Under Armour: Strong Brand Oversold

Summary

- Under Armour's growth trajectory and margins have disappointed in recent years, with the business in need of a turnaround.

- The athletics industry continues to remain attractive, with UAA's sales resilient against economic conditions.

- Compared to peers, the business is underperforming, but its multiple delta is far too high.

Spencer Platt

Investment thesis

Our current investment thesis is:

- UAA is a fundamentally strong brand that continues to maintain growth despite the issues in recent years with slowing interest.

- Margins are a major issue and will continue to be so, but we believe this is priced in.

- The athletics apparel industry will continue its upward trajectory we believe, and should support a healthy level of growth as Management attempts to re-energize the brand.

- Increased direct-to-consumer selling and international expansion remain key opportunities to improve growth.

- UAA's stock price looks oversold based on its relative valuation, implying upside.

Company description

Under Armour (NYSE:UAA) (NYSE:UA) is a company that develops and sells performance apparel, footwear, and accessories for various age groups. They offer different types of apparel and footwear for sports, training, and outdoor activities. The company also provides accessories like gloves, bags, and headwear, along with digital subscription services.

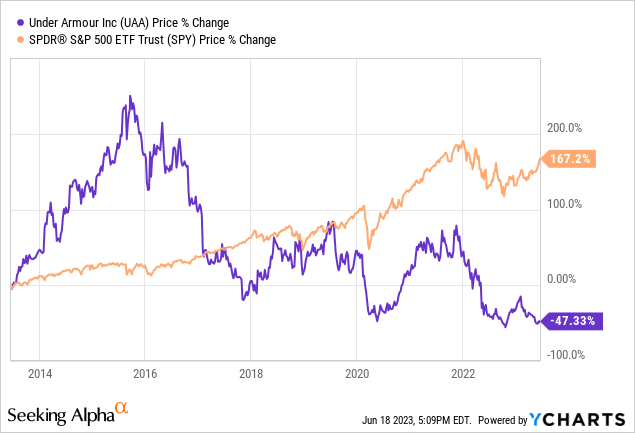

Share price

UAA's share price generated impressive gains at the start of the last 10 years, driven by impressive financial improvement, with both growth and margin improvement.

Since then, UAA's performance has softened, contributing to a noticeable correction in the share price which has seemingly trended in a continuous downward trajectory.

Financial analysis

Under Armour Financials (Tikr Terminal)

Presented above is UAA's financial performance for the last decade.

Revenue & Commercial Factors

UAA's revenue has grown at a CAGR of 11% between FY13 and FY23, with only one year of negative growth (Covid-19 impacted). This is a reflection of the company's resilience and ability to compete against other leading athletic brands.

This being said, there was a clear slowdown from FY17 onward. At the time, UAA experienced leadership changes, increased competition, general segment tailwinds, and missteps in its product roll-out.

Business model

UAA's focus is on branded performance apparel, footwear, and accessories, leaning into the athletic segment of the market. The company's demographic is wide, from those interested in athletics to performance athletes.

UAA generates revenue through sales to wholesalers/distributors, and through direct-to-consumer (DTC) channels (Stores and e-commerce websites).

UAA differentiation approach is the development of high-quality, innovative products to create an association of elite quality with its brand. UAA is focused on its cushioning technologies, such as Charged Cushioning, UA Flow, and HOVR. The objective is to enhance performance, but also manage comfort, fit, protection and temperature management. Although this may seem slightly gimmicky, many who are passionate about athletics are highly critical of these factors, and they end up being the influencers for the more casual buyers (Word-of-mouth marketing, reviews, etc).

Competes with established competitors in the sportswear industry, such as Nike (NKE), adidas (OTCQX:ADDYY), PUMA (OTCPK:PMMAF), Lululemon (LULU), and Reebok.

Athletic/apparel industry trends

In recent years, we have seen an increased focus on health and wellness, relating to a surge in demand for fitness-related products, including athletic apparel. The Covid-19 pandemic has accelerated this, as consumers were locked at home with more free time. The overarching trend has been driven by greater awareness of how to live a healthy life and social signaling. We suspect this trend will continue in the coming years and should be incredibly lucrative, as consumers purchase apparel/equipment before beginning activities (to which they may not necessarily remain committed).

In conjunction with the above point, there has also been the development of "athleisure", casual clothing that is versatile for differing uses. This is likely due to a blend of the above trends and the continuing social importance of dressing fashionably. This is likely an area of weakness for UAA, as although the company is well entrenched in the athletics market, its products do not necessarily have the same casual appeal when compared to Nike or adidas.

The rise of e-commerce has transformed the retail industry, causing a major shift in the fundamental structure. E-commerce businesses lacked the physical location costs of traditional retailers, allowing for increased customer acquisition investment. Although side a new value proposition to consumers, namely the ability to shop around and increased convenience, we saw customers flock to e-commerce websites.

This has contributed to increased competition for the traditional brands and we believe UAA has been noticeably impacted. This has pressured brands to improve their value proposition relative to cheaper options while also utilizing their physical locations to create benefits above and beyond the e-commerce-only option.

We believe UAA has been unable to wholly respond to this, contributing to the struggles it has faced. Others, such as Nike and adidas, have innovated and changed their approach, through such means as the creation of concept stores, increased marketing and new product launches, and leaning into fashion trends.

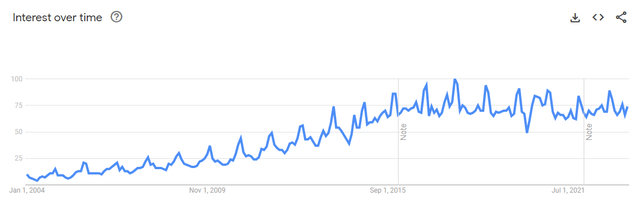

Utilizing celebrities and influencers for marketing has developed a necessity for brands but this form of marketing has been a mainstay in the athletics industry for many years. UAA is partnered with several high-profile athletes, celebrities, teams, leagues, and sports organizations. Although these partnerships continue to be with high-profile individuals, keeping its brand in the consumers' awareness as a leading athletics brand, there has been a clear stagnation in the brand's reach. Although revenue growth has been materially impacted by the factors discussed above, there has also been a softening of interest.

The concern with investing in retail is that consumer trends can change, and in many cases quite rapidly. In the case of UAA, the impression we get is that brand is not at the level it once was. As the following illustrates, the online searches support this assumption and look to have peaked around the same time as revenue growth.

The good news for UAA is that many of the major brands in history have been able to weather this, so long as they continue to seek improvement and develop their products in line with consumer interests.

Opportunities

Our view is that there are 2 key opportunities to exploit for improved growth in the coming years.

Firstly, greater DTC sales. We are seeing marketing directly funded by brands increasing, as retailer struggles contribute to reduced marketing spending and store closures. Given this, brands have increased their focus on driving consumers to their outlets, cutting out the middleman. This has the opportunity to improve margins.

Further, international expansion continues to be an avenue for further growth. Management sees significant growth potential in regions such as the Asia-Pacific and Latin America, as economic development drives income growth.

Economic & External Consideration

Current economic conditions represent a near-term headwind. With high inflation and elevated rates, consumers' finances are under attack, encouraging reduced retail spending.

In the most recent quarter, revenue was up 8% (10% CC), implying strong resilience by the business. This is driven by growth in EMEA and Asia-Pacific. This quarter outperforms the year as a whole, the opposite of what we would expect.

Looking ahead, we suspect several more quarters will be required until inflation normalizes at a sustainable level. This will likely restrict UAA's ability to generate healthy growth in FY24, but given the resilience, we do not foresee a loss.

Margins

UAA's margins are a large contributor to its recent underperformance. The company currently has a GPM of 45%, EBITDA-M of 7%, and a NIM of 7%. Across the historical period, margins have noticeably declined, due to both GPM erosion and increased S&A spending relative to revenue. This has been driven by increased marketing spending, a greater amount of discounting activities, and a degree of inflationary pressures.

As a mature business, this margin erosion is a material issue for the business. Given the inability to generate improvement in the last few years, we are concerned that UAA is stuck at its current level. Winning margin back in the retail industry is notoriously difficult due to the level of competition.

Balance sheet

UAA's inventory turnover has remained flat compared to Dec 2021, a strong performance during a period of uncertain demand. This said, its CCC is noticeably up, contributing to a decline in FCF margin.

UAA is conservatively financed, with a ND/EBITDA ratio of 1.4x. This gives the business flexibility to raise debt if required.

Distributions to shareholders have been historically light, with (relatively) large buybacks in recent periods implying this may cease as cash falls below half of Dec21 levels.

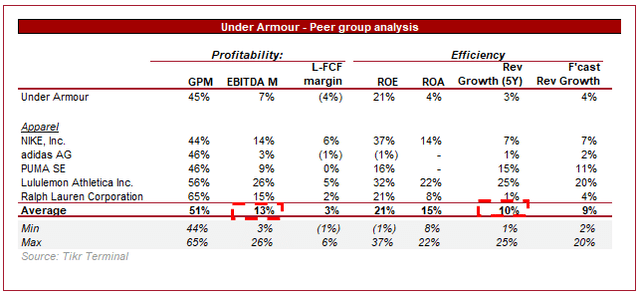

Peer analysis

In order to assess UAA's relative performance, we have compared it to a range of apparel brands, primarily those in athletics.

UAA's weakness relative to the cohort is clear to see, the company is almost half as profitable as the average. When considering growth, the company clearly underperforms also, but this normalizes on a forward basis.

The margin weakness is in large part due to the decline in GPM, illustrating that once pricing rigidity is relinquished to customers, it is difficult to win this back. Only Nike is able to operate with a subpar GPM and recover this at an EBITDA-M level (Unsurprising that it has one of the most valuable brands in the world).

Given these factors, we believe UAA should be trading at a noticeable discount to the average valuation of the peer group.

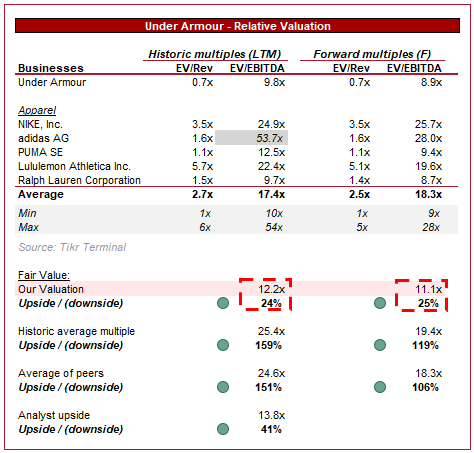

Valuation

Under Armour Valuation (Tikr Terminal)

Presented above is the valuation of the cohort presented above, as well as UAA.

UAA is currently trading at 9.5x LTM EBITDA and 8.6x NTM EBITDA. This is a substantial discount to its peer group, reflecting the poor market sentiment the business has developed.

In order to value the business, we have applied a 30% discount to the LTM average EBITDA multiple (excl. adidas which has seen earnings materially impacted by the loss of Yeezy), as well as the same discount applied to NTM.

Based on this, we imply an upside of 24-25%, far more conservative than the Street's consensus of 41%.

Key risks with our thesis

The risks to our current thesis are:

- Although UAA has remained robust thus far, inventory management and margin protection remain key. We are not even thinking of margin improvement currently and neither should Management. Any further margin slippage will materially impact valuation, and warrant a greater discount. If a further 5% discount was applied, UAA's valuation upside would decline to c.15% and change the rating to Hold.

Final thoughts

UAA looks to be a strong brand that has lost its way. Fundamentally, it is strong in our view but is in need of a transformation. Longer term, the focus needs to be placed on margin improvement and a reinvigoration of the brand.

Currently, however, industry tailwinds and a continuation of the current trajectory is sufficient to warrant a buy rating. Market sentiment is far too negative considering the company is still growing and the brand remains valuable.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.