Bloom: The Profit Clock Is Ticking

Summary

- Bloom Energy has experienced significant revenue growth but has yet to achieve profitability, with net income remaining negative as revenue increases.

- The company's debt load has grown to over $1 billion, but with over a billion dollars in revenue and a $3.3billion-dollar Market Cap, it appears more sustainable than previously thought.

- Bloom needs to focus on making a profit and addressing issues like growing accounts receivable and inventory days to become cash flow positive.

Daniel Balakov

Bloom Energy's (NYSE:BE) Q1 2023 earnings provided several surprises; loss per share improved from $0.44 in Q1 2022 to $0.35. Revenue was up 37% YoY, and the net loss narrowed 9% to $72 million. Revenue was above expectation, but earnings missed by 20%. Bloom announced a $575 million dollar debt offering that surprised the markets and lowered the share price. By May 16th, Bloom shares had lost more than 20%, and Wall Street lowered its price targets and EPS estimates.

Since its inception, surging revenue, debts, and promises of profitability have been a feature of Bloom, and it has attracted the attention of short sellers.

In 2019 the short seller Hindenburg Research published a report on Bloom; they expected Bloom to be bankrupt by now and made several assertions that need considering.

- Bloom is allegedly amassing large undisclosed service liabilities.

- Bloom's technology is allegedly not sustainable, clean, green, or profitable.

- High debt maturities would make Bloom a bankruptcy candidate.

- Bloom executives make exaggerated statements.

At the time, the report put me off investing in Bloom, but I did invest heavily in some of the other fuel cell companies and did extraordinarily well. Since 2021 the price of my fuel cell sector has plummeted (I track the performance of 14 companies engaged in fuel cell production and use, I do not currently have positions in any of the companies). While Bloom is down 38%, most are down more than 80%. Due to Bloom's outperformance against my sector, I decided it was a good time to review Bloom again and see if things have changed.

Bloom Allegedly Amassing Undisclosed Service Liability

This may still be true and relates to the Master Service Agreement Bloom has with its customers. Bloom offers a warranty for the assumed life of its products (20 years). Customers can renew the service agreement each year at a price pre-determined at the beginning of the contract. The master service agreement also includes a warranty for the device's efficiency, output, and performance. The cost of these warranties may become enormous in the future, perhaps even greater than the initial value of the sale. The risk is that the price is fixed at the purchase time, which may be 20 years before the warranty issue arises.

We offer certain customers the opportunity to renew their O&M Agreements (defined herein) on an annual basis, for up to 20 years, at prices pre-determined at the time of purchase of the Energy Server. We also provide performance warranties and performance guarantees covering the efficiency and output performance of our Energy Servers. Our pricing of these contracts and our reserves for warranty and replacement are based upon our estimates of the useful life of our Energy Servers and those components that are replaced as a part of standard maintenance, including assumptions regarding improvements in power module life that may fail to materialize.

I cannot estimate the possible size of this liability as the Bloom devices have not been in the field long enough. As Hindenburg suggests, it could be more than the company can support but may not be large if the machines perform well and prove reliable.

IS Bloom Tech Green and Clean?

The primary product of Bloom is the Bloom Energy Server 7.5, a SOFC fuel cell that uses Methane or Natural Gas as its fuel and produces Electricity. Being SOFC, it operates at very high temperatures (700 degrees or more) and has an awe-inspiring energy conversion rate if that temperature is re-cycled.

The fuel cell can develop problems if the Natural Gas is not pure, so it is cleaned before use. If the sulfur and other chemicals removed at this stage are dealt with carefully, the product should be much cleaner than coal and at least as clean as other gas-powered generators. It does not burn fuel, so it releases less particulate matter, which is good.

The chemistry requires (Natural Gas) Methane to be reformed into Hydrogen and carbon monoxide on the anode side of the fuel cell and oxygen to be on the cathode side. The Hydrogen becomes water, and the carbon monoxide becomes carbon dioxide, both of which are emitted.

It seems impossible that a technology fueled by Natural Gas could have zero emissions, so it should be no surprise that the Natural Gas fueled Bloom energy server emits CO2.

Bloom is still working on technology to capture this CO2, and until that tech is ready, I don't think the technology can be described as green or clean. It is cleaner than coal and oil but not as clean as solar and wind.

Is Bloom Technology Profitable?

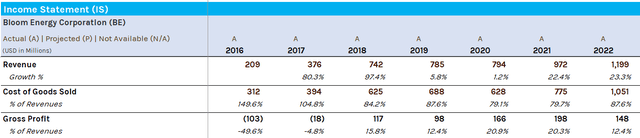

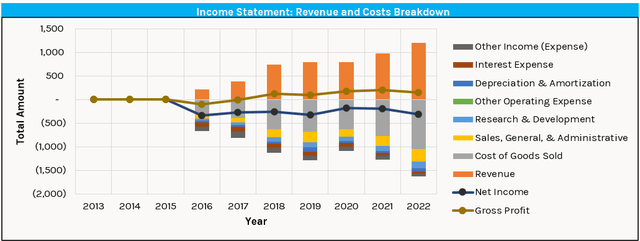

The revenue growth might be enough to teach us, naysayers, a lesson. From $248 million in 2014 to $1.2 Billion in 2022, outstanding growth has been constant, with each year hitting a new record. The company turned gross profit positive in 2018 and has continued to be gross profit positive since then.

Key Income Lines (Author Database)

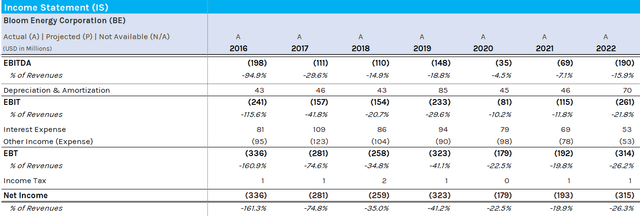

Operating income positive is proving more elusive since 2018 operating income has increased from -$162 million to -$150 million, an Improvement of only 7% in 5 years; at that rate, it will take some 60 years to make it positive.

Earnings from operations have continued to deteriorate over this period despite the improvement in gross profit and have fallen from -$295 million to -$315 million. Earnings are the real problem for Bloom at the moment. As revenue increases, net income to the company gets more negative. That situation needs some immediate attention.

The economic reality is that Bloom has never been profitable

Key Profit Lines (Author Database)

This is not sustainable; a company cannot lose hundreds of millions of dollars each year and continue indefinitely.

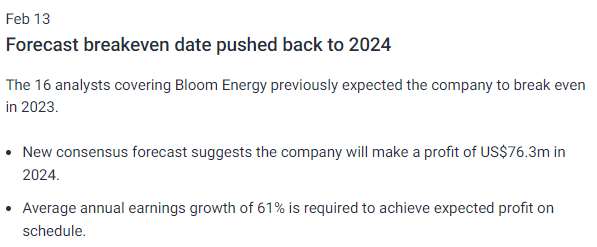

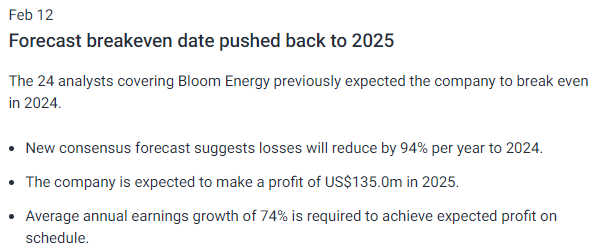

Bloom and Wall Street analysts keep pushing back the date Bloom will become profitable. I don't like this trend; we have been hearing since 2018 that Bloom will be positive next year, and it is still happening. (see next section)

Bloom Energy (FY 2021 Slide deck)

Bloom Energy (FY2022 Slide Deck)

Breakeven 2024? (Simplywall.st)

Breakeven 2025? (Simplywall.st)

Every time Bloom releases its annual results, the breakeven point is pushed back another year.

It isn't easy to see how Bloom will become profitable with its current business model.

Graph of Key Business Data (Author Database)

As revenue grows, Net Income remains stubbornly negative and, in the last reported FY 2022, was at its lowest since 2016 despite the dramatic increase in revenue over that period. It is also noticeable that gross profit is not growing at the same rate as revenue.

The net result is constant and ongoing. Bloom has to continue financing their losses by diluting shareholders or taking on more debt.

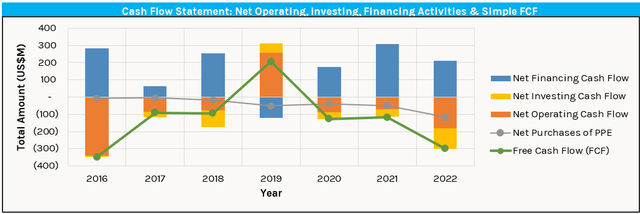

Finance, debt, and Cash flow (Author Database)

So far, the evidence would suggest that the Bloom product is not profitable, and the last graph indicates that as the revenue has increased, the situation has worsened.

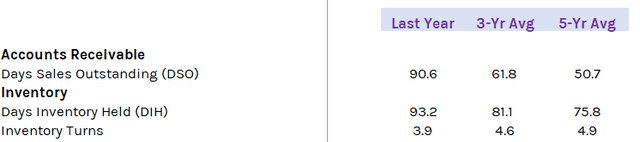

Bloom is a fast-growing company, and it is notoriously difficult to manage such a business analysis of Bloom's accounts suggests they are struggling in some key areas.

Bloom Poor Manufacturing Performance (Author Database)

Accounts receivable and inventory days are growing alarmingly. Those two figures increase the need for cash and reduce profitability. The growth in Inventory days will be using up free cash; if it continues, Bloom will never become cash flow positive.

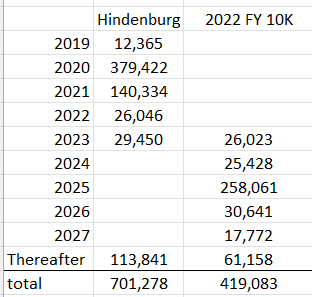

Bloom Debt

Hindenburg was concerned that the debt repayments in 2020 and 2021 might sink Bloom. That was not the case, Bloom managed its debt load easily, and its debts were lower by the end of 2022 than when Hindenburg wrote its report. (Repayment schedule from Hindenburg report and FY 2022 10K page 114)

Debt from short seller and FY 2022 (Author)

The markets were stunned in May 2023 when Bloom announced a +$500 million convertible debt offering. The current total debt load is over $1 billion.

There are still some large debts due indeed, the 2025 repayment is a concern, but Bloom has managed to navigate these waters before.

Growth in Debt and Revenue (Author Database)

Total debt repayments are shown below; the money to repay these debts is, on the whole, coming from the issuance of new stock.

Financing lines (Author database)

Bloom Managers and Alleged Exaggerated Statements

Management has been quite promotional in making optimistic statements about the business, but the achievements guided to often haven't been realized.

Bloom developed a reputation for overly positive statements in its early days,

Shortly after its IPO in 2018, Bloom CEO K.R. Sridhar told MarketWatch that Bloom would be "cash-flow positive and GAAP-profitable this year." He also said that Bloom is "a profitable company as of [the second quarter]," and that he expected that trend to continue.

Bloom PR reps quickly walked that back to: "Bloom Energy expects to be GAAP-profitable at the operating level, and thus cash-flow positive, this year, not net profitable."

Then Dan Primack of Axios noted that Bloom was profitable only on an adjusted operating basis, meaning that the walk-back needed a walk-back.

Bloom was forced to issue a filing, disclaiming those and a few other of its CEO's utterances: "The company disclaims any statement regarding its expectations for future profitability or cash flows, makes no such forecast or prediction at this time regarding its future operating results, and undertakes no obligation to do so in the future.

Link: The filing on the SEC website correcting the remarks of the CEO

In recent years Bloom has begun to sell a hydrogen story.

Hydrogen, The Current Story

On Nov 18th, 2020, Bloom introduced their Hydrogen strategy at an investor day. In the presentation, they make several claims.

- Bloom's learning rate is faster than other technologies (page 8).

- Bloom is larger than its six largest competitors combined(Page 11).

- Bloom will have a significant production advantage in all types of Hydrogen production in either 2025 or 2030 (page 15).

- Timing first Projects live in 2021, Commercial deployment in 2022, and ramp to 1GW by 2025 (page 16).

- Hydrogen Revenue $750 Million by 2025.

Point 2 was probably true (I don't know who Bloom considers their competitors); it was the year that Plug Power (PLUG) booked a negative $100 million in revenue due to the Amazon warrants problem. Even adjusting for the unusual Plug year and looking at 2021, Bloom's revenue was considerably larger than its competition Bloom's $972 Million, Plug $502 Million.

Point 1 is probably proven by point 2; they have grown their revenue far quicker than the competition.

Points 3, 4, and 5 appear to fall into the promotional and somewhat optimistic category. In 2023 Bloom issued the following, which implies that the dates quoted in the Hydrogen Day are no longer part of the timeline.

Given that large-scale projects are predominantly in the planning and early design stages, this timely Bloom demonstration should provide potential customers with the confidence they need to make the right technology choice rather than rely on less efficient legacy technologies. These examples illustrate how we make judicious and timely investments when we see opportunities to grow revenue and margin and then execute diligently to deliver strong returns on those investments.

(BE: 2023 Earnings call Q1 2023 Transcript, 2023-5-9)

Conclusion

We were all warned about Bloom in 2019 by the famed short seller Hindenburg research; they doubted that Bloom could manufacture profitably, and so far, have been proven correct. Bloom will need to make substantial progress in this area for me to consider investing.

Bloom continues to add to its debt pile while raising significant money from shareholders, using some of it to pay down debt.

The debt pile is very large at more than $1 billion, but now they have a billion-dollar revenue and a market cap approaching $3.5 billion, so it looks far more sustainable than it did 4 years ago.

Bloom managers tend to be overly positive and tell a compelling growth story; they keep promising positive cash flow next year, but next year never seems to arrive. The new Hydrogen strategy and its products follow a similar ongoing storyline.

Bloom is not a lost cause, it has developed some industry-leading revenue figures, but it must focus on making a profit rather than constantly diluting shareholders to build more capacity around new markets. Their market would appear big enough to make billions of dollars of sales and create a 10-billion-dollar order book (even if most of that order book is just assumed future service income). If they turned their attention to making a profit from that situation, I might be interested in buying.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a short seller, I do not have any holdings in Bloom Energy competitors and cannot benefit financially from any movement in Bloom stock.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)