Kura Sushi: Momentum Gone

Summary

- Kura Sushi's revenue growth is decelerating, and profitability metrics have not improved significantly despite aggressive increases.

- The company failed to significantly improve its margins, while the revenue grew threefold over the past five years.

- The stock's valuation appears unattractive, leading to a "Hold" rating.

Olasz Laszlo/iStock via Getty Images

Investment thesis

Kura Sushi USA (NASDAQ:KRUS) demonstrated a solid revenue growth recovery after the pandemic-related restrictions. This has led to a massive stock price appreciation, but my analysis suggests that the momentum is likely gone. Profitability ratios did not expand much, despite very aggressive revenue growth. The company's growth is heavily dependent on debt financing, which means the growth profile is highly likely to suffer under the current challenging macro conditions. And the next quarter's earnings are expected to decelerate notably, which is evidence of headwinds in action. Last but not least, the valuation looks very unattractive, according to my analysis. Therefore, I am not investing and assign the stock a "Hold" rating.

Company information

KRUS is headquartered in Irvine, California, and was established in 2008 as a subsidiary of Kura Sushi, Inc., a Japan-based revolving sushi chain with over 500 restaurants. KRUS opened its first restaurant in 2009. According to the latest 10-K report, KRUS operates more than 40 restaurants across twelve states and Washington, DC.

The company's fiscal year ends on August 31 and comprises a single reporting segment. All of the sales are derived in the U.S.

Financials

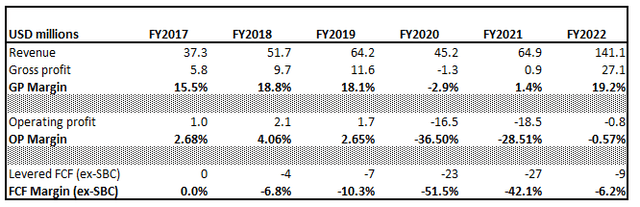

The company went public in 2019, so we have a relatively short time horizon for long-term financial analysis. Over the past six years, KRUS demonstrated a stellar 30% revenue CAGR. The company suffered during the 2020-2021 COVID-related restrictions, but the growth recovered in FY 2022. I don't like that profitability metrics did not expand much since FY 2017 despite the significant growth of a business scale. The company did not achieve a positive levered free cash flow (FCF) margin yet.

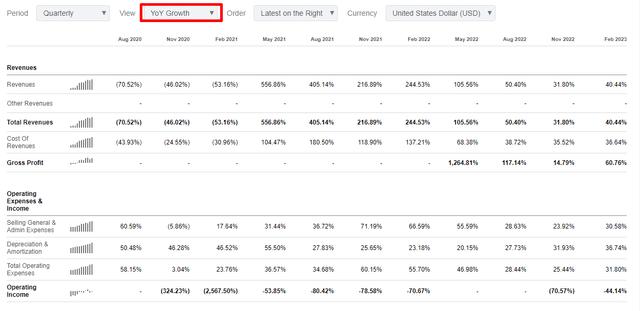

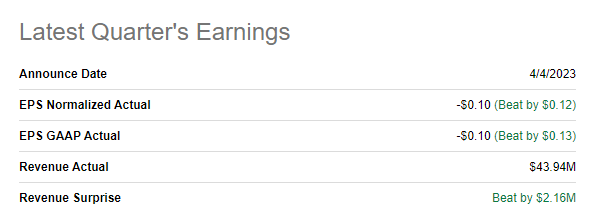

Now let me narrow down my financial analysis to a quarterly level. The latest earnings were released on April 4, and the company delivered above-consensus results. Revenue demonstrated an impressive 40% YoY growth, and EPS also improved notably, from -$0.19 to -$0.10.

Seeking Alpha

A 40% YoY revenue growth is very impressive, but I would like to add more context here. First, massive revenue growth shows signs of deceleration, meaning the momentum is weakening. By the way, consensus estimates forecast the upcoming quarter's revenue at $49.6 million, meaning about 30% YoY growth. It is a substantial growth deceleration compared to the previous quarters. Second, expenses lag behind revenue growth, but the gap is narrow, meaning margins are expanding slowly. Substantially decelerating revenue growth and slow margin expansion is not a good sign for me.

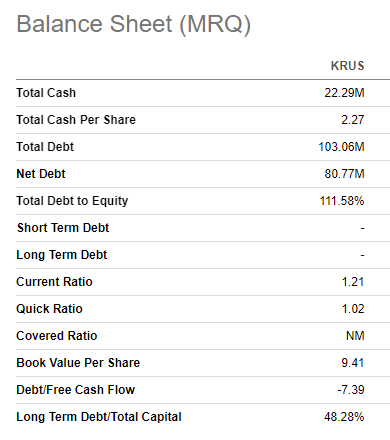

The company fuels its growth with debt, and that is the reason why I cannot say that the balance sheet is robust. I could have ignored the high leverage ratio if the business was highly profitable, but with a below 20% gross margin, I cannot say that high debt level is okay. On the other hand, liquidity metrics look decent.

Seeking Alpha

Overall, Kura's financial performance looks unstable, and it is not good for a company with such high financial leverage. I don't like that the company did not efficiently use strong revenue growth momentum to improve profitability metrics significantly. We see that the revenue growth is likely to decelerate in the upcoming quarters, and it will be more challenging to expand margins with a lower growth pace.

Valuation

The stock delivered a massive 88% rally year-to-date, which is significant outperformance of the broad market. Seeking Alpha Quant assigned KRUS almost the lowest possible "D-" grade due to high valuation ratios compared to the sector median.

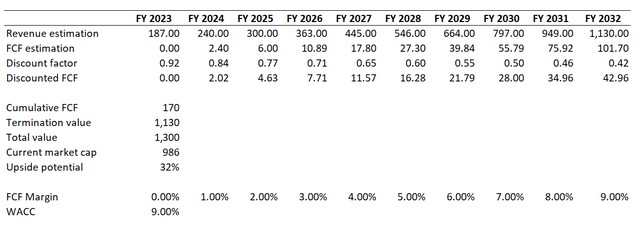

The company does not pay dividends, so the only reliable way to cross-check multiples analysis is the discounted cash flow (DCF) approach. ValueInvesting.io projects the company's WACC at just above 7%. I think it is too loose because the level of uncertainty is high and the company still did not reach sustainable profitability. Therefore, I prefer to use a 9% WACC. I have consensus revenue estimates for the next decade, expecting revenue to compound at about 22% CAGR. This also looks too optimistic, so I will simulate two different scenarios. For the FCF margin, I expect it to become positive in FY 2024 and to expand by one percentage point yearly.

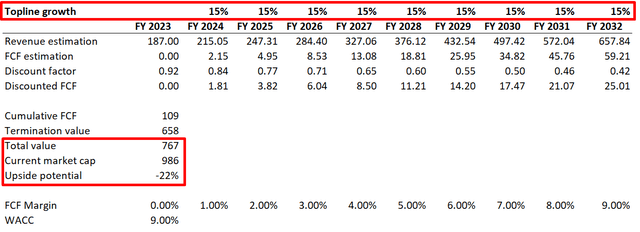

As you can see above, the stock is significantly undervalued. At the same time, I consider a 22% revenue CAGR over the decade as too optimistic. Let me simulate a 15% yearly revenue growth pace with other assumptions remaining unchanged.

I want to emphasize that a 15% long-term revenue CAGR is still very optimistic, meaning the topline will increase more than threefold over the decade. But, even with such an aggressive revenue growth assumption, the stock looks about 20% overvalued. The second scenario is more likely to unfold, in my opinion. Therefore, I consider KRUS's valuation unattractive.

Risks to consider

The company's business is cyclical, and the health of the broad economy significantly affects earnings. Weakness in the economy will lead to softening demand for discretionary spending like dining out, adversely affecting the company's financial performance. The recession in the U.S. is probable, and this is the most significant risk I see now for KRUS. The company's low gross margin and negative FCF margin mean the business might not be strong enough to weather the storm if the recession lasts for several quarters. On the other hand, KRUS endured during the 2020 recession, but it was short and lasted only a few months.

Kura's significant reliance on debt financing to fuel growth can also be a problem amid a looming credit crunch in the U.S. Several American banks seized operations during the past couple of months, and the Fed recently warned that this banking turmoil might lead to a credit crunch. With more difficult access to debt financing, Kura will have fewer options to fuel revenue growth. Rising interest rates are also not good for the company since it is much more expensive to fuel growth than two years ago.

Bottom line

I am not investing in KURA and give it a neutral rating. The revenue growth profile looks impressive, but we cannot ignore that the growth is decelerating rapidly, and momentum seems to be gone. Also, expenses are growing fast, so the company cannot improve profitability metrics as the business scales up significantly. The current harsh environment of a looming credit crunch and a probable recession will highly likely severely undermine the revenue growth prospects. Moreover, the valuation looks unattractive even with aggressive growth projections.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)