Tech Titans Clash: Evaluating Meta And Tesla For Investment Opportunities

Summary

- Tesla, Inc. and Meta Platforms, Inc. have both experienced significant stock growth, but Tesla's position in the expanding electric vehicle market and strong projected growth make it a more favorable investment option.

- Tesla's superior technology, brand recognition, and market dominance provide a solid foundation for future success, despite regulatory challenges and potential market share loss.

- Meta faces competition, data privacy concerns, and uncertain revenue growth in its metaverse-focused endeavors, making it a riskier investment compared to Tesla.

Mat Hayward

Some headlines just grab your attention:

CBS News

I hate to admit that I would be thoroughly interested in seeing this fight actually play out. Tesla, Inc. CEO Elon Musk is listed as being taller and having reach, but apparently Meta Platforms, Inc. CEO Mark Zuckerberg has medals from jiu-jitsu tournaments?! Celebrity boxing has become all the rage with YouTubers like Jake and Logan Paul stepping into the ring and former NBA stars like Deron Williams trying their hand at boxing as well, so it is really not out of the realm of possibility of this billionaire bout becoming a reality.

All joking aside, this social media farce between the two tech titans did get me thinking to which of their companies is a better buy. In recent years, the tech industry has witnessed the rise of multiple influential companies, including Meta and Tesla. These two giants have dominated headlines, capturing investors' attention and redefining the future of their respective industries. Meta, the social media and technology conglomerate, has evolved from its initial focus on connecting people to now envisioning a metaverse where users can interact and engage in immersive digital experiences. In contrast, Tesla, led by visionary entrepreneur Elon Musk, has revolutionized the automotive industry with its electric vehicles and renewable energy solutions. Both Tesla and Facebook (sorry, I mean “Meta Platforms”) have had huge run-ups this year, with Meta hitting +128% and Tesla at +123% YTD.

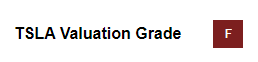

Triple-digit percent returns in only six months has been quite impressive and Meta, Tesla, and a few other mega cap tech stocks have represented a majority of the S&P 500 (SP500) and Nasdaq (COMP.IND) gains for 2023. Valuations have gotten quite lofty for both and are currently poorly rated by Seeking Alpha’s valuation metric:

Seeking Alpha Seeking Alpha

Traditional valuation metrics typically do not like growth stocks, and Meta and Tesla are no exceptions, with a 73 P/E ratio for Tesla considered absurdly overvalued and a 24 P/E for Meta considered overvalued as well. But if you went only by earnings ratios and did not factor in future economic conditions as well as market sentiment, you would miss out on these leading market returns.

When comparing stock performance, Tesla has enjoyed remarkable growth over the past decade with the last 5 years return topping 1000%. Its innovative products, strong brand presence, and continuous expansion have propelled the company's stock price to new heights. On the other hand, Meta's stock has also witnessed substantial growth, benefitting from its dominance in the social media landscape. The company's recent rebranding as Meta signals a strategic shift towards a metaverse-focused future, which has garnered significant investor interest, albeit at an incredibly high cost with R&D expenses topping $34 billion dollars. A very interesting comparison is Tesla, who you would think would have higher R&D costs with its battery research and new vehicle development, coming in under $3 billion.

Tesla's market capitalization remains formidable, reflecting its position as a leader in the electric vehicle market. However, its market dominance has faded as its EV market share has declined with wider EV adoption and increased competition.

Since January 2022, for example, Tesla's share of the EV market fell from 72% to 54% — and it will likely slide below 50% in the next month or two, says Tom Libby, associate director of industry analysis at S&P Global Mobility.

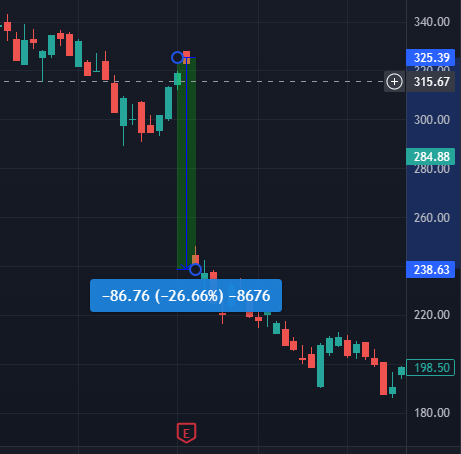

Meta also has seen declines in market share with the rise of TikTok and its immense popularity with users under the age of 30. And are we quickly forgetting last year’s cliff dive after Meta reported a decline in user base for the first time in its history?

META- After February 2022 Earnings Release (Tradingview)

Tesla and Meta's financial performance can be compared based on their per-share figures. Tesla's revenue per share showed a modest growth from $26.03 in 2021 to $27.35 in 2022, while Meta experienced a relatively slower increase from $41.89 to $43.40 during the same period. However, Tesla's earnings per share declined from $4.02 to $3.75, while Meta's earnings per share experienced a significant drop from $13.99 to $8.63. These numbers suggest potential challenges for both companies, with Tesla's profitability decreasing and Meta's experiencing a notable decline.

Both Meta and Tesla operate in industries subject to regulatory scrutiny. Meta has faced criticism over data privacy concerns and the spread of misinformation on its platforms and has been fined over a billion dollars by the European Union, and further increased regulation could impact the company's advertising revenue and user engagement. Tesla, on the other hand, faces regulatory challenges related to safety standards, emissions, and the development of autonomous driving technology. And making a product as heavily scrutinized and protected as automobiles always comes with recall and lawsuit risks.

That is a lot of negatives listed for two companies that have doubled in valuation in the last six months. But at the end of the day, both of these companies are money printers with brand recognition and first to market attributes that will keep them well positioned for years to come. Sure, Tesla may lose market share as more competition enters the EV space, but EVs only made up 7% of new car sales last year and that number is expected to climb to half of all new vehicle sales by 2035. A slightly smaller piece of a much larger pie should be just fine.

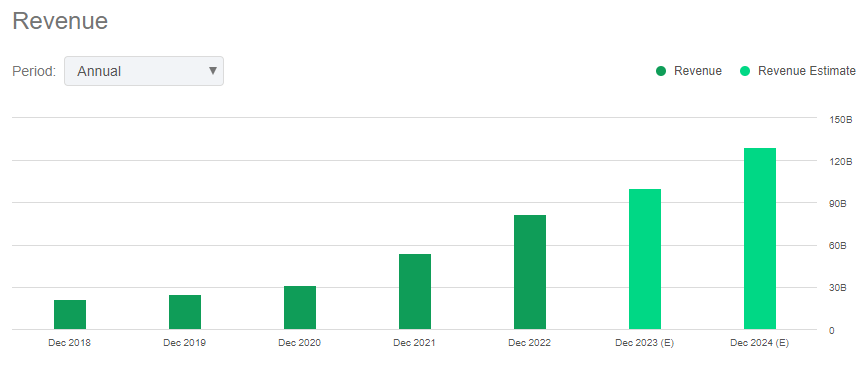

Tesla Revenue with 2023 and 2024 Estimates (Seeking Alpha)

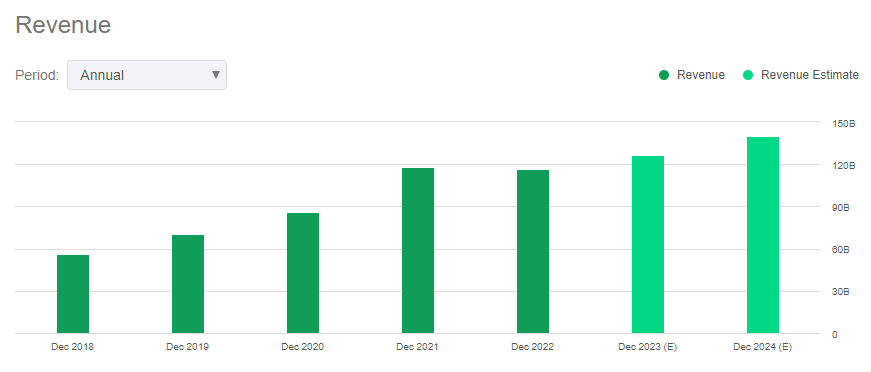

The metaverse I am not as keen on. Meta’s revenue growth projections are projected to be quite lower than Tesla’s and with such huge R&D expenses, less of that will be available to reward shareholders. While traditional automakers will take some market share from Tesla, its superior technology should help protect its position. The technology on the social media landscape, however, does not have the barriers to entry that automotive does, and TikTok’s popularity with the younger demographic makes me wary of an investment in Meta.

Meta Revenue with 2023 and 2024 Estimates (Seeking Alpha)

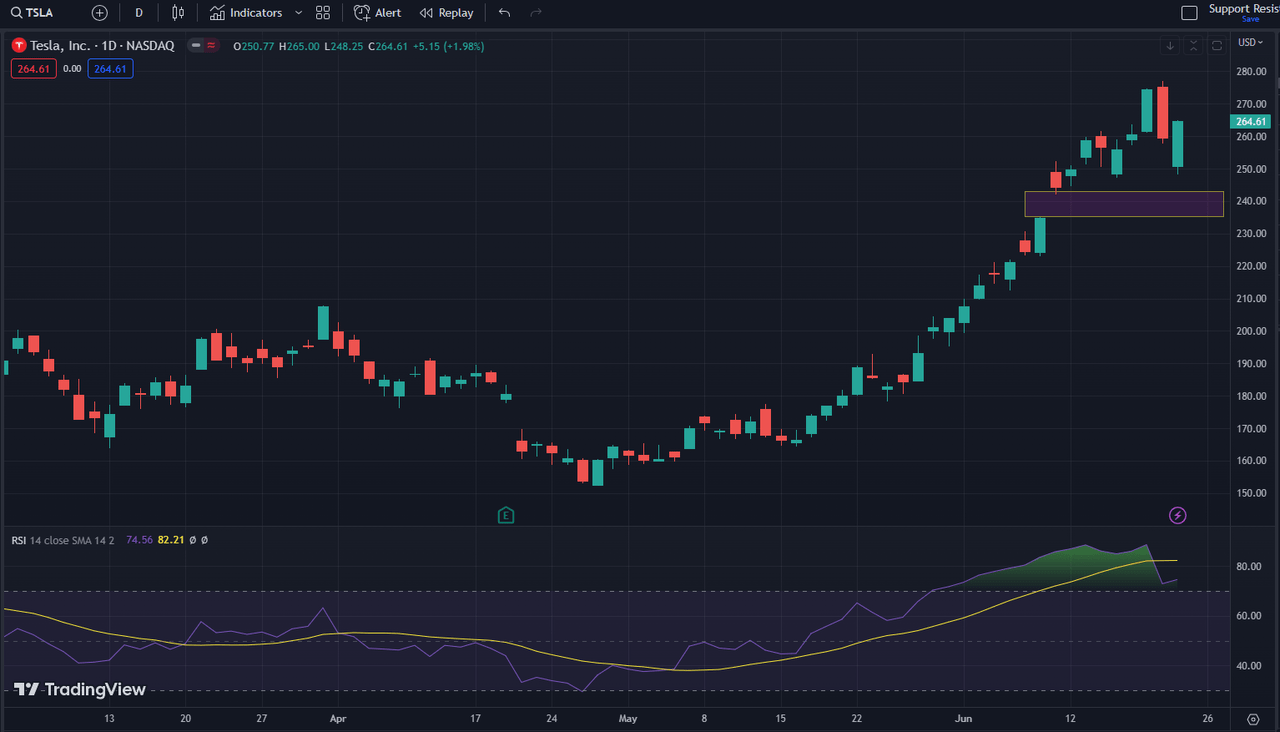

While valuation and recent per share performance are on Meta’s side, the barriers to entry on the EV landscape and strong projected EV sales growth make Tesla a clear winner. The valuation does remain quite elevated, though, so my trade idea will have to include some downside protection. Markets love to fill gaps, and this $240 area shown below seems to be a possible collection point for Tesla’s price action.

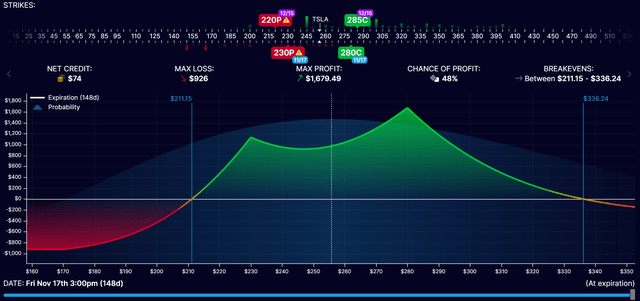

I like a creative trade since Tesla options are highly expensive, which makes me lean to a double diagonal slanting to the bullish side by moving the long-put strike out further from the short put to give some downside protection while also preserving a positive delta and theta value. This slant does make the position more sensitive to implied volatility, as a volatility drop will hurt it, but Tesla’s history shows that preserving volatility should not be an issue.

Trade Idea

Buy to Open $220 Put and $285 Call, December Expiration.

Sell to Open $230 Put and $280 Call November Expiration.

Protecting against theta decay is a key component of any options strategy, and selling the closer dated options helps alleviate that. Something of very important note, though, is these options have large bid-ask spreads which will lead to higher cost to enter a position and lower than expected credit to exit the position, so keep that in mind when formulating any risk management plan. The downside protection mentioned will also only manifest later in the options life cycle closer to expiration, so a sharp move down in the coming weeks will lead to the position being at a loss. Options are complicated instruments and the calculators have their limitations, but can still be a great way to leverage small price movements with a controlled risk by balancing out your short and long positions.

Conclusion

While the idea of a cage match between Mark Zuckerberg and Elon Musk may be intriguing, it's important to shift our focus back to their companies, Meta and Tesla, for investment considerations. Both have experienced significant stock growth, but Tesla's position in the expanding electric vehicle market, coupled with its superior technology and strong projected growth, makes it a more favorable investment option. Despite regulatory challenges, Tesla's brand recognition and market dominance provide a solid foundation for future success. On the other hand, Meta faces competition, data privacy concerns, and uncertain revenue growth in its metaverse-focused endeavors.

While both companies have their strengths and challenges, Tesla's potential for market share growth in the EV industry and its technological edge make it the clearer choice for investors.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)