TIM S.A. Momentum Is Slowing

Summary

- TIM S.A. has experienced impressive growth due to the completion of their Oi integration and positive Q1 2023 results, with a 33%+ increase in stock price over the last year.

- Despite strong year-over-year growth and promising synergy value, concerns over quarter-over-quarter performance and lack of context from management remain.

- TIM is considered a hold with a stable dividend and balanced upside/downside potential. Investors should exercise caution when considering new investments in the company.

FG Trade/E+ via Getty Images

TIM S.A. (NYSE:TIMB) is a telecommunications company that operates in Brazil, providing mobile, fixed-line, and broadband internet services to individuals and businesses. The company's business model is centered around innovation, sustainability, and customer satisfaction. TIM's main revenue streams come from its mobile and fixed-line services, which include voice and data plans, SMS and MMS messaging, and value-added services such as music and video streaming. The company also generates revenue through its broadband internet services, which provide high-speed internet access to homes and businesses.

In late 2020, TIM made a joint bid of 16.5 billion reais with Telefonica Brasil SA and Claro, Mexico's America Movil SAB de CV subsidiary, to purchase competitor Oi's mobile operations in an auction. The deal closed in April 2022 after facing significant regulatory scrutiny. TIM's management committed to $4 billion in synergy value from the deal, with 45% delivered by 2030. TIM announced during Q1 2023 earnings that the integration was complete.

I believe that TIM is now fairly valued after an impressive run-up in the stock price over the past few months. While growth has been impressive year-over-year, and the business will likely deliver synergy value, I am concerned by the quarter-over-quarter momentum that didn't follow industry trends. In my opinion, the additional upside is limited. I believe TIM is a hold with a stable dividend and balanced upside/downside potential.

TIM Has Had A Big Year

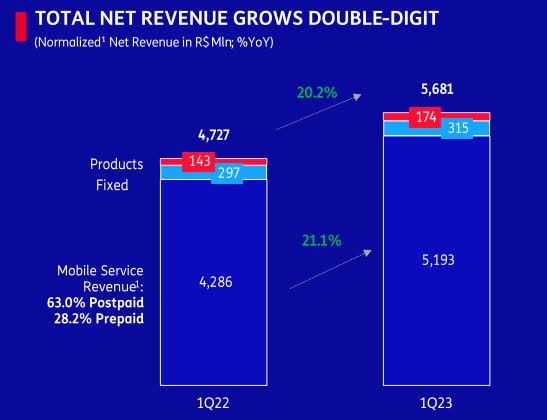

Management presented an extremely rosy picture in the Q1 earnings call. To be fair, a lot is going right. Net revenue grew double-digit across mobile and high-single digits in fixed wireless.

TIMB Q1 2023 Revenue Growth (ri.tim.com.br/en/)

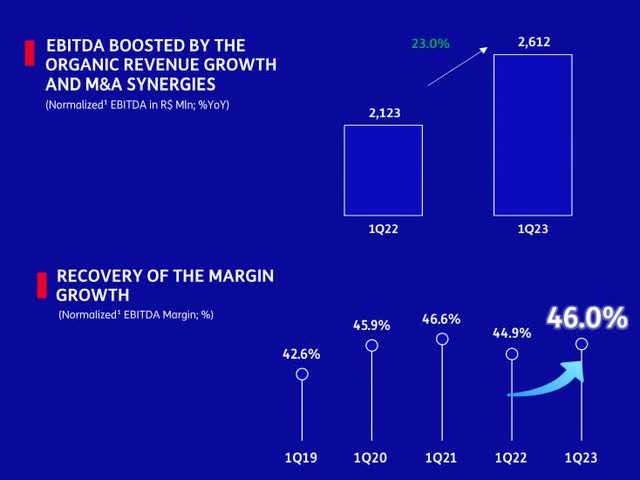

Profitability increased as M&A synergies were recognized, with nominal EBITDA and EBITDA margins growth.

TIMB Q1 2023 EBITDA Growth (ri.tim.com.br/en/)

On the qualitative side, Management said they completed the merger integration on time with Oi, continued 5G expansion, and developed a plan to drive synergy value faster alongside organic growth. Delivering organic growth or synergy value at or above management expectations could certainly present upside potential.

Q1 Decelerated From The Prior Quarter

Management included quarter-over-quarter (Q1 2023 vs Q4 2022) financials in the earnings release but did not mention the comparison once in the earnings call, earnings presentation, or earnings release. To me, that is a red flag and makes me take a closer look.

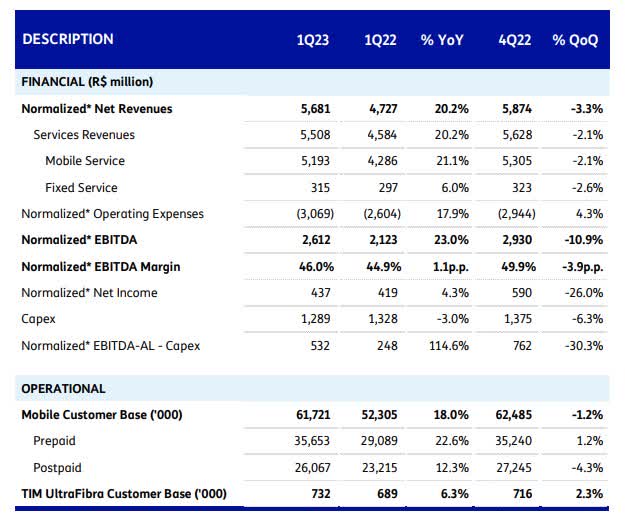

TIMB Quarterly Change (ri.tim.com.br/en/)

TIM underperformed in the quarter-over-quarter comparison across almost every point. Service revenue was down 2.1%; operating expenses were up 4.3%, and, most concerning, postpaid subscribers were down 4.3%.

In the broader industry context, the story becomes even more challenging. Brazil's wireless market stagnated in 2022 but returned to growth in Q1 2023. TIM competitor Telefonica called out mobile growth specifically when they posted an 11% increase in profitability for the same quarter. Management did not offer any explanation for the deceleration, which in my opinion, means they either don't know why performance decelerated or they took their foot off the gas, and they know it.

TIMB Is Correctly Priced After Run-Up

Over the last year, TIM is up 33%+, most of that growth from February 2023 to today. This growth reflects both the announcement that the Oi integration was complete and the Q1 2023 results.

TIMB 1-Year Stock Price (Seeking Alpha)

TIM's market cap has increased by more than $1.5 billion through the run-up to $7.5 billion today. That growth is almost as much as their book value at the end of last quarter ($1.8 billion). Also, TIM management promised $4 billion in synergy value, with 45% recognized by 2030. They almost added the 2030 synergy value to the market cap in 2023. While year-over-year EBITDA growth plays a role, the market has already recognized the synergy value.

Valuation multiples tell an interesting story. All of the revenue and sales multiples are inflated well above the industry. All of the profitability multiples, as well as cash flow, are well below the industry. This continues the narrative that there is both upside and downside risk.

The quant ratings show a buy and are borderline strong buys.

TIMB Quant Ratings (Seeking Alpha)

This is especially driven by the momentum in stock price over the past two quarters and the exceptional year-over-year growth. Certainly, those two items are true. However, the quarter-over-quarter performance concerns me the most, which is also not reflected in the quant ratings. Given the quarter-over-quarter declines and the lack of context from management, I discount the quant ratings for growth and momentum into the hold range.

Verdict

TIM has seen a 33%+ increase in stock price over the last year, largely due to the announcement of the completion of their Oi integration and positive Q1 2023 results. This growth has contributed to an increased market cap of $1.5 billion and almost as much as their book value at the end of last quarter. Management has also promised $4 billion in synergy value, with 45% recognized by 2030.

Valuation multiples tell an interesting story: the revenue and sales multiples are inflated well above the industry, while profitability multiples and cash flow are below. The quant ratings for TIM are a buy, and borderline strong buy, driven by momentum over the past two quarters and exceptional year-over-year growth. However, despite these positives, concerns over quarter-over-quarter performance remain, which is not reflected in the quant ratings. Consequently, I believe a hold rating is more appropriate for TIM now.

Overall, TIM has potential for upside given their Oi integration completion and promises of synergy value, but there are still uncertainties in their quarter-over-quarter performance and lack of context from management. Investors should exercise caution when considering a new investment in TIM but hold existing positions to enjoy a stable dividend.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.