Krispy Kreme: Widening Access Points To Freshly Baked Goods

Summary

- Krispy Kreme has seen upward trending revenue for over five years, currently at $1.576 billion TTM, but faces challenges with a negative levered free cash flow and high debt.

- Although the company's liquidity is concerning, its transition into a logistics driven operation increasing its products accessibility could be a major growth driver, especially through partnerships such as the McDonald's trial.

- I'm cautious that the stock price has been downward trending since its IPO in 2021 and many likely consider the stock to be overpriced due to a lack of earnings.

hapabapa/iStock Editorial via Getty Images

While Krispy Kreme, Inc. (NASDAQ:DNUT)'s glazed doughnut brand remains iconic and world-famous, it has seen its fair share of highs and lows throughout its 85 years of operations. It re-entered the stock market in 2021 as what many considered highly overvalued, with a "dough-not buy" rating. Since then, the stock price has dropped 25.30%, and the market cap stands at $2.42 billion, with an enterprise value of $3.79 billion.

Stock price since IPO (SeekingAlpha.com)

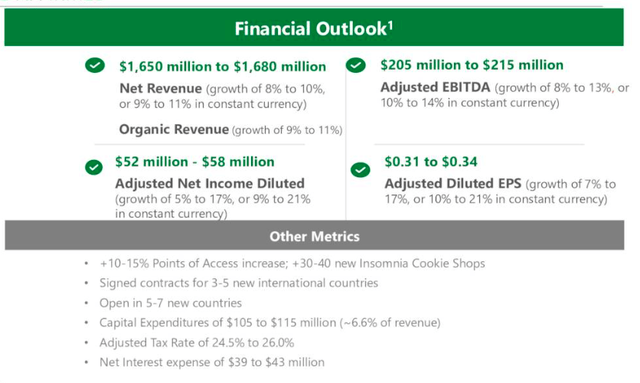

Although top-line results have been increasing YoY, we have not seen positive earnings results. However, the management team has reaffirmed its prediction of an adjusted diluted EPS between $0.31 and $0.34 for FY2023. Earnings have been mainly impacted by the company's transformation into a doughnut logistics company, which aims to deliver daily fresh doughnuts to as many points of access in the USA and internationally. One of the potential growth catalysts is a partnership trial with McDonald's (MCD), which has already extended from a small nine-restaurant test trial in Kentucky in October 2022 to a larger 160-restaurant trial which started in March 2023. While cautious of the company's high expenses, there is enormous upside potential in its logistic-orientated business model, which opens the brand to a much wider audience. Therefore, investors may want to take a long-term bullish stance on this stock.

Company overview

Krispy Kreme was founded in the Southern USA in 1937, and what followed was a long and colorful history of sugar highs and lows. In the earlier days, the company struggled with its original franchise setup, which saw cannibalism, a history of bankruptcies, problems expanding into the Northern states and a lack of internal control over the brand. It was a public company from 2000 to 2016 before going private due to several challenges. It re-entered the stock market in 2021 as a new company run by a new management team. The business can now be seen as an omnichannel business, using its hub and spoke distribution method to deliver fresh doughnuts daily. While transitioning into a distribution-orientated business has been costly, it has positively impacted the top line.

Topline growth per hub (Investor presentation 2023)

It is focused on the international markets and is now present in 32 countries at as many touchpoints as possible. In April 2023, the company decided to exit the prepackaged branded sweet treats business.

Company overview (Investor presentation 2023)

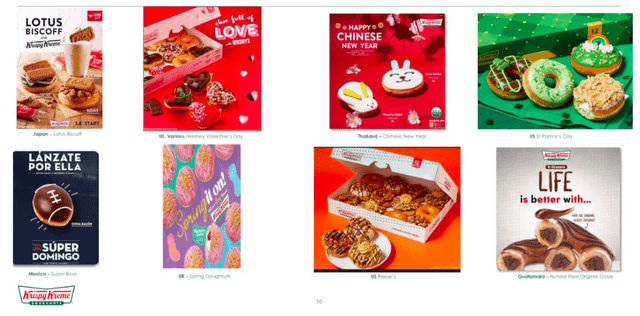

Krispy Kreme has partnered with key companies to enter international markets, expand access, and increase brand recognition and the premiumization of its doughnuts. One example is its first-ever collaboration with Lotus Biscoff (OTCPK:LOTBY) for a one-off collection of doughnuts earlier this year.

Strategic partnerships (Investor presentation 2023)

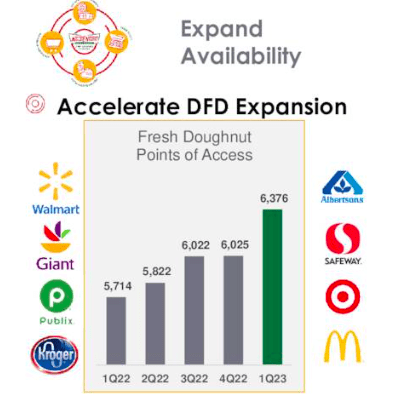

It has increased its availability through distribution in the grocery trade, convenience shops and club trade across the globe with companies such as Walmart (WMT), Target (TGT) and other large retailers.

Expand availability (Investor presentation 2023)

One of the critical drivers for the company's stock price increase year to date has been the reveal of its McDonald's partnership trial in Kentucky. Although there is no guarantee of whether this will be a long-term partnership, we have seen the trial grow from less than ten restaurants to over 160 restaurants in a few months. There are 13,446 McDonald's stores across the USA, which could have significant growth implications for Krispy Kreme.

McDonald's partnership trial (Finance.Yahoo.com)

Financials and valuation

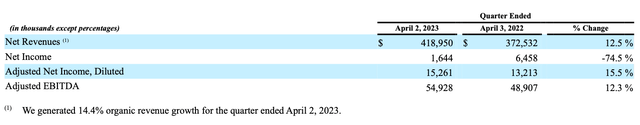

Krispy Kreme's sales started the financial year high, generating 14.4% organic growth. Furthermore, revenue has been upward trending for over five years, currently at $1.576 billion TTM. Before 2015 gross profit was less than 20%. The gross profit margin increased to 31.85% in FY2018. It has since dropped and is currently at 26.73%.

Income statement (sec.gov) Annual revenue growth (SeekingAlpha.com)

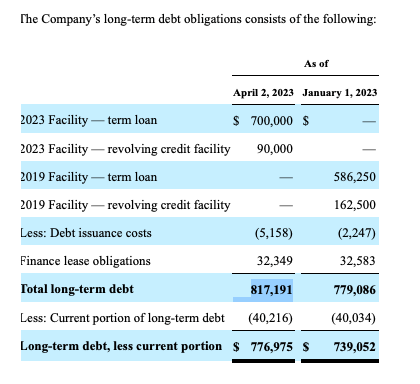

According to Q1 2023 Earnings Report, the company's levered free cash flow for TTM was negative, at $44.78 million, and also negative for FY2022. Furthermore, the company has a high debt intake. Since March 2023 it entered a new credit facility which includes a revolving credit facility of $300 million and term loan with an initial amount of $700 million. The company aims to reduce its reliance on expensive vendor financing programs.

Long-term debt obligations (Sec.gov)

Although the company has high debt obligations and minimal earnings, it has surpassed the S&P 500 in performance over six and nine-month periods due to its partnership trial with McDonald's. This has resulted in a positive impact on the company's stock performance. In comparison to industry giants like Starbucks (SBUX) and Tim Horton (QSR), Krispy Kreme is quite affordable with an attractive price-to-sales ratio of 1.51. The company has shown consistent growth in revenue, and if the partnership with McDonald's expands further, there is significant long-term growth potential. Although earnings have decreased year over year, it can be attributed to the costs associated with transforming the company, which is a one-time occurrence.

Relative peer valuation (SeekingAlpha.com)

Risks

Unfortunately, the company has not yet been able to generate positive earnings and has taken on a significant amount of debt as part of its business transition. This debt has variable interest rates, which have increased, leading to higher expenses. Additionally, the rising cost of raw materials significantly impacts the company's gross profit margin.

Final thoughts

While cautious of the company's high expenses due to the business transition into a logistics operation, we see positive top-line results due to increased access points, brand premiumization, and partnerships incentivizing one-off purchase opportunities and growing its potential global market. These efforts could result in a significant upside in the long run. The company has consistently increased its top-line results, and the growing McDonald's partnership trial could be an effective growth catalyst. Furthermore, the business expects an Adjusted Diluted EPS between $0.31 and $0.34 for FY2023. Therefore, investors may want to take a bullish stance on this stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.