SPYD's Underperformance Explained

Summary

- SPYD is a dividend equity index ETF.

- The fund had significantly outperformed since early 2021, but performance has materially weakened recently.

- An explanation as to why follows.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

domin_domin

Author's note: This article was released to CEF/ETF Income Laboratory members on June 19th.

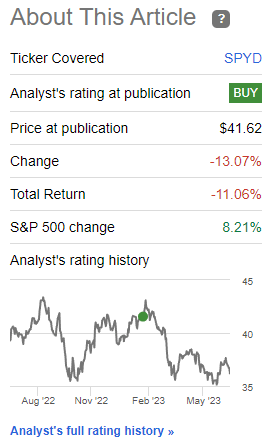

I last covered the SPDR Portfolio S&P 500 High Dividend ETF (NYSEARCA:SPYD), a high-yield equity index ETF, in early 2023. I was very slightly bullish on the fund at the time, arguing it offered an above-average, growing 4.1% dividend yield, but that it seemed fairly valued. SPYD has significantly underperformed since, seeing moderate losses even as equity markets recover.

SPYD Previous Article

Considering the above, I thought a quick article on the fund's recent underperformance was in order.

From what I've seen, SPYD's underperformance was due to being overweight financials and regional banks, which have significantly underperformed YTD as higher interest rates weakened bank balance sheets. Industry issues persist, making the fund a slightly riskier choice than average.

SPYD - Quick Overview

Let's take a quick overview on the fund before analysing its performance YTD.

SPYD is a U.S. equity index ETF, tracking the S&P 500 High Dividend Index. Said index includes the 80 S&P 500 stocks with the highest dividend yields, subject to a set of inclusion and exclusion criteria. It is an equal-weighted index.

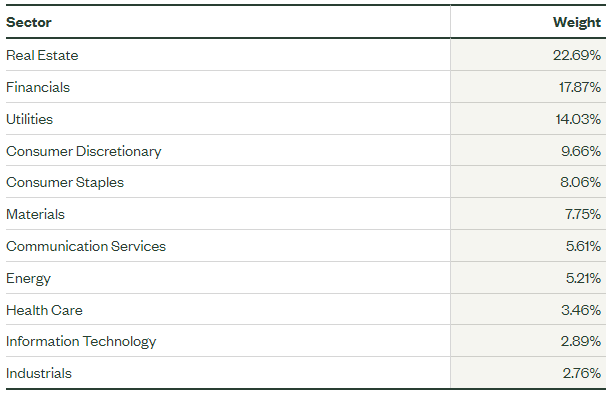

SPYD provides investors with exposure to all relevant industry segments. As is the case for most dividend/value ETFs, it is currently overweight old-economy industries like real estate and financials, while being underweight tech. Lots of real estate companies and banks pay good dividends, few tech companies do, hence the differing exposures.

SPYD

SPYD invests in 80 companies, equal-weighted. This is a reasonably large number of holdings, sufficient to ensure a good amount of diversification, although most broad-based equity indexes do have broader portfolios.

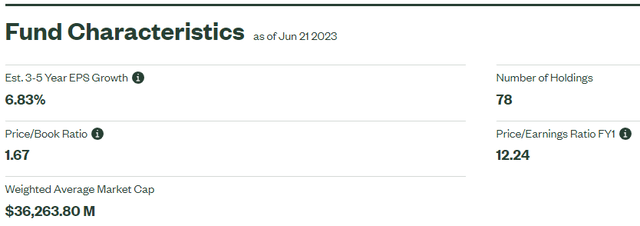

SPYD focuses on companies with above-average yields, which almost always are cheaply valued (very difficult to have a high yield with a high share price). Compare SPYD's valuation metrics:

SPYD

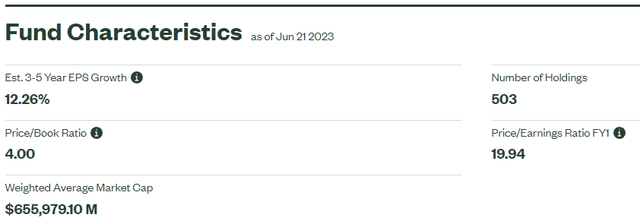

to those of the S&P 500:

SPY

SPYD is much cheaper than the S&P 500, and most other U.S. equity indexes as well.

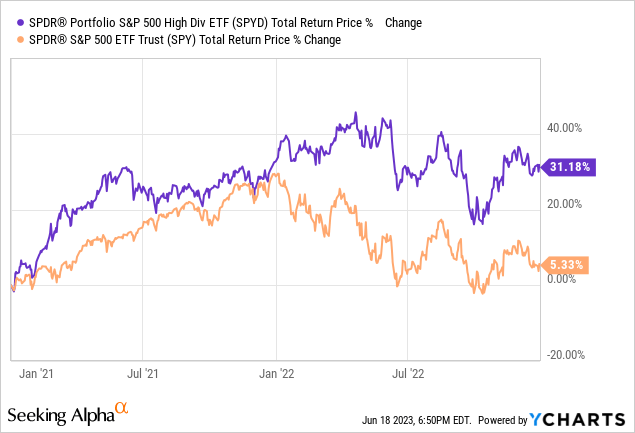

SPYD's cheap holdings outperformed in 2021, as the U.S. and its public corporations recovered from the coronavirus pandemic.

Data by YCharts

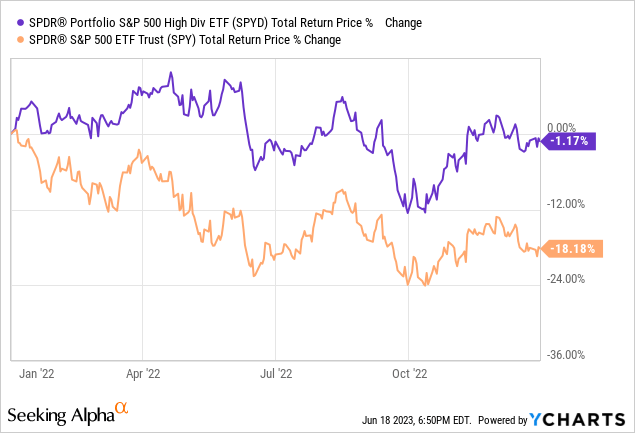

These also outperformed in 2022, as higher interest rates caused a shift in investor sentiment, from speculative growth to grounded value.

Data by YCharts

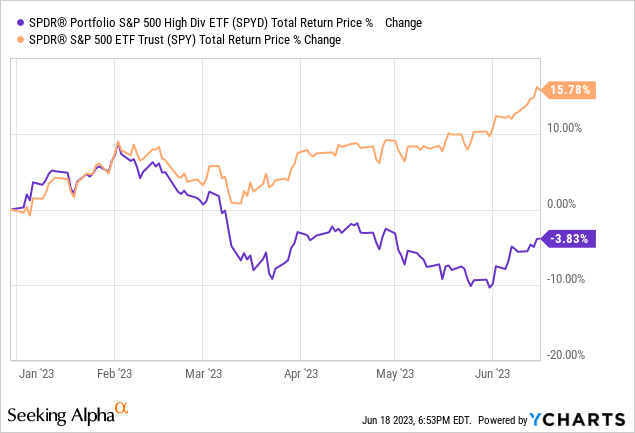

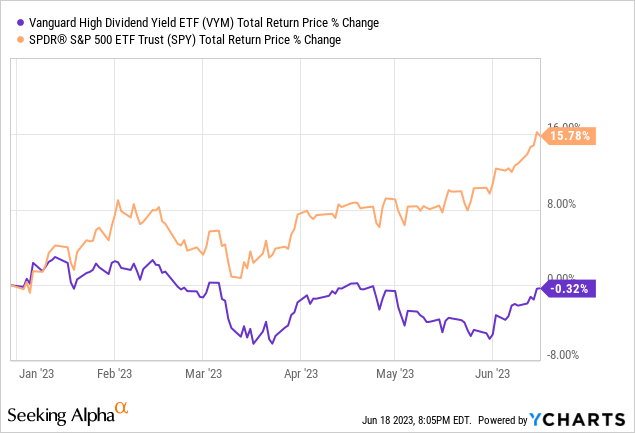

SPYD's performance has been much weaker in 2023, with the fund significantly underperforming on a YTD basis.

Data by YCharts

With the above in mind, let's have a closer look at the fund's recent performance.

SPYD's Underperformance Explained

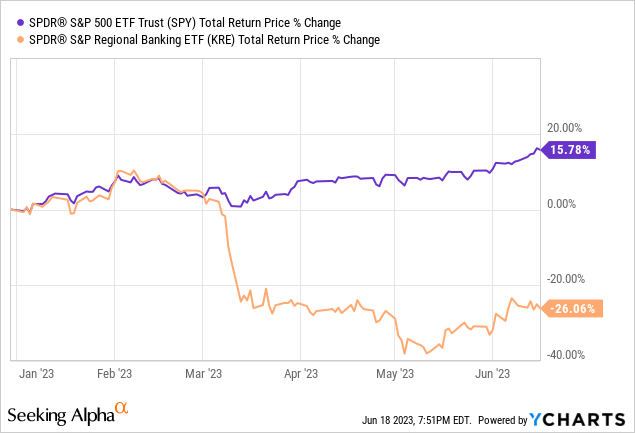

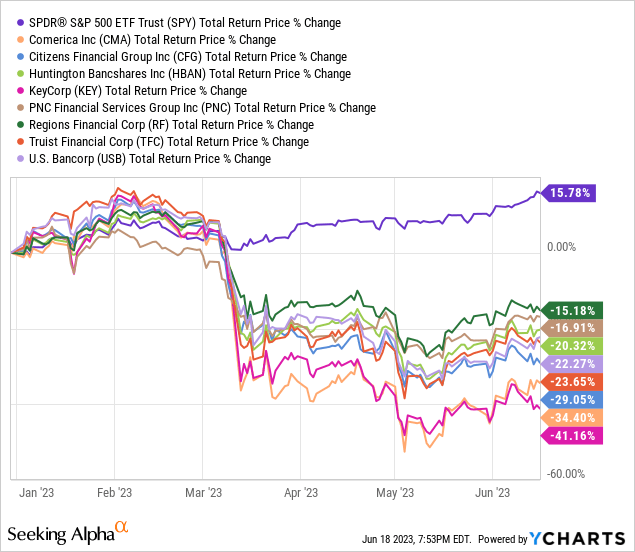

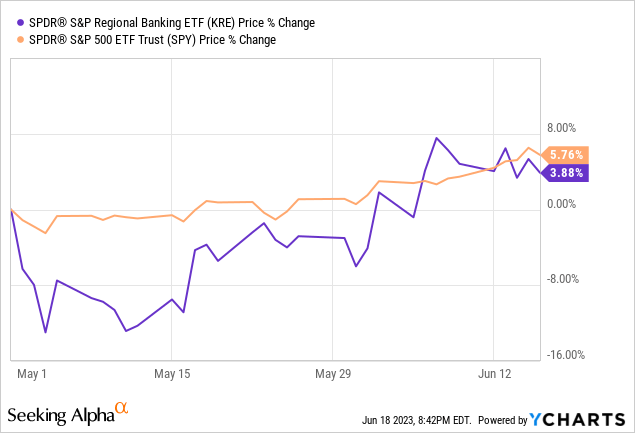

SPYD's underperformance is due to several factors. Key among these is the fund's overweight position in mid-sized regional banks, including U.S. Bancorp (USB) and PNC Financial Services (PNC), with these accounting for 15-20% of the value of the fund. Do bear in mind that SPYD only invests in S&P 500 components, and so does not include smaller regional banks in its holdings. Regional banks have significantly underperformed YTD:

Data by YCharts

As have SPYD's specific banking holdings:

Data by YCharts

SPYD's banking holdings underperformed, hence the fund's underperformance. To make matters worse, the fund was/is overweight financials, with these accounting for 22% of the value of the fund earlier in the year, versus 12% for the S&P 500 (the gap has narrowed these past few months). Being overweight underperforming banks led to significant underperformance for the fund.

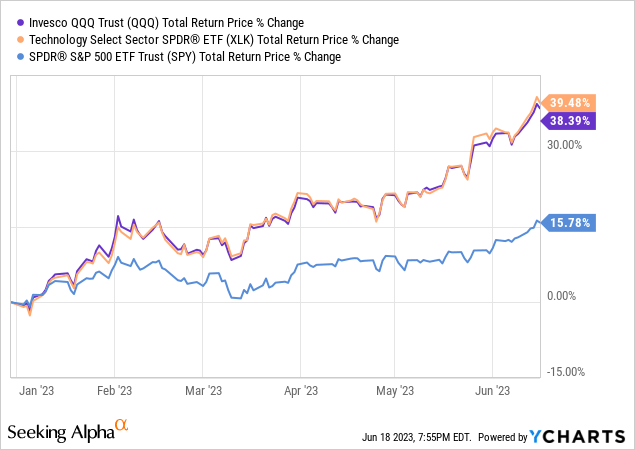

Besides the above issues, the fund's underweight tech position also led to some losses.

Data by YCharts

As did the fund's overall value focus:

Data by YCharts

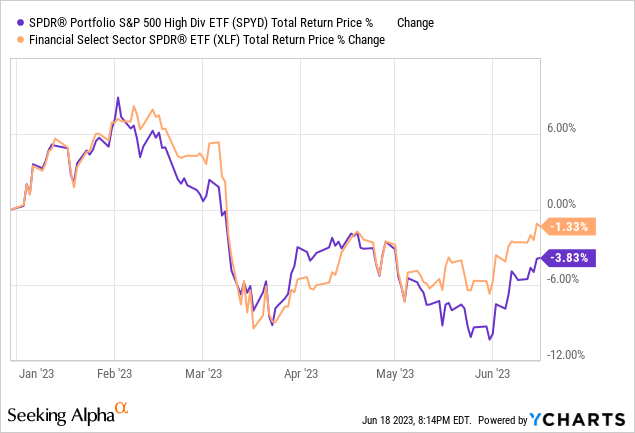

As an aside, the fund's performance has closely tracked that of the broader financial industry YTD, even though said industry only accounts/accounted for 15%-25% of the value of the fund. This is due to SPYD being overweight mid-sized banks, and mid-sized banks underperforming larger banks. In other words, the fund's moderate exposure to mid-sized banks was effectively equivalent to a full-sized, 100% position in financials in general.

Data by YCharts

Although SPYD's overweight regional bank position was a significant negative for shareholders in the past, I don't believe that this will be the case moving forward, for three reasons.

First, is the simple fact that the fund's financial exposure is much lower now than in the past. SPYD's financials used to account for more than 20% of the value of the fund, almost double-digits more than for the S&P 500. Right now, financials have dropped to 17.9%, only 5.5% more than for the index. As financial exposure goes down, so does any potential losses or underperformance from continued/renewed industry issues.

Second, is the fact that the regional banking crisis seems to have abated, as interest rates stabilize, and as evidenced by stronger segment performance.

Data by YCharts

Risks remain, but I do think these are lower now than in the past.

The third reason is the fact SPYD's specific bank holdings mostly seem fine. I saw no companies facing significant ongoing deposit outflows, with dangerously low capital ratios, or needing to raise emergency capital.

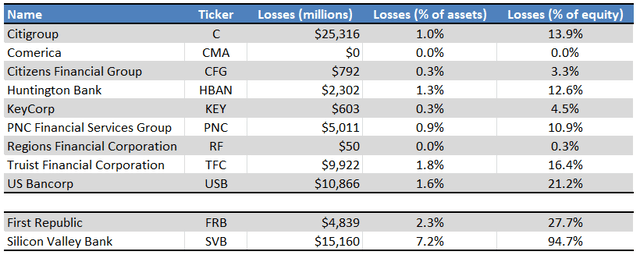

I also decided to calculate losses on each bank's held to maturity investment portfolios, as these were key to Silicon Valley Bank's (SVB) collapse, and precipitated the regional banking crisis. Only U.S. Bancorp (USB) seems to have experienced significant losses, although these were still much lower than those of SVB and somewhat lower than those of First Republic (OTCPK:FRCB). Here's a quick table of these with SPYD's holdings on the top.

Bank Filings - Chart by Author

As mentioned previously, the losses above refer to the losses on each bank's held to maturity investment portfolios. In essence, they quantify the losses from higher interest rates experienced by each bank that are not included in their accounting statements. Investors and customers grew weary about these losses in the past, hence the regional banking crisis, and hence my table.

Conditions could always worsen, and markets do not always care about fundamentals, but SPYD's bank holdings seem fine, with the sole exception of U.S. Bancorp, which seems a bit wobbly. In my opinion, for a fund with 80 holdings, one risky, speculative investment is fine, and not excessively risky.

Conclusion

SPYD has significantly underperformed YTD due to being overweight mid-sized regional banks.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.