Sphere Entertainment Spinoff Creating A Value Opportunity

Summary

- Undervalued Gem: Sphere presents a compelling investment opportunity as a spin-off from Madison Square Gardens, potentially overlooking its true worth.

- Revolutionary Entertainment Venue: The $2.3b Sphere, located in the heart of Las Vegas, is set to become a world-class iconic attraction.

- Discount on Price: Sphere is apparently selling for a 56% discount based even on the initial cost of production. The current projected cost is $2.3b.

- Risks involve the ownership of the Dolan family, potential allocation of funds to London’s projects & potential reluctance on foreclosure of MSGN if it came to that.

- Catalysts include the venue's opening, upcoming first standalone earnings & potential debt repayments.

sanfel/iStock Editorial via Getty Images

Investment Thesis

In the fast-paced world of investing, it is always exciting to discover a compelling opportunity that holds considerable upside potential. As value investors, our goal is to uncover hidden gems as the market may be overlooking their true worth, leading to an undervaluation. Today, we shift our focus to an exciting investment opportunity, Sphere Entertainment Co. (NYSE:SPHR), the result of a spin-off of renowned Madison Square Garden.

Our investment thesis rests on the fact that the Sphere, a 2.3b project, is currently priced significantly low. We are confident that the required earnings to validate the current market valuation of SPHR stock can easily be exceeded in the future, making this project a lucrative opportunity with substantial returns in the future.

Project Overview

Sphere is an entertainment venue, a wonder of technology, and is being built in Las Vegas. It's called MSG Sphere, at least for now. We expect a naming rights deal at some point.

The $2.3 billion venue is unlike anything the world has ever seen, and it's scheduled to open by coming September.

Located in the heart of the Las Vegas Strip, adjacent to the Venetian Expo, the MSG Sphere has the potential to become a long-standing central attraction for the city. To enhance connectivity, a pedestrian bridge measuring 1,000 feet will link the Sphere to the Venetian Expo.

The Sphere stands at an impressive height of 366 feet and has a maximum width of 516 feet. The venue is expected to have a seating capacity of 17,000-18,000 and a standing capacity of almost 20,000.

The Sphere will have the world's highest resolution screen, with an incredible 19,000 by 13,500 pixels. Just to give an idea, the screen itself covers an area of three football fields.

The exterior of the Sphere will consist of 600,000 square feet of programmable lighting, which will be a sight to behold.

The venue will employ an innovative acoustic system using "beamforming" technology, incorporating 157,000 ultra-directional speakers. An infrasound haptic system will be featured in the Sphere, allowing audiences to physically feel the sound.

It is designed to host a range of events, both first and third-party. SPHR is expected to host concerts, boxing, MMA fights, movie events, and sports tournaments, etc. Sphere promises to be one of the most iconic venues and tourist attractions in Las Vegas and will even be seen from flights landing in the city.

Analysis

To understand the calculations, we first need to understand the structure of the company before and after the spinoff. The original company, MSG, had broadly four types of assets/businesses:

- Madison Square Garden

- Sphere construction project

- Madison Square Garden Networks

- Tao Group.

Madison Square Garden was spun off with the original company retaining the other three assets and 33% of the spin-off company i.e., MSGE (Madison Square Garden Entertainment).

So, Sphere Entertainment Co. - SPHR (The remaining company) - was composed of three assets: Sphere, MSG Networks, and Tao GROUP. As well as a 33% interest in Madison Square Garden Entertainment Corp. (MSGE).

One development worth noting is the sale of Tao Group post-spinoff where SPHR is expected to receive a net of $300 million.

The sale of Tao Group leaves us with primarily two assets, Sphere and Madison Square Garden Network (MSGN).

First, we would like to discuss MSGN. This is the legacy regional cable and satellite television network and radio service. It consists of MSG Networks and MSG Sportsnet, as well as MSGNetworks.com and MSG GO, a live streaming service.

For Q1 ending 2023, MSGN's revenue was $161m compared to revenue of $167m in the same quarter last year, a decrease of just 3.65%, which doesn't look that bad.

However, when we look at the operating income (OI), it's a different story. OI for Q1 '23 was $10.4m compared to an OI of $46m in the same quarter last year, a decrease of a whopping 77.4%. This decrease is primarily driven by the spike in SG&M, which highlights how tough it has been for MSGN to sell its services. This highlights a likely downfall in the legacy networks business.

MSGN has a net loan of $869m, which is due to mature in 2024. We expect a refinancing of this loan by then but even with the refinancing, it seems very tough for MSGN to pay back its loans.

It is important to highlight here that the loan on MSGN is a non-recourse loan which means the debtholders will only have a claim on MSGN and not the entire group. The worst-case scenario and the one we must draw in the name of conservatism is to assume that the MSGN will be worth zero.

Coming to Sphere, given the complexities surrounding the spin-off, an asset valuation presents a buying opportunity, buying the Sphere asset (built at a cost of $2.3 billion) close to $575 million. This might seem questionable, yet market dynamics can occasionally create such scenarios.

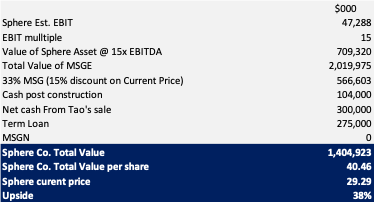

Our calculation methodology takes into account that Sphere holds a 33% stake in MSGE worth north of $566 million at a discount of 15% on current prices. To determine the adjusted price of Sphere, we subtract this holding from Sphere's overall market capitalization. Additionally, we incorporate a conservative estimate by adding $104 million in cash, considering that approximately $100 million goes to further construction expenses. Furthermore, we consider the anticipated net cash from the sale of Tao and deduct the outstanding term loan as part of our calculation. We get a price of around $574m which translates into a per-share price of $16.55. I must stress the fact that even the initial forecasted cost of Sphere was $1.3b, providing us with a remarkable discount at current prices.

Moat Investing

Considering the uniqueness of the project, we expect the company to trade at elevated multiples, and for that reason, we will be using a 15x EBIT multiple. At 15x multiples, the market is factoring in an EBIT of just $38m.

To build an understanding of just how low this EBIT is, we would highlight that the naming rights deal that the Dolan family is looking for is in the region of $50m per year. Naming rights are not just sold for the Arena but also for lounges inside the buildings.

Although we won't be using this full $50m in our earnings estimates but I would point out that the non-arena naming rights that JPMorgan acquired in Madison Square Garden were worth $30m a year when the deal was signed in 2010.

Arena naming rights are always worth more than non-arena naming rights and since the Dolan Family is openly looking to sell the arena naming rights of Sphere, this highlights the earnings potential of Sphere and just how unrealistic the $38m EBIT, which the market is factoring in the valuation of SPHR.

We realize that building the earnings projections of Sphere at this stage is nothing short of just assumptions and estimates, but one can easily understand the earnings potential by merely looking at how quickly they have been able to sell the tickets for the opening shows, the naming rights deals and the advertisement potential of Sphere since the outside will be fully covered with electronic displays. For the purpose of earnings, we will conservatively rely on the sell-side estimates of earnings.

The sell side is estimating an EBIT of $59.11m for YE '24. We believe this figure is already very conservative and accounts for the uncertainty and the discount for no earnings history, but we will still discount this by 20% just to prove our point of how cheap the Sphere is.

In this case, the value of Sphere could be $47mil EBIT @ 15x multiple, equal to $709 million.

Moat Investing

Indeed, the initial EBIT assumption of $47 million is conservative, especially when considering the scale and potential of the Sphere project. Given the Sphere's substantial initial budget of $1.3 billion, one would expect a target yield of at least 5 to 6% to justify such an investment, which translates to an EBIT in the ballpark of $65 to $78 million.

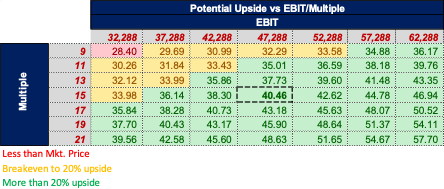

So, to our point, even a conservative EBIT of $47m gives a potential upside of 38% valuing Sphere at just $709m which is 45% less than even the initial expected cost of $1.3b. The sensitivity table below is very important to look at to understand the range of stock prices based on different EBIT and multiples.

Moat Investing

Catalysts

One of the catalysts driving our investment is the opening of the venue by the end of September, this opening will help to shed the pessimistic view of the project as everyone would be able to realize just how big of a project this is and what kind of impacts this can have in the entertainment industry. We believe that the opening will help reduce the elevated short interest on the company.

Another catalyst to consider here is the earnings on 16th August. This report will mark the first standalone financial disclosure of Sphere. We expect this will address the confusion regarding the financials of SPHR.

Furthermore, future catalysts may arise from debt repayments and potential capital returns to shareholders. Once Sphere is operational and generating cash flows, these factors could contribute to positive developments.

Risks

Understanding the forces at play behind the scenes requires an examination of the Dolan family. The Dolans have long held controlling interests in numerous companies, including MSGE, which owns iconic properties such as Madison Square Garden. Family patriarch Charles Dolan founded Cablevision, which was later sold to Altice, as well as HBO. His son, James Dolan, has played a significant role in managing Cablevision, MSGE, and sports franchises such as the New York Knicks and the New York Rangers.

For us, one of the risks is the ownership and controlling stake of the Dolan family in Sphere. Historically, the Dolan family has shown a tendency to prioritize their own interests over minority shareholders.

Recently, the Dolan family reached a settlement of $85m for a case dating back to 2021 involving the merger of MSG and MSGN. The plaintiffs accused the family of engineering the merger, overpaying for MSGN, diluting the value of MSGE's public stockholders, and advancing their own interests by increasing their voting rights.

In Fiscal Year 2019, Dolan received a total compensation of $54.1 million, making him the highest-paid CEO in the media sector, according to research conducted by S&P Global Market Intelligence. $49.9 million of that compensation comprised stock and option awards. In March 2019, a lawsuit was filed in the Delaware Court of Chancery, alleging that the MSG board has violated its fiduciary duties to stockholders by approving Dolan's compensation. In June 2020, the company reached a settlement with the plaintiffs and Dolan agreed to relinquish the additional one-time stock awards in MSG Sports (MSGS) and MSG Entertainment.

Another aspect to consider here is the anticipated project in London, as value investors, we prioritize the return of capital to shareholders in the forms of dividends and stock buybacks especially if the capex on growth is considered highly risky. However, with Sphere, there is a risk that the cash flows generated from the Vegas site might be directed toward the development of Sphere in London. Not only is this an inherently risky allocation of capital but it is also, in our view, a damaging business decision due to the vast cultural differences between Las Vegas and London.

London serves as a prominent global business hub with a distinct professional culture, where evenings tend to be quieter. British community has already raised concerns regarding the potential night-time brightness of Sphere. Subsequently, we believe that utilizing cash flow to pursue the development of the Sphere in London poses a significant risk.

Moreover, given the Dolan family's past actions, we consider it highly likely that they may repeat a similar pattern in the current circumstances. It is worth remembering that the Dolan family faced lawsuits when they merged with MSGN, with allegations suggesting that the merger was driven by the need to fund the Sphere project.

Another risk is the situation regarding MSGN. Although the loan associated with MSGN is non-recourse, which is the primary reason why we assigned a conservative valuation of zero to it. Our concern lies in the possibility that the Dolan family might be reluctant to let go of the legacy network business. They may take actions that will not align with the best interest of the overall group if it comes to protecting their legacy networks company.

It is also important to highlight a significant increase in the construction cost of Sphere, almost a billion dollars more than initially forecasted. It remains to be seen how much further the costs might escalate.

Conclusion

SPHR represents a compelling investment opportunity for those who recognize its potential and are willing to navigate through the associated risks.

As highlighted in the analysis sections, the price we are paying for the Sphere is basically a 56% discount even on the initial projected cost of the venue and at this price, the earnings fear seems to be oversold. Even with so much discount on EBIT, considering the assets' underlying value, the revolutionary nature of the venue, and the catalysts for value unlocking, the opportunity proves to be worth investing in.

When evaluating the risk-reward profile of investing in SPHR, we find it aligned with our risk appetite. That being said, the theoretical estimation of EBIT stemming from the fact that there is no earnings history, the risks associated with the Dolan family, and the potential long-term operational risk, we should limit our exposure to no more than 3-5% of the portfolio. This will provide a balanced approach to participate in Sphere's potential upside while mitigating downside risk. In conclusion, it is important to reiterate that this investment is primarily focused on the potential value of the underlying asset, with uncertain earnings at present.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)