Freeport-McMoRan: Declining Free Cash Flow Spells Trouble

Summary

- Freeport-McMoRan reported a decline in revenue and negative levered free cash flow due to operational challenges and weak global demand for primary metals.

- The company's profits are largely determined by the price of copper, which has been negatively impacted by poor economic conditions and a slowdown in China's housing industry.

- Despite the company's positive guidance, the current valuation of Freeport-McMoRan does not reflect the potential risks and macroeconomic factors affecting the price of copper and gold.

tracielouise

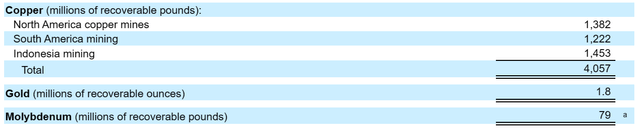

Freeport-McMoRan (NYSE:FCX) is a leading global mining concern, operating in North America, South America, and Indonesia. The company's numerous mines have trillions of recoverable pounds of copper, over a billion recoverable ounces of gold, and tens of millions of recoverable pounds of molybdenum:

10Q

While the company remains one of the largest miners in the world, issues with free cash flow generation of late have sent the company's TTM FCF and net income multiple into the stratosphere. This has occurred as a result of profits shrinking towards breakeven, as the global demand for primary metals appears to be weakening.

Is the recent jack up in multiples a momentary blip, or a serious warning about the company's future? In this article, we'll dive into the company's business, prospects, and the macro environment, in order to see whether or not the current price presents an attractive entry point for new investors, or if shareholders have significant cause for concern.

Financial Results

As always, let's begin with the financials. In its most recent quarter, Freeport reported above expectations on almost all fronts. EPS came in 7 cents above estimates, revenue beat by more than $140 million, and net income was solidly positive at $663 million.

On a revenue base of 5.3 billion, these results represent solid beats, and a decent profit margin of more than 12%. However, these numbers mask issues with cash flow and revenue.

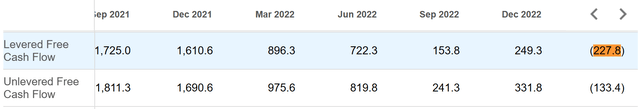

Revenue declined ~19% year-over-year, and on a levered basis, the company actually reported negative levered free cash flow for the first time in the last few years:

Seeking Alpha

Why the slowdown?

The company had the following to say:

We faced a number of operational challenges in first-quarter 2023, including a significant weather event in Indonesia, civil unrest in Peru and productivity challenges in the U.S. In addition, beginning January 1, 2023, PT Freeport Indonesia’s (PT-FI) commercial arrangement with PT Smelting (PT-FI’s 39.5% owned copper smelter and refinery in Gresik, Indonesia) converted from a concentrate sales agreement to a tolling arrangement, which resulted in a deferral of sales to future periods. As a result of the transition, approximately 110 million pounds of copper and 110 thousand ounces of gold from PT-FI’s first-quarter 2023 production is deferred in inventory and will be sold in future periods. We currently expect increasing sales volumes for the remainder of 2023.

In other words, "nothing to see here". The company blames civil unrest in Peru, weather in Indonesia, and a "drop in productivity" here in the States for the company's recent underperformance. They also point out issues with sales being deferred as a result of a smelting agreement in Indonesia.

We're less convinced.

In fact, if you look more broadly, things have held up relatively well for revenue - it's cash flow that's the concern:

TradingView

Freeport maintains significant fixed costs as a result of running its mines, this is standard in the industry.

However, as a result of that fixed cost base, the company's profits are widely determined by the price of the end product Freeport produces. You can see this above - a slight drop in revenues leads to a large drop in cash flow.

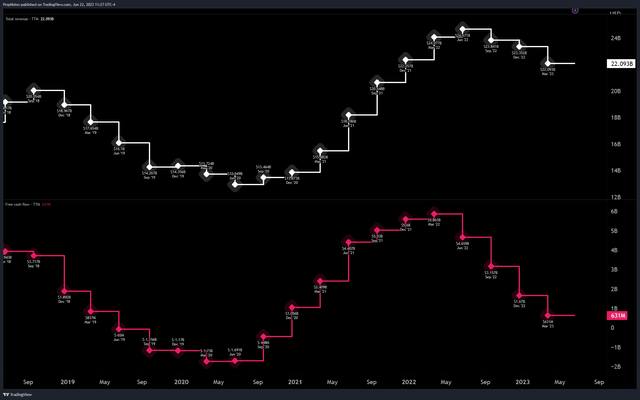

In this case, Copper is the main driving force:

TradingView

Over the last 5 years, Freeport's stock can most easily be seen as a bet on Copper, via operating leverage and profits.

Copper prices up, FCX cash flow up.

Copper prices down, FCX cash flow down.

In this way, we're concerned about the falling cash flows as a signal that underlying wholesale commodity pricing is weak, as evidenced by the poor results. If macro demand for copper is poor, it could lead to serious underperformance in the stock.

Macro

The recent issues make sense too, considering the weak overall demand for commodities right now.

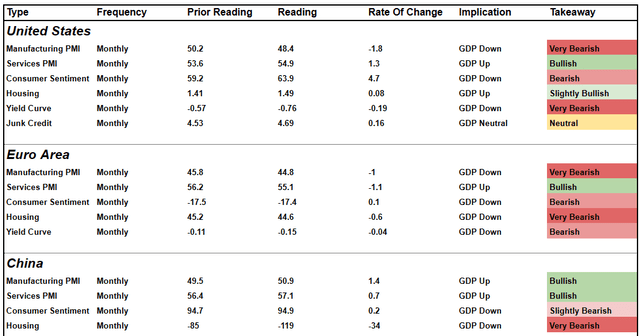

Global PMI's in the three largest economic areas are mixed at best, and housing (the main driver of demand for commodities) is quite weak:

PropNotes

Poor economic conditions often lead to lower commodity prices.

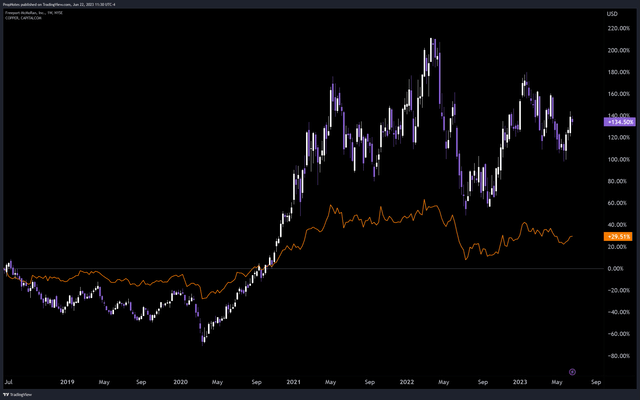

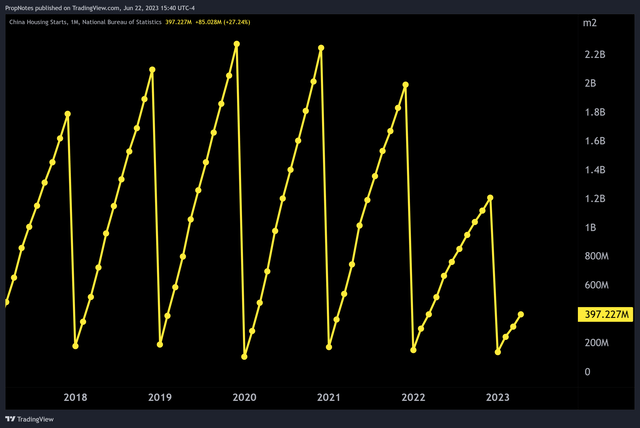

Of particular concern here is the slowdown in China:

TradingView

For a long time, China's housing industry has been one of the primary sources of demand for copper and base materials globally, and the numbers have been terrible as of late. The company is already 119 million square meters of housing starts behind where it was this time last year, and the trend deteriorating.

Should things continue in this direction, then it's not clear if the rest of the world can pick up the slack in demand. If the world can't pick up the slack in demand, then political unrest in Peru will be the least of FCX's problems.

Remember, less demand = lower prices for Freeport's end product.

If these numbers are anything to go by, then this poor quarter from Freeport begins to look like it could be the start to a new pattern.

Valuation

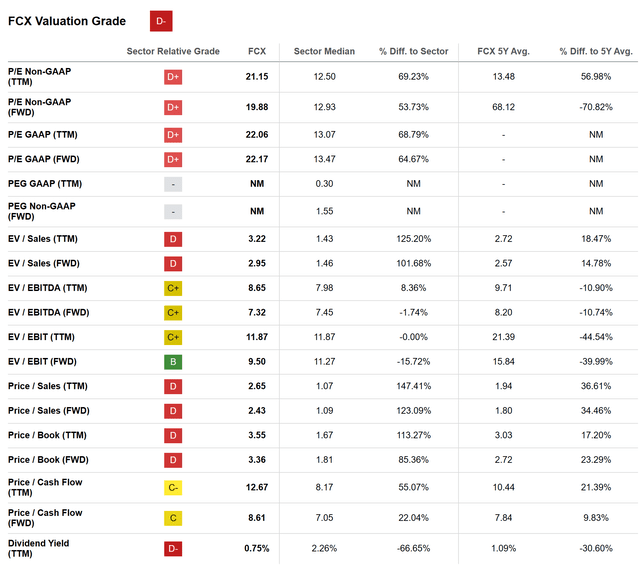

The macro picture for copper may be causing some issues with FCX's free cash flow, but is the company at least priced to reflect these issues?

Well, no. In fact, its priced as though the recent jump in multiple will come back down as things stabilize:

Seeking Alpha

This is likely due to the company's guidance, which remains rosy.

However, Freeport doesn't control the price of copper and gold globally, which means that we care less about the company's ability to ship copper on a certain schedule, versus the macro forces affecting the price of that copper itself.

At current prices, there's a lot of risk baked into this multiple, and there's a lot of room for air to come back out of the stock.

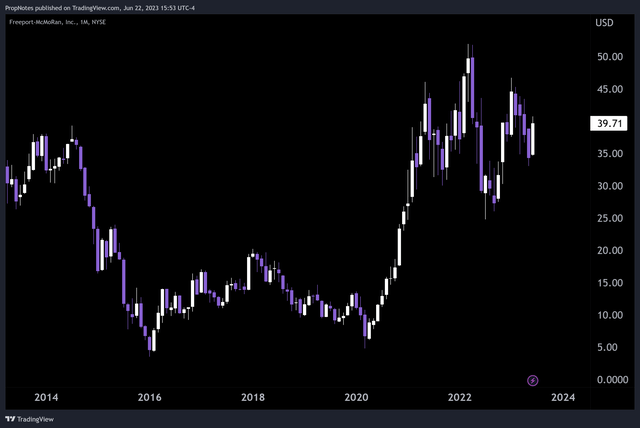

Remember, in the mid 2010's when commodity demand was weak, FCX traded at $4. We're not saying it's likely, but the stock is prone to leveraged swings in the market:

TradingView

Summary

Freeport is a top tier global mining company with efficient operations and a solid track record of financial beats in recent times. However, we remain concerned about the company's most recent quarter, as it could be a harbinger of what's to come as a result of worsening leading macroeconomic indicators. We rate the company a hold, but a very tenuous one at that. If things don't bounce back next quarter, we see material downside in the name.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.