FTSM: Not Compensated For Credit Risk

Summary

- The First Trust Enhanced Short Maturity ETF is an actively managed ETF that provides current income from short-duration investments.

- FTSM charges higher fees and delivers lower distribution yields compared to its peers, making it less attractive as a cash replacement tool.

- I recommend selling FTSM and considering higher-yielding peers like the Janus Henderson AAA CLO ETF or lower-risk treasury bill ETFs like the US Treasury 3 Month Bill ETF.

Maximusnd

The First Trust Enhanced Short Maturity ETF (NASDAQ:FTSM) is an actively managed ETF providing high income from short-duration investments. Some investors use high-quality short-duration funds like the FTSM ETF as a replacement for cash.

However, after reviewing the FTSM ETF's structure and historical performance, I do not see any compelling reason why investors should hold FTSM over peer funds that deliver higher yields or lower risk. I rate FTSM a sell.

Fund Overview

The First Trust Enhanced Short Maturity ETF is an actively managed ETF that seeks to provide current income from a portfolio of short-duration securities. At least 80% of the fund's investments will be made in investment grade ("IG") securities at the time of purchase, although the fund may invest in a broad range of assets like government and agency bonds, asset-backed securities ("ABS"), and mortgage-backed securities ("MBS").

The FTSM is a large under-the-radar ETF with over $8 billion in assets while charging a 0.45% expense ratio.

Portfolio Holdings

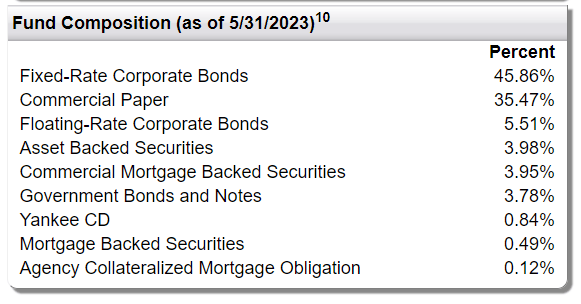

Figure 1 shows the sector allocation of the FTSM ETF. The FTSM ETF is primarily invested in fixed-rate corporate bonds (45.9%) and commercial paper (35.5%), with a handful of other sectors like floating-rate corporate bonds (5.5%) and ABS (4.0%).

Figure 1 - FTSM sector allocation (ftportfolios.com)

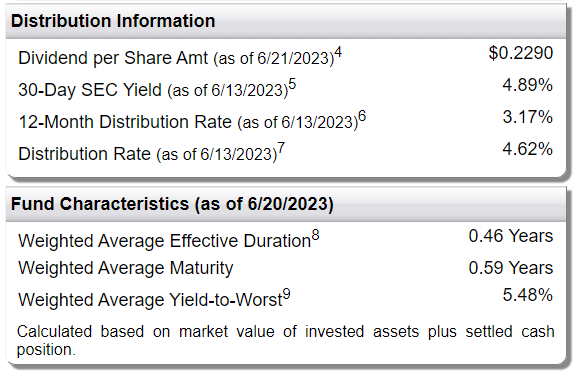

Figure 2 shows the fund's distribution and fund characteristics. The FTSM ETF currently has a 30-Day SEC yield of 4.9% and its latest annualized distribution rate is 4.6%.

Figure 2 - FTSM distribution and fund characteristics (ftportfolios.com)

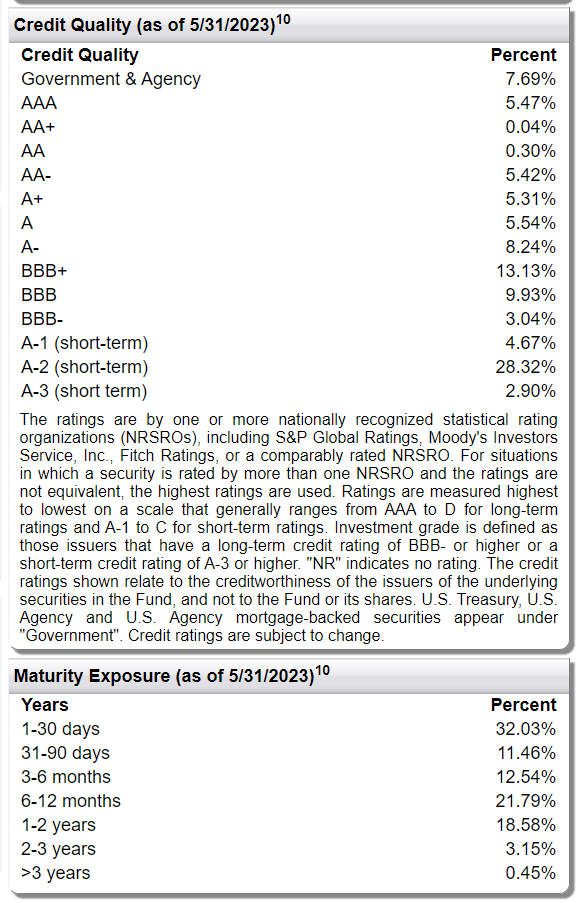

Finally, Figure 3 shows the credit quality allocation and maturity allocation of the FTSM ETF. As designed, almost all of the fund's assets are invested in IG assets and 78% of the investments mature in less than 1 year, leading to a 0.46Yr weighted average duration.

Figure 3 - FTSM credit quality and maturity allocation (ftportfolios.com)

Returns

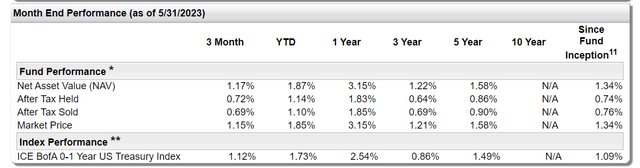

Figure 4 shows the historical returns of the FTSM ETF. Overall, the FTSM ETF has delivered very modest performance, with 1/3/5Yr annual returns of 3.2%/1.2%/1.6% respectively to May 31, 2023, slightly better than the ICE BofA 0-1 Year US Treasury Index's 2.5%/0.9%/1.5% returns on the same timeframes.

Figure 4 - FTSM returns (ftportfolios.com)

Distribution & Yield

As mentioned above, the FTSM ETF has a 30-Day SEC yield of 4.9% and its most recent monthly distribution of $0.2290 / share annualizes to a 4.6% distribution yield.

Usefulness As A Cash Replacement Tool

Given the FTSM ETF's high quality portfolio holdings and low weighted-average duration, I believe the FTSM ETF may have appeal to investors as a cash replacement tool, similar to the JPMorgan Ultra-Short Income ETF (JPST).

Another peer fund that I wanted to compare the FTSM ETF against is the Janus Henderson AAA CLO ETF (JAAA), an ETF that primarily invests in AAA-rated CLO securities that pay floating rate yields.

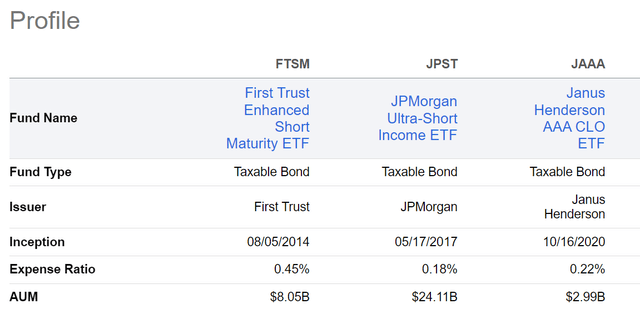

Out of the 3 ETFs mentioned, the FTSM ETF charges the highest expense ratio (Figure 5).

Figure 5 - FTSM charges the highest fees (Seeking Alpha)

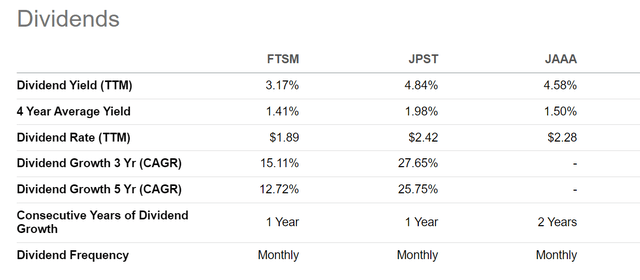

It also has the lowest trailing 12 month distribution yield, at 3.2% vs. 4.8% for JPST and 4.6% for JAAA (Figure 6). In terms of most recent monthly distribution annualized, FTSM is yielding 4.6% while JPST is yielding 4.8% and JAAA is yielding 6.0%.

Figure 6 - FTSM delivers the lowest yield (Seeking Alpha)

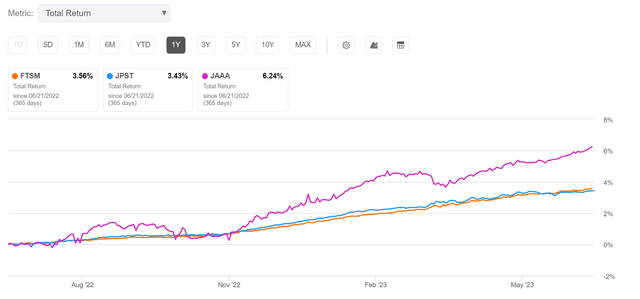

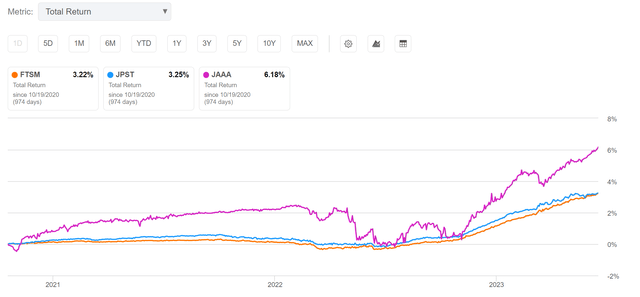

Finally, in terms of total returns, the FTSM ETF appears to be lagging the JAAA ETF on a 1Yr basis and since JAAA's inception on October 19, 2020 (Figure 7 and 8).

Figure 7 - FTSM vs. peers, 1Yr total return (Seeking Alpha)

Figure 8 - FTSM vs. peers, returns since October 19, 2020 (Seeking Alpha)

Investors should note that unlike FTSM and JPST, the JAAA ETF primarily invests in AAA-rated CLO tranches. CLOs are synthetic securities created out of pools of non-investment grade loans diversified across industries and may exhibit greater portfolio volatility during bear markets compared to the low duration treasury and corporate bonds that FTSM and JPST owns. Readers interested in learning more about JAAA can take a look at my initiation article.

FTSM Vs. T-Bills

For yield starved conservative investors in the past decade, cash replacement vehicles like FTSM and JPST were highly desired as it allowed investors to earn incrementally higher yields compared to treasuries that yielded close to nothing.

However, with the Fed's increase in short-term interest rates to over 5% in the past year, there are now alternatives for investors to consider that does not involve the credit risk of holding commercial paper and corporate bonds (Figure 9).

Figure 9 - 3 Month treasury yields (St Louis Fed)

Personally, for my cash allocation, I prefer the safety of treasury bills or funds that hold treasury bills like the US Treasury 3 Month Bill ETF (TBIL). The TBIL ETF currently pays an annualized 5.0% distribution yield. I last wrote about TBIL here.

In fact, as the TBIL ETF is currently yielding more than the FTSM ETF, one can argue that investors are not being compensated for the credit risk of owning the FTSM ETF.

Conclusion

The First Trust Enhanced Short Maturity ETF is an actively managed ETF that provides current income from a portfolio of short-duration investments. Short-duration funds like FTSM have historically been used by investors as cash replacement tools.

However, compared to other high quality, short-duration investments, I do not think FTSM's performance stands out. It pays more than double the fees of peer funds, while delivering lower distribution yields. In fact, cash, in the form of treasury bills and the TBIL ETF, is currently yielding more than FTSM.

I see no reason to hold the FTSM ETF relative to higher yielding peers like the JAAA ETF or lower risk treasury bill ETFs like TBIL. I rate FTSM a sell.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TBIL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.