Conagra: Our Investment Thesis Became Less Bullish, Rating Downgrade

Summary

- Conagra Brands' profitability and efficiency metrics show room for improvement. We would like to see both the net profit margin further expanding and the asset turnover further improving.

- The company's leverage has been gradually declining, which is a positive in the current high-interest rate environment, but in terms of liquidity CAG lags its peers.

- Despite mixed valuation multiples, Conagra Brands remains an attractive holding in a dividend and dividend growth portfolio, but the stock is downgraded to "hold" from "buy.".

Pgiam/E+ via Getty Images

Conagra Brands, Inc. (NYSE:CAG), together with its subsidiaries, operates as a consumer packaged goods food company in North America. The company operates in four segments: Grocery & Snacks, Refrigerated & Frozen, International, and Foodservice.

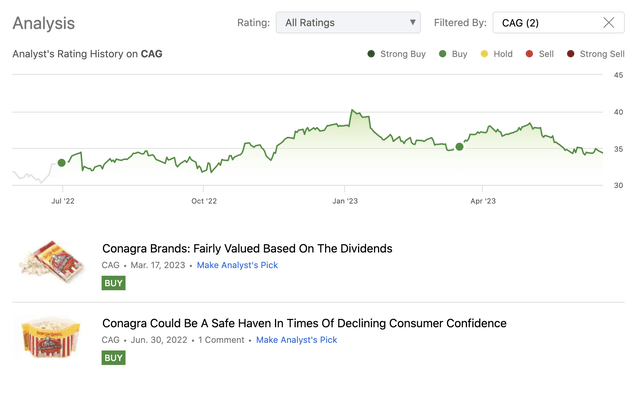

So far, we have published two articles about the company on Seeking Alpha, rating CAG stock as "buy" both times.

Over this time frame, despite some mild fluctuations, the stock price remained relatively flat, resulting in a roughly 10% underperformance, compared to the broader market.

Today, instead of focusing on the valuation and on the macroeconomic environment, we will be focusing on company specific metrics, and their development over time, that are used to measure the firm's profitability and efficiency. These metrics include the net profit margin, the asset turnover and the equity multiplier. These are essentially the three components that make up for the return on equity.

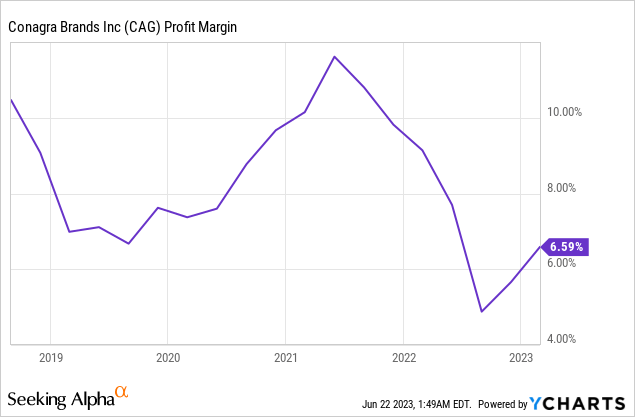

Net profit margin

The net profit margin is a widely used measure of profitability and is the ratio between the net income and revenue. Over the past 5 years, CAG's net profit margin has been varying between 5% to 11%, reaching a peak in 2021 and a low in late 2022.

Since the 2022, profitability has been increasing gradually, but slowly.

In general, we prefer to see a stable or improving profitability over time. The recent change in the trend is definitely a good sign and we would like to see this continue. The potentially improving macroeconomic environment, including moderating inflation levels and moderating energy prices, is likely to have a positive impact on the firm's profit margin in the near term. Pricing action could also help the margin expansion, however the still low levels of consumer confidence may not allow CAG to carry this out without losing customers.

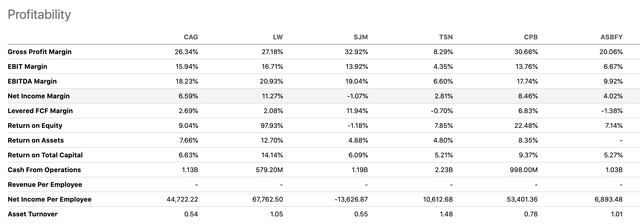

It is also important to put this figure into perspective and see how CAG's competitors and peers are doing in this regard.

CAG's profitability measures, not only the net profit margin, seem to be about in the middle of the range, established by the comparable firms.

All in all, we would like to see the profitability further improving, following the recent trend.

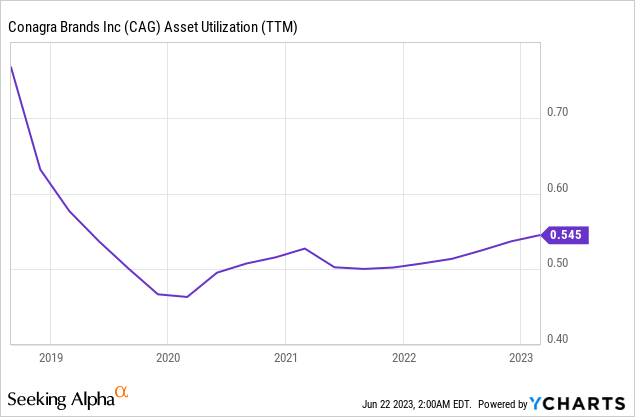

Asset turnover

Asset turnover is a measure of efficiency. It gives an idea about how efficiently the company can use its assets to generate sales. Just like with profitability, we generally like to see stable or increasing efficiency metrics.

Since the lows reached in early 2020, asset turnover has been gradually improving. The previous table shows, however, that this figure is still below those of its peers.

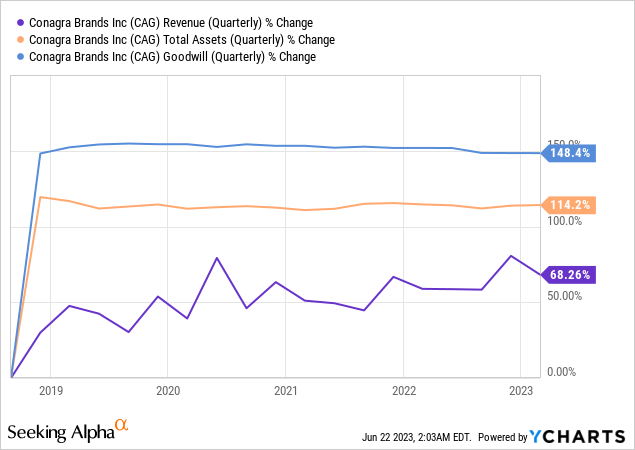

Important to note here that the decline in efficiency has been a result of an acquisition, namely the acquisition of Pinnacle Foods, as indicated by the jump in goodwill, which led to a substantial increase in the total assets.

Also in terms of asset turnover we would like to see the improvement continuing, reaching at least the pre-pandemic level of ~0.7. This would also put CAG in a better position compared with its peers.

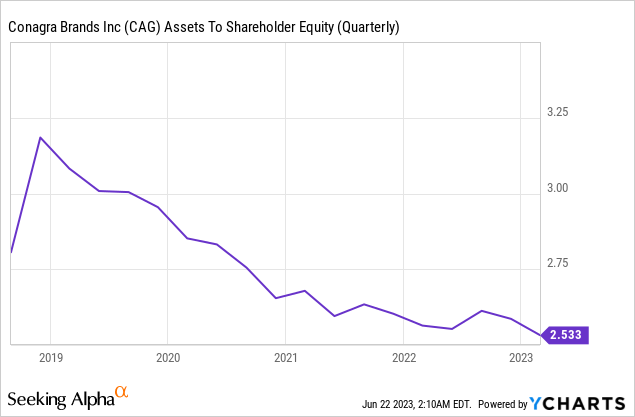

Equity multiplier

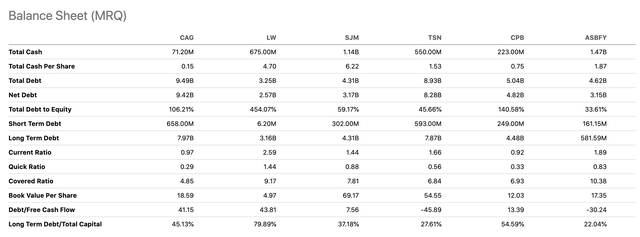

Last, but not least, we need to talk about the leverage of the firm. Since the acquisition of Pinnacle, which has been partially financed by debt, the firm's leverage has been gradually declining. We see this as a clear positive, especially in the current, high interest rate environment.

But once again, when comparing the metrics to CAG's peers, the firm appears to be somewhat less attractive.

Despite all of these firms being approximately the same size, CAG has substantially less cash, and significantly more debt on their balance sheets. Further, from a liquidity point of view, CAG is also lagging its peers. Both the current- and the quick ratio are below 1, indicating that the company's current assets are not enough to cover the current liabilities. Most other companies in our comparison have current ratios above 1, and while their quick ratios are also slightly below 1, they are still much higher than that of CAG's.

Key takeaways

When looking at all three of these metrics, we can conclude that there is room for improvement, both in terms of efficiency and profitability for CAG. But before we could make a recommendation on buying, holding or selling, we have to take a look at the valuation of the company.

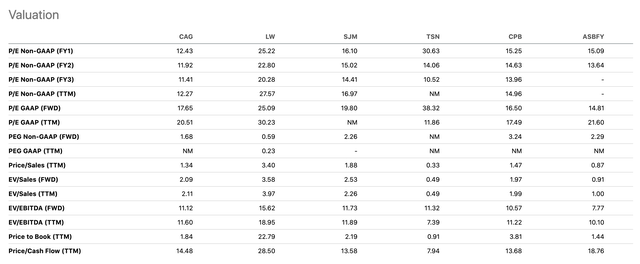

Valuation comparison (Seeking Alpha)

The traditional price multiples are showing a mixed picture. While the firm appears to be undervalued based on the P/E multiples, the P/CF and EV/EBITDA multiple do not support this view. Based on the firm's profitability and efficiency, we would like to see a clear discount compared to the peers, which is not the case.

Does it mean that we are downgrading now to a sell rating? - No.

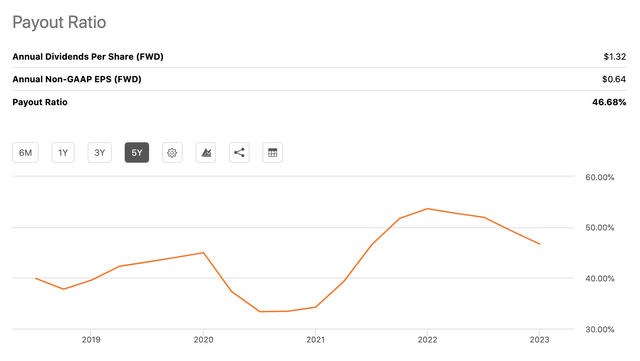

The firm still pays an attractive and sustainable quarterly dividend of $0.33, which is equivalent to an annual yield of 3.9%. The payout ratio has remained around the historical averages of the firm, and the dividend growth has also remained relatively high compared to the sector median.

Dividend growth (Seeking Alpha) Payout ratio (Seeking Alpha)

For these reasons, we believe that CAG remains an attractive holding in a dividend- and dividend growth portfolio and also a safe haven during times of low consumer confidence. However, we would like to see the company specific metrics improving before we would be confident that the firm could outperform the broader market in the near term. We downgrade CAG stock to "hold" from "buy".

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.