Build Your Own Bond Fund: Improve Yields And Certainty With A Bond Ladder

Summary

- Bonds are becoming a more attractive investment option as their yields are now competitive with stock earnings yields.

- A bond ladder can provide higher income, no management fees, and more certainty in cash flows compared to mutual funds or ETFs.

- Individual bonds offer diversification, lower volatility, and likely return of capital without sacrificing as much total return as before.

Andres Victorero

Introduction

Bonds have been an unpopular asset class from the end of the 2008-09 financial crisis until about a year ago. For most of that time, the key buzzword regarding portfolio strategy was TINA, short for "There Is No Alternative" to stocks due to unattractive returns on fixed income investments. Investors in that era who didn't need current income (those not yet retired, for example) did fine by ignoring bond markets entirely and investing only in stocks. "The Death of 60/40" was another popular concept during this period, referring to a conservative asset allocation mix between stocks and bonds.

Of course, alternatives existed for income-focused investors, but they typically involved credit quality risk and/or leverage to boost yields. Those types of investments, such as preferred stocks, baby bonds, and closed end funds - anything with a ticker symbol - were and still are well-covered here on Seeking Alpha. This is despite significant capital losses in many of these assets over the last year or two as interest rates increased.

Individual bonds, with no ticker but only a CUSIP to identify them, have gotten less coverage here, which was fine until recently as they did not provide much capital gain or income. In the current higher interest rate environment, even investment grade bonds now offer yields to maturity in the 5%-6% range or better. As stock P/Es have increased, bond yields are now comparable, something not seen since before the financial crisis. This makes bonds a useful asset in anyone's portfolio, whether or not they need the current income. Bonds add diversification and reduce volatility without sacrificing as much total return as they used to when rates were lower. It's tempting to outsource the bond side of the portfolio to a mutual fund or ETF, but a bond ladder provides several advantages. These include higher income, no management fees, and the ability to select maturity dates with greater certainty of cash flows.

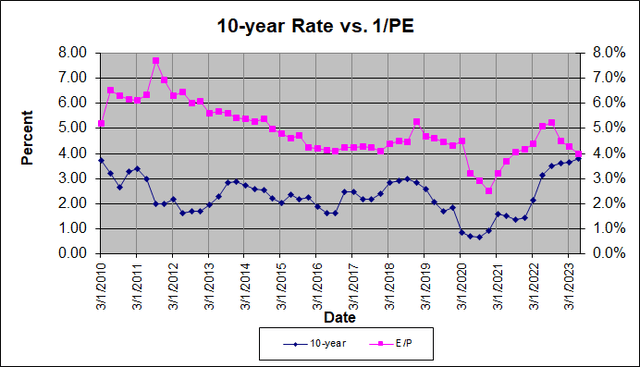

Valuations Are Now Competitive

Total return has always been my preferred lens to view investment performance, so when I say bond valuations are competitive with stocks, I am comparing the bond yield to maturity with the stock's earnings yield. Earnings yield is simply E/P, or the reciprocal of the P/E ratio. It captures not only the earnings paid to investors as dividends, but also the retained earnings reinvested in the business. Since the end of the dotcom bust in 2003, except during the 2008-09 financial crisis when earnings were unusually low, the earnings yield of the S&P 500 (SP500) has been above the yield on the 10-year US Treasury note (US10Y). Stocks' peak cheapness compared to bonds came in 2011 when corporate earnings had recovered from the financial crisis but bond yields were plummeting with the onset of global quantitative easing.

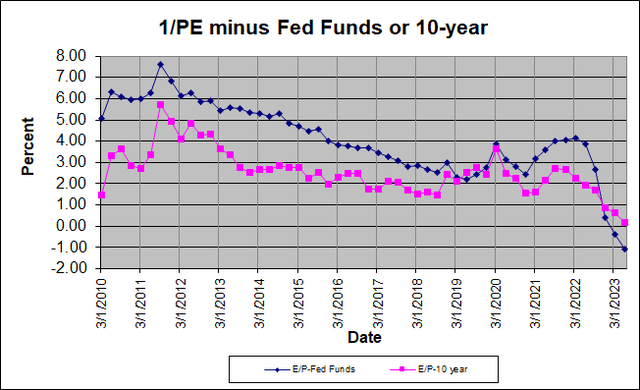

As investors got used to the low bond yield environment, stocks underwent multiple expansion (earnings yield contraction) until the middle of the decade, when the yield spread between the S&P and the 10-year settled around 2%. Even through the pandemic, the yield spread remained pretty constant, except for the initial shock in 1Q 2020.

Author Spreadsheet Author Spreadsheet

Data sources: US Treasury for 10-year yield, S&P for earnings yield

Earnings yields are based on trailing 12-month as-reported earnings and S&P 500 index level at quarter close.

Since the last quarter of 2022 however, the S&P has again started seeing multiple expansion, even as the 10-year yield continues to climb, leaving the yield spread at nearly zero. This can be rational if growth expectations for stocks have improved or if the market perceives lower risk ahead. Neither of those criteria seem like a given at this point.

With bond yields so much more competitive now compared to stock earnings yields, income is only one consideration for owning bonds. They now provide the diversification, lower volatility, and likely return of capital they always have. However, investors don't have to sacrifice as much total return to get these benefits.

The Case For Individual Bonds

As with stocks, there are ETFs that give investors exposure to every sub sector of the bond market. The positive points of ETFs are the time saving aspects of managing the portfolio and the regular monthly dividend. However, there are many negatives. These include the management fee, variability of both the dividend and share price as interest rates fluctuate, inability to evaluate and select individual issuers and bonds, and lack of a maturity date when face value will be paid back (barring default). A ladder of individual bonds solves these problems while providing ongoing income and a buffer against volatility.

Things To Consider When Building A Bond Ladder

A bond ladder is simply a portfolio of bonds with different maturities. As one bond matures, it is replaced with a new bond of longer maturity. Of course, there are many considerations when building the ladder, so every ladder will look different depending on the needs of the investor. I'll go over the key ones, using my own portfolio as an example.

Allocation Within Total Portfolio

This depends on risk tolerance, skill level at selecting individual bonds, and income needs. In my case, my total fixed income allocation is about 20% of my portfolio. The bond ladder makes up 10%, while ETFs and closed end funds make up about 7%, and preferreds make up the remaining 3%.

Maximum Maturity Length

If the yield curve is strongly upward sloping, you might want to have some long maturities (10 years or greater), as long as you don't expect long rates to rise significantly further. If the curve is inverted, as it is now with Treasuries, you may only want to go out a few years at this time and build further only as long rates move up. I currently go out 10 years to 2033.

Maturity Step Length

This depends on the above two aspects. I would make the steps even, with a similar amount of face value at maturity invested at each step. In my case, that means 1-year steps, with 1% of my total portfolio (10% of the ladder) allocated to each step.

Credit Quality

This depends on your risk tolerance and economic expectations. The lower the credit quality, the more likely the bonds will behave like stocks in an economic downturn, even if they don't default. This minimizes the diversification benefits of owning bonds. Be careful about choosing credit quality level based on your need for income. Chasing yield can be hazardous in both increasing rate environments and during recessions.

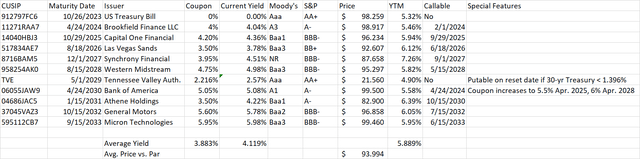

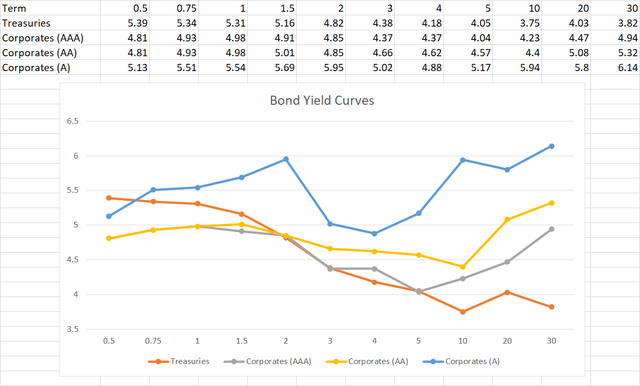

In my case, I wanted to stick with investment grade to limit default risk. I also wanted to avoid yield curve inversion to get good yields with each step in my ladder. Using my broker's table of available yields for different maturities, I concluded that the BBB and A ratings bands were most suitable.

Author Spreadsheet (Data Source: Charles Schwab)

Security Selection

This depends on the available yields as shown above, risk tolerance, desire for industry diversification, and special features such as callability or variable coupons.

In my case, I selected a T-Bill for the 2023 maturity due to the high rates available. For the longer maturities, I went with corporate bonds but diversified across sectors. While I have several Financial issues, I avoided regional banks, business development companies and companies with rapidly increasing leverage or declining interest coverage. Except for one issue, the bond are either not callable or callable only within 3 months of maturity or less. The one that is callable earlier has scheduled step increases in the coupon rate.

Putting It All Together

Using these criteria, over the past year I assembled the following ladder of 11 different issues. These can still be bought at an average price of $94, current yield of 4.1%, and yield to maturity of 5.9%.

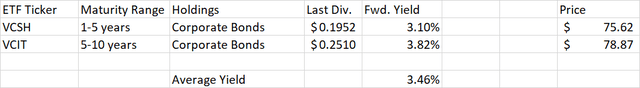

To illustrate the advantage over ETF's, here is a summary of Vanguard's corporate bond ETFs with similar maturities, the 1-5 year (VCSH) and the 5-10 year (VCIT). The average forward yield of these funds is more than 0.6% lower than the current yield of the ladder.

Conclusion

After a period of rising interest rates, coinciding with increasing stock valuations, bond yields are now competitive with stock earnings yields. There is now a place for bonds in everyone's portfolio, not just those who desire income. A ladder of individual bonds has many advantages over bond funds, including absence of a management fee, consistency and predictability of income, ability to evaluate and select individual issuers and bonds, and predictability of capital return.

Now is a good time to build a ladder of corporate bonds as far out as 10 years. Corporate bonds in the BBB and A rating bands offer yields to maturity in the 5%-6% range, with no yield curve inversion at the long end.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BONDS LISTED IN TABLE ABOVE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (8)