Kinder Morgan: Trying To Repair A Leaky Bucket

Summary

- Kinder Morgan has struggled to grow EBITDA over the past several years.

- In the near term, its commodity assumptions remain too high for the year.

- The stock is attractively valued, but other midstream operators like Energy Transfer and Enterprise Products Partners are preferred over KMI.

SSSCCC

In early April, I wrote the Kinder Morgan (NYSE:KMI) was a solid midstream operator, but that I find some its peers more attractive. Since then, the stock has underperformed with about a -5% total return, compared to +6% return for the S&P. Let’s catch up on the name.

Company Profile

As a reminder, KMI is a diversified company that operates in four segments. Its Natural Gas Pipeline segment is its largest, making up over 60% of its business. Included within the segment are its interstate and intrastate pipelines, storage facilities, LNG liquefaction & terminal facilities, and NGL fractionation facilities.

KMI’s Products Pipelines segment includes crude, refined product, and condensate pipelines, as well as a condensate processing facility, transmix processing facilities, and terminals. Its Terminals segment assets are comprised of its refined petroleum product, chemical, renewable fuel, and other liquid terminal facilities, as well as its Jones Act tanker fleet. Its CO2 segment, meanwhile, produces, transports, and markets CO2 for use in enhanced oil recovery projects. These three segments each represent between 10-15% of its business mix.

Steady Progress, But Commodity Assumptions Remain Too High

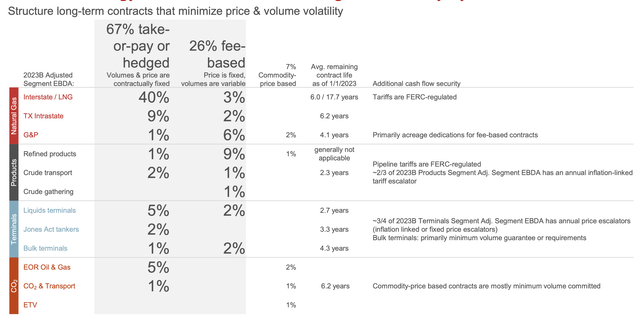

With about 61% of its business take or pay, 26% fee-based, and 6% hedged out, KMI has a pretty steady business. The fee-based business has some volumetric exposure, with refined product pipelines being 9% and gathering & processing being 7%. The about 7% of its business mix has commodity exposure, with most being in its CO2 segment.

As such, it’s no big surprise that KMI’s first quarter was pretty much in line with expectations. However, the company didn’t see much growth, with Adjusted EBITDA up just 1% to $1.996 billion from $1.967 billion. Its CO2 segment, which has commodity exposure, saw its EBDA fall -17% to $173 million, while its products pipelines, which has volume exposure, saw its EBDA fall -16% to $251 million. Distributable Cash Flow, meanwhile, fell nearly -6% to $1.374 billion from $1.455 billion a year ago.

At a recent Sanford Bernstein conference, management was asked about the perception that KMI was like a leaky bucket where it keeps outlaying growth capital but it hasn’t grown much. President Kimberly Dang noted that yes EBITDA has only risen by about $500 million from $7.2 billion in 2016 to an expected $7.7 billion this year. She said the reasons for the slow growth have been several folds.

One big reason behind the lackluster growth is that the company built a lot of supply-push pipelines in 2008 and 2009 to get molecules out of the big productive basins at the time. However, those basins (such as the Rockies, Barnett, and Fayetteville) didn’t turn out to be the most productive basins a few years later. So when contracts rolled over after their initial 10-year terms, they had to be renewed at lower rates. In addition, it sold a number of assets in order to reduce debt and get its balance sheet in better share. The company has also seen some price degradation in its CO2 business as well.

One of the bigger risks facing KMI over the long term is what happens to its refined product pipeline business as the U.S. transitions away from fossils fuels and embraces EVs more.

Discussing the threat of EVs and renewables at the Sanford Bernstein conference, Dang said:

“We've spent a lot of time looking at the refined products business and understanding what we think the trajectory of that business is. Now when you look at that business, so it's gasoline, diesel and jet fuel. And when you look at the diesel and jet fuel options, you've got a renewable option on both of those. So you can move renewable diesel through the pipeline, and we are doing a lot of that in California. And you can move sustainable aviation fuel through the pipelines. And so -- and there's not a good EV option on either one of those -- for either one of those fuel sources. And so that piece of those volumes, we don't have much concern about. The gasoline piece is where you're going to get the EV penetration. We've spent a lot of time looking at different studies, looking -- coming up with our own study on what happens to those volumes over time, varying, how much penetration you get on electric vehicles?

“I do think that the volumes potentially decline over time. If you look at what the EIA projects, they're like less than 0.5% on overall gasoline, diesel and jet fuel from less than 0.5% per year between 2022 and 2050. And so we have an inflation escalator on those. And on those pipelines, you get PPI, FG minus 0.21%. This year, that inflator was 13.3%. Last year, that inflation was 7.48%. That's obviously in highly inflationary environment. But you should get 2% or 3%, if that's where long-term inflation is. That should help offset the volume decline”

Dang added that KMI does expect EV penetration to continue to increase, but that it will take longer than expected. She noted that it took 18 years to get a power line permitted that goes from Wyoming to California, and that a community can’t have more than 30% of its households charging EVs before the whole system would need to be upgraded. Thus, the transition to EV will take a long time.

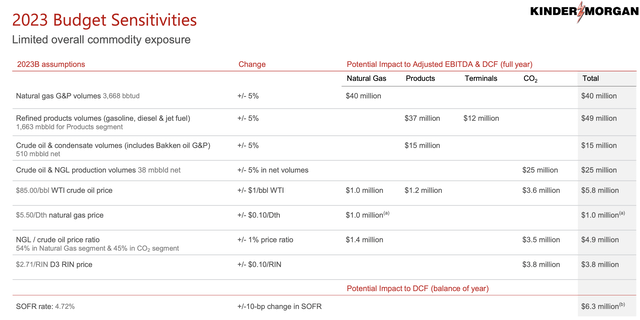

Outside of longer-term questions surrounding its refined product pipelines, another risk facing KMI is that its commodity assumptions are currently too high. The company’s full-year expectations for oil and natural gas prices are $85, and $5.50, respectively. If natural gas averages $3.00 for the year, that will be about a $25 million shortfall, while around $70 WTI would be about an $87 million shortfall. That’s not going to change the long-term outlook for KMI, but will contribute towards its near-term struggles to really get EBITDA growing.

Valuation

KMI trades at 8.1x the 2023 EBITDA consensus of $7.69 billion. Based on the 2024 EBITDA consensus of $7.94 billion, it is valued at 7.8x.

KMI stock has an attractive free cash flow yield of about 10% based on my 2023 projections calling for $3.75 billion in FCF. The stock has a yield of about 6.8%. As such, the dividend is well covered and has plenty of room to grow.

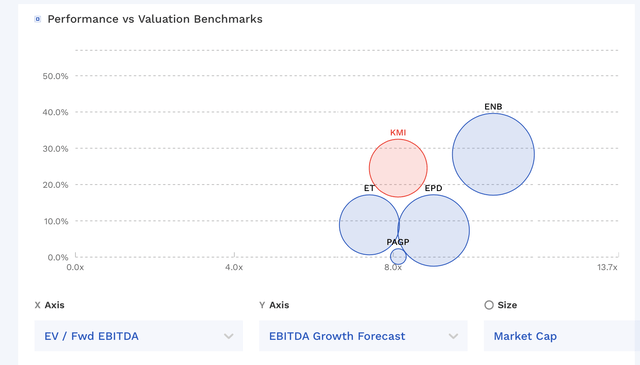

KMI trades in the middle of where other large midstream operators are currently trading.

KMI Valuation Vs Peers (FinBox)

Conclusion

Overall, like much of the midstream space, I find KMI to be attractively valued. As I’ve noted in other articles on the space, midstream valuations have compressed despite the companies being in better shape with their structures and balance sheets.

As for KMI, I still prefer the likes on Energy Transfer (ET) and Enterprise Products Partners (EPD) over KMI. The former two have very strong integrated systems that give them a huge amount of arbitrage opportunities, and I generally view their asset footprints as stronger.

KMI has done a lot of things right over the years, greatly improving its balance sheet and being shareholder friendly. It has room to grow its dividend, and the stock is not expensive. However, I continue to view it more as “Hold” at this point given my affinity to other midstream stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.