BDC Weekly Review: Bank Loan Defaults Are Rising

Summary

- We take a look at the action in business development companies through the third week of June and highlight some of the key themes we are watching.

- BDCs had another decent week with a small positive return. Recent underperformers led the charge, which is a pattern that's worth watching.

- Bank loan defaults have spiked in May as a slowing economy and rising interest expenses are starting to bite.

- TRIN raised its dividend by 2%. We remain on the sidelines due to poor recent returns and excessive valuation.

- I do much more than just articles at Systematic Income: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Darren415

This article was first released to Systematic Income subscribers and free trials on June 16.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company ("BDC") sector from both the bottom-up - highlighting individual news and events - as well as the top-down - providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the third week of June.

Market Action

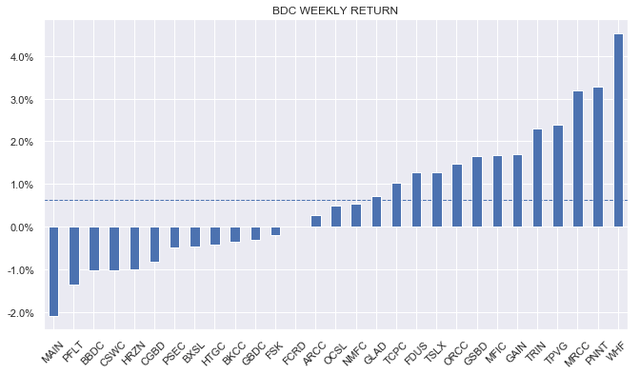

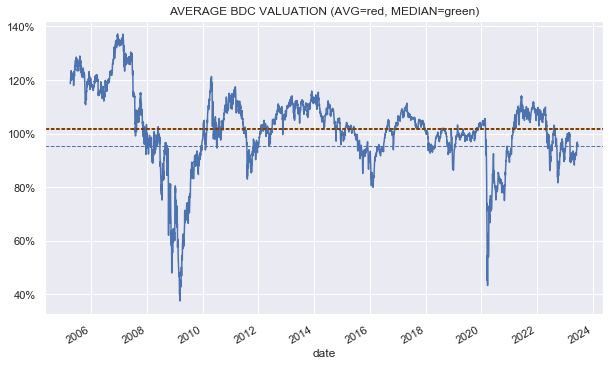

BDCs had a good week with a return of around 0.5%. Interestingly, for the second week recent and longer-term underperformers led the charge. This is a trend that's worth watching, particularly if the overall sector valuation moves above its historic level. The combination of lower-quality yield-chasing and expensive valuation would make us shift to a more defensive stance.

The sector is trading a few percentage points below its longer-term historic average.

Systematic Income

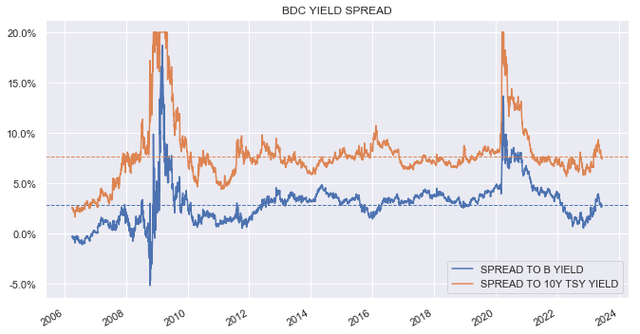

The median BDC dividend yield differential to B-rated bonds and Treasuries looks fair in the historic context. However, because dividend coverage is elevated in the sector (as many BDCs are adopting a cautious approach due to the possibility of future rate cuts), the net income differential to bonds is likely to be larger than the historic average.

Market Themes

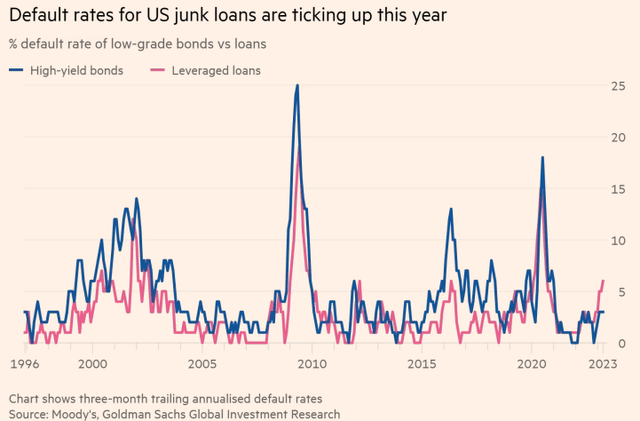

The Fed’s tightening campaign has had a number of consequences on the economy and markets. One of these has been a notable increase in corporate defaults. There were 18 bank loan defaults this year through May, totaling $21bn - greater in number and value than the sum total of 2021 and 2022. Just in May there were $7.8bn of defaults (37% of the YTD total) - the largest monthly figure since COVID.

The three-month trailing default rate of above 5% is also higher than outside the highly distressed periods of COVID, GFC and the Tech recession. What’s also notable is that the loan default rate has moved above the HY corporate bond default rate which has basically never happened this century. Of course this could be a temporary fluke - the 12-month trailing default rate through May is still only 1.6%. This is one of the key trends to watch through the rest of the year as some companies are clearly struggling with low interest coverage.

We have to wait for Q2 numbers to see if there has been a similar uptick in private credit defaults. Unlike with bank loans, private credit managers typically have additional ways to mitigate defaults as the number of lenders on each deal tends to be either one or a handful. This includes switching the loan to PIK, forgiving covenants, restructuring the loan to equity and bringing in additional managers to help the affected businesses work through their current difficulties. These avenues are not available to bank loan holders due to the difficulty in coordination among a large number of holders. That said, these mitigants don't always work and some private loans will end up in default anyway, but the additional flexibility and hands-on approach is one reason why private credit realized losses have been relatively low over time.

Market Commentary

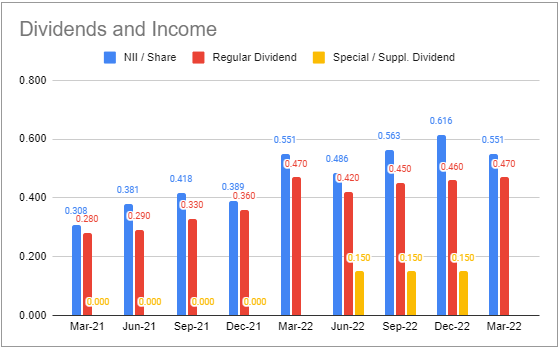

BDC Trinity Capital (TRIN) increased the base dividend by 2% to $0.48 and also declared a $0.05 supplemental. The company has increased the dividend nearly every quarter since its IPO. The total dividend is not far from Q1 net income of $0.55 so there may be some more room to hike the dividend, particularly if we get another net income boost in Q2, which is very likely.

Systematic Income BDC Tool

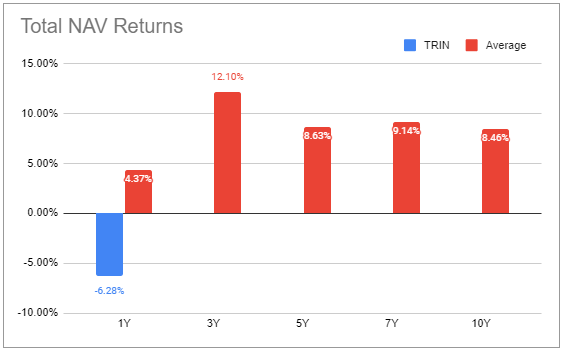

The dividend yield of 15.6% is only behind FSK in our coverage, which probably explains its 105% valuation or 9% above the sector average. TRIN has struggled over the past year, underperforming the sector by around 11% in total NAV terms.

Systematic Income BDC Tool

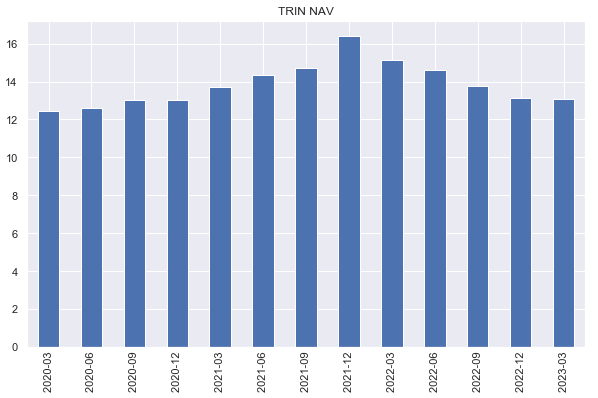

The NAV has fallen for 5 straight quarters, partly due to credit issues as well as large distributions.

Systematic Income

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.