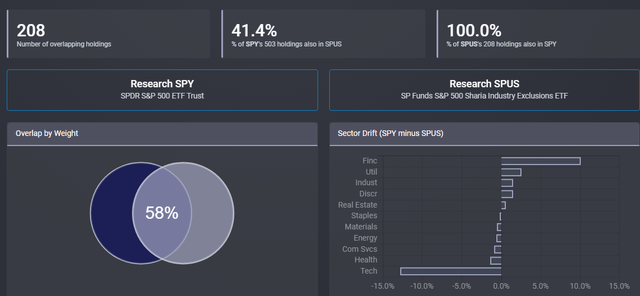

- The SP Funds S&P 500 Sharia Industry Exclusions ETF invests based on the S&P 500 Shariah Industry Exclusions Index.

- The SPDR® S&P 500 ETF, the world's largest ETF, invests based on the S&P 500 Index.

- This article reviews both ETFs, their respective index, and then compares the ETFs on risk, return, sectors and other important data points.

- While SPUS has done better so far, differences in sector allocations to Technology and Financial stocks will determine the better ETF currently.

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

May Lim/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

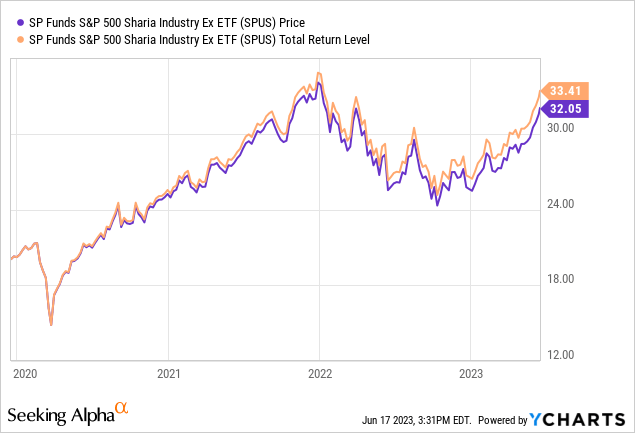

Last summer, I took my first look into an ETF that follows Sharia law in their screening, the ETFB Green SRI REITs ETF (RITA). Its REITs-only limited has not done as well as the iShares Global REIT ETF (REET). That has not been the case when comparing the two ETFs reviewed here:

Since it started just before Christmas in 2019, SPUS's screening has benefited investors. How you feel about Technology and Financials will drive the ownership decision from here.

SPDR S&P 500 ETF review

Since this ETF is better known, I chose to review it first. Seeking Alpha describes this ETF as:

The SPDR S&P 500 ETF seeks to track the performance of the S&P 500 Index, by using full replication technique. SPDR S&P 500 ETF Trust was formed on January 22, 1993.

Source: seekingalpha.com SPY

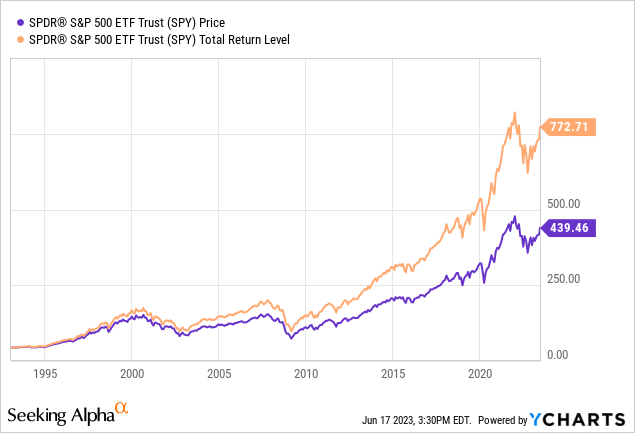

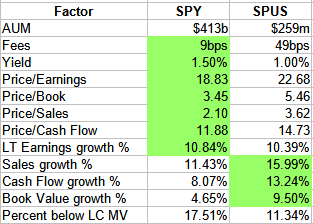

SPY, the world's largest ETF, has $413b in AUM and sports a low 9bps fee. The TTM Yield is 1.5%.

Index review

S&P describes their index as:

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. According to our Annual Survey of Assets, an estimated USD 15.6 trillion is indexed or benchmarked to the index, with indexed assets comprising approximately USD 7.1 trillion of this total (as of Dec. 31, 2021). The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Source: spglobal.com index

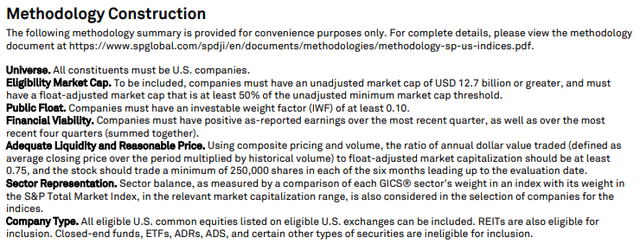

Provided were these methodology rules.

Current index characteristics include:

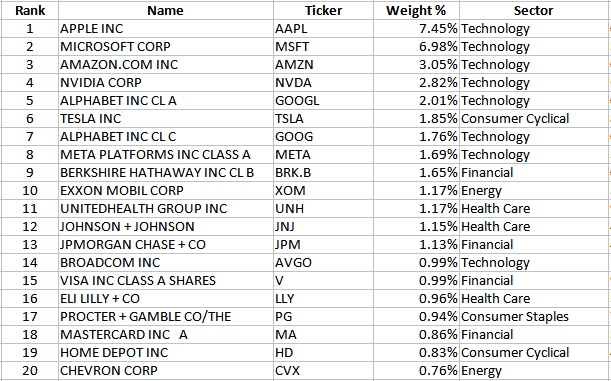

SPY holdings review

As SPY holders know, the ETF has a dominant position in Technology stocks. I will discuss sectors later when comparing ETFs. The holdings data did not include sector data; I added what you see to the best of my understanding.

ssga.com; compiled by Author

With just over 500 stocks, the Top 20 are 40% of the portfolio, compared to the smallest half being only 15%.

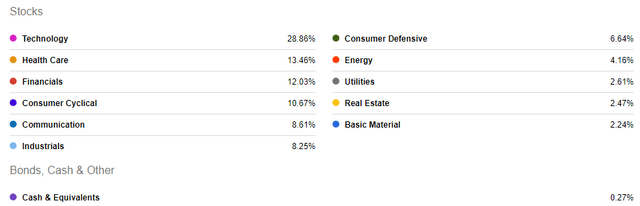

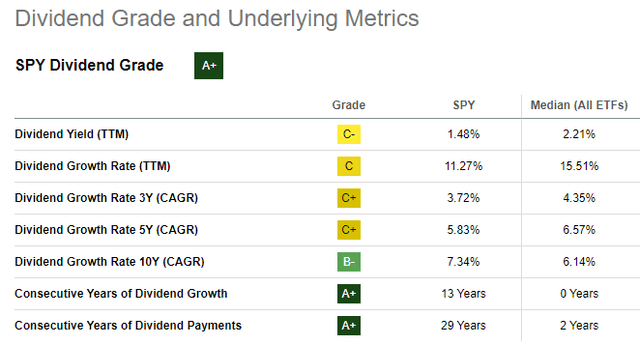

SPY distribution review

SPY has grown their payout by more than 7% over the past decade, not so much recently. Even so, Seeking Alpha gives the ETF an "A+" grade for this factor.

seekingalpha.com SPY scorecard

SP Funds S&P 500 Sharia Industry Exclusions ETF review

Seeking Alpha describes this ETF as:

SPUS seeks to track the performance, before fees and expenses, of the S&P 500 Shariah Industry Exclusions Index. The index is composed of the constituents of the S&P 500® Shariah Index other than those from the following sub-industries: Aerospace & Defense, Financial Exchanges & Data, and Data Processing & Outsourced Services. SPUS started on 12/17/19.

Source: seekingalpha.com SPUS

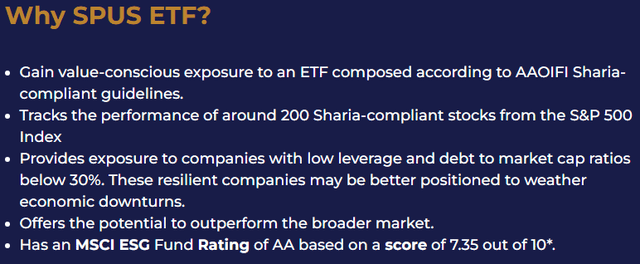

SPUS is small by comparison with only $259m in AUM. The fees at 49bps are high for an index-based ETF. The TTM Yield is 1%. The managers list these reasons an investor would want to own their ETF.

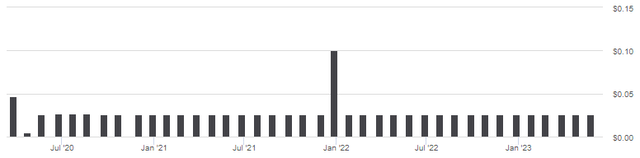

Index review

S&P provides these details about the index:

The index predates the ETF by five years.

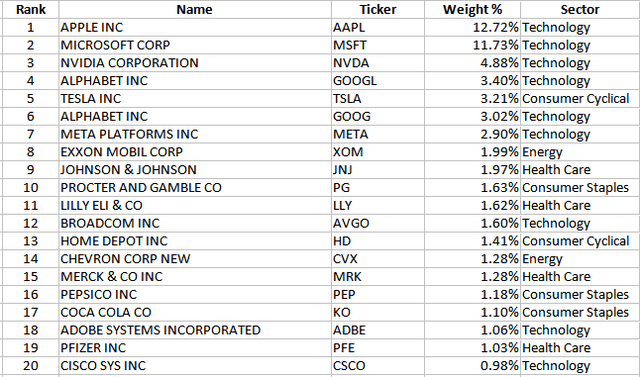

SPUS holdings review

The next table shows what stocks are excluded. The result is just over 200 stocks from the S&P 500 Index are held. Along with industry exclusions, the ETF provides exposure to companies with low-leverage and debt-to-equity ratios below 30%.

sp-funds.com SPUS restrictions

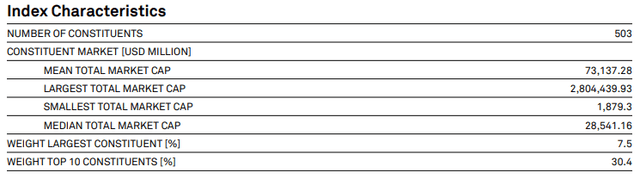

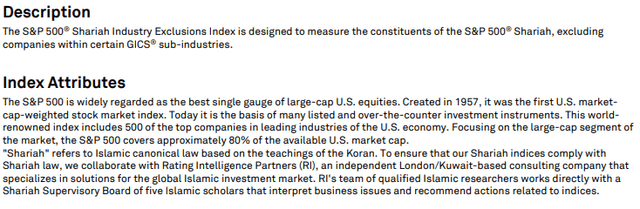

Here, the sector are:

There is no allocation to Financials, due to interest not being allowed, and Utilities, which are held by other Sharia-compliant ETFs. Over half the stocks are in both Top 20 lists. I again had to add the sector.

sp-funds.com; compiled by Author

With just over 200 stocks, the Top 20 are just under 90% of the portfolio. Here, the smallest half are only 9.5% of the ETF's allocation.

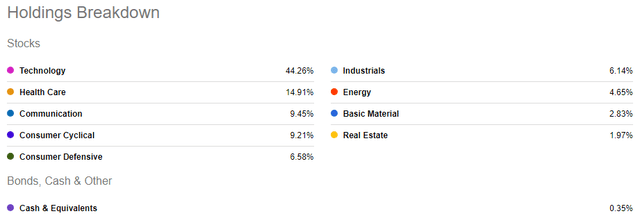

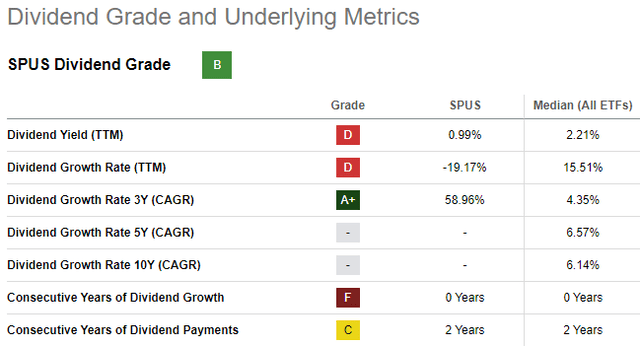

SPUS distribution review

Payouts have been $.206 most months since inception, earning the ETF a "B" grade from Seeking Alpha.

seekingalpha.com SPUS scorecard

Comparing ETFs

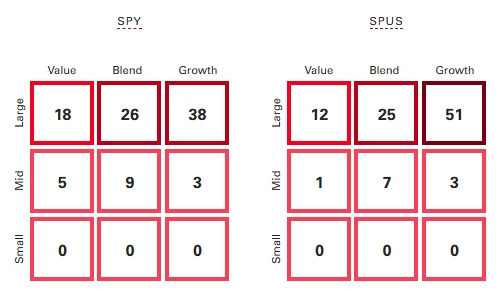

First, let us see how the restrictions effect market-cap and growth/value allocations.

advisors.vanguard.com compare

SPUS shifts the weight more toward growth stocks, which I suspect accounts for the higher allocation to Large-Cap stocks. The growth/value shift shows when comparing data points. The green cells mark the better value as I see it.

morningstar.com; compiled by Author

The effect on sector allocations is mainly in two: Financials, where SPUS has no allocation due to Shariah law prohibiting interest on loans, and Technology, where SPUS has over 40% of its portfolio.

For anti-bank, pro-tech investors, SPUS seems like the perfect ETF. With no exposure in SPUS, the Utilities sector is the 3rd largest weight difference.

Portfolio strategy

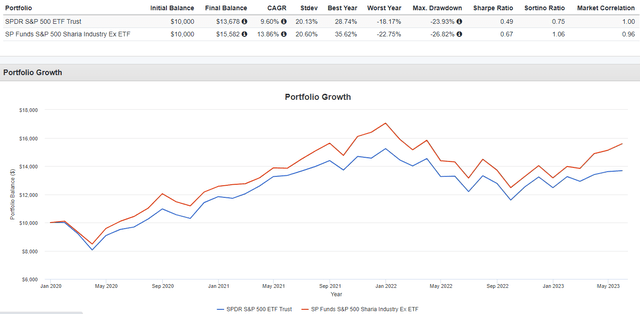

PortfolioVisualizer.com PortfolioVisualizer.com

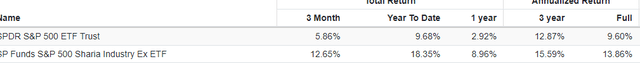

While history is limited, SPUS has outperformed SPY each year except for 2022. SPUS does have a slightly worst down-year data, but its CAGR result is superior in Sharpe and Sortino ratios.

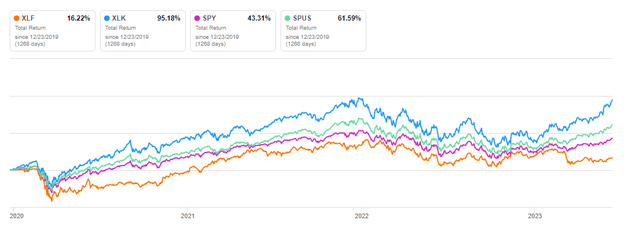

When you look at how Financials and Technology stocks have done, it helps understand why SPUS was the better ETF since late 2019.

seekingalpha.com ticker charting

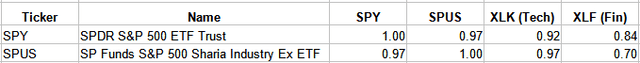

The monthly correlation numbers for SPY and SPUS against the Technology Select Sector SPDR (XLK) and the Financial Select Sector SPDR ETF (XLF) show how over/under weighting sectors can affect an ETF's return.

PortfolioVisualizer.com; compiled by Author

SPUS is more correlated to Tech stocks and less so to Financials than SPY is during a time when Technology stocks outperformed Financial stocks.

Final thoughts

I mentioned my RITA ETF: A Shariah Screened REIT For Investors article. This special class of screened funds is becoming as diverse as other strategies available with ETFs. Since Shariah law bans collecting interest on debt, there are no Shariah-compliant bond ETFs. I understand there are ways around that, but so far those processes do not lend themselves to the ETF design.

For investors who believe Technology stocks will continue to provide better returns than Financial stocks, the SPUS ETF is the better choice. For those believing Technology is overvalued and Financials will snap back once the FOMC stops fighting inflation, the SPY ETF is the better choice.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)