Costamare: Buying A Dollar For 50 Cents

Summary

- Costamare is selling for a P/E multiple of 2.03 and P/B of 0.49.

- Growth potential with strengthening market and dry bulk segment.

- Strong profitable company with a strong recovering dividend.

- Risks from low order book and underwhelming dry bulk market.

AlbertPego/iStock via Getty Images

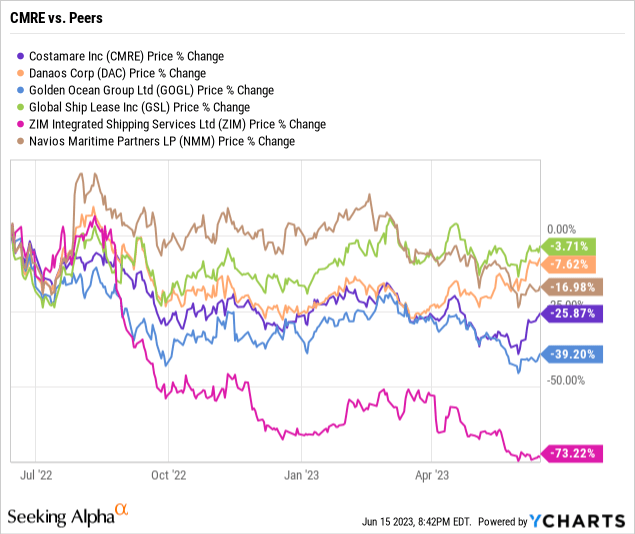

Costamare Inc. (NYSE:CMRE) now sells for only half of its tangible value and has reached a value low enough to enter into a position. I entered at an average price of $9.26 on June 13th. Each share is worth $18.47 in tangible assets, yet the stock is now selling for just over $9. As Benjamin Graham states in his book The Intelligent Investor, "the stock market is a popularity contest in the short term, but a very accurate weighing scale in the long term." Costamare is in no means a high-growth or popular stock due to its sector, but has been lagging its peers over the last year despite having similar or better revenue growth rates.

Buying Opportunity

CMRE is down 26% over the last year and still about a dollar cheaper than pre-Covid prices.

According to Benjamin Graham's value investing strategy, in order to find value in common stocks, they must be selling at a low multiple in relation to earnings. For example, 15 is the maximum P/E ratio Graham would recommend buying. He also restricts the P/B ratio to 1.5. The only exception to a stock not satisfying both criteria is if the P/E multiplied by the P/B is less than 22.5.

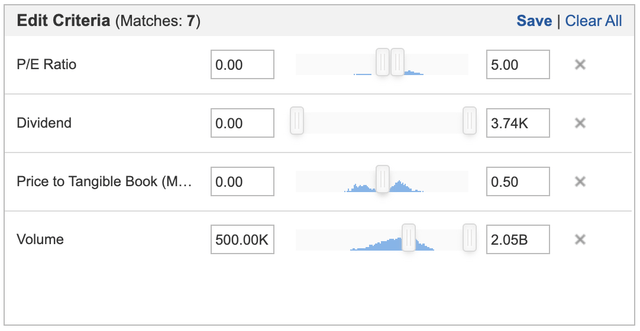

Costamare satisfies both criteria by having a P/E of 2.03 and P/B of 0.49 both of which are 80-90% lower than the sector median according to Seeking Alpha. Using the simple stock screener, CMRE is one of 7 companies remaining.

P/E, Dividend, P/B Stock Screener (Investing.com Stock Screener)

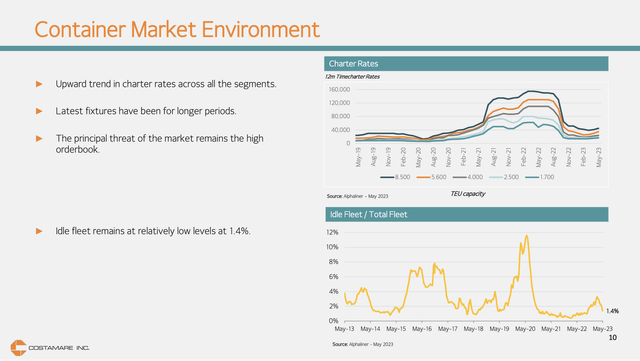

Costamare just completed their first full operational quarter of Costamare Bulkers which is their new dry bulk company. They entered into 60 new chartering agreements since Q4, resulting in 98% and 86% of their fleet fixed for 2023 and 2024 (Costamare Q1 2023 Earnings Presentation). Their new dry bulk company shows potential for growth in the coming quarter as charter prices continue to increase as demand remains high along with longer fixture periods.

Container Market Environment (Costamare's Q1 2023 Earnings Presentation)

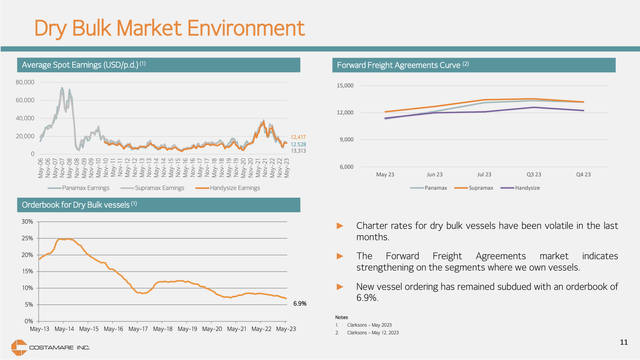

Dry Bulk Market Growth Opportunities

As stated before, one of the recent highlights for Costamare was completing the first full quarter with their new dry bulk operating company. According to Costamare's Q1 Earnings Report, "the Forward Freight Agreements market indicates strengthening on the segments where we own vessels" (Costamare Q1 2023 Earnings Presentation). Adding this new revenue stream and business segment should provide ample growth opportunities as the charter rates show signs of strength and hope of a rising orderbook up from the current 6.9%.

Costamare's Dry Bulk Market (Costamare's Q1 2023 Earnings Presentation)

Along with increasing charter rates, the idle fleet remains at low levels at 1.4%. Costamare has also now contracted revenues for their containership fleet of approximately $3.1 billion with a TEU-weighted duration of 4.1 years (Costamare Q1 2023 Earnings Presentation).

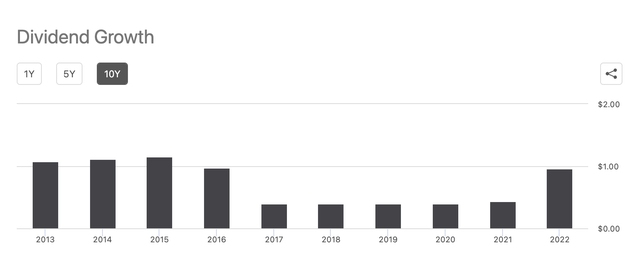

Dividend Growth

Costamare paid out their regular Q1 2023 dividend of $0.115 per share on May 5, 2023, marking 50 consecutive quarterly common dividends since their IPO. The one catch is the dividend is still down from 2016 levels but has been slowly increasing over the last two years, including a special $0.50 dividend paid out in April 2021.

Costamare's Dividend History (Seeking Alpha)

$145 million reinvested by the sponsor family through the Dividend Reinvestment Plan to date along with ample liquidity of over $1 billion signaling strength and potential growth with hopes of getting back to 2015/16 levels of over $1.00 annually.

Investment Risks

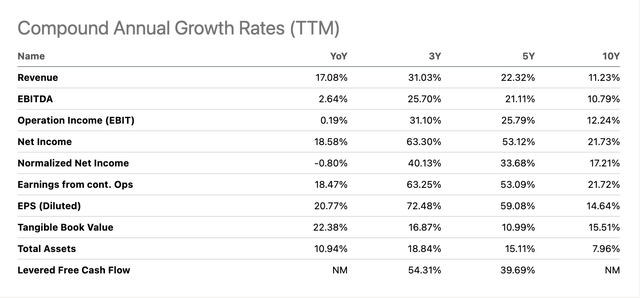

Costamare doesn't come without risks as they've stalled in growth over the last year with actually a negative Normalized Net Income and flat EBITDA YoY.

Costamare's Growth Rates (Seeking Alpha)

According to Costamare's CFO Gregory Zikos, "The orderbook remains the principal threat to the market." But as mentioned several times now, he reinforced that "charter rates are on a rising trend with high demand across the board, while fixture periods are increasing in duration." There is some hope as the total orderbook of the four main components of the merchant fleet has increased by about 160 vessels (6.5%) compared to the end of the first quarter of 2022 with Dry Bulk increasing by 19% (Hellenic Shipping News). Costamare's overall results were "impacted by the softer dry bulk environment … [but] the container segment remains robust, more than offsetting losses from the dry bulk segments" (Freight Waves). Costamare's recent investment in Dry Bulk could also be a huge risk moving forward if the tides don't shift in their favor as Forward Freight Agreements predict.

Overall Verdict: Buy And Hold

Costamare shows some promise as a value pick by having a P/E of 2.03 and P/B of 0.49 both of which are 80-90% lower than the sector showing upside. Any correction towards the sector P/E would ensure gains from our investment, with the added benefit of a respectable dividend. While there is some upside with CMRE, I'm calling this a buy and hold until the stock recovers to past highs and will likely sell around the 2022 high of $17.45. Despite the uncertain market conditions and potential slow growth rates, I am long on CMRE, and I entered a position at $9.26 on June 13th, 2023.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMRE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.