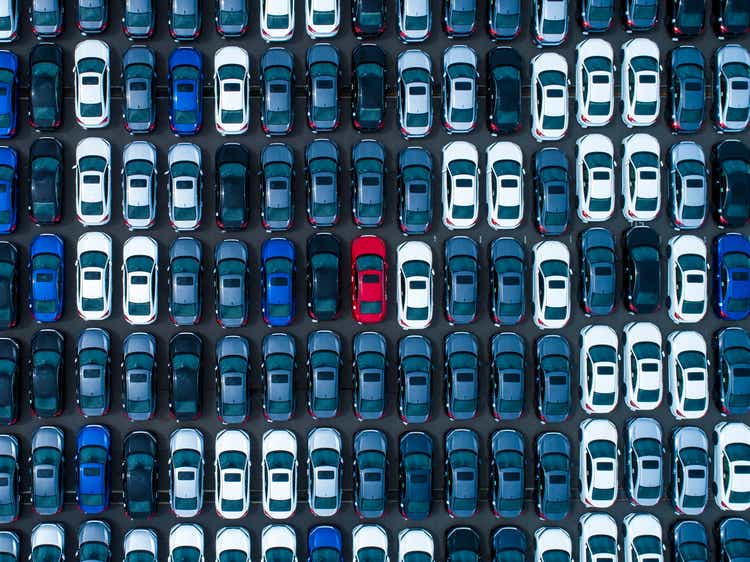

Lithia Motors: A Promising Future Anchored On Acquisitions

Summary

- Lithia Motors has seen solid growth due to its acquisitions and expansion strategy, including the recent purchase of 13 car dealerships and expansion into Atlanta.

- The company's earnings per share have grown exponentially, with a 57% annual growth rate over the last three years, and its valuation appears to be at a discount compared to industry peers.

- Despite the positive outlook, investors should be aware of risks such as dependence on automotive manufacturers, sudden changes in consumer preferences, and operational challenges.

Michael H

Investment Thesis

Lithia Motors, Inc. (NYSE:LAD) is a North American automotive reseller that sells vehicles from various worldwide automakers. The company offers a comprehensive range of financing, leasing, repair, and maintenance services. Over the last year, the company’s shares gained about 6%, which maintained LAD stock's upward trajectory over the last five years, translating to a total return of about 175%.

I attribute the company’s solid performance to its acquisitions and expansion strategy, resulting in improved financial performance. With the company still executing this strategy with expansion to the US in Atlanta and buying 13 car dealerships, I am optimistic about the company’s future financial strength.

US Expansion

LAD announced the acquisition of Wade Ford in Smyrna, Georgia, expanding its Southeast Region footprint and adding an anticipated $285 million in annualized revenue. The Wade Ford acquisition is expected to raise Lithia & Driveway’s total year-to-date estimated annualized revenue acquired to $3.5 billion, up from $17.5 billion since announcing its 2025 sales goal of $50 billion. LAD has completed 70% of its $25 billion network development target for the 2025 Plan. The transaction was funded with existing on-balance-sheet capacity.

Given Georgia’s suitability in the automotive business, I feel this acquisition is a good choice. Georgia is a regional hub for trade, logistics, and global investments for markets east and west, making it an ideal nearshoring site for car manufacturing. Georgia has a well-connected location in the middle of Eurasia, with contemporary infrastructure and an expanding transportation system, and it offers numerous transit options for supply chain diversification. Georgia is the quickest route from Europe to China and Asia, and modern train routes require only 8-10 days to complete the voyage.

It has free trade agreements with the European Union, China, Turkey, Ukraine, EFTA, and CIS countries, obtaining tariff-free access to markets with a combined population of 2.3 billion people, putting Georgian automotive industry at the heart of critical global value chains. It is the only country in the region with such access to both the European Union and China, creating the unique potential for foreign enterprises seeking to enter these markets.

Further, another factor which makes the region suitable is its lowest utility costs. Up to 80% of power is generated by hydro and wind power plants, resulting in cleaner and less expensive energy. 1 kWh of high voltage power costs approximately 6.6 USD cents, which is one of the lowest rates among competitor countries. This adds to other key benefits of expanding to Georgia.

fDi Benchmark from the Financial Times Ltd 202

13 Car Dealerships Bought: Still On An Acquisition Binge

LAD purchased 13 vehicle dealerships in Virginia from Priority Automotive Group in order to extend its presence in the flourishing Mid-Atlantic region. The transaction expands the American automotive retailer’s portfolio by adding three Honda, two Chevrolet, two Toyota, one Ford, and one Hyundai stores, as well as a few small outlets. These dealerships are expected to bring in more than $1.2 billion in annual revenues.

With this deal, Lithia has increased its annualized revenues by more than $3.2 billion, laying the groundwork for another strong year of acquisition growth. The business brought in more over $3.5 billion in annualized revenue last year. Currently, Lithia is on an acquisition binge. It acquired Jardine Motors Group in March 2023 in order to benefit from the latter’s solid track record and dominant market position in the United Kingdom. Revenues from Jardine are projected to reach $2 billion annually.

Due to its diverse product mix and multiple revenue streams, Lithia has a lower risk profile and is better positioned for long-term top- and bottom-line development. The company estimates it is well positioned to deliver $50 billion in revenues and $55–$60 in earnings per share by 2025, notwithstanding current macroeconomic headwinds and industry constraints, which I believe is feasible given its progressive acquisitions in prime markets.

The EPS Trend

Share prices should eventually follow up with earnings per share [EPS], as the market functions as a voting mechanism in the near term but as a weighing machine in the long term. As a result, EPS growth is an appealing attribute for every company. Lithia Motors stockholders have something to be pleased about the annual EPS growth of 57% over the last three years. That kind of growth may be transitory, but it should be enough to excite the interest of shrewd stock buyers.

Examining a company’s revenue and EBIT margin trends might help validate its growth. Lithia Motors kept its EBIT margins stable throughout the past year, even as its revenue increased by 23% to US$28 billion. That’s good progress. Earnings per share at Lithia Motors have been skyrocketing, with exponential growth rates. That kind of development, in my view, is nothing less than astounding.

Valuation

The stock price appears justified, at least based on my multiple-price model, which compares the company’s price-to-earnings ratio to the industry medians. Here, I’ve used a PE ratio. If you were to buy LAD right now, I think you would be paying a reasonable price because its ratio of 6.84x is selling at a discount to the sector median ratio of 16.71x.

If you believe its share price should be in this range, there isn’t much room for it to grow above the levels of other companies in the same industry over the long run. However, there might be a chance to purchase in the future. This is due to its high beta of 1.02, which indicates that its price fluctuations will be disproportionate to those of the rest of the market. In a bearish market, the company’s shares will probably decline more than the market, creating an excellent purchasing opportunity.

When considering whether to purchase a company, the future outlook is crucial, particularly if you’re an investor trying to expand your portfolio. Let’s also look at the firm’s projections for the future since investing in a terrific company with a strong outlook at a low price is always a wise decision. In the coming years, its earnings growth is anticipated to be in the teens, pointing to a bright future. Strong cash flows should result from this, raising share value.

Given these possibilities, I think the optimistic trend is more likely than the pessimistic one, especially considering the company’s ongoing growth and acquisitions. As a result, investors should buy at the current price to take advantage of the upside potential inherent in its growth strategies.

Risks

Like any investment, LAD carries risks, some of which are outlined below:

- Dependence on automotive manufacturers: Lithia Motors relies on its relationships with automotive manufacturers to obtain dealership franchises and competitive pricing for its vehicle inventory. Any strain in these relationships or changes in manufacturers’ policies can have an adverse impact on its operations.

- Sudden changes in consumer preferences: Shifts in consumer preferences towards electric vehicles, ride-sharing, or other alternative modes of transportation could pose a risk to LAD’s traditional dealership model. Failure to adapt to changing consumer demands may impact the company’s sales and profitability.

- Operational risks: The company operates a network of dealerships across multiple locations, which presents operational challenges. These include inventory management, maintaining quality customer service consistently, and hiring and retaining skilled personnel. Failure to address these operational risks effectively can affect its performance.

My Take

Given the information presented in this research, I believe LAD stock is an excellent investment, bolstered by solid growth levers such as strategic acquisitions and expansion. From a relative valuation standpoint, the company appears to be selling at a discount, which I think is a fantastic entry point for investors. However, investors should be mindful of the risks associated with investing in this stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article was researched and written by January Mbuvi of Fade The Market.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.